Single Asset Funds concentrate investments in one specific asset class, offering targeted exposure and potentially higher returns but with increased risk due to lack of diversification. Multi-Asset Funds distribute investments across various asset classes, reducing risk through diversification and providing a more balanced portfolio that can adapt to market fluctuations. Investors seeking focused growth may prefer Single Asset Funds, while those aiming for risk mitigation and steady returns often choose Multi-Asset Funds.

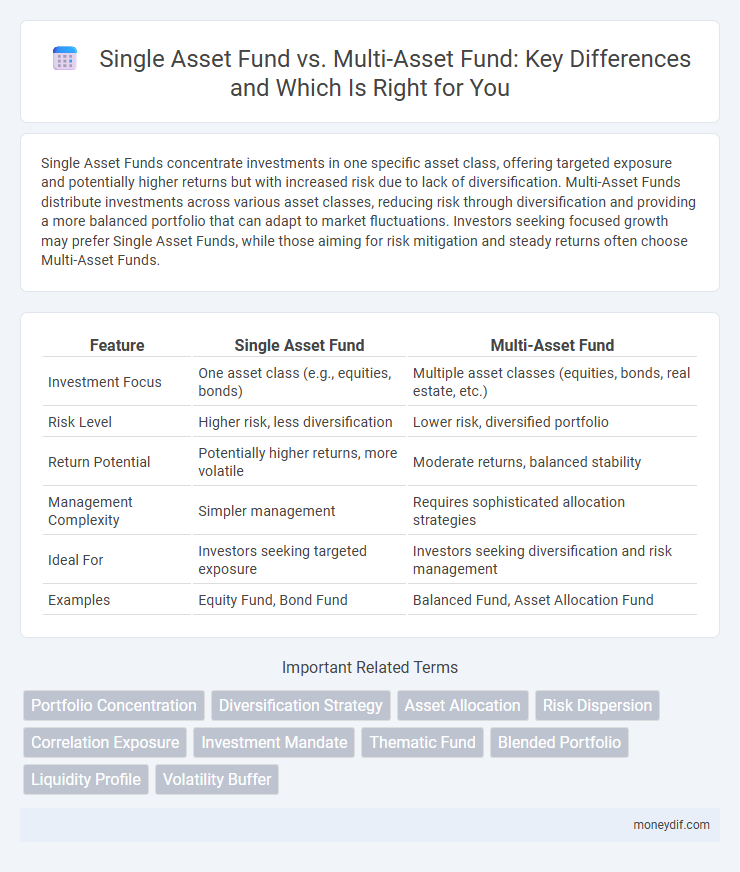

Table of Comparison

| Feature | Single Asset Fund | Multi-Asset Fund |

|---|---|---|

| Investment Focus | One asset class (e.g., equities, bonds) | Multiple asset classes (equities, bonds, real estate, etc.) |

| Risk Level | Higher risk, less diversification | Lower risk, diversified portfolio |

| Return Potential | Potentially higher returns, more volatile | Moderate returns, balanced stability |

| Management Complexity | Simpler management | Requires sophisticated allocation strategies |

| Ideal For | Investors seeking targeted exposure | Investors seeking diversification and risk management |

| Examples | Equity Fund, Bond Fund | Balanced Fund, Asset Allocation Fund |

Introduction to Single Asset and Multi-Asset Funds

Single Asset Funds invest exclusively in one type of asset, such as stocks, bonds, or real estate, allowing focused exposure and targeted risk management. Multi-Asset Funds diversify investments across various asset classes, including equities, fixed income, and commodities, aiming to balance risk and return through asset allocation. Both fund types cater to different investor goals, with Single Asset Funds emphasizing sector specialization and Multi-Asset Funds prioritizing portfolio diversification.

Key Differences Between Single Asset and Multi-Asset Funds

Single asset funds concentrate investments in one type of asset, such as real estate or equities, offering targeted exposure and potentially higher risk due to lack of diversification. Multi-asset funds allocate capital across various asset classes like stocks, bonds, and commodities, providing risk mitigation through diversification and more stable returns. Investors choose single asset funds for focused growth opportunities, while multi-asset funds appeal to those seeking balanced risk and steady income streams.

Risk Diversification: Multi-Asset vs Single Asset Funds

Multi-asset funds provide enhanced risk diversification by investing across various asset classes such as equities, bonds, and commodities, reducing the impact of volatility in any single market. Single asset funds concentrate risk in one type of asset or sector, increasing exposure to market fluctuations and specific economic factors. Investors seeking balanced risk profiles often prefer multi-asset funds for their ability to mitigate losses through diversified holdings.

Performance Potential and Volatility

Single Asset Funds typically offer higher performance potential due to concentrated investments in a specific sector or asset class but exhibit increased volatility and risk exposure. In contrast, Multi-Asset Funds diversify across various asset classes, reducing overall volatility and providing more stable returns, though they may have moderate performance potential compared to single-asset strategies. Investors seeking aggressive growth might prefer Single Asset Funds, while those prioritizing risk management often choose Multi-Asset Funds for balanced portfolio outcomes.

