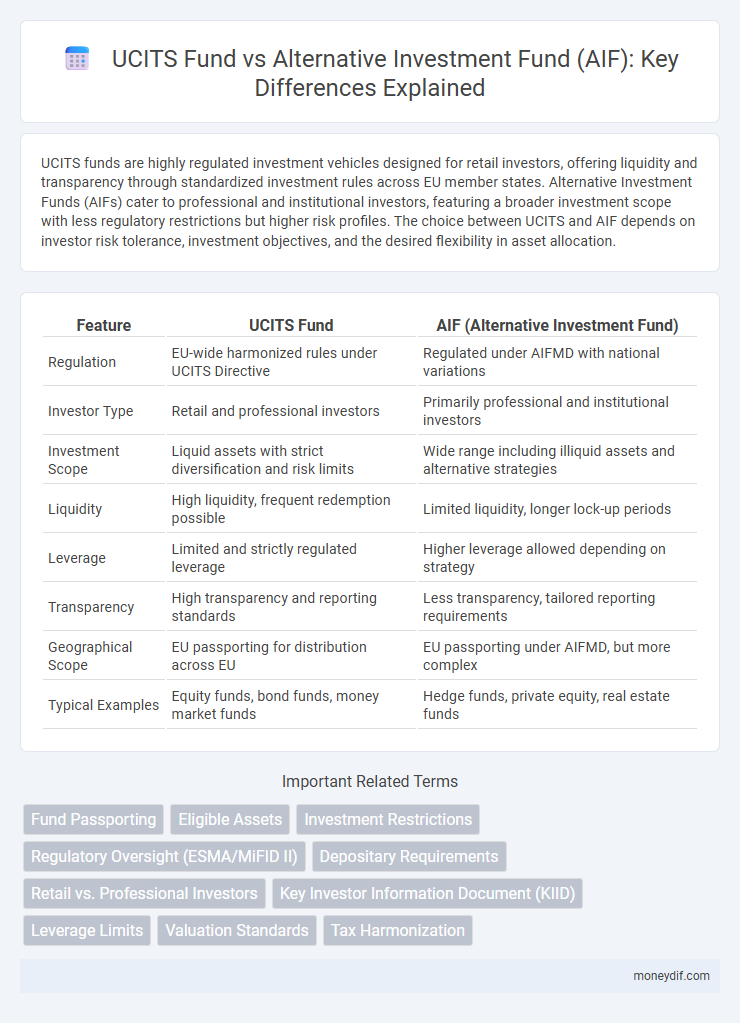

UCITS funds are highly regulated investment vehicles designed for retail investors, offering liquidity and transparency through standardized investment rules across EU member states. Alternative Investment Funds (AIFs) cater to professional and institutional investors, featuring a broader investment scope with less regulatory restrictions but higher risk profiles. The choice between UCITS and AIF depends on investor risk tolerance, investment objectives, and the desired flexibility in asset allocation.

Table of Comparison

| Feature | UCITS Fund | AIF (Alternative Investment Fund) |

|---|---|---|

| Regulation | EU-wide harmonized rules under UCITS Directive | Regulated under AIFMD with national variations |

| Investor Type | Retail and professional investors | Primarily professional and institutional investors |

| Investment Scope | Liquid assets with strict diversification and risk limits | Wide range including illiquid assets and alternative strategies |

| Liquidity | High liquidity, frequent redemption possible | Limited liquidity, longer lock-up periods |

| Leverage | Limited and strictly regulated leverage | Higher leverage allowed depending on strategy |

| Transparency | High transparency and reporting standards | Less transparency, tailored reporting requirements |

| Geographical Scope | EU passporting for distribution across EU | EU passporting under AIFMD, but more complex |

| Typical Examples | Equity funds, bond funds, money market funds | Hedge funds, private equity, real estate funds |

Introduction to UCITS and AIF

UCITS (Undertakings for Collective Investment in Transferable Securities) funds are regulated investment vehicles designed for retail investors, offering high liquidity, transparency, and diversification across European markets. Alternative Investment Funds (AIFs) encompass a broader range of assets including private equity, hedge funds, and real estate, targeting sophisticated investors with less regulatory constraints but higher risk profiles. Both UCITS and AIFs serve distinct purposes, with UCITS emphasizing investor protection and market standardization, while AIFs provide flexibility and access to alternative investment strategies.

