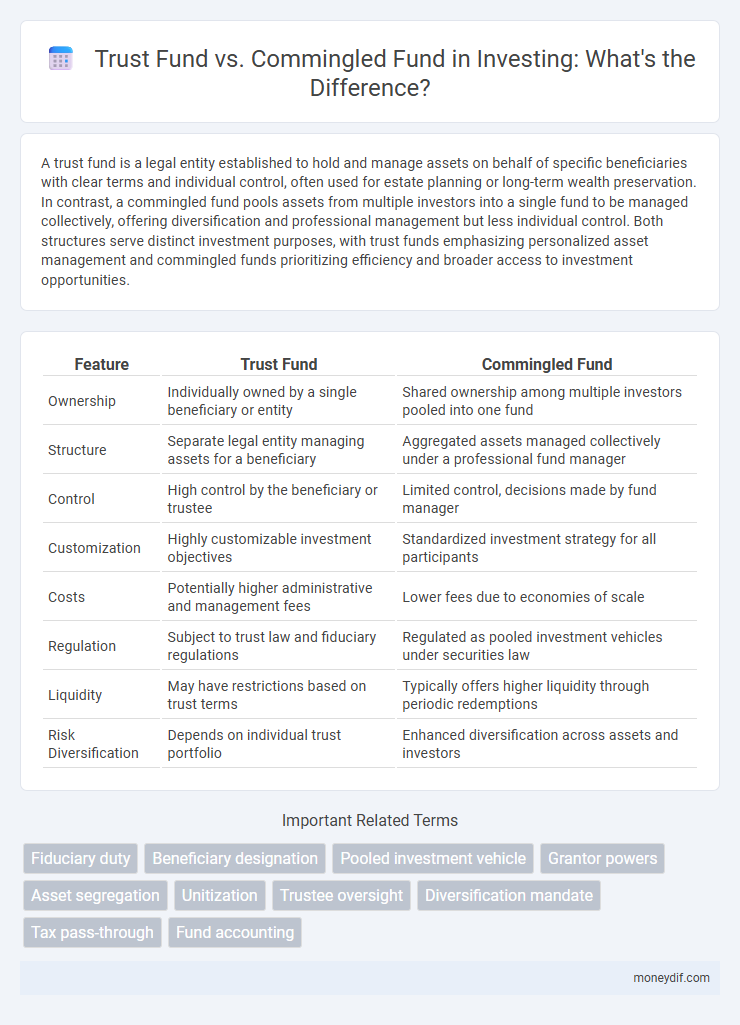

A trust fund is a legal entity established to hold and manage assets on behalf of specific beneficiaries with clear terms and individual control, often used for estate planning or long-term wealth preservation. In contrast, a commingled fund pools assets from multiple investors into a single fund to be managed collectively, offering diversification and professional management but less individual control. Both structures serve distinct investment purposes, with trust funds emphasizing personalized asset management and commingled funds prioritizing efficiency and broader access to investment opportunities.

Table of Comparison

| Feature | Trust Fund | Commingled Fund |

|---|---|---|

| Ownership | Individually owned by a single beneficiary or entity | Shared ownership among multiple investors pooled into one fund |

| Structure | Separate legal entity managing assets for a beneficiary | Aggregated assets managed collectively under a professional fund manager |

| Control | High control by the beneficiary or trustee | Limited control, decisions made by fund manager |

| Customization | Highly customizable investment objectives | Standardized investment strategy for all participants |

| Costs | Potentially higher administrative and management fees | Lower fees due to economies of scale |

| Regulation | Subject to trust law and fiduciary regulations | Regulated as pooled investment vehicles under securities law |

| Liquidity | May have restrictions based on trust terms | Typically offers higher liquidity through periodic redemptions |

| Risk Diversification | Depends on individual trust portfolio | Enhanced diversification across assets and investors |

Introduction to Trust Funds and Commingled Funds

Trust funds are legal arrangements where assets are held and managed by a trustee on behalf of beneficiaries, providing personalized investment strategies and asset protection. Commingled funds pool assets from multiple investors into a single investment portfolio, offering diversification and reduced management costs. Understanding the key differences in structure, control, and regulatory oversight helps investors choose between tailored trust funds and cost-efficient commingled investment options.

Defining Trust Funds

Trust funds are legal entities created to hold and manage assets on behalf of beneficiaries, providing fiduciary protection and clearly defined ownership rights. They offer personalized investment strategies tailored to the specific goals and risk tolerance of the grantor or beneficiaries. Unlike commingled funds, trust funds maintain separate accounts, ensuring asset segregation and enhanced control over investment decisions.

Understanding Commingled Funds

Commingled funds pool assets from multiple investors into a single investment vehicle, offering diversification and professional management while reducing individual costs. Unlike trust funds, which hold assets on behalf of a specific beneficiary with designated terms, commingled funds provide collective exposure to securities or assets without individualized ownership. This structure enhances liquidity and operational efficiency, making it a preferred choice for institutional investors seeking broad market exposure.

Key Differences Between Trust Funds and Commingled Funds

Trust funds are legal entities established to manage assets on behalf of specific beneficiaries with clearly defined terms, while commingled funds pool resources from multiple investors into a single investment portfolio. Trust funds offer individualized management and fiduciary responsibilities tailored to the grantor's instructions, whereas commingled funds emphasize diversification and cost efficiency through collective investment management. Key differences include regulatory frameworks, control over asset allocation, and the level of transparency provided to participants.

