Absolute Return Funds aim to achieve positive returns regardless of market conditions by employing diverse strategies such as hedging and short selling. Relative Return Funds seek to outperform a specific benchmark or index but may still experience negative returns if the benchmark declines. Investors choose Absolute Return Funds for capital preservation and consistent gains, while Relative Return Funds appeal to those prioritizing market-relative performance.

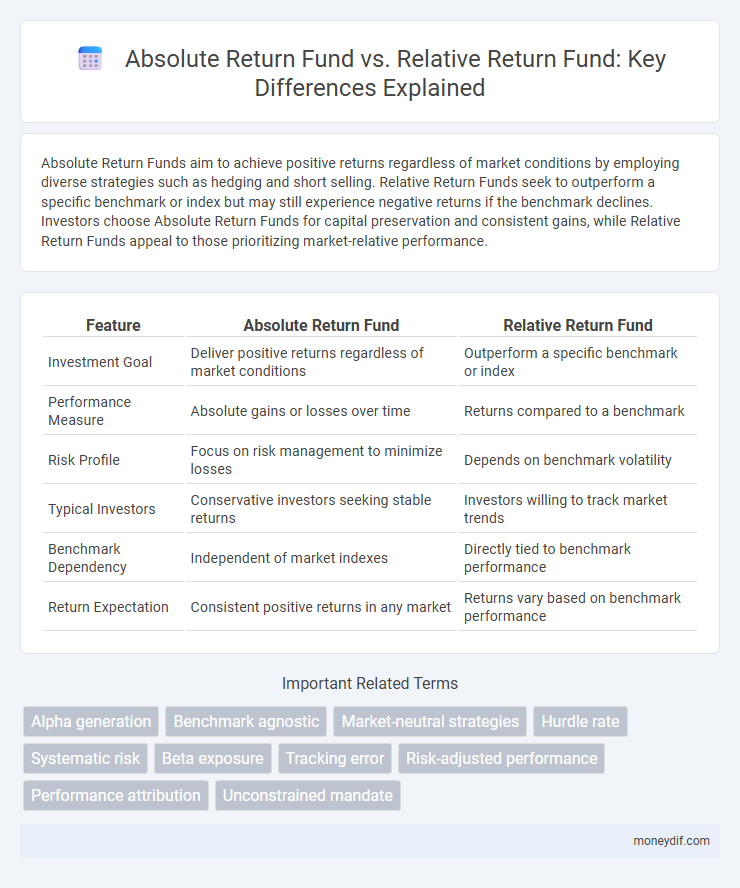

Table of Comparison

| Feature | Absolute Return Fund | Relative Return Fund |

|---|---|---|

| Investment Goal | Deliver positive returns regardless of market conditions | Outperform a specific benchmark or index |

| Performance Measure | Absolute gains or losses over time | Returns compared to a benchmark |

| Risk Profile | Focus on risk management to minimize losses | Depends on benchmark volatility |

| Typical Investors | Conservative investors seeking stable returns | Investors willing to track market trends |

| Benchmark Dependency | Independent of market indexes | Directly tied to benchmark performance |

| Return Expectation | Consistent positive returns in any market | Returns vary based on benchmark performance |

Overview of Absolute Return Funds

Absolute Return Funds aim to deliver positive returns regardless of market conditions by employing diverse strategies such as long/short equity, arbitrage, and global macro. These funds focus on minimizing volatility and downside risk through active risk management and hedging techniques. Investors seeking consistent performance and capital preservation often prefer Absolute Return Funds over traditional relative return benchmarks.

Overview of Relative Return Funds

Relative return funds aim to outperform a specific benchmark or market index, such as the S&P 500, by closely tracking its performance while seeking incremental gains. These funds employ various active management strategies to achieve returns that exceed or closely match the benchmark over defined periods. Investors use relative return funds to measure fund manager effectiveness against market trends and to maintain alignment with the overall market risk profile.

Key Differences Between Absolute and Relative Return Funds

Absolute Return Funds aim to generate positive returns regardless of market conditions by employing diverse strategies such as long-short equity, derivatives, and arbitrage. Relative Return Funds measure performance against a benchmark index, targeting to outperform the specified market or sector while accepting market risks. The key differences lie in investment objectives, risk profile, and performance evaluation metrics, with Absolute return focusing on constant positive gains and Relative return dependent on benchmark comparison.

Investment Objectives: Absolute vs Relative Return

Absolute return funds aim to generate positive returns regardless of market conditions by focusing on capital preservation and consistent growth, often employing diverse strategies such as hedging and alternative investments. Relative return funds seek to outperform a benchmark index, measuring success based on gains compared to market performance rather than achieving positive returns in all environments. Investors choose absolute return funds for stability and risk mitigation, while relative return funds appeal to those prioritizing market-beating performance linked to specific benchmarks.

Risk Management Approaches Compared

Absolute Return Funds employ risk management strategies focused on minimizing losses through diversification, hedging, and dynamic asset allocation to achieve consistent positive returns regardless of market conditions. Relative Return Funds manage risk by benchmarking performance against a specific market index, adjusting portfolios to outperform or track that index while accepting market-wide volatility. These contrasting approaches highlight Absolute Return Funds' emphasis on capital preservation versus Relative Return Funds' focus on relative performance within market fluctuations.

Performance Metrics and Benchmarks

Absolute Return Funds measure performance based on positive returns regardless of market conditions, targeting consistent gains through diverse strategies without relying on benchmarks. Relative Return Funds evaluate performance against specific market indexes or peer groups, aiming to outperform these benchmarks by a defined margin. Key metrics for Absolute Return Funds include Sharpe Ratio and Sortino Ratio, while Relative Return Funds focus on tracking error, alpha, and beta to assess risk-adjusted returns and market-relative performance.

