Rule 40 Act Funds are investment vehicles that comply with specific regulatory requirements to allow their managers to trade freely without certain restrictions, often targeting increased transparency and investor protection. Exempt Funds, in contrast, operate under exemptions from some regulations, enabling more flexibility in investment strategies but usually requiring higher investor qualification standards. Understanding the differences between these fund types is crucial for investors seeking the appropriate balance between regulatory oversight and investment freedom.

Table of Comparison

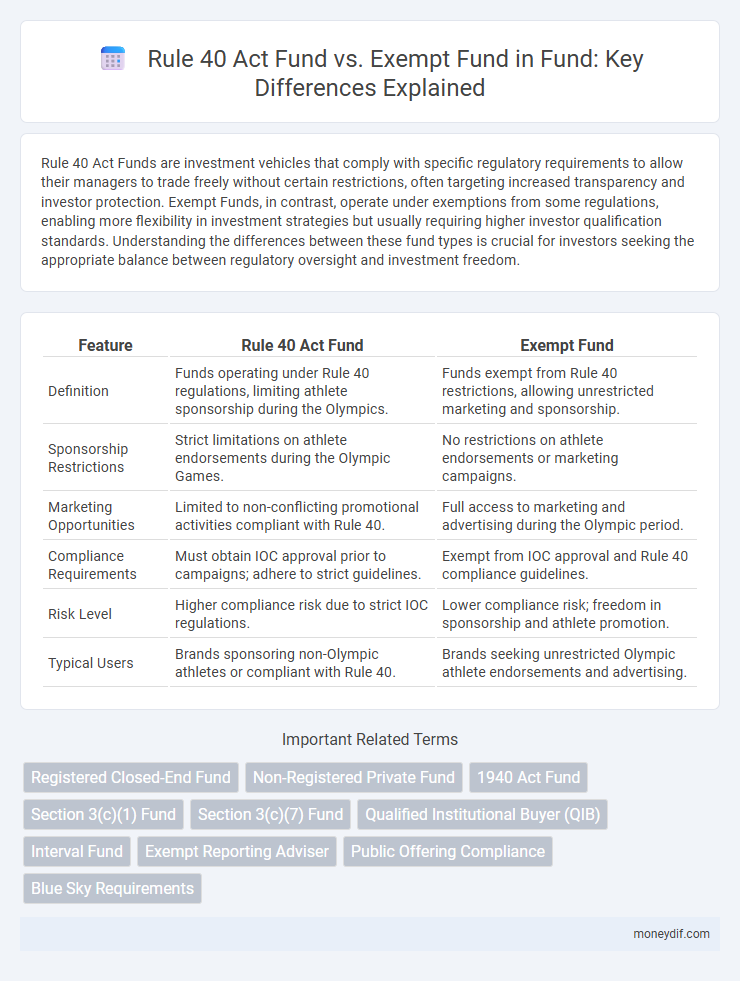

| Feature | Rule 40 Act Fund | Exempt Fund |

|---|---|---|

| Definition | Funds operating under Rule 40 regulations, limiting athlete sponsorship during the Olympics. | Funds exempt from Rule 40 restrictions, allowing unrestricted marketing and sponsorship. |

| Sponsorship Restrictions | Strict limitations on athlete endorsements during the Olympic Games. | No restrictions on athlete endorsements or marketing campaigns. |

| Marketing Opportunities | Limited to non-conflicting promotional activities compliant with Rule 40. | Full access to marketing and advertising during the Olympic period. |

| Compliance Requirements | Must obtain IOC approval prior to campaigns; adhere to strict guidelines. | Exempt from IOC approval and Rule 40 compliance guidelines. |

| Risk Level | Higher compliance risk due to strict IOC regulations. | Lower compliance risk; freedom in sponsorship and athlete promotion. |

| Typical Users | Brands sponsoring non-Olympic athletes or compliant with Rule 40. | Brands seeking unrestricted Olympic athlete endorsements and advertising. |

Introduction to Fund Structuring: Rule 40 Act vs Exempt Fund

Rule 40 Act funds require compliance with specific regulatory frameworks that govern investment limits and reporting standards, ensuring transparency and investor protection. Exempt funds operate under relaxed regulations, allowing greater flexibility in investment strategies and reduced disclosure requirements. Understanding the structural differences between Rule 40 Act funds and exempt funds is crucial for aligning investment objectives with regulatory constraints and risk tolerance.