Legal Structure and Governance

Trust funds are established as legal entities under fiduciary law, with clearly defined beneficiaries and governed by trustees who have a duty to manage assets prudently according to the trust agreement. Commingled funds pool assets from multiple investors into a single fund structure, typically organized as partnerships or corporations, subject to regulatory oversight and governed by a board or management team responsible for investment decisions. Legal structures in trust funds emphasize individual asset protection and beneficiary rights, whereas commingled funds focus on operational efficiency and collective investment governance.

Investment Objectives and Strategies

Trust funds typically pursue specific investment objectives aligned with the grantor's directives, emphasizing capital preservation, income generation, or targeted growth through diversified, low-risk assets. Commingled funds pool assets from multiple investors to achieve broader market exposure, leveraging economies of scale for diverse strategies including equities, bonds, and alternative investments aimed at maximizing overall returns. Investment strategies in trust funds prioritize fiduciary responsibility and individual beneficiary needs, while commingled funds focus on risk-adjusted performance across a larger asset base.

Risk Management in Trust vs. Commingled Funds

Trust funds offer enhanced risk management by maintaining separate accounts for each beneficiary, limiting exposure to the risks of other investors and providing clear asset segregation. Commingled funds pool assets from multiple investors, increasing diversification but exposing participants to shared market and operational risks across the entire fund. Regulatory oversight and fiduciary responsibilities in trust funds prioritize capital preservation, whereas commingled funds focus on achieving collective growth through broader investment strategies.

Fees and Cost Structures

Trust funds typically involve higher fees due to personalized management and fiduciary responsibilities, with costs often including administrative fees, trustee fees, and investment management expenses tailored to the individual beneficiary. Commingled funds, such as mutual funds or pooled investment vehicles, benefit from economies of scale, resulting in lower overall expense ratios and reduced management fees spread across multiple investors. Understanding these cost structures is essential for investors prioritizing fee efficiency and transparency in fund management.

Suitability: Who Should Choose Trust or Commingled Funds?

Trust funds are suitable for individuals seeking personalized asset management, enhanced privacy, and specific inheritance goals, often recommended for high-net-worth families and estate planning purposes. Commingled funds appeal to investors aiming for diversification, lower minimum investment thresholds, and professional management of pooled assets, typically favored by small to mid-sized investors. Suitability depends on the investor's objectives, risk tolerance, and the desired level of control over fund administration.

Conclusion: Selecting the Right Fund Type for Your Needs

Choosing between a trust fund and a commingled fund depends on your investment goals, risk tolerance, and desired level of control. Trust funds offer personalized management and legal protection, ideal for individual beneficiaries needing tailored asset distribution. Commingled funds provide diversified, cost-efficient access to pooled assets, suitable for investors seeking broad market exposure with lower fees.

Important Terms

Fiduciary duty

Fiduciary duty requires trustees to manage trust funds separately and prudently, whereas commingled funds involve pooling assets from multiple beneficiaries, which may complicate individualized fiduciary accountability.

Beneficiary designation

Beneficiary designation in a trust fund ensures that assets are distributed directly to named individuals or entities, providing controlled and specific allocation aligned with the trust's terms; in contrast, a commingled fund pools assets from multiple investors, making individual beneficiary designations impractical and focusing instead on proportional ownership shares. Trust funds offer tailored estate planning benefits and creditor protection, while commingled funds prioritize collective investment growth and liquidity without individualized beneficiary directives.

Pooled investment vehicle

A pooled investment vehicle aggregates capital from multiple investors to enhance diversification and professional management, commonly structured as trust funds or commingled funds. Trust funds are legally established entities with specific beneficiary designations and fiduciary oversight, whereas commingled funds combine assets from various investors without segregating ownership, offering greater flexibility but potentially less personalized control.

Grantor powers

Grantor powers in a trust fund allow the grantor to retain certain controls, such as the ability to revoke or amend the trust, which directly affects the taxation and management of trust assets. In contrast, commingled funds pool assets from multiple investors without individualized grantor control, emphasizing collective management and typically limiting any single investor's direct powers over the fund.

Asset segregation

Asset segregation in trust funds ensures individual investor protection by legally separating assets, whereas commingled funds pool assets from multiple investors, increasing efficiency but reducing individualized asset protection.

Unitization

Unitization allows investors to hold proportional interests in a trust fund or a commingled fund, optimizing asset management by treating pooled assets as individual investment units.

Trustee oversight

Trustee oversight in Trust funds involves managing specific assets held for designated beneficiaries, ensuring fiduciary duties are met with transparency and strict adherence to the trust agreement. In contrast, oversight of Commingled funds focuses on pooled assets from multiple investors, requiring rigorous monitoring for proper allocation, risk management, and compliance with regulatory standards to protect collective interests.

Diversification mandate

A Diversification mandate in trust funds typically emphasizes individual asset allocation to minimize risk and ensure fiduciary compliance, whereas commingled funds employ pooled assets from multiple investors, leveraging scale for broader diversification and operational efficiency. Trust funds prioritize tailored investment strategies aligned with specific beneficiary requirements, while commingled funds benefit from enhanced liquidity and reduced management costs due to shared administration.

Tax pass-through

Tax pass-through treatment allows income from trust funds to be reported directly to beneficiaries, whereas commingled funds are taxed at the fund level before distributions.

Fund accounting

Fund accounting distinguishes trust funds, which segregate assets for specific beneficiaries, from commingled funds that pool resources from multiple investors for collective management.

Trust fund vs Commingled fund Infographic

moneydif.com

moneydif.com