Sidecar funds and co-investment funds both provide investors with opportunities to participate alongside a lead private equity or venture capital fund but differ in structure and risk exposure. Sidecar funds are typically structured to invest alongside the main fund in all or specific deals, offering proportional exposure, while co-investment funds allow investors to choose individual deals to invest in directly, often with lower fees. Understanding these distinctions helps investors align their strategies with desired levels of control, diversification, and cost efficiency in private market investing.

Table of Comparison

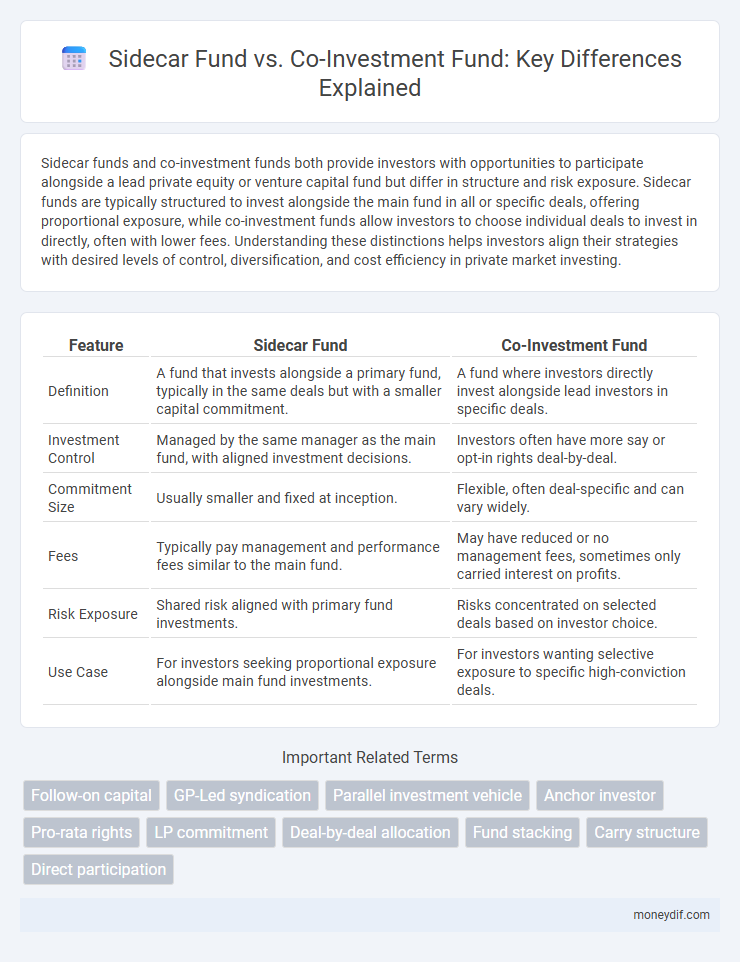

| Feature | Sidecar Fund | Co-Investment Fund |

|---|---|---|

| Definition | A fund that invests alongside a primary fund, typically in the same deals but with a smaller capital commitment. | A fund where investors directly invest alongside lead investors in specific deals. |

| Investment Control | Managed by the same manager as the main fund, with aligned investment decisions. | Investors often have more say or opt-in rights deal-by-deal. |

| Commitment Size | Usually smaller and fixed at inception. | Flexible, often deal-specific and can vary widely. |

| Fees | Typically pay management and performance fees similar to the main fund. | May have reduced or no management fees, sometimes only carried interest on profits. |

| Risk Exposure | Shared risk aligned with primary fund investments. | Risks concentrated on selected deals based on investor choice. |

| Use Case | For investors seeking proportional exposure alongside main fund investments. | For investors wanting selective exposure to specific high-conviction deals. |

Overview of Sidecar Funds and Co-Investment Funds

Sidecar funds are investment vehicles that allow limited partners to invest alongside a primary private equity fund, providing additional capital for specific portfolio companies without diluting the main fund's ownership. Co-investment funds offer limited partners direct investment opportunities into individual deals alongside the lead investor, typically with lower fees and carried interest compared to traditional fund structures. Both structures aim to enhance returns by granting investors selective exposure to high-conviction opportunities within a broader fund strategy.

Key Structural Differences Between Sidecar and Co-Investment Funds

Sidecar funds typically invest alongside a lead fund, mirroring its positions while maintaining a separate legal structure and capital base, allowing investors to participate in targeted deals without full fund exposure. Co-investment funds enable investors to invest directly alongside the lead fund in specific portfolio companies, providing concentrated equity stakes without additional management fees. Key structural differences include capital commitment models, fee arrangements, and investment flexibility, where sidecar funds operate like a parallel fund and co-investments act as single deal participations.

Investment Strategies: Sidecar Fund vs. Co-Investment Fund

Sidecar funds typically invest alongside a lead investor in a primary fund, mirroring its portfolio to leverage shared diligence and minimize risk while maintaining close alignment with the lead's strategy. Co-investment funds, by contrast, invest directly into specific deals alongside the main fund, allowing for selective exposure to high-conviction opportunities with potentially higher returns and greater control over investment decisions. The sidecar approach emphasizes parallel fund performance replication, whereas co-investment strategies offer tailored deal selection and concentrated risk profiles.

Fund Formation and Legal Considerations

Sidecar funds are typically structured as separate legal entities affiliated with the main fund, requiring distinct formation processes, including independent regulatory approvals and investor agreements. Co-investment funds often leverage the existing fund's legal framework but necessitate tailored agreements to address investor rights, profit allocation, and liability issues specific to direct investments alongside the main fund. Legal considerations for both focus on compliance with securities laws, fiduciary duties, and alignment of interests between general partners and limited partners to mitigate conflicts and ensure transparent governance.