Legal Framework: Understanding the Rule 40 Act Fund

The Rule 40 Act Fund operates under specific legal parameters that regulate athlete endorsements during the Olympic Games, restricting unapproved marketing tied to the event. Unlike Exempt Funds, which are not subject to these restrictions and can freely engage in promotional activities, the Rule 40 Act Fund must adhere to strict compliance measures to avoid penalties. Understanding these legal frameworks ensures that fund management aligns with Olympic guidelines, protecting both athletes and sponsors from legal implications.

What Defines an Exempt Fund? Key Characteristics

An Exempt Fund is defined by its compliance with specific regulatory criteria that exclude it from certain securities laws and registration requirements. Key characteristics include limited investor eligibility, restrictions on marketing and solicitation, and strict limits on fund size or asset thresholds. These features allow Exempt Funds to operate with reduced regulatory burdens while maintaining investor protections.

Regulatory Requirements: Compliance and Oversight

Rule 40 Act Funds are subject to stringent regulatory requirements, including comprehensive SEC compliance protocols and detailed financial disclosures to ensure investor protection. Exempt Funds benefit from reduced regulatory oversight under specific exemptions, such as Regulation D or Rule 506, allowing for fewer reporting obligations but limiting the investor base. Compliance for Rule 40 Act Funds involves ongoing audits and transparency measures, whereas Exempt Funds primarily focus on maintaining eligibility criteria to retain exemption status.

Investor Eligibility and Access: Who Can Invest?

Rule 40 Act Funds restrict investment to accredited investors, institutional entities, and qualified purchasers, ensuring compliance with specific regulatory requirements. Exempt Funds broaden access by allowing non-accredited investors to participate under certain exemptions, such as Regulation D or Regulation A offerings. Investor eligibility in Rule 40 Act Funds is tightly regulated, whereas Exempt Funds provide more flexible entry points, enabling a wider range of investors to access alternative investment opportunities.

Fund Disclosure and Transparency Standards

Rule 40 Act Funds are subject to stringent disclosure and transparency standards, requiring detailed reporting of investment strategies, risk factors, and periodic financial statements to ensure investor protection. Exempt Funds benefit from relaxed regulatory requirements, often allowing less frequent or less comprehensive disclosures, which can result in reduced transparency for investors. The difference in disclosure obligations between Rule 40 Act Funds and Exempt Funds significantly impacts investor confidence and regulatory compliance.

Tax Implications for Rule 40 Act and Exempt Funds

Rule 40 Act funds are subject to standard taxation regulations, requiring income to be reported and taxed according to ordinary income rules, often leading to higher tax liabilities for investors. Exempt funds benefit from specific tax advantages, such as exemption from certain federal taxes or preferential tax treatment on distributions, which can enhance after-tax returns. Understanding the distinct tax implications of Rule 40 Act versus exempt funds is critical for investment planning and optimizing tax efficiency.

Performance Metrics and Reporting Obligations

Rule 40 Act Funds generally adhere to stricter reporting obligations, requiring frequent disclosures on performance metrics such as net asset value (NAV), internal rate of return (IRR), and risk-adjusted returns to maintain regulatory compliance. In contrast, Exempt Funds benefit from reduced reporting requirements, often submitting performance data on a quarterly or biannual basis, which may limit real-time transparency for investors. The differing frequency and detail in performance metrics reporting influence fund evaluation, with Rule 40 Act Funds providing enhanced data precision for performance assessment and risk management.

Costs, Fees, and Operational Differences

Rule 40 Act Funds typically incur higher regulatory compliance costs and increased administrative fees due to stringent SEC oversight and mandatory reporting requirements. Exempt Funds benefit from reduced operational expenses, as they are not subject to the same level of disclosure or governance mandates, resulting in lower overall fees for investors. Operationally, Rule 40 Act Funds implement more robust risk management protocols and transparency measures, whereas Exempt Funds operate with greater flexibility but less regulatory scrutiny.

