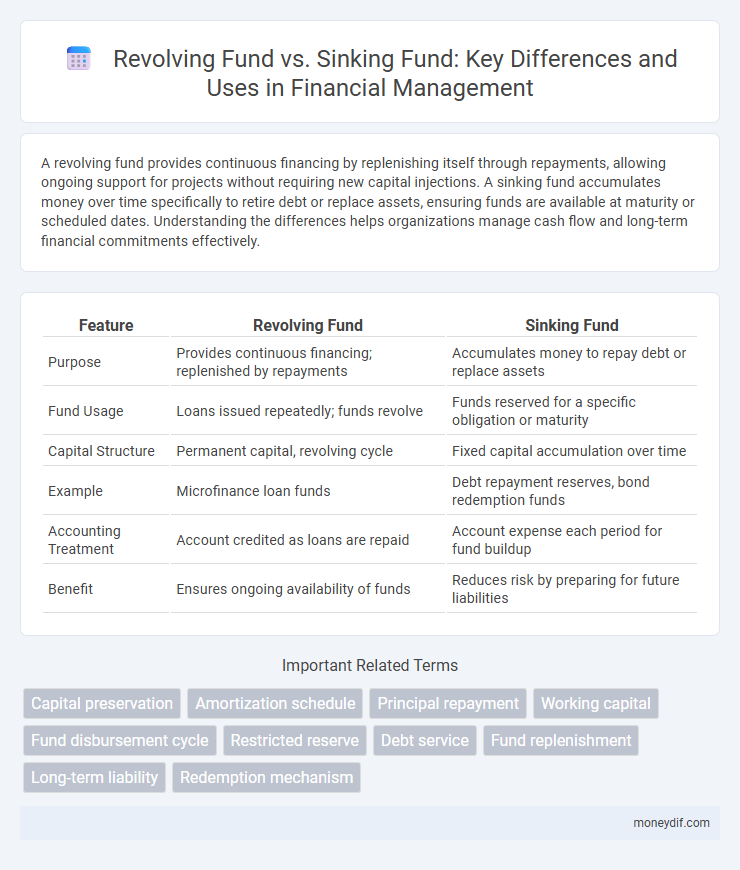

A revolving fund provides continuous financing by replenishing itself through repayments, allowing ongoing support for projects without requiring new capital injections. A sinking fund accumulates money over time specifically to retire debt or replace assets, ensuring funds are available at maturity or scheduled dates. Understanding the differences helps organizations manage cash flow and long-term financial commitments effectively.

Table of Comparison

| Feature | Revolving Fund | Sinking Fund |

|---|---|---|

| Purpose | Provides continuous financing; replenished by repayments | Accumulates money to repay debt or replace assets |

| Fund Usage | Loans issued repeatedly; funds revolve | Funds reserved for a specific obligation or maturity |

| Capital Structure | Permanent capital, revolving cycle | Fixed capital accumulation over time |

| Example | Microfinance loan funds | Debt repayment reserves, bond redemption funds |

| Accounting Treatment | Account credited as loans are repaid | Account expense each period for fund buildup |

| Benefit | Ensures ongoing availability of funds | Reduces risk by preparing for future liabilities |

Introduction to Revolving Funds and Sinking Funds

Revolving funds are self-replenishing financial sources that maintain a continuous cycle of funding by using repayments or revenues generated to finance new projects or expenses. Sinking funds consist of accumulating money gradually over time to repay debt or replace assets, ensuring long-term financial stability and targeted savings. Both funds serve distinct roles in financial management, where revolving funds prioritize liquidity and reuse, while sinking funds emphasize scheduled reserves for future obligations.

Core Definitions: Revolving Fund vs Sinking Fund

A revolving fund is a self-replenishing financial resource used to finance ongoing operations, allowing continuous reuse of capital as collections are received. A sinking fund is a reserve fund established by an organization to accumulate money over time for the specific purpose of repaying debt or replacing a large asset. While revolving funds maintain liquidity for recurring expenses, sinking funds ensure future financial obligations are systematically met.

Key Features and Characteristics

A revolving fund is a self-replenishing financing mechanism allowing continuous funding for recurring expenses or projects by recycling repayments or revenues, whereas a sinking fund is a reserve established to accumulate money over time specifically to repay debt or replace an asset. The revolving fund provides ongoing liquidity and flexibility, ideal for operational needs, while the sinking fund emphasizes long-term financial planning and debt reduction through scheduled contributions. Key characteristics include revolving fund's repeated use of principal and interest repayments versus sinking fund's periodic deposits aimed at principal accumulation for future liabilities.

How Revolving Funds Work

Revolving funds operate by continuously replenishing themselves through repayments from borrowers or revenues generated, allowing for ongoing funding without the need for additional capital infusions. These funds are commonly used in government and nonprofit sectors to finance projects or programs where repayments are expected, maintaining liquidity and sustainability. Unlike sinking funds that accumulate money over time to retire debt, revolving funds provide a dynamic and renewable source of financing.

How Sinking Funds Operate

Sinking funds operate by systematically setting aside money over time to repay debt or replace assets, ensuring financial resources are available when obligations mature. Unlike revolving funds, which replenish as expenses occur, sinking funds accumulate a dedicated reserve with scheduled contributions and planned withdrawals. This method reduces default risk and enhances creditworthiness by maintaining a clear repayment strategy for bonds or loans.

