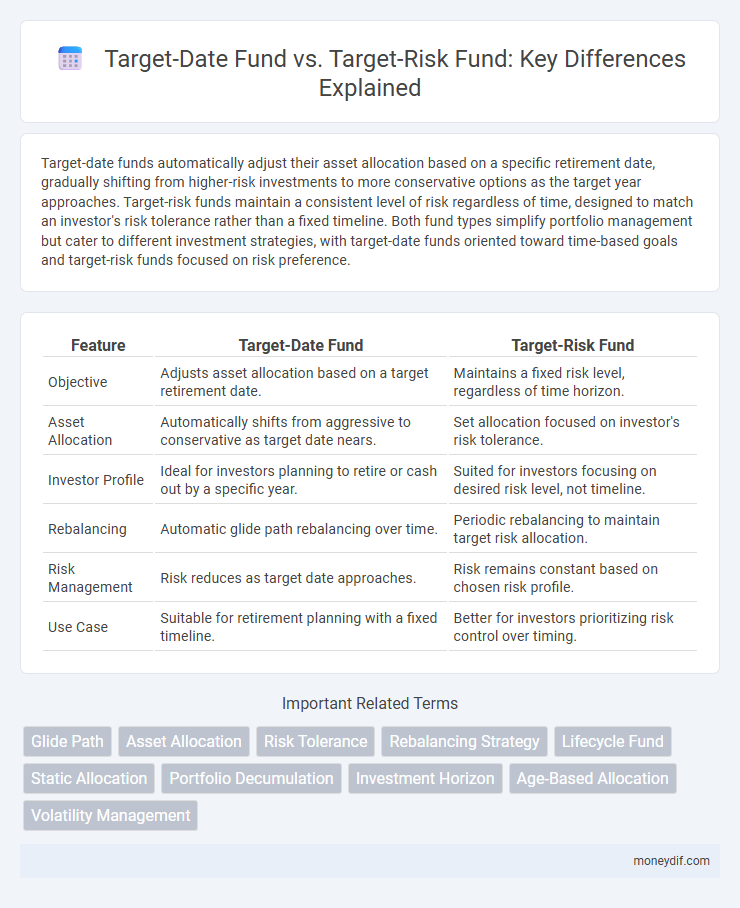

Target-date funds automatically adjust their asset allocation based on a specific retirement date, gradually shifting from higher-risk investments to more conservative options as the target year approaches. Target-risk funds maintain a consistent level of risk regardless of time, designed to match an investor's risk tolerance rather than a fixed timeline. Both fund types simplify portfolio management but cater to different investment strategies, with target-date funds oriented toward time-based goals and target-risk funds focused on risk preference.

Table of Comparison

| Feature | Target-Date Fund | Target-Risk Fund |

|---|---|---|

| Objective | Adjusts asset allocation based on a target retirement date. | Maintains a fixed risk level, regardless of time horizon. |

| Asset Allocation | Automatically shifts from aggressive to conservative as target date nears. | Set allocation focused on investor's risk tolerance. |

| Investor Profile | Ideal for investors planning to retire or cash out by a specific year. | Suited for investors focusing on desired risk level, not timeline. |

| Rebalancing | Automatic glide path rebalancing over time. | Periodic rebalancing to maintain target risk allocation. |

| Risk Management | Risk reduces as target date approaches. | Risk remains constant based on chosen risk profile. |

| Use Case | Suitable for retirement planning with a fixed timeline. | Better for investors prioritizing risk control over timing. |

Understanding Target-Date Funds

Target-date funds are designed to automatically adjust their asset allocation based on a specified retirement year, shifting from higher-risk investments like stocks to more conservative options such as bonds as the target date approaches. These funds simplify retirement planning by providing a diversified portfolio tailored to an investor's time horizon and risk tolerance. Compared to target-risk funds, which maintain a consistent risk level regardless of time, target-date funds offer dynamic risk management aligned with an investor's evolving financial goals.

