Discretionary funds allow fund managers to make investment decisions on behalf of investors without prior consent, leveraging their expertise to optimize returns. Non-discretionary funds require client approval before executing any trades, offering greater control but potentially slower response times. Choosing between these funds depends on the investor's preference for control versus professional management efficiency.

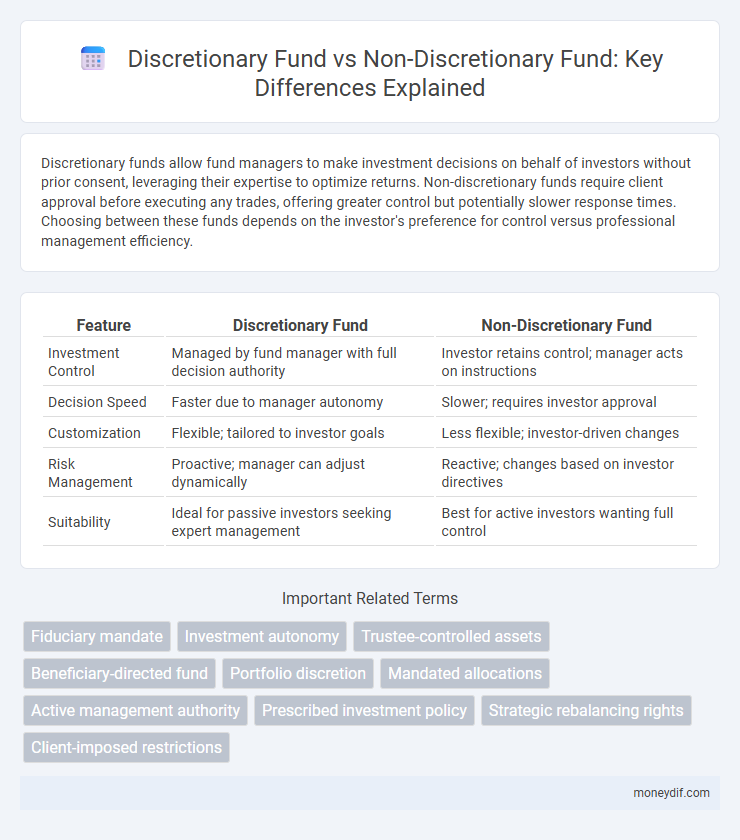

Table of Comparison

| Feature | Discretionary Fund | Non-Discretionary Fund |

|---|---|---|

| Investment Control | Managed by fund manager with full decision authority | Investor retains control; manager acts on instructions |

| Decision Speed | Faster due to manager autonomy | Slower; requires investor approval |

| Customization | Flexible; tailored to investor goals | Less flexible; investor-driven changes |

| Risk Management | Proactive; manager can adjust dynamically | Reactive; changes based on investor directives |

| Suitability | Ideal for passive investors seeking expert management | Best for active investors wanting full control |

Understanding Discretionary and Non-Discretionary Funds

Discretionary funds give investment managers full authority to make decisions and execute trades without client approval, enabling rapid responses to market changes and tailored portfolio management. Non-discretionary funds require client consent for each transaction, ensuring clients maintain control over investment choices but may result in slower decision-making processes. Understanding the balance between autonomy in discretionary funds and client oversight in non-discretionary funds is crucial for aligning investment strategies with individual risk tolerance and financial goals.

Key Differences Between Discretionary and Non-Discretionary Funds

Discretionary funds grant portfolio managers full authority to make investment decisions without prior client approval, enabling agile responses to market changes. Non-discretionary funds require client consent for each transaction, ensuring client involvement but potentially delaying investment actions. The key differences lie in control level, decision-making speed, and client participation in fund management.

Roles and Responsibilities of Fund Managers

Fund managers of discretionary funds have full authority to make investment decisions, manage asset allocation, and execute trades without client approval, ensuring timely responses to market changes. Conversely, fund managers of non-discretionary funds act as advisors, providing investment recommendations while requiring client consent before any transactions occur. The key responsibility difference lies in decision-making autonomy, where discretionary fund managers carry greater fiduciary duty and active management obligations.

Investment Control and Decision-Making Authority

Discretionary funds grant investment managers full authority to make decisions and actively manage assets without client approval, maximizing responsiveness and potential returns. Non-discretionary funds require investor consent for each transaction, maintaining investor control over investment choices but potentially slowing responsiveness to market changes. The key distinction lies in control: discretionary funds prioritize manager autonomy, while non-discretionary funds emphasize investor decision-making authority.

Risk Management in Discretionary vs Non-Discretionary Funds

Discretionary funds allow fund managers to make investment decisions and adjustments autonomously, enabling dynamic risk management strategies that can quickly respond to market fluctuations and mitigate potential losses. Non-discretionary funds require investor approval for each transaction, limiting the ability to promptly address risks and potentially increasing exposure to market volatility. The proactive risk mitigation in discretionary funds often results in more effective portfolio protection compared to the more rigid, approval-dependent approach in non-discretionary funds.

