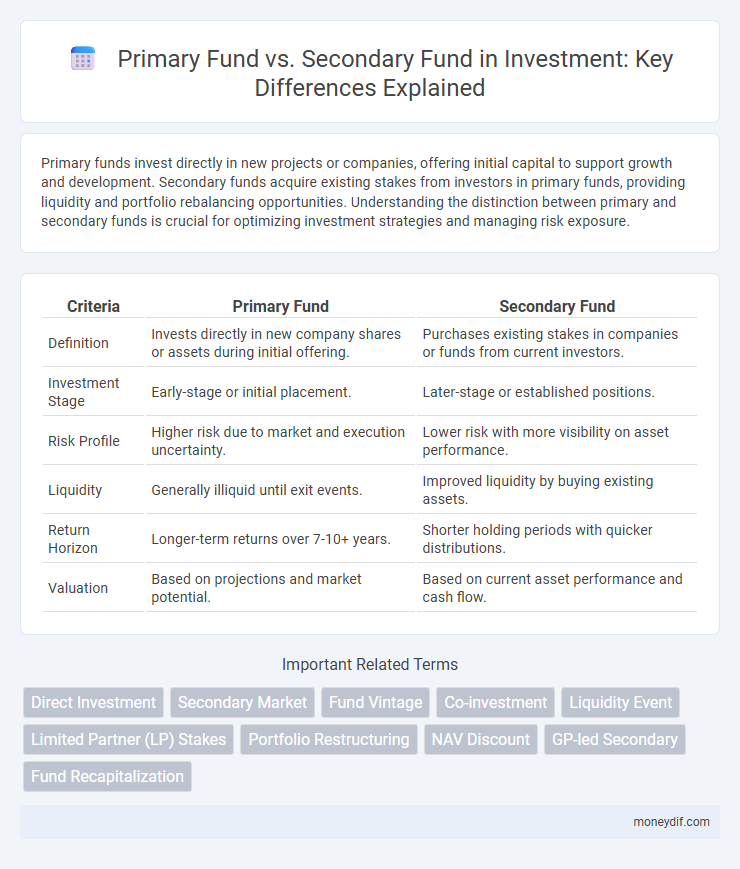

Primary funds invest directly in new projects or companies, offering initial capital to support growth and development. Secondary funds acquire existing stakes from investors in primary funds, providing liquidity and portfolio rebalancing opportunities. Understanding the distinction between primary and secondary funds is crucial for optimizing investment strategies and managing risk exposure.

Table of Comparison

| Criteria | Primary Fund | Secondary Fund |

|---|---|---|

| Definition | Invests directly in new company shares or assets during initial offering. | Purchases existing stakes in companies or funds from current investors. |

| Investment Stage | Early-stage or initial placement. | Later-stage or established positions. |

| Risk Profile | Higher risk due to market and execution uncertainty. | Lower risk with more visibility on asset performance. |

| Liquidity | Generally illiquid until exit events. | Improved liquidity by buying existing assets. |

| Return Horizon | Longer-term returns over 7-10+ years. | Shorter holding periods with quicker distributions. |

| Valuation | Based on projections and market potential. | Based on current asset performance and cash flow. |

Introduction to Primary and Secondary Funds

Primary funds invest directly in startup companies during their initial funding rounds, providing early-stage capital that supports business growth and innovation. Secondary funds purchase existing shares of companies from early investors or employees, offering liquidity and the opportunity to acquire stakes without participating in new funding rounds. Both fund types serve distinct purposes in the investment lifecycle, catering to different risk profiles and strategic objectives within private equity portfolios.

Key Differences Between Primary and Secondary Funds

Primary funds invest directly in new portfolio companies or projects, focusing on initial capital deployment and early-stage value creation. Secondary funds acquire existing interests in private equity or other investment funds, providing liquidity to original investors and often achieving discounted entry valuations. Key differences include timing of investment, risk exposure, and potential returns, with primary funds facing higher early-stage risk and secondary funds benefiting from more mature, de-risked assets.

Structure and Lifecycle of Primary Funds

Primary funds are typically structured as closed-end investment vehicles with a fixed lifecycle, often ranging from 7 to 12 years, during which capital is committed, invested, and ultimately realized through exits. Fund managers raise capital commitments upfront, deploying these funds over an investment period, followed by a hold period focused on value creation and asset management before distributions occur. This structured lifecycle offers investors a predictable timeline for capital deployment and returns, contrasting with the more variable timelines seen in secondary funds.

Structure and Lifecycle of Secondary Funds

Secondary funds acquire existing stakes in primary funds or direct investments, enabling liquidity for original investors and portfolio diversification. Their structure typically involves limited partners committing capital to a fund manager who actively sources and purchases these secondary interests, often at a discount to net asset value. The lifecycle of secondary funds is generally shorter than primary funds, focusing on asset acquisition, portfolio management, and eventual exit within a 5 to 7-year horizon.

Investment Strategies: Primary vs. Secondary Funds

Primary funds invest directly in new assets or companies during their early funding stages, focusing on initial offerings and long-term growth potential. Secondary funds acquire existing stakes from current investors, aiming to provide liquidity and capitalize on more mature or seasoned investments. This strategic difference allows primary funds to target high-growth opportunities, while secondary funds emphasize risk mitigation and shorter investment horizons.

