Committed capital refers to the total amount of money investors pledge to a fund, which the fund manager can call upon over time for investments. Invested capital is the portion of committed capital that has actually been deployed into portfolio companies or assets. Understanding the difference between these two is crucial for evaluating a fund's deployment pace and capital efficiency.

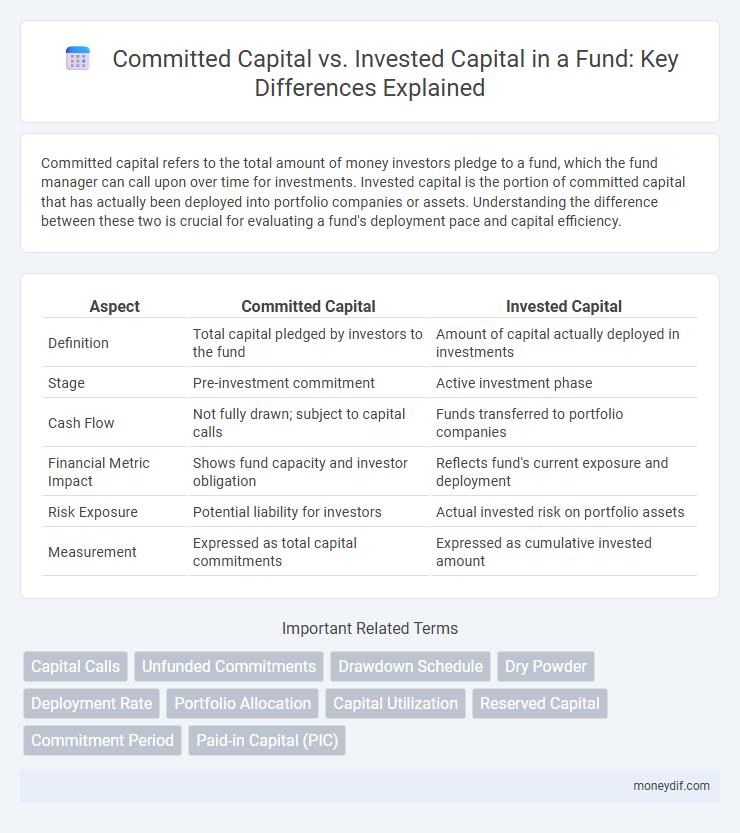

Table of Comparison

| Aspect | Committed Capital | Invested Capital |

|---|---|---|

| Definition | Total capital pledged by investors to the fund | Amount of capital actually deployed in investments |

| Stage | Pre-investment commitment | Active investment phase |

| Cash Flow | Not fully drawn; subject to capital calls | Funds transferred to portfolio companies |

| Financial Metric Impact | Shows fund capacity and investor obligation | Reflects fund's current exposure and deployment |

| Risk Exposure | Potential liability for investors | Actual invested risk on portfolio assets |

| Measurement | Expressed as total capital commitments | Expressed as cumulative invested amount |

Definition of Committed Capital

Committed capital refers to the total amount of money that investors have legally pledged to a fund, which the fund managers can draw down over time to make investments. It represents the maximum capital the fund can call upon from its limited partners, distinct from invested capital, which is the portion of committed capital actually deployed in portfolio companies. Understanding committed capital is crucial for assessing a fund's capacity to finance future opportunities and its overall investment strategy.

Definition of Invested Capital

Invested capital refers to the actual amount of money deployed by a fund into portfolio companies or assets, representing the capital actively at work generating returns. It differs from committed capital, which is the total capital pledged by investors but not yet fully drawn or invested. Understanding invested capital helps measure the fund's operational engagement and efficiency in utilizing committed resources.

Key Differences Between Committed and Invested Capital

Committed capital represents the total amount of money that investors pledge to a fund, while invested capital refers to the portion of that commitment already deployed into portfolio companies or assets. Key differences include liquidity timing, as committed capital remains available for future investments, whereas invested capital is actively allocated and generating returns. Understanding these distinctions is crucial for assessing fund performance, capital calls, and investor obligations in private equity and venture capital contexts.

Importance of Committed Capital in Fund Management

Committed capital represents the total amount investors pledge to a fund, serving as the primary resource for strategic long-term investments and operational planning. This capital underpins a fund manager's ability to secure deals, allocate resources efficiently, and maintain financial stability even before actual investment deployment. Understanding the distinction from invested capital, which reflects funds already deployed, highlights the crucial role committed capital plays in ensuring fund growth and operational flexibility.

Role of Invested Capital in Portfolio Performance

Invested capital plays a crucial role in portfolio performance by directly reflecting the actual funds deployed into investments, which generate returns and impact growth. Unlike committed capital, which represents the total capital pledged by investors but not yet utilized, invested capital provides a precise measure of active exposure and risk within the portfolio. Monitoring invested capital enables fund managers to optimize allocation strategies and maximize value creation for limited partners.