Primary Purposes and Objectives

A revolving fund is designed to provide continuous financing for ongoing operations by replenishing used funds through repayments or revenues, ensuring liquidity for recurring expenses. A sinking fund's primary objective is to accumulate money over time to retire long-term debt or replace capital assets, promoting financial stability and reducing risk. Both funds serve distinct purposes: revolving funds maintain cash flow flexibility, while sinking funds emphasize debt management and asset replacement.

Advantages and Disadvantages

Revolving funds allow continuous use of capital for ongoing projects, offering flexibility and immediate access to resources, but they risk depletion if inflows are inconsistent. Sinking funds provide disciplined savings for debt repayment or asset replacement, reducing financial risk and improving creditworthiness, yet they require strict adherence to contribution schedules and limit fund availability. Choosing between these funds depends on organizational cash flow stability and long-term financial planning needs.

Common Use Cases and Applications

Revolving funds are commonly used to finance ongoing operational expenses, such as maintenance or minor capital projects, allowing continuous replenishment as expenses are paid off. Sinking funds are typically employed to accumulate resources over time to repay long-term debts or replace major assets, ensuring availability of funds at maturity without impacting operational liquidity. Organizations often apply revolving funds for short-term financing needs while reserving sinking funds for planned, large-scale expenditures or debt retirement.

Financial Management Implications

Rotating funds optimize liquidity by allowing continuous borrowing and repayment cycles, enhancing short-term cash flow management for organizations. In contrast, sinking funds accumulate capital over time to meet future debt obligations, promoting long-term financial stability and reducing default risk. Effective financial management requires balancing revolving fund flexibility with sinking fund discipline to ensure operational efficiency and sustainable debt servicing.

Choosing the Right Fund Type for Your Needs

Choosing between a revolving fund and a sinking fund depends on your financial goals and cash flow management needs. A revolving fund allows continuous reuse of capital for ongoing expenses or investments, offering flexibility and liquidity for recurring costs. In contrast, a sinking fund is designed for saving a specific amount over time to pay off a debt or large future expense, providing disciplined financial planning and reducing long-term debt risk.

Important Terms

Capital preservation

A revolving fund provides continuous capital replenishment through ongoing income for sustained operations, while a sinking fund systematically accumulates capital over time to preserve assets and meet future debt obligations.

Amortization schedule

An amortization schedule for a sinking fund details periodic contributions and interest accumulation to meet future debt repayment, whereas a revolving fund lacks such a fixed schedule, allowing continuous replenishment and flexible usage.

Principal repayment

Principal repayment in a revolving fund involves continuous replenishment as the fund is reused for new loans, enabling sustained liquidity and ongoing financing activities. In contrast, a sinking fund accumulates scheduled principal payments over time to ensure sufficient reserves for future debt redemption or large capital expenditures, promoting structured financial planning and reduced default risk.

Working capital

Working capital management involves maintaining sufficient liquidity to meet short-term obligations, where a revolving fund provides continuous access to working capital by replenishing itself through regular repayments, enhancing operational flexibility. In contrast, a sinking fund accumulates resources over time for a specific future obligation, limiting immediate cash availability but ensuring structured long-term financial stability.

Fund disbursement cycle

The fund disbursement cycle for a revolving fund involves continuous replenishment as funds are disbursed and repaid, enabling ongoing financing without depleting the principal. In contrast, a sinking fund's disbursement cycle is designed for gradual accumulation and periodic withdrawal to repay debt or replace assets, focusing on capital preservation rather than liquidity.

Restricted reserve

Restricted reserves represent portions of a company's equity set aside for specific purposes, often linked to obligations in sinking funds designed to repay debt over time. Revolving funds, unlike sinking funds, maintain liquidity for ongoing operational needs without fixed repayment schedules, making restricted reserves less commonly associated with them.

Debt service

Debt service for a revolving fund involves ongoing borrowing and repayment flexibility, while a sinking fund requires periodic allocations to accumulate capital for future debt repayment.

Fund replenishment

Fund replenishment in a revolving fund occurs through continuous contributions from repayments or revenues, while a sinking fund accumulates resources over time to meet a future, specific debt repayment or capital expenditure.

Long-term liability

Long-term liabilities involving revolving funds refer to recurring credit arrangements allowing continuous borrowing and repayment up to a credit limit, whereas sinking funds are specific reserves accumulated over time to repay a fixed debt or bond. Revolving funds offer flexible financing for ongoing operational needs, while sinking funds provide a systematic approach to debt retirement, minimizing default risk.

Redemption mechanism

The redemption mechanism for a sinking fund involves periodic payments to retire debt before maturity, reducing default risk and enhancing creditworthiness, while a revolving fund periodically replenishes its capital to finance ongoing operations without accumulating debt. Sinking funds systematically allocate resources to repay bonds, contrasting with revolving funds which maintain liquidity by cycling finances, optimizing cash flow management and long-term financial stability.

Revolving fund vs Sinking fund Infographic

moneydif.com

moneydif.com