Asset Allocation Strategies

Single Asset Funds concentrate investments in one specific asset class, enabling targeted exposure and potentially higher returns through sector specialization. Multi-Asset Funds diversify across various asset classes such as equities, bonds, and real estate, aiming to balance risk and return by optimizing portfolio allocation. Effective asset allocation strategies in Multi-Asset Funds involve dynamic rebalancing based on market conditions and risk tolerance, contrasting with the focused strategy of Single Asset Funds.

Suitability for Different Investor Profiles

Single Asset Funds cater to investors seeking concentrated exposure to a specific asset class, such as equities or real estate, often suitable for those with higher risk tolerance and targeted expertise. Multi-Asset Funds offer diversified portfolios across various asset classes, providing balanced risk and return potential, ideal for conservative investors or those seeking steady growth with lower volatility. Investor profiles should align with fund complexity and risk appetite, as single asset investments may yield higher returns but increase exposure risk, whereas multi-asset funds emphasize risk mitigation through diversification.

Cost Structure and Management Fees

Single Asset Funds typically have lower management fees due to their concentrated investment focus, reducing administrative complexity and trading costs. Multi-Asset Funds incur higher management fees as they require active oversight across diverse asset classes, increasing operational expenses and portfolio rebalancing costs. The cost structure of Single Asset Funds favors investors seeking minimal fee drag, while Multi-Asset Funds offer diversification at a premium cost.

Liquidity and Accessibility

Single asset funds often offer higher liquidity as they focus on a specific asset class, enabling quicker transactions and easier valuation. Multi-asset funds provide broader accessibility by diversifying across various asset types, reducing risk but potentially impacting liquidity due to complex portfolio management. Investors seeking rapid access to capital might prefer single asset funds, while those aiming for diversified exposure may opt for multi-asset funds despite the trade-off in liquidity.

Tax Efficiency Considerations

Single Asset Funds often offer clearer tax efficiency due to straightforward asset tracking and simpler capital gains calculation, making it easier for investors to manage tax liabilities. Multi-Asset Funds may face complex tax scenarios as they combine equities, bonds, and other assets, potentially causing varied tax treatments across different asset classes which can reduce overall tax efficiency. Investors should evaluate the fund's tax structure, underlying asset types, and transaction frequency to optimize tax outcomes between single and multi-asset fund options.

Choosing Between Single Asset and Multi-Asset Funds

Choosing between single asset and multi-asset funds depends on your risk tolerance and investment goals. Single asset funds focus on one type of investment like real estate or equities, offering targeted exposure and potentially higher returns with increased volatility. Multi-asset funds diversify across stocks, bonds, and other assets, reducing risk through diversification while providing more stable, balanced growth over time.

Important Terms

Portfolio Concentration

Portfolio concentration in a Single Asset Fund increases risk exposure due to focus on one investment, whereas a Multi-Asset Fund diversifies risk by distributing investments across various asset classes.

Diversification Strategy

Diversification strategy in investment aims to reduce risk by allocating capital across various asset classes, making multi-asset funds inherently less volatile compared to single asset funds that concentrate exposure on one specific asset. Multi-asset funds typically balance equities, bonds, and alternative investments, thereby enhancing risk-adjusted returns and mitigating the impact of market fluctuations affecting any single asset class.

Asset Allocation

Single Asset Funds focus investments on one asset class, increasing risk and volatility, while Multi-Asset Funds diversify across multiple asset classes to optimize risk-adjusted returns and enhance portfolio stability.

Risk Dispersion

Multi-asset funds reduce risk dispersion by diversifying investments across various asset classes, whereas single asset funds concentrate risk within one asset, leading to higher volatility.

Correlation Exposure

Correlation exposure in single asset funds is concentrated on the price movements of one specific asset, increasing risk if that asset underperforms, whereas multi-asset funds diversify correlation risk by spreading investments across various asset classes, reducing the impact of any single asset's volatility. Managing correlation exposure in multi-asset funds enhances portfolio stability and can improve risk-adjusted returns by capitalizing on lower correlations among diverse investments.

Investment Mandate

Investment mandates for Single Asset Funds focus on maximizing returns from one specific asset class, while Multi-Asset Fund mandates emphasize diversification across various asset classes to balance risk and growth potential.

Thematic Fund

Thematic funds focus on specific sectors or trends and are often structured as single asset funds targeting concentrated exposure, whereas multi-asset funds diversify investments across various asset classes to reduce risk and enhance portfolio stability.

Blended Portfolio

Blended portfolios combine Single Asset Funds, focusing on specialized exposure, with Multi-Asset Funds that diversify across various asset classes to optimize risk-adjusted returns.

Liquidity Profile

A Single Asset Fund typically offers higher liquidity due to concentrated investments in easily tradable assets, enabling quicker asset liquidation and redemption. In contrast, a Multi-Asset Fund may have lower liquidity as it diversifies across multiple asset classes, including less liquid securities, which can delay asset conversion and impact timely withdrawals.

Volatility Buffer

A volatility buffer in a multi-asset fund typically reduces overall risk exposure by diversifying across asset classes, whereas a single asset fund relies heavily on price stability within one asset, increasing vulnerability to market fluctuations.

Single Asset Fund vs Multi-Asset Fund Infographic

moneydif.com

moneydif.com