How Fund Managers Use Committed and Invested Capital

Fund managers strategically allocate committed capital as the total amount investors agree to provide, ensuring sufficient resources are reserved for future investments and operational needs. Invested capital, representing the actual deployed funds in portfolio companies, reflects the fund's progress and risk exposure. Efficient management of both committed and invested capital enables fund managers to optimize investment pacing, enhance portfolio diversification, and maximize returns.

Tracking Capital Deployment: Metrics and Reporting

Committed capital represents the total funding that investors pledge to a fund, while invested capital reflects the actual amount deployed into portfolio companies. Tracking capital deployment involves measuring metrics such as capital called versus committed, investment pace, and remaining dry powder to assess fund utilization and efficiency. Accurate reporting ensures transparency and helps fund managers optimize allocation strategies and inform stakeholder decisions.

Impact on Limited Partners: Committed vs Invested Capital

Committed capital represents the total amount Limited Partners (LPs) pledge to invest in a fund, defining their financial obligation over the fund's life. Invested capital reflects the portion of committed capital actively deployed into portfolio companies or assets, influencing the timing and realization of returns. LPs monitor the gap between committed and invested capital to assess fund pacing, risk exposure, and the efficiency of capital deployment strategies.

Challenges in Managing Committed and Invested Capital

Managing committed capital poses challenges such as aligning investor expectations with fund deployment timelines and ensuring sufficient liquidity to meet capital calls without overleveraging. Invested capital management requires rigorous monitoring of portfolio performance, timely exit strategies, and mitigating risks associated with market volatility and asset valuation. Balancing the pace of investment while optimizing returns demands sophisticated capital allocation frameworks and robust communication with limited partners to navigate uncertainties effectively.

Best Practices for Optimizing Capital Efficiency

Committed capital refers to the total amount investors pledge to a fund, while invested capital is the portion actually deployed into assets or projects. Best practices for optimizing capital efficiency include carefully timing drawdowns to align with investment opportunities and maintaining a disciplined portfolio rebalancing strategy. Monitoring the fund's capital deployment rate helps minimize idle capital and maximize return on investment.

Important Terms

Capital Calls

Capital calls represent the process by which private equity firms request committed capital from investors to fund specific investments, reflecting the distinction between committed capital--the total amount investors have pledged--and invested capital, which is the portion actually deployed into assets. Efficient capital call management ensures optimal liquidity and aligns cash flow timing with investment opportunities, minimizing the gap between committed and invested capital.

Unfunded Commitments

Unfunded commitments represent the portion of committed capital that investors have pledged but not yet contributed, contrasting with invested capital which reflects the actual funds deployed in investments.

Drawdown Schedule

A Drawdown Schedule outlines the timeline and amounts by which committed capital is called from investors and converted into invested capital within a fund. It helps track capital deployment efficiency by comparing total committed capital against the progressively invested capital over the fund's lifespan.

Dry Powder

Dry powder represents the uncalled committed capital that private equity firms reserve for future investments, contrasting with invested capital, which refers to the funds already deployed into portfolio companies. Efficient management of dry powder is crucial for maintaining liquidity and seizing market opportunities while balancing the timing between committed capital commitments and actual capital deployment.

Deployment Rate

Deployment rate measures the proportion of committed capital that has been actively invested, highlighting the efficiency of capital utilization. A higher deployment rate indicates effective allocation of committed funds into portfolio assets, reflecting strong investment execution.

Portfolio Allocation

Portfolio allocation balances committed capital--the total capital investors pledge to a fund--against invested capital, which represents the actual amount deployed into assets. Optimizing this balance ensures efficient capital utilization, maximizing returns while managing liquidity and risk within private equity or venture capital portfolios.

Capital Utilization

Capital utilization measures the efficiency of deploying committed capital, reflecting the proportion of total committed capital actively invested in projects or assets. High capital utilization indicates optimal conversion of committed capital into invested capital, enhancing returns and minimizing idle funds.

Reserved Capital

Reserved capital refers to the portion of committed capital that has been allocated but not yet deployed by a fund, distinguishing it from invested capital which represents the actual funds deployed into investments. Efficient management of reserved capital ensures liquidity for future opportunities while maintaining alignment with investor commitments and portfolio strategy.

Commitment Period

The commitment period refers to the timeframe in which investors are obligated to provide committed capital to a fund, enabling the fund to make investments. Committed capital represents the total amount pledged by investors, while invested capital denotes the actual portion deployed into assets during and after the commitment period.

Paid-in Capital (PIC)

Paid-in Capital (PIC) represents the amount of capital that shareholders have invested in a company, reflecting the total funds received from equity issuance beyond par value. Committed capital refers to the total amount investors pledge to provide, while invested capital is the portion of committed capital actually contributed and recorded as PIC on the balance sheet.

Committed capital vs Invested capital Infographic

moneydif.com

moneydif.com