A syndicated fund pools capital from multiple investors, spreading risk across a broader base, while a lead fund is managed by a primary investor who takes charge of decision-making and deal structuring. Syndicated funds offer diversification and collective expertise, whereas lead funds provide more control and potentially higher returns due to active involvement. Understanding the differences helps investors align their risk tolerance and management preferences with fund strategies.

Table of Comparison

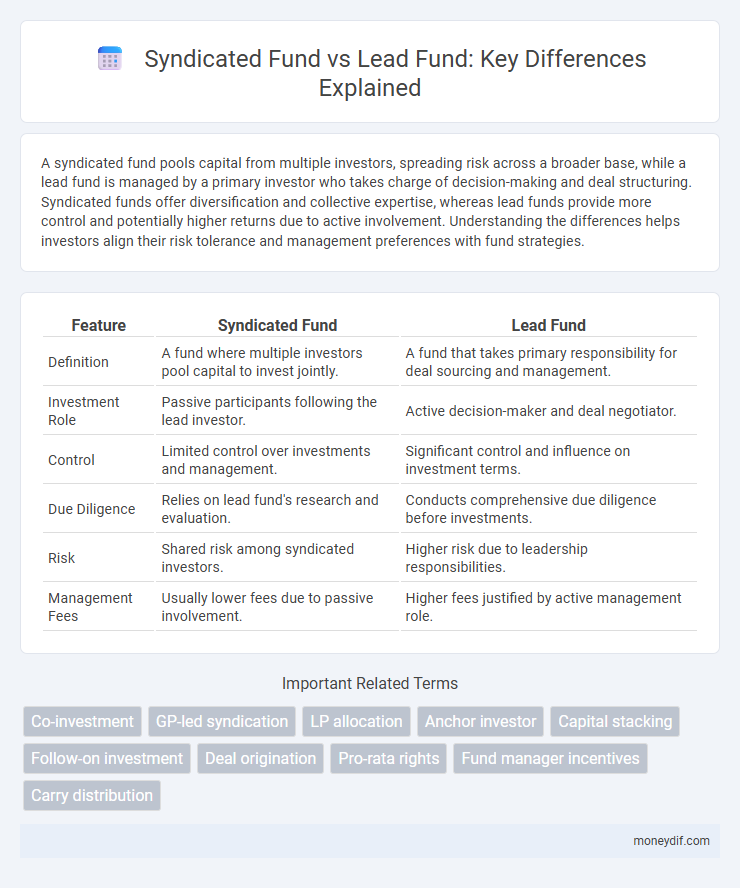

| Feature | Syndicated Fund | Lead Fund |

|---|---|---|

| Definition | A fund where multiple investors pool capital to invest jointly. | A fund that takes primary responsibility for deal sourcing and management. |

| Investment Role | Passive participants following the lead investor. | Active decision-maker and deal negotiator. |

| Control | Limited control over investments and management. | Significant control and influence on investment terms. |

| Due Diligence | Relies on lead fund's research and evaluation. | Conducts comprehensive due diligence before investments. |

| Risk | Shared risk among syndicated investors. | Higher risk due to leadership responsibilities. |

| Management Fees | Usually lower fees due to passive involvement. | Higher fees justified by active management role. |

Definition of Syndicated Fund

A syndicated fund is a pooled investment vehicle where multiple investors combine capital to finance large projects or investments, spreading risk across participants. It enables access to higher-value deals that individual investors might not afford independently. Unlike a lead fund, which initiates and manages the investment, the syndicated fund primarily focuses on collective investment without direct management control.

Definition of Lead Fund

A lead fund in syndicated financing is the primary investor responsible for structuring the deal, conducting due diligence, and negotiating terms on behalf of co-investors. This fund assumes a leadership role by coordinating investment strategies and overseeing ongoing management of the syndicated capital. Syndicated funds comprise multiple investors pooling resources, while the lead fund drives decision-making and risk assessment within the group.

Key Differences Between Syndicated and Lead Funds

Syndicated funds involve multiple investors pooling capital to share risks and returns, whereas lead funds are managed primarily by one fund acting as the lead investor, making key decisions on behalf of others. Lead funds have greater control over investment terms and strategies, while syndicated funds emphasize collective participation and diversified input from various investors. The lead fund typically undertakes due diligence and negotiation responsibilities, setting it apart from syndicated funds that distribute these duties among participants.

Structure and Roles in Syndicated Funds

Syndicated funds involve multiple investors pooling capital, with a lead fund manager orchestrating the overall investment strategy, due diligence, and negotiations. The lead fund assumes primary responsibility for deal sourcing, structuring, and ongoing management, while participating investors contribute capital and share returns proportional to their investment. This structure enhances risk diversification and access to larger deals compared to single-lead funds.