Key Features of Target-Risk Funds

Target-Risk Funds prioritize asset allocation based on an investor's risk tolerance rather than a specific retirement date, offering diversified portfolios tailored to conservative, moderate, or aggressive risk profiles. These funds maintain a consistent risk level by adjusting asset classes within the portfolio instead of shifting allocations over time, making them suitable for investors seeking stable risk exposure. Key features include flexibility in investment strategy, ongoing risk management, and alignment with individual risk preferences, distinguishing them from the time-driven approach of Target-Date Funds.

How Target-Date Funds Work

Target-Date Funds automatically adjust their asset allocation based on a specific retirement year, gradually shifting from higher-risk investments like stocks to more conservative options such as bonds as the target date approaches. This glide path strategy reduces portfolio risk over time, aligning with the investor's changing risk tolerance and investment horizon. Investors simply select a fund with a target date matching their expected retirement year, allowing for hands-off portfolio management that evolves with their retirement timeline.

How Target-Risk Funds Operate

Target-risk funds operate by allocating assets according to a predetermined risk level, adjusting the mix of stocks, bonds, and other investments to maintain that risk profile over time. They emphasize maintaining a consistent allocation aligned with the investor's risk tolerance rather than adjusting for a specific retirement date. Portfolio managers periodically rebalance these funds to preserve the targeted risk exposure, ensuring alignment with long-term investment objectives.

Asset Allocation Strategies Compared

Target-date funds adjust asset allocation by gradually shifting investments towards more conservative assets as the specified retirement date approaches, focusing on time-based risk reduction. Target-risk funds maintain a consistent risk level by distributing assets according to a predetermined risk tolerance, regardless of the investor's timeline. These contrasting strategies cater to different investor preferences: target-date funds emphasize chronological risk adjustment, while target-risk funds prioritize stable risk exposure.

Risk Management: Target-Date vs Target-Risk

Target-Date Funds manage risk by automatically adjusting asset allocation to become more conservative as the specified retirement date approaches, reducing exposure to high-volatility investments over time. Target-Risk Funds maintain a consistent risk level based on investors' risk tolerance, offering a fixed allocation designed to balance growth and risk throughout the investment horizon. Both fund types employ diversification strategies but differ in their approach to dynamic risk adjustment versus steady risk targeting.

Suitability: Which Fund for Which Investor?

Target-date funds suit investors seeking a hands-off approach with asset allocation automatically adjusted based on a specific retirement year, ideal for those with a clear investment horizon. Target-risk funds appeal to investors wanting control over risk tolerance while maintaining consistent asset allocation, suitable for individuals with a steady risk appetite regardless of timeline. Choosing between the two depends on whether the investor prioritizes time-specific goals or risk preference as the primary factor in portfolio construction.

Performance Analysis & Historical Returns

Target-date funds adjust asset allocation based on a specific retirement year, typically shifting from aggressive to conservative investments, resulting in historically smoother returns aligned with investors' changing risk tolerance. Target-risk funds maintain a consistent risk level regardless of time horizon, often delivering steadier performance within predetermined volatility parameters but may underperform during market shifts favoring dynamic strategies. Historical returns show target-date funds generally outperform target-risk funds in long-term growth due to automatic rebalancing and lifecycle adjustments, while target-risk funds can offer more predictable returns when market conditions are stable.

Fees and Costs: A Comparative Overview

Target-Date Funds typically feature a single fee structure that gradually decreases as the fund approaches the target retirement year, with average expense ratios ranging from 0.50% to 1.00%, reflecting the cost of automatic asset rebalancing over time. Target-Risk Funds often have slightly lower expense ratios, usually between 0.40% and 0.85%, as fees are tied to a fixed risk profile rather than a shifting asset allocation schedule. Investors should consider the potential for higher trading costs in Target-Date Funds due to periodic glide path adjustments, whereas Target-Risk Funds may incur lower transaction fees but require more active management to maintain the chosen risk level.