Performance Outcomes: Comparing Fund Types

Discretionary funds typically exhibit higher performance outcomes due to professional managers making real-time investment decisions based on market conditions and fund objectives. Non-discretionary funds often show more stable but potentially lower returns since investors retain control over transactions, leading to delayed reactions to market changes. Studies indicate discretionary management can enhance returns by 2-5% annually, depending on fund size, strategy, and market volatility.

Suitability for Different Investor Profiles

Discretionary funds appeal to investors seeking professional management with less involvement, ideal for those with limited time or expertise, while non-discretionary funds suit investors who prefer direct control over investment decisions and have a higher risk tolerance. Discretionary management aligns well with conservative or moderate investors aiming for balanced portfolios, whereas non-discretionary funds attract more active investors comfortable with self-directed strategies. Understanding individual risk appetite, time commitment, and investment knowledge is crucial for determining the appropriate fund type.

Regulatory and Compliance Considerations

Discretionary funds allow fund managers to make investment decisions without prior client approval, requiring strict regulatory oversight to ensure adherence to fiduciary duties and anti-fraud laws. Non-discretionary funds mandate client consent for each transaction, increasing compliance requirements related to transparent communication and detailed record-keeping under securities regulations. Both fund types must comply with regulatory bodies like the SEC or FCA, emphasizing the importance of robust internal controls and audit trails to prevent breaches and ensure investor protection.

Fees and Cost Structures Explained

Discretionary funds typically involve higher fees due to active management and the fund manager's authority to make investment decisions on behalf of investors. Non-discretionary funds generally have lower fees as investors retain control over investment choices, leading to reduced management and advisory costs. Understanding the fee structures, including management fees, performance fees, and advisory charges, is crucial when comparing discretionary and non-discretionary fund options.

Choosing the Right Fund Type for Your Investment Goals

Discretionary funds grant portfolio managers full authority to make investment decisions based on their expertise, ideal for investors seeking professional management and active portfolio adjustments. Non-discretionary funds require investor approval for each transaction, offering greater control and suitable for those who prefer direct involvement in investment choices. Selecting the right fund type depends on your risk tolerance, desired level of involvement, and long-term financial objectives to align with your investment goals.

Important Terms

Fiduciary mandate

A fiduciary mandate requires clear differentiation between discretionary funds, where the fiduciary has the authority to make investment decisions, and non-discretionary funds, where the investor retains decision-making control while the fiduciary provides advice.

Investment autonomy

Investment autonomy varies significantly between discretionary and non-discretionary funds, with discretionary funds granting portfolio managers full authority to make investment decisions without prior client approval, enabling agile responses to market changes. Non-discretionary funds require investor consent for each transaction, limiting the manager's autonomy and often resulting in slower decision-making processes.

Trustee-controlled assets

Trustee-controlled assets in discretionary funds grant trustees the authority to decide on investment choices and distributions without beneficiary consent, while non-discretionary funds require beneficiaries' approval for asset management decisions. This distinction influences the flexibility and control over asset allocation, impacting tax planning and legal obligations within estate and trust administration.

Beneficiary-directed fund

Beneficiary-directed funds empower recipients to allocate resources according to personal priorities, contrasting with discretionary funds managed solely by trustees who control distributions. Non-discretionary funds legally require managers to follow specified instructions, whereas discretionary funds grant fiduciaries flexibility to decide distributions based on evolving beneficiary needs.

Portfolio discretion

Portfolio discretion enables discretionary funds to be managed by investment professionals without client approval for each trade, unlike non-discretionary funds where client consent is required before executing transactions.

Mandated allocations

Mandated allocations require specific budgetary distribution, contrasting with discretionary funds that allow flexible spending and non-discretionary funds obligated by law or contract.

Active management authority

Active management authority in discretionary funds grants portfolio managers full control to make investment decisions without client approval, enabling swift responses to market changes. In contrast, non-discretionary funds require client consent for each transaction, limiting manager autonomy and potentially delaying investment actions.

Prescribed investment policy

A prescribed investment policy clearly defines asset allocation and risk parameters for discretionary funds managed by trustees, whereas non-discretionary funds require investor approval for each transaction, limiting manager autonomy.

Strategic rebalancing rights

Strategic rebalancing rights in discretionary funds allow portfolio managers to adjust asset allocations based on predetermined strategies without client approval, optimizing returns and risk management. In contrast, non-discretionary funds require client consent for any rebalancing actions, limiting flexibility but enhancing client control over investment decisions.

Client-imposed restrictions

Client-imposed restrictions in discretionary funds allow portfolio managers to actively manage investments while adhering to specific client mandates, such as excluding certain sectors or asset classes. In contrast, non-discretionary funds require client approval for each transaction, limiting the manager's ability to respond swiftly to market changes or optimize asset allocation.

Discretionary fund vs Non-discretionary fund Infographic

moneydif.com

moneydif.com