Open-end funds continuously issue and redeem shares at their net asset value, offering high liquidity and flexibility to investors. Closed-end funds issue a fixed number of shares traded on stock exchanges, often at prices diverging from their net asset value. Understanding the structural differences between these funds is crucial for aligning investment strategies with objectives and risk tolerance.

Table of Comparison

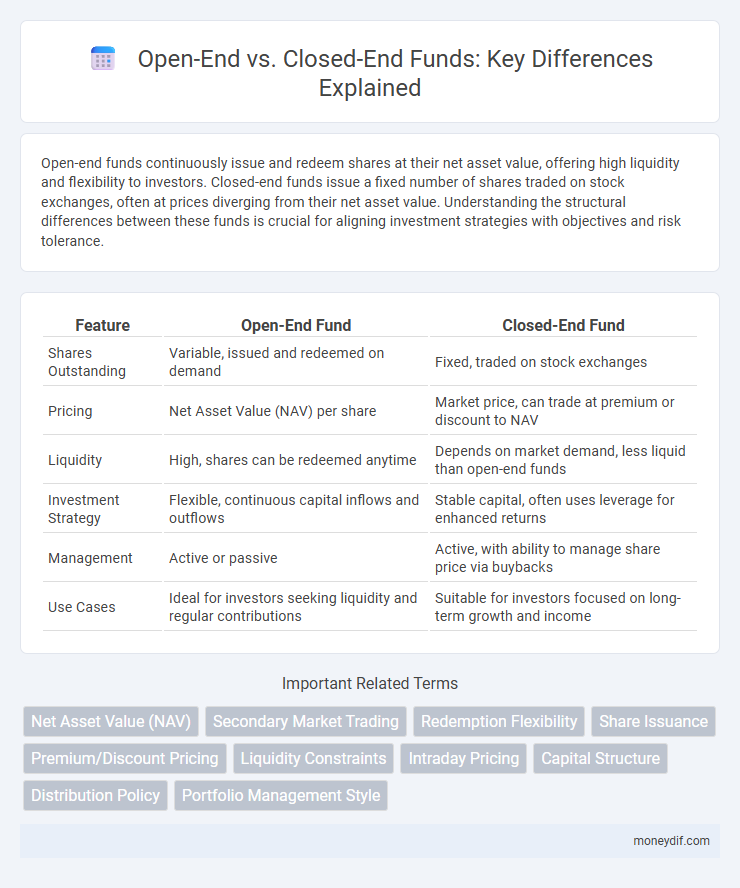

| Feature | Open-End Fund | Closed-End Fund |

|---|---|---|

| Shares Outstanding | Variable, issued and redeemed on demand | Fixed, traded on stock exchanges |

| Pricing | Net Asset Value (NAV) per share | Market price, can trade at premium or discount to NAV |

| Liquidity | High, shares can be redeemed anytime | Depends on market demand, less liquid than open-end funds |

| Investment Strategy | Flexible, continuous capital inflows and outflows | Stable capital, often uses leverage for enhanced returns |

| Management | Active or passive | Active, with ability to manage share price via buybacks |

| Use Cases | Ideal for investors seeking liquidity and regular contributions | Suitable for investors focused on long-term growth and income |

Introduction to Open-End and Closed-End Funds

Open-end funds continuously issue and redeem shares at their net asset value (NAV), providing high liquidity for investors. Closed-end funds raise a fixed amount of capital through an initial public offering (IPO) and trade shares on stock exchanges at market prices that may differ from the NAV. The structural differences affect pricing, liquidity, and investment strategies within open-end and closed-end fund frameworks.

Key Differences Between Open-End and Closed-End Funds

Open-end funds continuously issue and redeem shares at their net asset value (NAV), providing high liquidity and allowing investors to buy or sell shares directly from the fund. Closed-end funds issue a fixed number of shares that trade on stock exchanges at market prices, which may differ from the NAV, leading to premiums or discounts. The distinct structures affect pricing, liquidity, and investor accessibility, with open-end funds focusing on daily NAV-based transactions and closed-end funds influenced by market demand and supply dynamics.

Structure and Fund Management

Open-end funds continuously issue and redeem shares based on investor demand, allowing liquidity at the net asset value (NAV) per share, while closed-end funds issue a fixed number of shares traded on stock exchanges, often at a premium or discount to NAV. Open-end fund management involves ongoing portfolio adjustments to meet redemption requests, requiring highly liquid assets, whereas closed-end fund managers can pursue longer-term investment strategies without the need to maintain liquidity for redemptions. The structural difference influences investor access, fund volatility, and management flexibility in asset allocation.

How Shares Are Bought and Sold

Open-end fund shares are purchased and redeemed directly through the fund at the net asset value (NAV) calculated at the end of each trading day, allowing investors to buy or sell shares at that day's NAV. Closed-end fund shares trade on stock exchanges like regular stocks, meaning investors buy and sell shares through the market at prices that can differ from the NAV based on supply and demand. This trading mechanism influences liquidity and price volatility, with open-end funds offering daily liquidity at NAV and closed-end funds subject to market price fluctuations.

