Grants refer to funds awarded by a government or organization for a specific purpose, often requiring an application and adherence to strict guidelines. Appropriations are legislative authorizations that allocate government funds to various agencies or programs, providing the legal authority to spend public money. Understanding the distinction ensures proper financial management and compliance in funding processes.

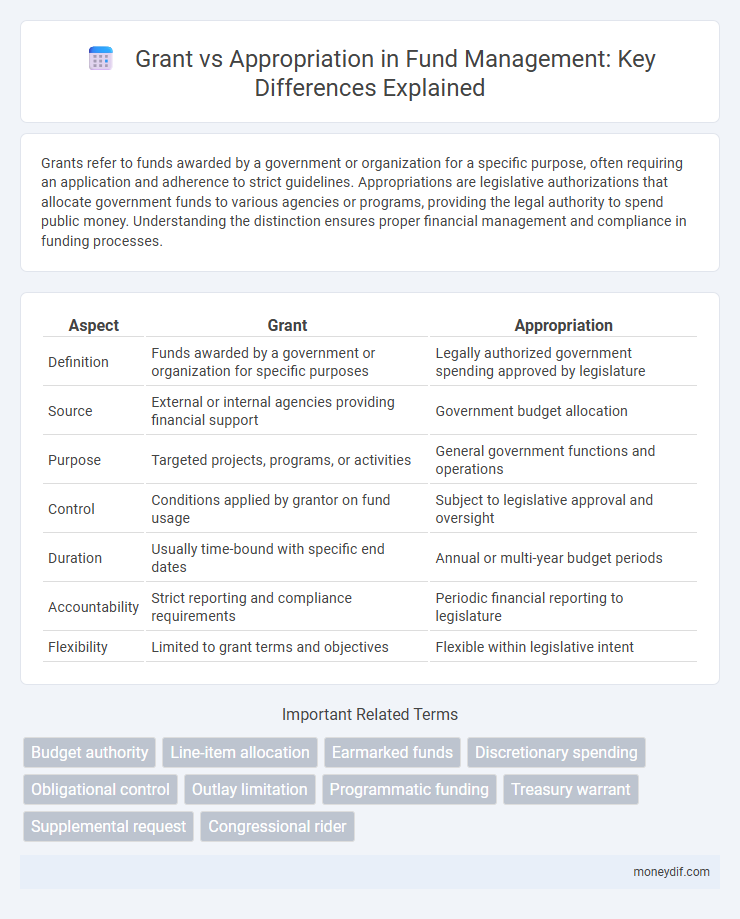

Table of Comparison

| Aspect | Grant | Appropriation |

|---|---|---|

| Definition | Funds awarded by a government or organization for specific purposes | Legally authorized government spending approved by legislature |

| Source | External or internal agencies providing financial support | Government budget allocation |

| Purpose | Targeted projects, programs, or activities | General government functions and operations |

| Control | Conditions applied by grantor on fund usage | Subject to legislative approval and oversight |

| Duration | Usually time-bound with specific end dates | Annual or multi-year budget periods |

| Accountability | Strict reporting and compliance requirements | Periodic financial reporting to legislature |

| Flexibility | Limited to grant terms and objectives | Flexible within legislative intent |

Introduction to Grants and Appropriations

Grants are funds provided by governments or organizations to support specific projects or initiatives with defined objectives and accountability requirements. Appropriations refer to legislative authorizations that allocate government funds for specific purposes, enabling agencies to incur obligations and make payments. Understanding the distinction between grants and appropriations is essential for managing public funding and ensuring compliance with financial regulations.

Definition of Grant in the Context of Funds

A grant in the context of funds refers to a financial award given by a government entity, foundation, or other organization to support specific projects or activities without the requirement of repayment. It is typically allocated based on eligibility criteria and designed to promote public purposes such as education, research, or community development. Grants differ from appropriations, which are formal allocations of funds authorized by a legislative body for government spending.

Understanding Appropriation in Public Finance

Appropriation in public finance refers to the legal authorization granted by a legislative body to allocate funds for specific government purposes, ensuring controlled and transparent expenditure within a fiscal year. It differs from a grant, which is a transfer of funds often with fewer restrictions, typically provided to support particular projects or initiatives. Understanding appropriation is crucial for maintaining budgetary discipline and enabling government accountability in managing public resources.

Key Differences between Grants and Appropriations

Grants are funds provided by one entity, often a government or foundation, to support specific projects or activities, usually requiring compliance with detailed guidelines and reporting. Appropriations are legislative authorizations that allocate government funds for general or specific purposes within a fiscal year, enabling agencies to spend public money as outlined in the budget. Unlike grants, appropriations do not typically require a competitive application process but are essential for government financial planning and control.

