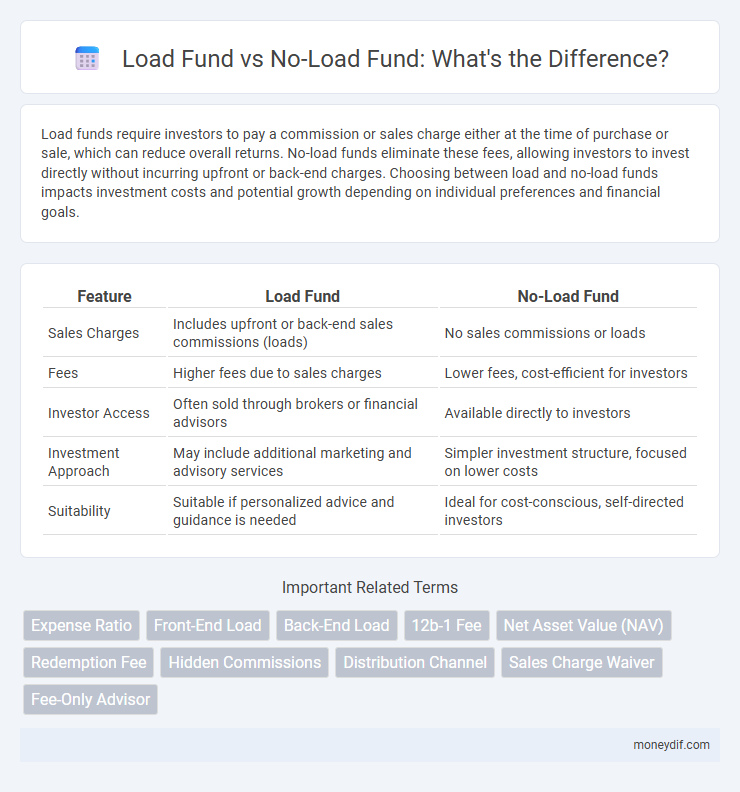

Load funds require investors to pay a commission or sales charge either at the time of purchase or sale, which can reduce overall returns. No-load funds eliminate these fees, allowing investors to invest directly without incurring upfront or back-end charges. Choosing between load and no-load funds impacts investment costs and potential growth depending on individual preferences and financial goals.

Table of Comparison

| Feature | Load Fund | No-Load Fund |

|---|---|---|

| Sales Charges | Includes upfront or back-end sales commissions (loads) | No sales commissions or loads |

| Fees | Higher fees due to sales charges | Lower fees, cost-efficient for investors |

| Investor Access | Often sold through brokers or financial advisors | Available directly to investors |

| Investment Approach | May include additional marketing and advisory services | Simpler investment structure, focused on lower costs |

| Suitability | Suitable if personalized advice and guidance is needed | Ideal for cost-conscious, self-directed investors |

Introduction to Load and No-Load Funds

Load funds charge investors a sales commission or fee at the time of purchase or sale, which compensates brokers for their services, while no-load funds do not impose such fees, offering a cost-effective way to invest. Load funds typically involve front-end loads, back-end loads, or level loads, affecting the overall return on investment. No-load funds are commonly offered directly by mutual fund companies, making them attractive for investors aiming to minimize trading costs and maximize returns.

Defining Load Funds

Load funds require investors to pay a sales charge or commission when buying or selling shares, which can reduce the overall investment returns. These charges often compensate brokers or financial advisors who assist with fund transactions and typically range from 1% to 5% depending on the fund class. Understanding the impact of load fees is crucial for comparing the cost-effectiveness of load funds versus no-load funds in a portfolio.

Understanding No-Load Funds

No-load funds are investment options that do not charge investors a commission or sales fee when buying or selling shares, making them cost-effective for long-term growth. These funds are often managed by companies that sell directly to investors, reducing expenses and allowing a larger portion of returns to be reinvested. Understanding no-load funds is crucial for investors seeking lower fees and maximizing portfolio value without sacrificing professional management.

Key Differences Between Load and No-Load Funds

Load funds charge a sales commission or fee, either upfront (front-end load) or when shares are sold (back-end load), which directly impacts the investor's initial or exit cost. No-load funds do not impose these sales charges, allowing investors to purchase and redeem shares without paying a commission, leading to potential cost savings. Expense ratios and fund performance should be compared alongside load structures to assess overall investment value.

Advantages of Investing in Load Funds

Load funds provide access to professional management and disciplined investment strategies that can potentially enhance portfolio performance over time. These funds often come with dedicated advisory support, helping investors make informed decisions aligned with their financial goals. The structured fee, despite being upfront, can incentivize fund managers to actively pursue value creation for investors.

Pros of Choosing No-Load Funds

No-load funds offer investors the advantage of zero sales charges, allowing the entirety of their investment to remain fully deployed from the start. This cost efficiency can significantly enhance long-term returns, especially for investors with larger principal amounts or those making frequent contributions. Transparency and direct purchase options through fund companies or online platforms further empower investors to manage their portfolios without intermediary fees.

