Collective Investment Trusts (CITs) offer lower fees and fewer regulatory requirements compared to Mutual Funds, making them ideal for retirement plans and institutional investors. Unlike Mutual Funds, CITs are not publicly traded and have limited redemption options, providing potential stability in investment management. Investors seeking diversification and cost efficiency often consider CITs as a viable alternative to traditional Mutual Funds.

Table of Comparison

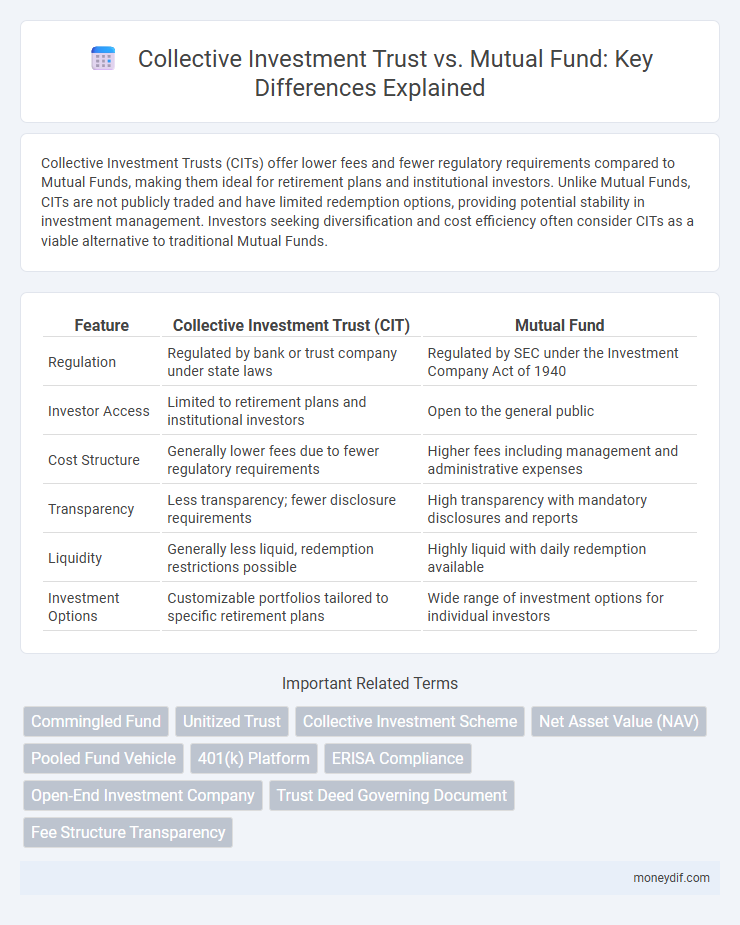

| Feature | Collective Investment Trust (CIT) | Mutual Fund |

|---|---|---|

| Regulation | Regulated by bank or trust company under state laws | Regulated by SEC under the Investment Company Act of 1940 |

| Investor Access | Limited to retirement plans and institutional investors | Open to the general public |

| Cost Structure | Generally lower fees due to fewer regulatory requirements | Higher fees including management and administrative expenses |

| Transparency | Less transparency; fewer disclosure requirements | High transparency with mandatory disclosures and reports |

| Liquidity | Generally less liquid, redemption restrictions possible | Highly liquid with daily redemption available |

| Investment Options | Customizable portfolios tailored to specific retirement plans | Wide range of investment options for individual investors |

Introduction to Collective Investment Trusts and Mutual Funds

Collective Investment Trusts (CITs) are pooled investment vehicles managed by banks or trust companies, primarily available to qualified retirement plans and institutional investors, offering lower fees and customized investment options. Mutual funds are regulated investment companies accessible to the general public, providing daily liquidity and a wide range of investment strategies under the oversight of the SEC. Both CITs and mutual funds pool assets from multiple investors to achieve diversification and professional management but differ in regulatory frameworks, investor types, and operational structures.