Structure and Roles in Lead Funds

Syndicated funds involve multiple investors pooling capital to diversify risk and increase investment capacity, whereas lead funds are structured with a primary lead investor who manages deal sourcing, due diligence, and negotiation. The lead fund's role includes setting terms, coordinating follow-on investments, and providing active management oversight to ensure alignment and execution efficiency. This centralized leadership streamlines decision-making and often attracts co-investors by leveraging the lead fund's expertise and network.

Investment Process Comparison

Syndicated funds combine capital from multiple investors to diversify risk and enhance funding capacity, relying on collaborative due diligence and shared decision-making during the investment process. Lead funds, managed by a primary investor or firm, take charge of sourcing deals, conducting comprehensive evaluations, and setting terms, streamlining the investment process with centralized control. The investment process in syndicated funds emphasizes consensus and co-investment, while lead funds prioritize agility and consistent strategic direction.

Risk Allocation in Syndicated vs Lead Funds

Syndicated funds distribute risk among multiple investors by pooling capital, reducing the financial exposure of each participant through shared responsibility. Lead funds concentrate risk primarily on the lead investor or manager, who undertakes the majority of due diligence and decision-making, bearing higher individual risk. This risk allocation difference impacts investor confidence and potential returns, as syndicated structures offer diversified risk, while lead funds demand greater trust in the lead entity's management capabilities.

Advantages and Disadvantages of Syndicated Funds

Syndicated funds pool capital from multiple investors, diversifying risk and enabling participation in larger deals unfeasible for individual investors. Advantages include shared due diligence, access to a broader network, and reduced individual exposure, while disadvantages involve potential conflicts among syndicate members, less control for each investor, and longer decision-making processes. Syndicated funds can offer scalability and risk mitigation but may sacrifice agility and centralized control compared to lead funds.

Advantages and Disadvantages of Lead Funds

Lead funds provide strategic advantages by setting investment terms and steering deal negotiations, allowing for greater influence and control in syndicated financing. Their disadvantages include higher risk exposure and increased responsibility for due diligence, which require significant expertise and resources. Investors benefit from lead funds' ability to attract co-investors but must weigh the potential for operational burden and liability in complex transactions.

Which Fund Structure is Right for Your Investment Goals?

Syndicated funds pool resources from multiple investors to diversify risk and increase capital reach, ideal for those seeking broad market exposure and shared management expertise. Lead funds centralize decision-making and investment control with a primary investor, offering more influence and potentially higher returns for experienced investors. Choosing the right fund structure depends on your risk tolerance, desired level of involvement, and investment horizon, ensuring alignment with your financial goals and management preferences.

Important Terms

Co-investment

Co-investment in syndicated funds allows investors to participate alongside multiple backers, while lead funds provide centralized management and decision-making control by a single primary investor.

GP-led syndication

GP-led syndication involves the general partner structuring a secondary transaction to facilitate liquidity and continuation options, contrasting with a syndicated fund where multiple investors jointly commit capital upfront. In syndication, the lead fund directs deal flow and controls negotiation, whereas GP-led syndication emphasizes managing existing assets and reallocating ownership among investors.

LP allocation

LP allocation in syndicated funds typically involves multiple investors sharing risk and returns, while lead funds often allocate larger LP commitments to maintain control and investment direction.

Anchor investor

Anchor investors typically provide substantial initial capital commitments that enhance credibility in syndicated funds, whereas lead funds actively manage and coordinate investment decisions within the syndicate.

Capital stacking

Capital stacking in syndicated funds involves multiple investors contributing layered equity and debt, whereas lead funds typically structure primary investment portions with strategic control and risk allocation.

Follow-on investment

Follow-on investments in syndicated funds typically involve multiple investors sharing risk and due diligence, whereas lead funds drive decision-making and negotiate terms, often securing preferential rights for subsequent financing rounds.

Deal origination

Syndicated funds pool capital from multiple investors to diversify risk, while lead funds actively manage deal origination and negotiation to secure favorable terms.

Pro-rata rights

Pro-rata rights in syndicated funds allow investors to maintain their ownership percentage during subsequent financings, while lead funds typically negotiate these rights to secure preferential investment opportunities and preserve influence.

Fund manager incentives

Fund manager incentives in syndicated funds typically align with shared performance fees among multiple parties, whereas lead funds often offer higher individual incentives due to greater management control and risk exposure.

Carry distribution

Carry distribution in syndicated funds typically allocates carried interest proportionally among all participating investors based on their investment size, whereas lead funds often receive a larger share of the carry due to their role in deal sourcing, negotiation, and management. This structure incentivizes lead funds to maximize returns while allowing syndicated partners to benefit from the fund's overall performance without direct operational involvement.

Syndicated fund vs Lead fund Infographic

moneydif.com

moneydif.com