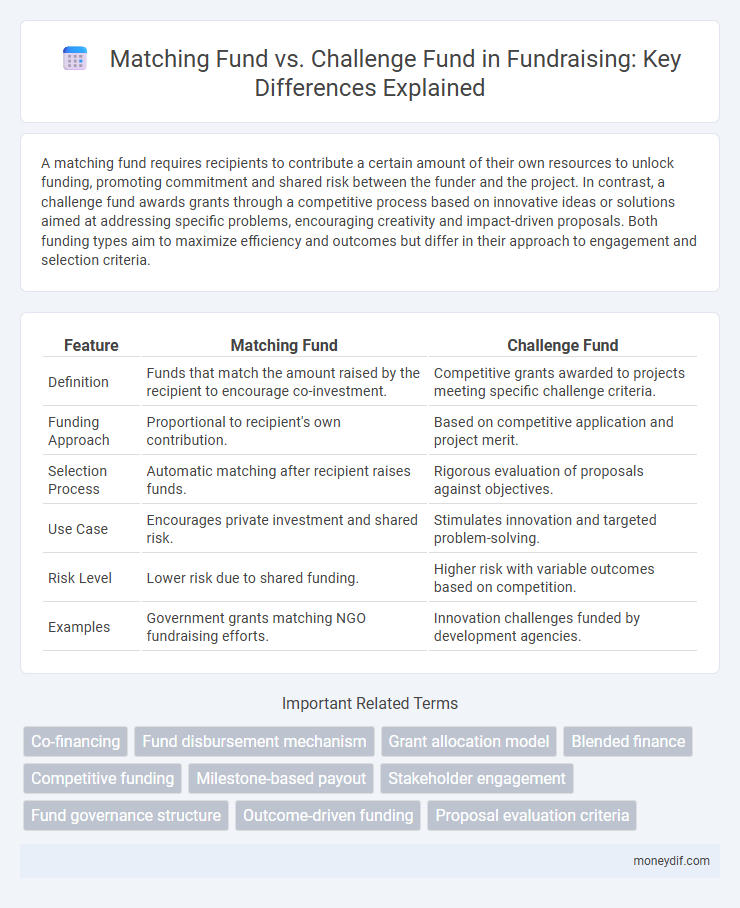

A matching fund requires recipients to contribute a certain amount of their own resources to unlock funding, promoting commitment and shared risk between the funder and the project. In contrast, a challenge fund awards grants through a competitive process based on innovative ideas or solutions aimed at addressing specific problems, encouraging creativity and impact-driven proposals. Both funding types aim to maximize efficiency and outcomes but differ in their approach to engagement and selection criteria.

Table of Comparison

| Feature | Matching Fund | Challenge Fund |

|---|---|---|

| Definition | Funds that match the amount raised by the recipient to encourage co-investment. | Competitive grants awarded to projects meeting specific challenge criteria. |

| Funding Approach | Proportional to recipient's own contribution. | Based on competitive application and project merit. |

| Selection Process | Automatic matching after recipient raises funds. | Rigorous evaluation of proposals against objectives. |

| Use Case | Encourages private investment and shared risk. | Stimulates innovation and targeted problem-solving. |

| Risk Level | Lower risk due to shared funding. | Higher risk with variable outcomes based on competition. |

| Examples | Government grants matching NGO fundraising efforts. | Innovation challenges funded by development agencies. |

Understanding Matching Funds: Definition and Purpose

Matching funds are financial contributions from an organization that require recipients to raise a specific amount of money to unlock the matching grant, incentivizing fundraising efforts and increasing total available capital. These funds aim to leverage additional resources, encourage stakeholder investment, and enhance project sustainability by aligning donor and recipient interests. Understanding the purpose of matching funds is crucial for organizations seeking to maximize impact through collaborative financing strategies.

What is a Challenge Fund? Key Features Explained

A Challenge Fund is a competitive grant mechanism designed to stimulate innovation and support projects aligned with specific development goals by providing financial incentives. Key features include a transparent, merit-based selection process, emphasis on leveraging co-financing or partnerships, and a focus on results-driven, high-impact solutions that address targeted challenges. This fund type encourages collaboration among applicants and often requires measurable outcomes to ensure effective use of resources.

Core Differences Between Matching and Challenge Funds

Matching funds require recipients to contribute a portion of the total project cost, ensuring stakeholder commitment and leveraging additional resources, while challenge funds competitively allocate grants to projects based on predefined criteria aimed at innovation and impact. Matching funds often focus on co-financing and partnership strengthening, whereas challenge funds prioritize stimulating new solutions and driving performance through competitive selection. The core difference lies in their funding approach: matching funds demand recipient investment alignment, whereas challenge funds emphasize competition and merit-based allocation.

Advantages of Matching Funds for Donors and Organizations

Matching funds incentivize increased donor contributions by doubling the impact of individual donations, thereby maximizing fundraising efforts. Organizations benefit from enhanced credibility and donor trust, as matching funds demonstrate external validation and financial support. This mechanism encourages sustained giving and fosters stronger partnerships between donors and recipients through shared commitment and risk reduction.

