A soft close in a fund allows limited new investments while maintaining some flexibility for existing investors to adjust their holdings, fostering controlled growth. In contrast, a hard close fully halts all new capital commitments, signaling a strict end to fundraising efforts and enabling the management to concentrate on portfolio optimization. Choosing between a soft close and hard close impacts investor relations and fund deployment strategies significantly.

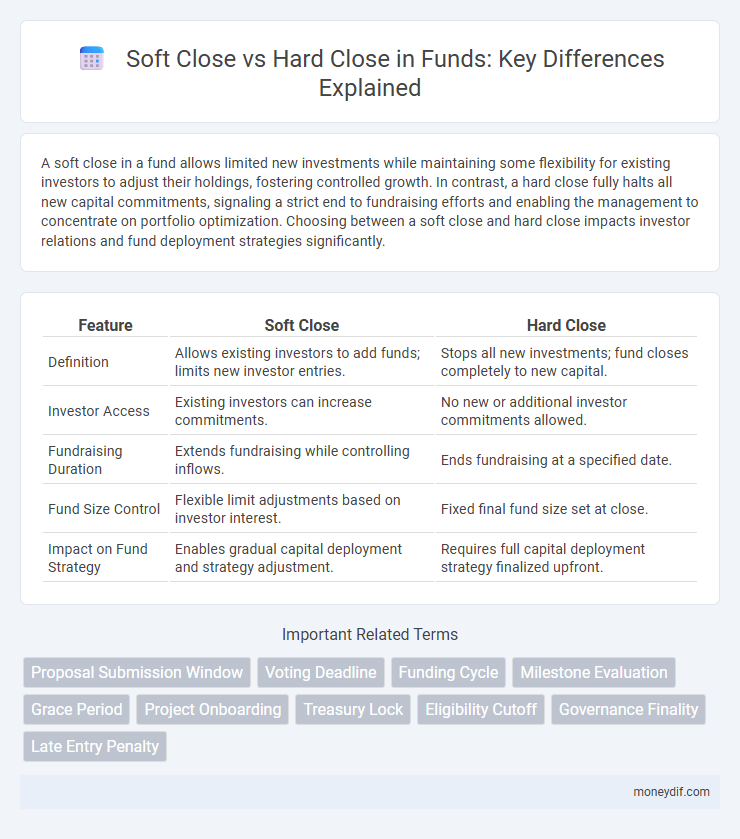

Table of Comparison

| Feature | Soft Close | Hard Close |

|---|---|---|

| Definition | Allows existing investors to add funds; limits new investor entries. | Stops all new investments; fund closes completely to new capital. |

| Investor Access | Existing investors can increase commitments. | No new or additional investor commitments allowed. |

| Fundraising Duration | Extends fundraising while controlling inflows. | Ends fundraising at a specified date. |

| Fund Size Control | Flexible limit adjustments based on investor interest. | Fixed final fund size set at close. |

| Impact on Fund Strategy | Enables gradual capital deployment and strategy adjustment. | Requires full capital deployment strategy finalized upfront. |

Understanding Fund Closures: Soft vs Hard Close

Soft close in fund management allows existing investors to continue contributing while restricting new investors, facilitating gradual capital accumulation without halting fundraising. Hard close signifies a definitive end to fundraising, preventing any new capital inflow and enabling the fund to focus on deployment and portfolio management. Recognizing these closure types is crucial for investors and fund managers to align investment strategies and timelines effectively.

Defining Soft Close and Hard Close for Funds

Soft close in funds refers to the temporary suspension of new investor entries while allowing existing investors to continue adding capital, aiming to manage fund size and maintain performance. Hard close signifies the definitive cutoff date when a fund stops accepting any new investments, often to preserve fund strategy and protect investor interests. These mechanisms help fund managers control asset inflows and optimize fund operations.

Key Differences Between Soft Close and Hard Close

Soft close allows a fund to stop accepting new investors while still permitting existing investors to add capital, maintaining portfolio stability and managing asset growth gradually. Hard close completely shuts the fund to all new and additional investments, signaling the end of the fundraising period and focusing solely on managing existing assets. Key differences include investor access limitations, capital inflow control, and strategic timing for scaling or stabilizing fund size.

Advantages of Soft Close for Investors

Soft close allows existing investors to increase their stakes while preventing new investors from entering, preserving fund stability and protecting returns. It provides flexibility for portfolio managers to manage capital efficiently without a full shutdown. This approach minimizes dilution risk and maintains alignment with investor interests, enhancing overall value preservation.

Benefits and Drawbacks of Hard Close

A hard close in fund management sets a strict deadline for capital commitments, enhancing fundraising certainty and enabling more precise investment planning. This approach limits investor commitments, which may restrict additional capital inflows but fosters discipline and urgency among investors. However, it can lead to missed opportunities for securing further capital and potentially exclude late investors seeking entry.

