White label funds offer customized investment solutions that allow financial firms to brand the fund as their own, providing greater control over fund management and marketing. Shelf funds are pre-registered investment vehicles ready for rapid launch, enabling fund managers to expedite the fundraising process without starting from scratch. Choosing between the two depends on whether customization and branding or speed and regulatory convenience are the primary priorities.

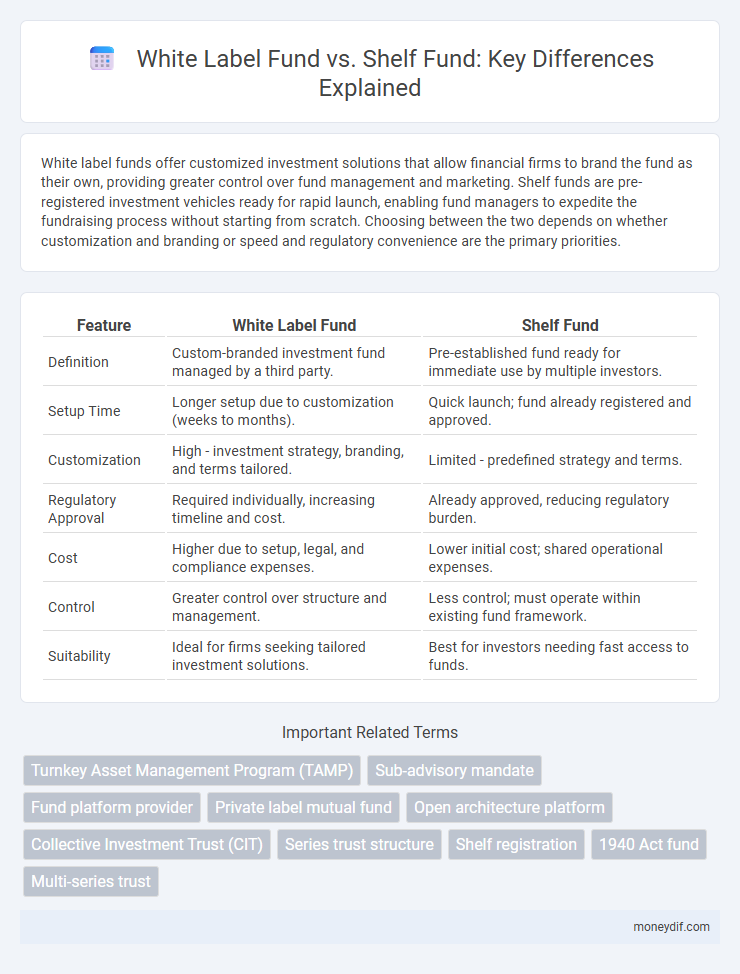

Table of Comparison

| Feature | White Label Fund | Shelf Fund |

|---|---|---|

| Definition | Custom-branded investment fund managed by a third party. | Pre-established fund ready for immediate use by multiple investors. |

| Setup Time | Longer setup due to customization (weeks to months). | Quick launch; fund already registered and approved. |

| Customization | High - investment strategy, branding, and terms tailored. | Limited - predefined strategy and terms. |

| Regulatory Approval | Required individually, increasing timeline and cost. | Already approved, reducing regulatory burden. |

| Cost | Higher due to setup, legal, and compliance expenses. | Lower initial cost; shared operational expenses. |

| Control | Greater control over structure and management. | Less control; must operate within existing fund framework. |

| Suitability | Ideal for firms seeking tailored investment solutions. | Best for investors needing fast access to funds. |

Understanding White Label Funds and Shelf Funds

White label funds offer customizable investment solutions branded by financial intermediaries while using the underlying infrastructure of established fund managers, enabling quick market entry and tailored client solutions. Shelf funds refer to pre-registered investment funds available for immediate launch, providing regulatory approval in advance and saving time on setup for asset managers. Understanding the operational flexibility and regulatory advantages of white label funds versus the regulatory efficiency and speed of shelf funds is crucial for selecting the appropriate fund structure in asset management.

Key Differences Between White Label and Shelf Funds

White label funds allow financial advisors to offer customized investment products under their own brand, providing flexibility in fund management and marketing. Shelf funds consist of pre-established, regulatory-approved structures that enable quicker market entry without the need for creating a fund from scratch. Key differences include customization capabilities, time-to-market efficiency, and branding control, with white label funds focusing on personalization and shelf funds emphasizing speed and regulatory compliance.