Fee Structures: Load vs No-Load Funds

Load funds charge investors a sales commission or load fee, which can be front-end (paid at purchase) or back-end (paid at redemption), increasing the overall investment cost and potentially reducing net returns. No-load funds eliminate these sales charges, leading to lower direct transaction costs and often making them a more cost-efficient choice for long-term investors. Management fees and other expenses may still apply to both fund types, but the absence of load fees in no-load funds enhances their appeal for cost-sensitive investors.

Impact on Investment Returns

Load funds charge a commission or sales fee either at purchase (front-end load) or sale (back-end load), which directly reduces the initial capital available for investment and diminishes overall returns. No-load funds do not impose these fees, allowing investors' entire capital to remain in the fund, potentially enhancing growth and compounding over time. Over the long term, the absence of load fees in no-load funds often translates into higher net returns compared to load funds, especially for smaller or frequent investments.

How to Decide: Load Fund or No-Load Fund?

When deciding between a load fund and a no-load fund, consider the impact of sales charges on your overall returns; load funds impose upfront or back-end fees that can reduce initial investment capital or redemption proceeds, while no-load funds eliminate these fees, maximizing your investment amount. Analyze your investment timeline and goals, as load funds may offer professional advisory services justifying fees for long-term investors, whereas no-load funds are preferable for cost-sensitive investors seeking immediate exposure without commissions. Evaluate the fund's performance history, expense ratios, and the added value of personalized advice to determine if the potential benefits of load funds outweigh the cost compared to no-load alternatives.

Conclusion: Which Fund Type Suits Your Goals

Load funds charge a sales commission that can impact your overall returns, making no-load funds more cost-effective for long-term investors focused on growth. Investors seeking professional management without upfront fees often prefer no-load funds due to lower expense ratios and greater transparency. Choosing between load and no-load funds depends on your investment horizon, fee sensitivity, and whether you value personalized financial advice.

Important Terms

Expense Ratio

Expense ratio represents the annual fee expressed as a percentage of assets under management charged by mutual funds, directly impacting investor returns in both load and no-load funds. Load funds incur additional sales charges or commissions on top of the expense ratio, whereas no-load funds typically have lower overall costs due to the absence of these front-end or back-end sales loads.

Front-End Load

Front-end load refers to the sales charge paid upfront when purchasing shares in a load fund, reducing the initial investment amount. No-load funds do not impose this upfront fee, allowing 100% of your money to be invested, making them more cost-effective for investors seeking to avoid sales charges.

Back-End Load

Back-end load refers to a fee charged when shares are sold in a load fund, contrasting with no-load funds that do not impose sales charges upon purchase or sale, enhancing cost efficiency for investors seeking long-term growth. Load funds often have higher expense ratios due to these fees, while no-load funds allocate more of the investment toward portfolio assets, potentially increasing net returns.

12b-1 Fee

A 12b-1 fee is an annual marketing or distribution expense charged by some load funds to cover promotion and shareholder services, typically ranging from 0.25% to 1% of the fund's assets. No-load funds usually do not impose 12b-1 fees, making them a cost-effective option by eliminating sales charges and ongoing distribution fees, thereby enhancing net returns.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of a mutual fund's assets minus liabilities, calculated at the end of each trading day. Load funds charge a sales commission or fee either at purchase (front-end load) or sale (back-end load), which can reduce the initial investment or redemption amount, whereas no-load funds allow investors to buy or sell shares without paying sales charges, making the NAV calculation straightforward without deductions for sales fees.

Redemption Fee

Redemption fees are charges imposed on investors when they sell shares within a specified short-term period, commonly applied by load funds to discourage frequent trading and cover transaction costs, whereas no-load funds typically do not have redemption fees to attract long-term investors. These fees, often ranging from 0.5% to 2% of the redemption amount, can impact overall returns and should be carefully considered when choosing between load and no-load mutual funds.

Hidden Commissions

Hidden commissions often appear in load funds through sales charges or 12b-1 fees embedded in the fund's expense ratio, increasing the cost of investment beyond the stated load. No-load funds typically avoid these fees, offering a more transparent fee structure that benefits investors seeking to minimize hidden costs.

Distribution Channel

Load funds use intermediaries and sales agents that charge commission fees through distribution channels, whereas no-load funds are sold directly to investors, minimizing distribution costs.

Sales Charge Waiver

Sales charge waiver applies to load funds by eliminating or reducing front-end or back-end loads, allowing investors to purchase shares without paying the usual sales commission. No-load funds inherently have no sales charges, providing a cost-effective alternative with direct investment in mutual funds.

Fee-Only Advisor

A Fee-Only Advisor provides unbiased investment guidance by charging a flat fee or percentage of assets under management, avoiding commissions from Load Funds, which levy sales charges; instead, they often recommend No-load Funds that eliminate sales fees, enhancing cost efficiency and investor returns. Selecting No-load Funds through a Fee-Only Advisor reduces conflicts of interest and aligns investment strategies solely with client financial goals.

Load Fund vs No-load Fund Infographic

moneydif.com

moneydif.com