Structural Differences Between CITs and Mutual Funds

Collective Investment Trusts (CITs) are private funds governed by bank trustees and exempt from SEC registration, offering more flexible investment strategies and lower fees compared to Mutual Funds, which are publicly registered under the Investment Company Act of 1940. CITs primarily serve qualified retirement plans and have fewer regulatory disclosure requirements, while Mutual Funds are available to the general public with strict compliance on transparency and investor protections. These structural differences impact liquidity, investor access, and regulatory oversight, making CITs more suitable for institutional investors and Mutual Funds more accessible to retail investors.

Regulatory Oversight: CITs vs Mutual Funds

Collective Investment Trusts (CITs) are regulated by the Office of the Comptroller of the Currency (OCC) and state banking authorities, while Mutual Funds fall under the jurisdiction of the Securities and Exchange Commission (SEC) with stringent disclosure and reporting requirements enforced by the Investment Company Act of 1940. CITs benefit from less regulatory burden, allowing more operational flexibility but with limited investor protections compared to Mutual Funds, which must comply with strict governance, transparency, and liquidity standards to protect individual investors. The regulatory differences impact CITs' accessibility, target investor base, and compliance costs, influencing fund managers' choice between these two investment vehicles.

Fee Structures and Cost Comparison

Collective Investment Trusts (CITs) typically offer lower fee structures compared to mutual funds, as they are exempt from SEC registration and have fewer regulatory expenses. CIT fees often range from 0.20% to 0.65%, while mutual funds commonly charge between 0.50% and 1.50%, including management and distribution costs. The reduced operational and administrative costs of CITs make them a cost-efficient option for institutional investors seeking collective investment vehicles.

Investment Flexibility and Customization

Collective Investment Trusts (CITs) offer enhanced investment flexibility and customization compared to Mutual Funds by allowing tailored portfolio strategies that meet specific fiduciary requirements and investor needs. CITs often feature lower fees and fewer regulatory restrictions, enabling asset managers to implement more dynamic asset allocations and unique investment mandates. Mutual Funds, regulated by the SEC, adhere to standardized investment approaches with limited customization, catering primarily to individual retail investors through predefined fund objectives.

Account Minimums and Accessibility

Collective Investment Trusts (CITs) typically have higher account minimums, often starting at $100,000 or more, limiting accessibility to institutional investors or high-net-worth individuals. Mutual Funds generally offer lower minimum investments, sometimes as low as $500, making them more accessible to retail investors. The accessibility difference influences investor choice, with CITs favored for large-scale portfolios and mutual funds preferred for broader market participation.

Tax Efficiency and Implications

Collective Investment Trusts (CITs) often provide enhanced tax efficiency compared to mutual funds due to lower turnover rates and fewer capital gains distributions, resulting in potentially reduced taxable events for investors. Mutual funds are subject to greater regulatory oversight under the Investment Company Act of 1940, which can lead to higher operational costs and taxable distributions that impact after-tax returns. Investors seeking to minimize tax liabilities may favor CITs for their structure allowing more strategic management of capital gains and taxable income.

Transparency and Reporting Standards

Collective Investment Trusts (CITs) typically offer lower transparency compared to Mutual Funds, as CITs are subject to less stringent reporting requirements and are not registered with the SEC, limiting public access to detailed financial disclosures. Mutual Funds adhere to rigorous Transparency and Reporting Standards enforced by the Securities and Exchange Commission (SEC), including regular filings such as Form N-PORT and N-CSR, which provide investors with comprehensive insights into holdings, performance, and fees. This regulatory oversight makes Mutual Funds more accessible for individual investors seeking detailed and consistent reporting on their investments.

Performance History and Benchmarks

Collective Investment Trusts (CITs) often demonstrate consistent performance history by leveraging lower expense ratios and institutional management, resulting in potentially higher net returns compared to Mutual Funds. Mutual Funds are benchmarked against standard indices such as the S&P 500 or the MSCI World Index, providing transparent performance comparison for retail investors. CITs typically use customized benchmarks aligned with specific investment objectives, enhancing performance relevance for institutional portfolios.