Suitability for Different Investor Profiles

Absolute Return Funds suit investors seeking consistent positive returns regardless of market direction, prioritizing capital preservation and low volatility. Relative Return Funds appeal to investors comfortable with benchmark comparisons, aiming to outperform market indices but accepting potential fluctuations. Risk tolerance, investment goals, and market outlook are key factors determining which fund type aligns with an investor's profile.

Fee Structures and Costs

Absolute Return Funds typically charge higher management fees and performance-based fees due to their active strategies aimed at delivering positive returns regardless of market conditions. Relative Return Funds generally have lower fees, often structured as a percentage of assets under management, since they aim to outperform a benchmark rather than achieve absolute gains. Investors should carefully assess the total expense ratios and potential performance fees as these costs directly impact net returns in both fund types.

Historical Performance Analysis

Absolute Return Funds deliver consistent positive returns by targeting a fixed benchmark independent of market conditions, often proven by historical performance showing reduced volatility and steady gains during downturns. Relative Return Funds aim to outperform a specific market index, with historical performance fluctuating in line with market cycles, sometimes outperforming in bull markets but underperforming during downturns. Historical data highlights Absolute Return Funds' resilience in bear markets, while Relative Return Funds excel during strong market rallies.

Choosing the Right Fund for Your Portfolio

Absolute Return Funds aim to generate positive returns regardless of market conditions, making them suitable for investors seeking consistent performance and lower volatility. Relative Return Funds, by contrast, focus on outperforming a benchmark index, appealing to those willing to accept market fluctuations for potentially higher gains. Choosing the right fund depends on your risk tolerance, investment goals, and the desire for stability versus benchmark-relative growth.

Important Terms

Alpha generation

Alpha generation measures an Absolute Return Fund's ability to deliver returns exceeding a benchmark by capturing unique market opportunities, whereas a Relative Return Fund focuses on outperforming a specific index or peer group regardless of overall market performance. Investors seeking consistent, market-independent gains prioritize Absolute Return Funds for their potential to generate positive alpha across varied economic conditions.

Benchmark agnostic

Benchmark agnostic funds focus on generating positive returns regardless of market conditions, making Absolute Return Funds a prime example by aiming for consistent gains without comparing performance to traditional indices. Relative Return Funds, in contrast, measure success based on outperforming specific benchmarks, emphasizing relative performance rather than absolute profit.

Market-neutral strategies

Market-neutral strategies aim to achieve consistent Absolute Return Fund performance by minimizing market risk, unlike Relative Return Funds that focus on outperforming specific benchmarks.

Hurdle rate

Hurdle rate is a predefined minimum return that Absolute Return Funds must exceed to generate performance fees, ensuring investors receive positive gains regardless of market benchmarks, while Relative Return Funds measure performance against a specific index or benchmark without a fixed hurdle rate. This distinction impacts risk management and incentive structures, with Absolute Return Funds focusing on absolute gains and Relative Return Funds targeting outperformance relative to market conditions.

Systematic risk

Systematic risk, also known as market risk, affects Absolute Return Funds and Relative Return Funds differently based on their investment strategies; Absolute Return Funds aim to minimize market exposure by targeting positive returns regardless of market direction, while Relative Return Funds focus on outperforming a benchmark, thus being more sensitive to market fluctuations. The effectiveness of risk management in Absolute Return Funds typically leads to lower correlation with market indices, reducing vulnerability to systematic risk compared to Relative Return Funds, which inherently carry higher beta and are more exposed to systemic market events.

Beta exposure

Beta exposure measures the sensitivity of an Absolute Return Fund and a Relative Return Fund to market movements, with Absolute Return Funds typically targeting low or near-zero beta to minimize market risk while seeking positive returns across various conditions. Relative Return Funds often have higher beta exposure, aiming to outperform a benchmark index by capturing market trends and volatility.

Tracking error

Tracking error measures the volatility of the difference in returns between an Absolute Return Fund and its benchmark, reflecting how closely the fund follows its intended target performance. Absolute Return Funds aim to deliver positive returns regardless of market conditions, often resulting in higher tracking error compared to Relative Return Funds, which seek to outperform a benchmark by maintaining similar risk exposures.

Risk-adjusted performance

Risk-adjusted performance measures such as the Sharpe ratio and Sortino ratio are critical in comparing Absolute Return Funds, which aim for positive returns regardless of market conditions, versus Relative Return Funds that seek to outperform a benchmark index. Absolute Return Funds often focus on strategies that minimize volatility and drawdowns to enhance risk-adjusted returns, while Relative Return Funds may exhibit higher beta exposure relative to market fluctuations, impacting their risk-adjusted metrics differently.

Performance attribution

Performance attribution in Absolute Return Funds focuses on identifying sources of returns independent of benchmark indices, emphasizing genuine alpha generation through market-neutral strategies. In contrast, Relative Return Funds attribute performance based on deviations from a benchmark index, highlighting the impact of sector allocation, stock selection, and timing decisions relative to that reference.

Unconstrained mandate

An unconstrained mandate in investment management allows portfolio managers to invest across asset classes, geographies, and market capitalizations without strict benchmarks, focusing on achieving absolute returns rather than relative performance. Absolute Return Funds seek positive gains regardless of market conditions, contrasting with Relative Return Funds that aim to outperform a specified benchmark or index.

Absolute Return Fund vs Relative Return Fund Infographic

moneydif.com

moneydif.com