Purpose and Objectives: Grant vs Appropriation

Grants are funds provided to support specific projects or activities with clearly defined objectives, often requiring accountability and performance reporting aligned with the grant's intended purpose. Appropriations are budgetary authorizations by a legislative body that allocate funds for broader governmental functions or programs without the stringent project-specific oversight seen in grants. The primary distinction lies in grants targeting precise outcomes tied to the grantee's goals, while appropriations facilitate general public service funding based on legislative priorities.

Source of Funding: Grants versus Appropriations

Grants are funds provided by one entity, often the federal or state government, to another, such as a nonprofit or local government, earmarked for specific projects or initiatives. Appropriations refer to the legislative authorization to allocate government funds from general revenues or tax collections for broad public sector functions. While grants rely on external funding sources with defined purposes, appropriations stem from internal government budget decisions and fiscal planning.

How Grants are Allocated and Used

Grants are allocated through a competitive application process where eligible entities submit proposals that are evaluated based on specific criteria such as project impact, budget justification, and alignment with funding priorities. Once awarded, grant funds must be used exclusively for the purposes outlined in the grant agreement, with strict compliance to reporting requirements and allowable expenses defined by the grantor. Monitoring and audits ensure that grants are properly managed and funds are spent according to federal or organizational regulations to maximize project outcomes.

Appropriation Processes and Implementation

Appropriation processes involve formal legislative authorization to allocate government funds for specific purposes, ensuring legal compliance and budgetary control. The implementation phase requires careful monitoring, disbursement, and management of appropriated funds to meet policy objectives effectively. Clear documentation and reporting mechanisms are critical for transparency and accountability in public fund appropriations.

Accountability and Oversight Mechanisms

Grants require recipients to comply with strict accountability standards, including detailed reporting and audits to ensure funds are used for designated purposes. Appropriations involve legislative oversight, with government bodies monitoring expenditures through budget reviews and performance evaluations. Both mechanisms enforce transparency but vary in the scope and frequency of oversight to maintain fiscal responsibility.

Choosing the Right Funding: Grant or Appropriation?

Choosing between a grant and an appropriation depends on the source and purpose of funding: grants are typically awarded by external entities like government agencies or foundations with specific project goals and reporting requirements, while appropriations are allocated by legislative bodies for broader public programs and government operations. Evaluating the flexibility, accountability standards, and eligibility criteria of each funding type ensures alignment with organizational objectives and compliance mandates. Understanding these distinctions optimizes resource acquisition and enhances financial planning strategies.

Important Terms

Budget authority

Budget authority grants the legal permission for federal agencies to incur financial obligations or spend funds, while appropriations provide the actual statutory funding allocated by Congress to support specific programs or activities. Understanding the distinction ensures proper fiscal management, as grants may include budget authority, but appropriations determine the availability and limits of those funds.

Line-item allocation

Line-item allocation differentiates the specific distribution of funds within a grant's overall budget, ensuring expenditures align precisely with predetermined categories and purposes, whereas appropriations refer to the legal authorization by a legislative body to incur obligations and make payments from the Treasury for specified amounts. Effective management of line-item allocations within grant appropriations guarantees compliance with funding restrictions and optimizes financial oversight in public sector budgeting.

Earmarked funds

Earmarked funds refer to specific allocations within appropriations designated by grants for particular projects or purposes, ensuring restricted use as mandated by the funding authority.

Discretionary spending

Discretionary spending is determined through annual appropriations legislation, where Congress allocates specific funds via grants and appropriations to federal agencies.

Obligational control

Obligational control ensures that grant funds are legally committed through appropriations before obligations are made, maintaining compliance with budgetary laws and preventing unauthorized spending.

Outlay limitation

Outlay limitation restricts the amount of federal funds that can be spent within a fiscal year, controlling cash outflows regardless of grant obligations or budget authority. While appropriations provide statutory authority to incur obligations, outlay limitations ensure actual expenditures do not exceed the specified financial ceiling, influencing grant disbursements and project timelines.

Programmatic funding

Programmatic funding refers to the allocation of financial resources specifically designated for a particular program or project, often distinguished by grant or appropriation types; grants typically provide funding based on competitive applications and specific eligibility criteria, while appropriations are legislative allocations that authorize government agencies to spend money from the treasury. Understanding the distinctions between grants and appropriations is crucial for effective budget management and ensuring compliance with regulatory requirements in programmatic funding.

Treasury warrant

A Treasury warrant authorizes the disbursement of funds allocated through an appropriation, distinguishing it from a grant, which provides financial assistance to entities for specific projects or purposes.

Supplemental request

A supplemental request is a formal proposal to secure additional funds beyond the original grant or appropriation to cover unforeseen expenses or changes in project scope.

Congressional rider

A congressional rider is a provision added to a grant appropriation bill that directs specific use of funds without separate legislative approval, often blurring the distinction between grant authority and direct appropriations.

Grant vs Appropriation Infographic

moneydif.com

moneydif.com