Choosing Between CITs and Mutual Funds: Key Considerations

When choosing between Collective Investment Trusts (CITs) and Mutual Funds, investors should evaluate factors such as regulatory oversight, cost efficiency, and liquidity. CITs typically offer lower expense ratios due to less stringent regulatory requirements under the Office of the Comptroller of the Currency (OCC), while Mutual Funds are regulated by the Securities and Exchange Commission (SEC) and provide greater transparency and liquidity. Understanding the investment horizon, risk tolerance, and fee structures plays a critical role in making an informed decision between these two pooled investment vehicles.

Important Terms

Commingled Fund

Commingled funds are pooled investment vehicles primarily used by institutional investors, offering lower fees and tailored strategies compared to mutual funds, which are retail-focused and regulated under the Investment Company Act of 1940. Collective Investment Trusts (CITs) share similarities with commingled funds by providing tax advantages and flexible investment options, but they are regulated by bank authorities rather than the SEC, distinguishing them from mutual funds.

Unitized Trust

Unitized Trusts combine features of Collective Investment Trusts (CITs) and Mutual Funds by offering pooled investment structures with unitized accounting, enabling institutional investors to access diversified portfolios with lower fees and regulatory requirements compared to mutual funds. Unlike mutual funds registered with the SEC, Unitized Trusts under CITs benefit from less stringent compliance, making them an attractive option for retirement plans seeking cost-effective investment vehicles.

Collective Investment Scheme

Collective Investment Trusts typically have lower fees and are exclusive to accredited investors, while Mutual Funds offer broader accessibility and regulatory oversight under the Investment Company Act of 1940.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of a fund's assets minus liabilities, crucial for both Collective Investment Trusts (CITs) and Mutual Funds in determining investor transactions. CITs often have lower expense ratios and fewer regulatory requirements than Mutual Funds, but both calculate NAV daily to reflect the intrinsic value of the underlying portfolio assets accurately.

Pooled Fund Vehicle

Pooled Fund Vehicles, such as Collective Investment Trusts (CITs) and Mutual Funds, serve as investment structures that aggregate capital from multiple investors to enhance diversification and reduce risk. While Mutual Funds are regulated by the Securities and Exchange Commission (SEC) and widely accessible to retail investors, Collective Investment Trusts operate under the oversight of banking regulators and are primarily available to qualified retirement plans, offering lower fees and potentially higher tax efficiency.

401(k) Platform

401(k) platforms increasingly favor Collective Investment Trusts (CITs) over Mutual Funds due to CITs' lower fees and greater customization options for retirement plan sponsors. CITs offer enhanced economies of scale and regulatory efficiencies, making them cost-effective investment vehicles compared to traditional mutual funds within defined contribution plans.

ERISA Compliance

ERISA compliance for Collective Investment Trusts (CITs) offers fiduciaries greater flexibility and lower operational costs compared to mutual funds, which are subject to stricter SEC regulations and potentially higher fees.

Open-End Investment Company

An Open-End Investment Company issues redeemable shares and continuously offers new shares to investors, making it a common structure for mutual funds, which are regulated by the Investment Company Act of 1940; in contrast, Collective Investment Trusts (CITs) are pooled investment funds managed by banks or trust companies and are exempt from many mutual fund regulations, often providing lower fees and catering primarily to retirement plans. Mutual funds offer broad investor access and detailed regulatory oversight, while CITs provide institutional investors with tax-efficient, cost-effective investment alternatives typically used within 401(k) plans and pension trusts.

Trust Deed Governing Document

A Trust Deed Governing Document outlines the legal framework and fiduciary responsibilities for Collective Investment Trusts, distinguishing them from Mutual Funds by specifying trustee roles, beneficiary rights, and investment guidelines.

Fee Structure Transparency

Collective Investment Trusts offer lower fee structure transparency compared to Mutual Funds due to limited regulatory disclosure requirements.

Collective Investment Trust vs Mutual Fund Infographic

moneydif.com

moneydif.com