Pricing Mechanisms: NAV vs Market Price

Open-end funds are priced based on their net asset value (NAV), calculated at the end of each trading day by dividing the total value of the fund's assets minus liabilities by the number of outstanding shares. Closed-end funds trade on stock exchanges at market prices, which can deviate from their NAV due to supply and demand dynamics, often resulting in premiums or discounts. Understanding the distinction between NAV-based pricing and market-driven valuation is crucial for investors assessing liquidity, price transparency, and potential discount opportunities in fund investments.

Liquidity and Accessibility

Open-end funds offer high liquidity as investors can buy and redeem shares at the fund's net asset value (NAV) on any business day, providing easy accessibility for both individual and institutional investors. Closed-end funds have a fixed number of shares traded on stock exchanges, which can lead to price fluctuations above or below the NAV, potentially limiting liquidity and accessibility based on market demand. The continuous issuance and redemption feature distinguishes open-end funds from closed-end funds, impacting how investors access and exit their investments.

Dividend and Distribution Policies

Open-end funds typically pay dividends based on the income generated from their portfolio assets, with distributions often made monthly or quarterly, allowing investors to reinvest dividends or receive them as cash. Closed-end funds may offer higher dividend yields due to their fixed capital structure and the use of leverage, distributing income through regular dividends, capital gains, or return of capital, which can lead to varying tax implications. Dividend and distribution policies in closed-end funds are generally more flexible, influenced by fund performance and market conditions, whereas open-end funds maintain more consistent payout schedules aligned with NAV fluctuations.

Fees and Expense Ratios

Open-end funds typically charge management fees ranging from 0.5% to 1.5%, with expense ratios averaging around 0.75%, reflecting ongoing operational costs and portfolio management. Closed-end funds often incur higher fees, including management fees plus costs related to leverage and premium/discount trading, leading to average expense ratios between 1% and 2%. Expense ratios in closed-end funds tend to be less transparent due to additional trading costs and bid-ask spreads, impacting overall investor returns.

Pros and Cons of Open-End Funds

Open-end funds offer high liquidity as investors can buy or redeem shares at the fund's net asset value (NAV) daily, making them suitable for those seeking flexibility and accessibility. These funds provide professional management and diversification benefits but may face dilution and capital gains distribution challenges due to continuous share issuance. However, open-end funds can be susceptible to redemption pressure in volatile markets, potentially impacting portfolio stability and performance.

Pros and Cons of Closed-End Funds

Closed-end funds offer the advantage of professional management and the ability to invest in less liquid assets due to their fixed capital structure, which allows fund managers to focus on long-term investment strategies without worrying about redemptions. However, closed-end funds may trade at a discount or premium to their net asset value, creating potential pricing inefficiencies and volatility for investors. The limited liquidity of shares on secondary markets can restrict investors' ability to exit positions quickly, contrasting with the daily redemption feature of open-end funds.

Important Terms

Net Asset Value (NAV)

Net Asset Value (NAV) of Open-End Funds is calculated daily based on the total market value of assets minus liabilities divided by outstanding shares, while Closed-End Funds trade on exchanges often above or below their NAV due to market demand and supply.

Secondary Market Trading

Secondary market trading in closed-end funds occurs continuously at market prices that can deviate from net asset value, whereas open-end funds do not trade on secondary markets and are bought or redeemed directly at net asset value.

Redemption Flexibility

Open-end funds offer higher redemption flexibility with daily liquidity at net asset value, while closed-end funds have limited redemption options often requiring secondary market sales.

Share Issuance

Share issuance in open-end funds occurs continuously, allowing investors to purchase or redeem shares at the fund's net asset value (NAV) based on the current valuation of the underlying assets. In contrast, closed-end funds issue a fixed number of shares during an initial public offering (IPO), after which shares trade on secondary markets at prices influenced by market demand and supply, often differing from the NAV.

Premium/Discount Pricing

Premium and discount pricing occur when closed-end funds trade above (premium) or below (discount) their net asset value (NAV) due to market supply and demand, unlike open-end funds that issue and redeem shares at NAV, preventing persistent premiums or discounts. Closed-end funds offer potential for capital appreciation through market price fluctuations, whereas open-end funds provide liquidity and price stability by transacting directly at NAV.

Liquidity Constraints

Liquidity constraints in open-end funds allow investors to redeem shares at net asset value daily, while closed-end funds have limited liquidity as shares trade on exchanges at market prices, potentially causing discounts or premiums to NAV.

Intraday Pricing

Intraday pricing allows investors to trade closed-end funds at market prices throughout the day, unlike open-end funds which are priced once daily at their net asset value (NAV).

Capital Structure

Open-end funds continuously issue and redeem shares at net asset value, impacting capital structure flexibility, whereas closed-end funds have a fixed capital structure with shares traded on exchanges.

Distribution Policy

Distribution policy in open-end funds typically involves regular dividends based on income and realized gains, while closed-end funds often use fixed distribution rates regardless of income fluctuations.

Portfolio Management Style

Open-end funds continually issue and redeem shares at net asset value, providing liquidity and flexibility, while closed-end funds trade on exchanges with fixed capital, often allowing for active management and market price fluctuations.

Open-End Fund vs Closed-End Fund Infographic

moneydif.com

moneydif.com