Key Differences Between UCITS and AIF

UCITS funds are regulated investment vehicles designed for retail investors with strict diversification, liquidity, and transparency requirements under the EU UCITS Directive. In contrast, Alternative Investment Funds (AIFs) cater primarily to professional investors or those with higher risk tolerance, offering greater flexibility in investment strategies but subject to the AIFMD regulatory framework. Key differences include UCITS' standardized regulatory environment focusing on investor protection, while AIFs allow for specialized, less liquid assets with varied risk profiles.

Regulatory Framework Comparison

UCITS Funds operate under a harmonized regulatory framework established by the European Union, ensuring strict investor protection, transparency, and liquidity requirements. Alternative Investment Funds (AIFs) are governed by the Alternative Investment Fund Managers Directive (AIFMD), which offers more flexible investment strategies but imposes rigorous reporting and risk management obligations. The key regulatory distinction lies in UCITS being suitable for retail investors with standardized rules, whereas AIFs target professional investors with broader asset options and tailored regulatory oversight.

Investor Eligibility and Protection

UCITS Funds offer broad investor eligibility with strict regulatory frameworks ensuring high investor protection through standardized risk management, transparency, and liquidity requirements. AIFs target qualified or professional investors with fewer regulatory constraints, allowing more complex and higher-risk investment strategies but offering lower investor protection standards. The regulatory environment under the UCITS directive prioritizes retail investor safety, whereas AIF regulations provide flexibility tailored to sophisticated investors seeking alternative assets.

Investment Strategies and Restrictions

UCITS funds primarily focus on liquid assets with strict diversification and liquidity rules, enabling retail investor protection and daily redemption. AIFs offer broader investment strategies, including private equity, real estate, and hedge funds, with fewer regulatory constraints and typically limited liquidity. The regulatory framework for UCITS mandates transparency and risk controls, whereas AIFs allow tailored strategies to meet sophisticated investor needs and risk profiles.

UCITS Fund Advantages and Limitations

UCITS funds offer high levels of investor protection through strict regulatory requirements, including diversification rules and liquidity mandates, making them suitable for retail investors seeking transparency and safety. However, UCITS funds face limitations such as restrictions on investment strategies and asset classes, which can constrain potential returns compared to Alternative Investment Funds (AIFs) that allow more flexible and diverse investment approaches. The standardized regulatory framework of UCITS ensures cross-border marketing ease within the EU but may limit innovation and access to niche markets available through AIFs.

AIF Fund Benefits and Risks

AIFs (Alternative Investment Funds) offer greater flexibility in investment strategies compared to UCITS funds, enabling access to a broader range of asset classes such as private equity, real estate, and hedge funds. These funds provide opportunities for higher returns through diversified portfolios but come with increased risks including lower liquidity, less regulatory oversight, and potential for higher volatility. Investors should carefully assess the risk profile, management expertise, and alignment with their investment objectives before committing to an AIF.

Distribution and Passporting Rights

UCITS funds benefit from a harmonized EU regulatory framework allowing seamless cross-border distribution and passporting rights across all member states, facilitating broad retail investor access. AIFs, governed by the Alternative Investment Fund Managers Directive (AIFMD), face more restricted distribution rights and require compliance with national private placement regimes, limiting their passporting efficiency compared to UCITS. The UCITS passport supports mass market accessibility, while AIF passporting is often confined to professional investors and subject to additional regulatory conditions.

Performance, Fees, and Transparency

UCITS funds are highly regulated with strict transparency requirements, offering lower fees and broad market access, which often leads to more predictable performance for retail investors. Alternative Investment Funds (AIFs) typically exhibit higher fees reflecting active management and specialized strategies, resulting in potentially superior but more volatile performance outcomes. While UCITS emphasize liquidity and investor protection, AIFs provide greater flexibility in asset allocation but involve less frequent reporting and higher risks.

Choosing Between UCITS and AIF: Factors to Consider

Choosing between a UCITS fund and an Alternative Investment Fund (AIF) involves evaluating regulatory framework, target investors, and investment strategies. UCITS funds offer standardized regulation across the EU, enhancing liquidity and investor protection, suitable for retail investors seeking diversified, lower-risk portfolios. AIFs provide flexibility for complex, higher-risk strategies targeting professional investors, requiring thorough assessment of risk tolerance, reporting requirements, and market access.