Key Benefits of Challenge Funds in Social Innovation

Challenge funds accelerate social innovation by targeting high-impact projects through competitive grant processes that drive creativity and scalability. They leverage diverse stakeholder expertise and resources to identify and support groundbreaking solutions addressing complex social issues. The competitive nature ensures efficient allocation of funds to the most promising initiatives, enhancing transparency and accountability in social impact investing.

Eligibility Criteria: Matching Fund vs Challenge Fund

Matching fund eligibility typically requires recipients to secure a portion of the project's total funding from other sources, ensuring commitment and shared financial risk. Challenge fund eligibility focuses on innovative solutions addressing specific thematic problems, with applicants often needing to demonstrate capacity for scalability and impact. Both funds prioritize transparency and accountability, but matching funds emphasize co-financing while challenge funds target solution-driven projects within defined eligibility scopes.

Impact Measurement: Assessing Success in Both Fund Models

Matching funds track success through direct alignment of donor contributions with recipient funds, emphasizing quantifiable leverage and financial engagement metrics. Challenge funds prioritize impact measurement by evaluating project outcomes against pre-defined social or environmental goals, using rigorous monitoring and evaluation frameworks. Both fund models rely on data-driven assessment tools, but challenge funds focus more on long-term impact and innovation, while matching funds highlight immediate financial mobilization effects.

Case Studies: Real-World Examples of Matching and Challenge Funds

Case studies from the Bill & Melinda Gates Foundation illustrate matching funds boosting local NGO contributions by 50%, enhancing community health projects. The UK's Department for International Development successfully utilized challenge funds to award over PS100 million to innovative climate adaptation technologies, driving scalable impact through competition. Research on the Global Innovation Fund reveals that matching funds typically secure sustained donor engagement, whereas challenge funds catalyze breakthrough solutions with faster deployment.

Choosing the Right Fund Type for Your Project or Organization

Matching funds require recipients to contribute an equal or proportional amount, encouraging organizational commitment and leveraging additional resources, while challenge funds provide competitive grants based on proposals addressing specific thematic goals. Selecting the right fund depends on your project's capacity for co-financing and strategic alignment with fund objectives, ensuring optimal resource utilization and impact. Understanding the differences in funding mechanisms enhances effective application strategies and maximizes financial support for sustainable project implementation.

Future Trends in Philanthropy: Matching and Challenge Funds Evolution

Matching funds increasingly leverage digital platforms and data analytics to enhance donor engagement and impact measurement, driving efficiency in philanthropic capital allocation. Challenge funds are evolving towards outcome-based financing models, emphasizing measurable social returns and fostering innovation through competitive grantmaking. Future trends indicate a convergence of both fund types with technological integration, promoting transparency and scalability in philanthropic investments.

Important Terms

Co-financing

Co-financing strategies leverage matching funds to ensure proportional financial contributions from partners, while challenge funds allocate competitive grants to stimulate innovation and impact.

Fund disbursement mechanism

Matching funds require recipients to provide a portion of the financing themselves, while challenge funds award grants based on competitive proposal submissions to drive innovation.

Grant allocation model

Grant allocation models often compare matching funds, which require recipients to contribute resources, with challenge funds that distribute grants based on competitive proposals to incentivize innovation and impact.

Blended finance

Blended finance leverages private investment by combining matching funds, which require proportional co-investment, with challenge funds that provide competitive grants to incentivize innovative projects and drive scalable development impact.

Competitive funding

Competitive funding mechanisms include Matching Funds, which require recipients to match contributions to leverage investment, and Challenge Funds, which allocate resources through competitive proposals to incentivize innovation.

Milestone-based payout

Milestone-based payout structures allocate funds incrementally upon achieving specific project goals, improving accountability and progress tracking. Matching funds require recipients to secure co-investment, enhancing resource leverage, while challenge funds provide competitive grants based on proposal merit, promoting innovation and targeted impact.

Stakeholder engagement

Stakeholder engagement in matching funds involves active collaboration and shared financial commitment between funders and beneficiaries, ensuring mutual accountability and alignment of interests. In contrast, challenge funds emphasize competitive innovation and risk-sharing by awarding grants to proposals demonstrating the highest potential impact, requiring stakeholders to engage through proposal development and performance monitoring.

Fund governance structure

A fund governance structure for matching funds typically emphasizes co-financing partnerships and donor alignment, while challenge funds prioritize competitive project selection and performance-based oversight.

Outcome-driven funding

Outcome-driven funding prioritizes measurable results by combining government or donor matching funds with competitive challenge funds to incentivize efficient project performance.

Proposal evaluation criteria

Proposal evaluation criteria prioritize alignment with fund-specific objectives, emphasizing matching funds' capacity to leverage additional resources and challenge funds' focus on innovation and risk mitigation.

Matching fund vs Challenge fund Infographic

moneydif.com

moneydif.com