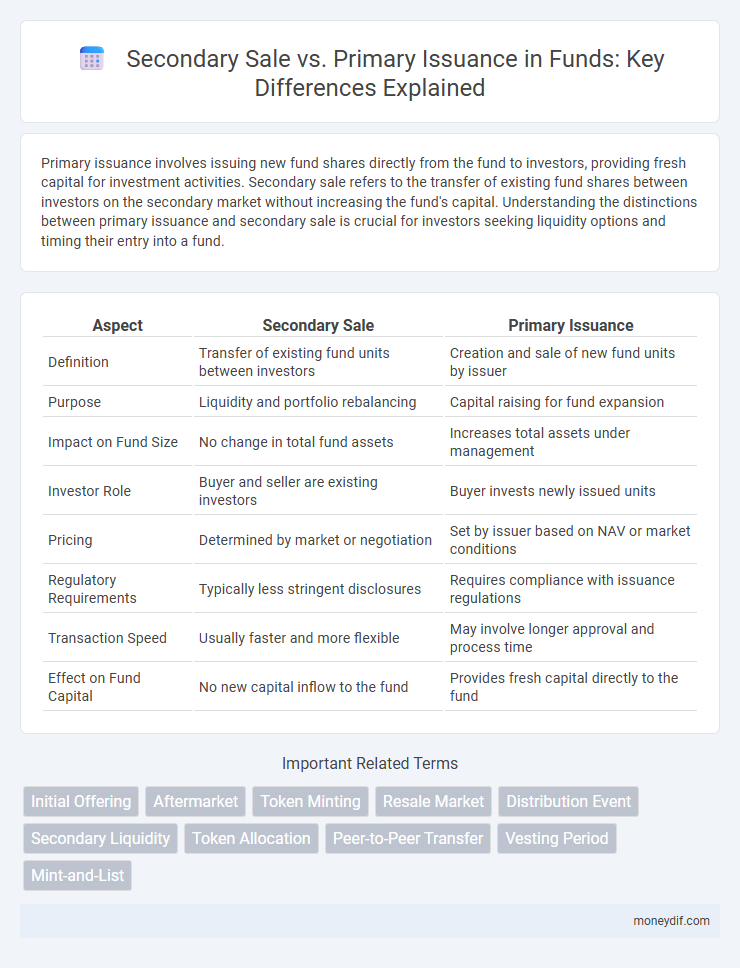

Primary issuance involves issuing new fund shares directly from the fund to investors, providing fresh capital for investment activities. Secondary sale refers to the transfer of existing fund shares between investors on the secondary market without increasing the fund's capital. Understanding the distinctions between primary issuance and secondary sale is crucial for investors seeking liquidity options and timing their entry into a fund.

Table of Comparison

| Aspect | Secondary Sale | Primary Issuance |

|---|---|---|

| Definition | Transfer of existing fund units between investors | Creation and sale of new fund units by issuer |

| Purpose | Liquidity and portfolio rebalancing | Capital raising for fund expansion |

| Impact on Fund Size | No change in total fund assets | Increases total assets under management |

| Investor Role | Buyer and seller are existing investors | Buyer invests newly issued units |

| Pricing | Determined by market or negotiation | Set by issuer based on NAV or market conditions |

| Regulatory Requirements | Typically less stringent disclosures | Requires compliance with issuance regulations |

| Transaction Speed | Usually faster and more flexible | May involve longer approval and process time |

| Effect on Fund Capital | No new capital inflow to the fund | Provides fresh capital directly to the fund |

Introduction to Fundraising: Primary Issuance vs Secondary Sale

Primary issuance involves the initial sale of new shares or units directly from the fund to investors, generating fresh capital for the fund's growth and operations. Secondary sales refer to the transfer of existing shares between investors, providing liquidity without affecting the fund's capital structure. Understanding the distinction between primary issuance and secondary sales is crucial for fundraising strategies and investor portfolio management.

Defining Primary Issuance in Fund Structures

Primary issuance in fund structures refers to the initial offering of new shares or units directly from the fund to investors, allowing the fund to raise fresh capital for investments or operations. This process establishes the fund's capital base and determines the net asset value (NAV) by capturing new inflows. Unlike secondary sales, which involve trading existing shares among investors, primary issuance directly impacts the fund's capitalization and expansion potential.

Understanding Secondary Sales in Fund Markets

Secondary sales in fund markets refer to transactions where investors buy and sell existing fund shares rather than participating in primary issuance, which involves the creation of new shares directly from the fund. These secondary market transactions provide liquidity to investors, enabling them to adjust their portfolios without affecting the fund's capital inflows. Understanding the dynamics of secondary sales is crucial for assessing market demand, fund valuation, and the overall liquidity environment within private equity and mutual fund markets.

Key Differences Between Primary Issuance and Secondary Sale

Primary issuance involves the initial offering of new shares or securities directly from the issuer to investors, establishing the original capital inflow and ownership structure. Secondary sales occur when existing investors sell their shares to other buyers, facilitating liquidity without additional capital raised for the issuing company. Key differences include the impact on company capitalization, with primary issuance diluting ownership and raising fresh funds, whereas secondary sales transfer ownership without altering the company's equity base.

Advantages of Primary Fundraising for Investors

Primary fundraising offers investors direct access to newly issued shares or fund units, often at a preferential price before they reach the secondary market. This process enhances potential capital appreciation as the initial valuation is generally lower compared to secondary sales. Investors benefit from increased transparency and regulatory oversight during primary issuance, reducing risks related to market fluctuations and liquidity constraints.