Important Terms

Fund Passporting

Fund passporting enables UCITS funds to be marketed across the EU with a harmonized regulatory framework, facilitating cross-border investment and investor protection under the UCITS Directive. In contrast, AIFs rely on the Alternative Investment Fund Managers Directive (AIFMD) passport, which offers fund managers the ability to distribute alternative investment products within EU member states while adhering to specific risk management and transparency requirements.

Eligible Assets

Eligible assets for UCITS funds are primarily liquid financial instruments like equities, bonds, money market instruments, and derivatives that comply with strict diversification and liquidity rules. In contrast, AIFs (Alternative Investment Funds) can invest in a broader range of assets, including real estate, private equity, hedge funds, and other less liquid investments, allowing for greater flexibility but often with higher risk profiles.

Investment Restrictions

Investment restrictions in UCITS funds are strictly regulated by the European UCITS Directive, limiting asset concentration, leverage, and eligible securities to ensure high liquidity and investor protection. In contrast, Alternative Investment Funds (AIFs) operate under the AIFMD framework with more flexible investment strategies, allowing greater leverage, diverse asset classes, and less stringent diversification rules tailored for professional or sophisticated investors.

Regulatory Oversight (ESMA/MiFID II)

Regulatory oversight under ESMA and MiFID II mandates stringent transparency, investor protection, and risk management standards for both UCITS funds and AIFs, with UCITS funds subject to harmonized EU rules promoting liquidity and capital preservation, whereas AIFs face tailored requirements addressing diverse asset classes and complex strategies. ESMA plays a central role in supervising compliance, enhancing market integrity, and facilitating investor confidence across these investment structures within the European Union.

Depositary Requirements

Depositary requirements for UCITS funds enforce strict oversight, including asset safekeeping, valuation control, and cash monitoring, ensuring investor protection under the UCITS Directive 2009/65/EC, whereas AIFs, governed by the AIFMD 2011/61/EU, mandate a depositary with broader functions such as asset oversight, fund compliance verification, and liability for asset loss, reflecting diverse risk profiles and investment strategies. Both frameworks prioritize transparency and risk mitigation but differ in scope and liability standards to address the distinct regulatory environments of retail-oriented UCITS and institutionally-focused AIFs.

Retail vs. Professional Investors

Retail investors often access UCITS funds due to their standardized regulation, liquidity, and transparency tailored for non-professionals, while professional investors typically engage with Alternative Investment Funds (AIFs) offering diverse strategies, higher risk profiles, and less regulatory constraints under the AIFMD framework. UCITS funds prioritize investor protection and capital preservation, whereas AIFs focus on alternative asset classes and complex investment techniques aligned with sophisticated investor needs.

Key Investor Information Document (KIID)

The Key Investor Information Document (KIID) provides standardized, concise information to retail investors about UCITS funds, detailing investment objectives, risks, costs, and past performance to enhance transparency and comparability. Unlike UCITS, AIFs (Alternative Investment Funds) are not required to produce a KIID, as they target professional investors with more complex strategies and varying regulatory disclosures under the AIFMD framework.

Leverage Limits

Leverage limits in UCITS funds are strictly regulated under the UCITS Directive, typically capped at a maximum of 100% of the fund's net asset value, ensuring risk containment and investor protection, whereas AIFs operate under the Alternative Investment Fund Managers Directive (AIFMD) which allows more flexible but supervised leverage strategies depending on the fund's risk profile and investment objectives. This regulatory distinction impacts portfolio composition, borrowing capacity, and risk management frameworks between UCITS and AIFs within the European investment landscape.

Valuation Standards

Valuation standards for UCITS funds adhere to strict regulatory guidelines under the European Securities and Markets Authority (ESMA), focusing on daily asset valuation to ensure liquidity and investor protection. In contrast, AIF valuation follows the Alternative Investment Fund Managers Directive (AIFMD), allowing more flexibility in valuation frequency and methodologies, accommodating diverse asset types and illiquid investments.

Tax Harmonization

Tax harmonization between UCITS funds and Alternative Investment Funds (AIFs) ensures consistent tax treatment across jurisdictions, reducing regulatory arbitrage and enhancing investor protection. UCITS funds benefit from standardized tax regimes that facilitate cross-border distribution, while AIFs often face diverse tax structures requiring aligned policies to promote market competitiveness and transparency.

UCITS Fund vs AIF (Alternative Investment Fund) Infographic

moneydif.com

moneydif.com