Pros and Cons: Target-Date vs Target-Risk Funds

Target-date funds automatically adjust asset allocation to become more conservative as the target retirement year approaches, providing a simplified, hands-off investment strategy ideal for investors seeking time-based risk management; however, their one-size-fits-most approach may not suit individual risk tolerances or changing market conditions. Target-risk funds maintain a fixed risk profile, allowing investors to select portfolios aligned with their personal risk tolerance and investment goals, offering greater control but requiring active decision-making to rebalance and adapt to life changes. Both fund types offer diversification and professional management, but the choice hinges on whether an investor prioritizes automated lifecycle adjustments or personalized risk control.

Important Terms

Glide Path

A Glide Path in a Target-Date Fund systematically shifts asset allocation from higher-risk equities to lower-risk bonds as the target retirement date approaches, optimizing risk reduction over time. In contrast, a Target-Risk Fund maintains a consistent risk level tailored to an investor's risk tolerance without changing allocations based on time.

Asset Allocation

Asset allocation in Target-Date Funds automatically shifts investment mix from growth-oriented assets like equities to conservative assets such as bonds as the specified target retirement date approaches, optimizing risk reduction over time. Target-Risk Funds maintain a consistent risk level by allocating assets according to a predefined risk tolerance, balancing stocks and bonds without adjusting for a specific retirement timeline.

Risk Tolerance

Target-date funds adjust asset allocation based on a specific retirement date to match evolving risk tolerance, while target-risk funds maintain a fixed risk level regardless of the investment horizon.

Rebalancing Strategy

Rebalancing strategy in Target-Date Funds adjusts asset allocation over time to become more conservative as the target date approaches, while Target-Risk Funds maintain a consistent risk level with periodic rebalancing to preserve the chosen risk profile. Target-Date Funds often shift from equities to fixed income automatically, whereas Target-Risk Funds focus on rebalancing within a fixed risk category, optimizing for volatility control and long-term growth.

Lifecycle Fund

Lifecycle funds automatically adjust asset allocation over time, gradually shifting from higher-risk equities to more conservative fixed income as the target retirement date approaches. Unlike target-date funds, which focus on a predetermined retirement year, target-risk funds maintain a consistent risk level regardless of time horizon, aiming to match investors' risk tolerance rather than their retirement timeline.

Static Allocation

Static allocation in investment portfolios involves maintaining a fixed asset mix regardless of market fluctuations, commonly applied in Target-Risk Funds where the portfolio's risk level remains consistent over time. Target-Date Funds, in contrast, adjust their asset allocation dynamically as the target retirement date approaches, reducing exposure to riskier assets and increasing more conservative investments.

Portfolio Decumulation

Portfolio decumulation strategies differ significantly between Target-Date Funds, which automatically adjust asset allocation to become more conservative as the retirement date approaches, and Target-Risk Funds, which maintain a consistent risk level based on the investor's risk tolerance regardless of time horizon. Target-Date Funds prioritize reducing volatility and preserving capital during retirement, while Target-Risk Funds focus on steady investment risk aligned with investor preferences throughout the decumulation phase.

Investment Horizon

Investment horizon critically influences the choice between Target-Date Funds, which automatically adjust asset allocation based on a specified retirement year, and Target-Risk Funds, which maintain a consistent risk level aligned with the investor's risk tolerance regardless of time frame. Target-Date Funds suit investors with a clear retirement timeline seeking a decreasing risk profile, whereas Target-Risk Funds appeal to those prioritizing a steady risk approach independent of the investment duration.

Age-Based Allocation

Age-based allocation in Target-Date Funds adjusts asset mix progressively to reduce risk as investors approach retirement age, emphasizing fixed income over equities for capital preservation. Target-Risk Funds maintain a consistent risk profile regardless of age, providing investors with a fixed allocation aligned to their risk tolerance rather than a changing timeline.

Volatility Management

Volatility management in Target-Date Funds involves gradually reducing risk exposure by shifting asset allocation to more conservative investments as the target retirement date approaches, whereas Target-Risk Funds maintain a consistent risk level aligned with the investor's risk tolerance regardless of time horizon. Target-Date Funds prioritize time-based risk reduction, while Target-Risk Funds emphasize risk level stability, making each suitable for different investor objectives regarding market volatility sensitivity.

Target-Date Fund vs Target-Risk Fund Infographic

moneydif.com

moneydif.com