Choosing the Right Fund Structure: Rule 40 Act vs Exempt Fund

Choosing the right fund structure between a Rule 40 Act Fund and an Exempt Fund hinges on regulatory compliance and investor eligibility criteria. Rule 40 Act Funds are subject to stringent Securities Act registration requirements and are suitable for funds targeting a broad investor base, including public offerings. Exempt Funds, often falling under private placement exemptions such as Regulation D, allow for greater flexibility in fundraising but limit participation to accredited or institutional investors, optimizing compliance costs and operational efficiency.

Important Terms

Registered Closed-End Fund

Registered Closed-End Funds operate under the Investment Company Act of 1940, providing liquidity and investor protections, while Rule 40 Act Funds specifically comply with sections regulating closed-end funds, ensuring adherence to disclosure and governance standards. Exempt Funds differ by being excluded from certain regulatory requirements, often due to limited offerings or private placements, resulting in fewer reporting obligations but higher risk profiles.

Non-Registered Private Fund

Non-Registered Private Funds under Rule 40 Act typically target accredited investors and are subject to specific regulatory compliance that limits public solicitation, differentiating them from Exempt Funds which operate under exemptions granting broader fundraising flexibility but still impose investor eligibility and disclosure requirements. These distinctions impact minimum investment thresholds, offering structures, and reporting obligations critical for fund managers navigating Canadian securities law.

1940 Act Fund

The 1940 Act Fund operates under the Investment Company Act of 1940, ensuring regulatory compliance, liquidity, and investor protection, while Rule 40 Act Funds are exempt from specific provisions, often due to private placement or limited investor eligibility. Exempt Funds typically bypass certain reporting and operational restrictions, offering flexibility but less regulatory oversight compared to traditional 1940 Act Funds.

Section 3(c)(1) Fund

Section 3(c)(1) Funds are privately offered hedge funds exempt from SEC registration under the Investment Company Act, whereas Rule 40 Act Funds pertain to specific exemptions related to employee benefit plans and differ in regulatory scope and investor eligibility.

Section 3(c)(7) Fund

Section 3(c)(7) Funds qualify as exempt funds under the Investment Company Act of 1940 by limiting ownership exclusively to qualified purchasers, avoiding registration requirements unlike Rule 40 Act Funds that must register unless an exemption applies. Rule 40 Act Funds primarily cater to retail investors with stringent disclosure obligations, whereas Section 3(c)(7) Funds target sophisticated investors, enabling greater flexibility in investment strategies and reduced regulatory burdens.

Qualified Institutional Buyer (QIB)

Qualified Institutional Buyers (QIBs) under Rule 144A are institutional investors recognized for their financial sophistication and large investment portfolios, facilitating private resales of securities. Rule 40 Act Funds, subject to the Investment Company Act of 1940, often qualify as QIBs due to regulatory compliance and asset thresholds, whereas Exempt Funds may lack QIB status as they operate outside these regulatory frameworks.

Interval Fund

Interval funds operate under the Investment Company Act of 1940, allowing periodic redemptions but limiting liquidity compared to open-end funds; Rule 40 Act funds specifically refer to interval funds registered under this rule, offering enhanced investor protections through SEC oversight. Exempt funds, in contrast, avoid certain regulatory requirements by qualifying for exemptions under the 1940 Act, typically resulting in less frequent liquidity opportunities and different disclosure obligations.

Exempt Reporting Adviser

An Exempt Reporting Adviser under Rule 40 of the Act manages private funds meeting specific exemption criteria, distinguishing Exempt Funds by their limited investor count and reporting requirements compared to broader Act Funds.

Public Offering Compliance

Rule 40 Act Funds must adhere to strict public offering compliance by registering securities with the SEC and providing detailed disclosures to protect investors, whereas Exempt Funds qualify for exemptions under Regulation D or other safe harbors, allowing them to avoid full public offering registration while still meeting investor suitability and reporting requirements. The differentiation impacts fundraising strategies, regulatory scrutiny, and investor access, making compliance frameworks critical for fund classification and operational legality.

Blue Sky Requirements

Blue Sky Requirements vary significantly between Rule 40 Act Funds and Exempt Funds, with Rule 40 Act Funds generally facing stricter state securities registration and disclosure obligations to ensure investor protection.

Rule 40 Act Fund vs Exempt Fund Infographic

moneydif.com

moneydif.com