Risk Profiles in Primary and Secondary Funds

Primary funds typically exhibit higher risk profiles due to investment in early-stage or newly issued assets with limited performance history and greater market uncertainty. Secondary funds generally carry lower risk as they acquire existing stakes in portfolios, providing more liquidity and visibility into asset performance and valuation. The risk differentiation stems from the timing and nature of asset acquisition, impacting volatility, return predictability, and capital deployment dynamics.

Liquidity Considerations: Primary Fund vs. Secondary Fund

Primary funds typically involve longer lock-up periods with limited liquidity due to initial capital commitments in new ventures, which restricts investor access to capital until fund maturation. Secondary funds offer enhanced liquidity by purchasing existing fund interests on the market, enabling quicker capital redeployment and reduced holding periods. Investors prioritize secondary funds when seeking faster liquidity solutions compared to the extended timelines generally associated with primary fund investments.

Performance Metrics and Historical Returns

Primary funds typically invest directly in new assets, offering potential for higher returns but with greater risk and longer deployment timelines, reflected in metrics like Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC). Secondary funds acquire pre-existing stakes in assets, often providing more immediate liquidity and reduced risk, resulting in steadier but sometimes lower historical returns, with performance measured by metrics such as Discount to Net Asset Value (NAV) and cash-on-cash multiples. Evaluating historical returns, secondary funds generally exhibit less volatility due to the matured state of invested assets, while primary funds display more variable yet potentially higher performance over comparable periods.

Advantages and Disadvantages of Each Fund Type

Primary funds provide direct access to new investment opportunities, allowing investors to participate in early-stage growth but often require longer lock-up periods and higher risk exposure. Secondary funds offer liquidity by purchasing existing stakes from current investors, enabling quicker entry and reduced risk through diversification, though they may involve discounts and less control over underlying assets. Each fund type balances trade-offs between timing, risk, and asset management flexibility, making them suitable for different investment strategies.

Choosing Between Primary and Secondary Fund Investments

Primary fund investments offer the advantage of accessing early-stage opportunities with potential for higher returns but entail longer lock-up periods and greater risk. Secondary fund investments provide increased liquidity and reduced blind pool risk by purchasing existing fund interests, often at a discount. Investors should evaluate their risk tolerance, liquidity needs, and investment horizon when choosing between primary and secondary fund options.

Important Terms

Direct Investment

Direct investment involves allocating capital directly into primary funds that acquire new assets, contrasting with secondary funds that purchase existing stakes in established investments.

Secondary Market

Secondary market investments provide liquidity by allowing investors to buy and sell pre-existing stakes in private equity funds, contrasting with primary funds where capital is committed directly to new investments. Secondary funds specialize in acquiring these existing interests, offering portfolio diversification and quicker returns compared to primary fund commitments.

Fund Vintage

Fund vintage indicates the year a primary fund starts investing, while secondary funds acquire interests in older vintage funds, impacting liquidity and risk profiles.

Co-investment

Co-investment involves investing directly alongside a primary fund in new private equity deals, allowing investors to gain targeted exposure with potentially lower fees and increased transparency compared to secondary funds, which acquire existing stakes in private equity funds on the resale market. Primary funds focus on capital commitments to new portfolio companies, whereas secondary funds provide liquidity by purchasing pre-existing fund interests, often at a discount, enabling diversified risk management and shorter investment horizons.

Liquidity Event

A liquidity event in the context of private equity involves the realization of returns when investors exit their positions, with primary funds focusing on direct investments in new companies and secondary funds specializing in purchasing existing stakes from previous investors. Secondary funds provide liquidity by enabling investors to sell their interests before the fund's maturity, while primary funds generate liquidity primarily through the eventual exit of portfolio companies via IPOs, mergers, or acquisitions.

Limited Partner (LP) Stakes

Limited Partner (LP) stakes in primary funds represent original commitments to new investment vehicles, while LP stakes in secondary funds involve trading pre-existing interests, enabling liquidity and portfolio diversification.

Portfolio Restructuring

Portfolio restructuring involves reallocating assets between primary funds, which invest directly in new ventures or projects, and secondary funds, which acquire existing interests from current investors to optimize liquidity and risk. This strategic adjustment enhances portfolio diversification and capital efficiency by balancing exposure to emerging opportunities through primary funds with immediate access to seasoned assets via secondary funds.

NAV Discount

NAV Discount occurs when a Secondary fund acquires interests in a Primary fund at a net asset value lower than its reported value, reflecting illiquidity or market inefficiencies; this discount enables secondary investors to benefit from immediate exposure to diversified assets at reduced prices compared to committing fresh capital in Primary funds. The magnitude of NAV Discount varies by fund size, vintage year, and underlying asset quality, often signaling risk perception differences and liquidity premiums between primary commitments and secondary transactions.

GP-led Secondary

GP-led secondary transactions enable primary fund investors to achieve liquidity and portfolio rebalancing by offering tailored exit opportunities, while secondary funds specialize in acquiring these interests at a discount, optimizing returns compared to direct primary fund investments.

Fund Recapitalization

Fund recapitalization involves restructuring capital allocation between primary funds, which invest directly in new ventures or assets, and secondary funds, which focus on acquiring existing stakes from early investors. This process enhances liquidity and portfolio diversification by enabling limited partners to exit mature investments while providing fresh capital for continued growth.

Primary fund vs Secondary fund Infographic

moneydif.com

moneydif.com