Benefits and Challenges of Secondary Transactions

Secondary transactions in funds offer increased liquidity by enabling investors to buy or sell existing fund interests before the fund's maturity, providing flexibility unmatched by primary issuances. These sales can help investors achieve portfolio diversification and risk management but often involve challenges such as complex valuation, limited market transparency, and potential discounts on net asset value. Despite such hurdles, secondary markets facilitate price discovery and improve overall fund market efficiency by connecting buyers and sellers outside the primary issuance cycle.

Impact on Fund Valuation: Primary vs Secondary Markets

Primary issuance directly influences fund valuation by introducing new shares, impacting net asset value (NAV) through capital inflows and dilution effects. Secondary sales affect fund valuation indirectly by altering market perception and liquidity without changing the total assets under management (AUM). Understanding the distinction between primary issuance and secondary market transactions is crucial for accurately assessing fund performance and investor returns.

Regulatory Considerations in Primary and Secondary Sales

Primary issuance of fund shares involves strict regulatory compliance, including registration with securities authorities and adherence to disclosure requirements under frameworks like the Securities Act of 1933. Secondary sales, often exempt from registration if conducted in private markets or under Rule 144A, still require careful consideration of transfer restrictions and investor qualifications to avoid violations. Both primary and secondary transactions must ensure compliance with anti-fraud provisions and ongoing reporting obligations imposed by the Securities Exchange Commission (SEC).

Liquidity Implications for Investors and Fund Managers

Secondary sales provide investors with enhanced liquidity by allowing the transfer of existing fund interests, enabling quicker capital access compared to primary issuance, which involves issuing new shares and often requires longer lock-up periods. Fund managers benefit from secondary sales as they can better manage fund capitalization and investor turnover without diluting ownership or altering fund strategy. Liquidity in secondary markets attracts a broader investor base, improving pricing efficiency and facilitating portfolio rebalancing.

Deciding Between Primary Issuance and Secondary Sale in Fund Strategies

Choosing between primary issuance and secondary sale in fund strategies hinges on the desired capital flow and investor liquidity preferences. Primary issuance generates new capital directly from investors, enhancing fund resources for fresh investments, while secondary sales facilitate liquidity by allowing existing investors to transfer ownership without impacting fund capital. Evaluating market conditions, investor demand, and fund growth objectives ensures optimal alignment of issuance type with strategic goals.

Important Terms

Initial Offering

Initial offerings primarily involve the issuance of new securities directly from a company to investors, generating fresh capital through a primary issuance. In contrast, secondary sales occur when existing shares trade between investors on the open market without impacting the company's equity or capital raised during the initial offering.

Aftermarket

Aftermarket trading involves the buying and selling of securities after their initial issuance in the primary market, enabling price discovery and liquidity for investors. Secondary sales facilitate ongoing market activity without raising new capital for the issuing entity, contrasting with primary issuance where securities are sold directly by the issuer to raise funds.

Token Minting

Token minting refers to the creation of new tokens during the primary issuance, where tokens are generated and distributed for the first time, often through initial coin offerings (ICOs) or token generation events (TGEs). Secondary sales occur after minting, involving the trading of already issued tokens on marketplaces, which does not create new tokens but facilitates liquidity and price discovery within the ecosystem.

Resale Market

The resale market facilitates trading of securities after the initial offering, providing liquidity and price discovery distinct from primary issuance where new securities are created and sold directly by issuers. Secondary sales occur between investors without impacting the issuer's capital, contrasting with primary issuance that directly funds the issuing entity.

Distribution Event

Distribution events differ fundamentally between primary issuances and secondary sales; primary issuance involves the initial offering of securities directly from the issuer to investors, facilitating capital formation and increasing the total shares outstanding. In contrast, secondary sales occur between investors on the open market without affecting the company's capital structure, providing liquidity and price discovery.

Secondary Liquidity

Secondary liquidity refers to the availability of trading activity in existing securities, enabling investors to buy and sell shares on the secondary market after the initial issuance. Unlike primary issuance, where new securities are created and sold directly by the issuer to raise capital, secondary sales involve the exchange of pre-owned shares among investors without impacting the company's outstanding share count.

Token Allocation

Token allocation in primary issuance directly impacts initial market distribution, while secondary sale token allocation influences liquidity and price discovery post-launch.

Peer-to-Peer Transfer

Peer-to-Peer Transfer enables direct exchange of assets between holders, facilitating secondary sales without involving the issuer, unlike primary issuance where new securities or tokens are created and sold initially by the issuer. This mechanism boosts liquidity in secondary markets by allowing seamless asset redistribution among investors, enhancing market efficiency beyond the primary issuance phase.

Vesting Period

Vesting period in primary issuance ensures founders and employees earn equity gradually, aligning incentives with company growth, while secondary sales typically involve already vested shares, allowing early investors or insiders to liquidate holdings without new equity creation. Understanding distinctions in vesting implications aids in evaluating liquidity options and maintaining corporate governance during funding rounds.

Mint-and-List

Mint-and-List enables creators to issue NFTs directly on the primary market while simultaneously listing them on secondary marketplaces, streamlining the transition from initial issuance to resale. This approach enhances liquidity and market visibility by integrating primary issuance with immediate secondary sale opportunities.

secondary sale vs primary issuance Infographic

moneydif.com

moneydif.com