Risk Management in Sidecar and Co-Investment Funds

Sidecar funds typically offer enhanced risk management by enabling limited partners to invest alongside the main fund with exposure to a narrower portfolio, reducing overall volatility. Co-investment funds provide direct equity stakes in specific deals, allowing investors to exercise greater control and perform individualized due diligence, which mitigates risk concentration. Both structures improve risk diversification compared to traditional fund investments, but sidecar funds generally afford a more balanced risk profile through selective participation.

Fee Structures and Incentive Alignment

Sidecar funds typically charge management fees of 1-1.5% and carry interest of 10-15%, aligning incentives by closely matching the lead fund's performance. Co-investment funds often forgo management fees and carry interest, reducing costs for limited partners and directly incentivizing returns without layered fees. This distinction in fee structures impacts investor alignment, with sidecar funds offering aligned interests through traditional fees, while co-investments emphasize cost efficiency and direct performance participation.

Typical Investors in Sidecar versus Co-Investment Funds

Typical investors in sidecar funds are often venture capital firms seeking to increase exposure to specific portfolio companies without committing additional primary fund capital. Co-investment funds, in contrast, attract limited partners such as institutional investors and high-net-worth individuals aiming for direct equity stakes alongside lead investors while benefiting from reduced fees and enhanced returns. Both fund types appeal to investors pursuing complementary investment strategies and diversified risk profiles within private equity markets.

Portfolio Diversification and Capital Deployment

Sidecar funds enhance portfolio diversification by enabling investors to participate alongside a lead fund in specific deals, providing targeted exposure without committing to the entire fund portfolio. Co-investment funds allow direct investment into individual companies alongside the main fund, optimizing capital deployment by reducing fees and increasing deal-level control. Both fund structures complement traditional venture capital allocations, balancing risk and return through strategic capital allocation.

Advantages and Challenges of Sidecar Funds

Sidecar funds offer the advantage of providing investors with targeted exposure to specific deals alongside a lead fund, enabling enhanced portfolio diversification and access to high-conviction opportunities. They allow for increased flexibility in capital allocation and typically involve lower management fees compared to traditional venture funds. Challenges include potential alignment issues with the lead fund, less control over investment decisions, and risks related to the reliance on the lead manager's performance and diligence.

Benefits and Limitations of Co-Investment Funds

Co-investment funds offer investors direct access to specific deals alongside the main fund, enabling lower fees and enhanced control over investment choices. They provide opportunities for increased returns due to concentrated exposure but carry higher risk due to less diversification compared to traditional funds. Limitations include potential conflicts of interest and the need for significant due diligence, as co-investors often bear more responsibility for deal assessment and management.

Important Terms

Follow-on capital

Follow-on capital in sidecar funds typically involves smaller, flexible investments that augment a lead investor's stake, whereas co-investment funds provide direct, proportional investments alongside the main fund, often enabling larger exposure without additional management fees. Sidecar funds prioritize agility and opportunistic capital deployment, while co-investment funds emphasize scale and alignment with the primary fund's investment strategy.

GP-Led syndication

GP-led syndication often leverages Sidecar funds to provide supplementary capital alongside the main fund, while Co-investment funds enable limited partners to directly invest in specific deals alongside the GP, enhancing portfolio diversification and alignment of interests.

Parallel investment vehicle

A sidecar fund typically pools limited partners alongside a main fund for concentrated investments, whereas a co-investment fund allows investors to directly invest alongside the lead investor in specific deals without additional fees.

Anchor investor

Anchor investors provide substantial initial capital to Sidecar funds, enhancing credibility and fundraising potential, while in Co-investment funds, they invest alongside lead investors, sharing both risks and returns on specific deals.

Pro-rata rights

Pro-rata rights in a sidecar fund typically allow investors to maintain their ownership percentage by participating in follow-on funding rounds alongside the main fund, whereas co-investment funds provide direct investment opportunities in specific portfolio companies without automatic pro-rata participation rights.

LP commitment

LP commitment in sidecar funds typically involves allocating capital to a smaller, targeted pool that co-invests alongside a lead fund, while co-investment funds enable limited partners to invest directly in specific portfolio companies alongside the main fund. Sidecar funds often offer more concentrated exposure and potentially higher returns on select deals, whereas co-investment funds provide LPs diversified access without additional management fees.

Deal-by-deal allocation

Deal-by-deal allocation enables Sidecar funds to selectively participate in individual investments alongside lead funds, whereas Co-investment funds typically commit capital across multiple deals with proportional stakes.

Fund stacking

Fund stacking occurs when limited partners invest in both sidecar funds and co-investment funds associated with the same lead investor, potentially magnifying exposure to overlapping portfolio companies and increasing concentration risk.

Carry structure

Carry structure in Sidecar funds often involves a proportional carried interest aligned with the main fund's performance, whereas Co-investment funds typically offer carry terms that are lower or waived to attract limited partners and foster direct investment alongside lead sponsors.

Direct participation

Direct participation in a Sidecar fund involves investors allocating capital alongside the lead investor to specific deals within the fund's portfolio, often mirroring their investment terms and timelines. In contrast, Co-investment funds allow investors to directly invest in individual portfolio companies alongside a primary fund, providing targeted exposure and potentially lower fees without the pooled risk of a Sidecar fund.

Sidecar fund vs Co-investment fund Infographic

moneydif.com

moneydif.com