Impact of Soft Close on Fund Liquidity

A soft close limits new investor entries without halting additional subscriptions from existing investors, thereby maintaining a more stable capital inflow and reducing liquidity strain. This approach can preserve fund liquidity by preventing sudden large cash outflows while still allowing manageable contributions to support ongoing investments. Funds employing a soft close often experience smoother liquidity management compared to hard close funds that freeze all further investments, which can lead to abrupt adjustments in cash reserves.

How Hard Close Influences Fund Performance

Hard close in fund management strictly limits new investor entries after the specified cutoff date, preserving fund capacity and maintaining investment strategy integrity. This approach can enhance fund performance by preventing asset dilution and enabling more focused portfolio management. By restricting inflows, hard close helps fund managers execute long-term strategies without pressure to deploy excess capital, often resulting in improved returns and risk control.

When Fund Managers Implement Soft or Hard Close

Fund managers implement a soft close when inflows risk diluting existing investors' returns, allowing limited new subscriptions while maintaining fund stability. A hard close is enforced to completely halt new investments, typically triggered by reaching capacity, regulatory constraints, or strategic shifts in fund management. Timing the close depends on market conditions, investor demand, and the fund's growth objectives to optimize portfolio performance.

Investor Considerations for Closed-End Funds

Investors evaluating closed-end funds must consider the impact of soft close versus hard close on liquidity and capital deployment strategies. A soft close allows limited new investments, maintaining flexibility while controlling fund size, whereas a hard close halts all new capital, potentially preserving existing investor value but limiting growth. Understanding these mechanisms is crucial for assessing fund management's approach to market opportunities and investor exit timing.

Choosing the Right Strategy: Soft Close vs Hard Close

Choosing the right fund closing strategy depends on investor demand, fund size, and market conditions; a soft close allows limited new investments to manage capacity without fully halting fundraising, preserving relationships and potential capital influx. Hard close completely stops accepting new commitments, providing clear fund size limits and operational focus but may restrict growth opportunities. Assessing investor appetite and long-term fund goals ensures selecting between a flexible soft close or definitive hard close aligns with optimal capital deployment and performance.

Important Terms

Proposal Submission Window

The Proposal Submission Window defines the timeframe during which applicants can submit their proposals, with a Soft Close allowing submissions past the deadline for a short grace period, often with penalties or limited consideration. In contrast, a Hard Close enforces a strict cutoff time where no submissions are accepted beyond the deadline, ensuring firmer control over the evaluation process and schedule.

Voting Deadline

Voting deadlines determine the final opportunity for shareholders to cast votes, with soft close allowing late votes received after the deadline but before the meeting, while hard close strictly rejects any votes submitted after the deadline. Companies opting for a soft close can increase shareholder participation and flexibility, whereas a hard close ensures a definitive cutoff, providing clarity and secure vote tabulation.

Funding Cycle

A funding cycle with a soft close allows investment commitments to continue after the initial target is met, whereas a hard close strictly ends fundraising at a predetermined deadline.

Milestone Evaluation

Milestone evaluation in project management distinguishes soft close, which allows flexible completion and stakeholder feedback, from hard close, enforcing strict deadline adherence and final deliverables submission.

Grace Period

A grace period in financial soft close allows limited post-close adjustments without reopening accounts, whereas a hard close finalizes all records with no further changes permitted.

Project Onboarding

Project onboarding involves a clear distinction between soft close and hard close phases; soft close allows for final adjustments and minor deliverables refinement before officially concluding project tasks, while hard close marks the formal completion with finalized documentation, contract closure, and resource release. Effective management of the soft close phase ensures all stakeholder feedback is integrated, which minimizes post-project adjustments during the hard close, enhancing overall project success and compliance.

Treasury Lock

A Treasury Lock is a financial derivative used to hedge against interest rate risk on future Treasury securities purchases, often implemented during budgeting periods with either soft close or hard close accounting methods. Soft close allows adjustments after the fiscal period for better accuracy in Treasury Lock valuation, whereas hard close finalizes accounts immediately, limiting flexibility in accounting for interest rate fluctuations.

Eligibility Cutoff

Eligibility cutoff for soft close allows late entries before the final deadline, whereas hard close enforces a strict cutoff with no exceptions.

Governance Finality

Governance finality ensures that decisions within a blockchain or decentralized network are irreversible and recognized as definitive, with soft close allowing tentative transaction acceptance subject to change, while hard close enforces strict immutability and immediate transaction finalization. This distinction impacts network security, user trust, and the efficiency of consensus algorithms, as soft close may optimize flexibility whereas hard close prioritizes absolute certainty and risk mitigation.

Late Entry Penalty

Late Entry Penalty in financial accounting refers to the additional charges or adjustments applied when transactions are recorded after the official closing date, impacting the accuracy of Soft Close and Hard Close processes; Soft Close allows limited post-period adjustments with minimal penalties, whereas Hard Close enforces strict cutoffs, resulting in higher penalties for late entries. This distinction ensures timely and precise financial reporting, reducing discrepancies and enhancing audit compliance.

Soft Close vs Hard Close Infographic

moneydif.com

moneydif.com