Advantages of White Label Funds

White label funds offer customizable investment solutions, allowing financial firms to maintain brand identity while leveraging established fund structures. They provide quicker market entry compared to shelf funds, which require more regulatory approval and setup time. Enhanced flexibility in fund management and marketing strategies makes white label funds a preferred choice for firms seeking tailored product offerings.

Benefits of Shelf Funds

Shelf funds offer greater flexibility by enabling rapid capital raising without the need for new regulatory approval for each issuance, accelerating time-to-market. They reduce administrative costs and streamline compliance processes compared to white label funds, making them ideal for managing multiple investment tranches efficiently. Shelf funds also provide enhanced adaptability for portfolio managers to respond to market opportunities with pre-approved structures.

Regulatory Framework: White Label vs Shelf Fund

White label funds operate under a flexible regulatory framework that allows fund managers to customize investment strategies and branding while leveraging an existing fund license, enhancing market agility. Shelf funds are governed by predefined regulatory structures with predetermined investment mandates, enabling faster launch times but limiting customization options. Regulatory compliance for white label funds often demands ongoing disclosures tailored to bespoke strategies, whereas shelf funds follow standardized reporting requirements aligned with their preset frameworks.

Cost Structure Comparison

White label funds typically involve lower initial setup costs due to their pre-established structures but may incur higher ongoing fees linked to customization and branding. Shelf funds require substantial upfront expenses for registration and compliance but benefit from reduced operational costs over time thanks to their ready-to-use framework. Both fund types present distinct cost structures, influencing fund managers' decisions based on budget constraints and long-term financial strategies.

Suitability for Asset Managers and Investors

White label funds offer asset managers a customizable solution ideal for tailored investment strategies, enabling closer alignment with specific investor preferences and compliance requirements. Shelf funds provide a pre-registered, ready-to-launch option appealing to asset managers seeking expedited market entry and streamlined administration for diverse investor groups. Investors benefit from white label funds through enhanced personalization and control, while shelf funds present advantages in reduced launch times and lower initial regulatory hurdles.

Operational Flexibility and Customization

White label funds offer greater operational flexibility by allowing asset managers to customize investment strategies, fee structures, and reporting to meet specific client needs. Shelf funds, while more standardized and quicker to launch, provide limited customization options, relying on pre-approved templates and regulatory filings. This makes white label funds ideal for tailored investment solutions, whereas shelf funds suit straightforward, cost-efficient fund launches.

Risk and Compliance Considerations

White label funds transfer investment management responsibilities to third parties, increasing risks such as compliance breaches and operational errors if due diligence is insufficient. Shelf funds offer a pre-registered, ready-to-launch structure that enhances regulatory compliance and reduces setup risks but may limit customization flexibility. Investors must weigh the higher compliance oversight in white label funds against the standardized, lower-risk profile of shelf funds when selecting a fund vehicle.

Choosing Between White Label and Shelf Fund Models

Selecting between white label and shelf fund models requires evaluating customization needs and speed to market. White label funds offer tailored investment strategies and branding to meet specific client demands, while shelf funds provide ready-to-go structures that accelerate fund launch timelines. Investors prioritize control and flexibility in white label funds versus operational simplicity and cost-efficiency in shelf funds when making their decision.

Important Terms

Turnkey Asset Management Program (TAMP)

The Turnkey Asset Management Program (TAMP) offers financial advisors streamlined access to professionally managed portfolios, enabling the use of white label funds that allow customization and branding flexibility compared to shelf funds, which are pre-packaged and marketed by third-party firms with limited adaptability. White label funds within TAMP platforms provide greater control over investment strategies and client experience, while shelf funds benefit from broader product selection and simplified implementation.

Sub-advisory mandate

A sub-advisory mandate allows an external manager to oversee investment decisions within a white label fund, offering tailored strategies under a branded product, whereas shelf funds provide pre-registered investment vehicles enabling quicker market access without custom portfolio management.

Fund platform provider

A fund platform provider offers customizable white label fund solutions enabling clients to brand and tailor investment products, whereas shelf funds provide pre-established investment vehicles ready for immediate deployment without customization.

Private label mutual fund

Private label mutual funds offer customized investment solutions branded for specific financial institutions, contrasting with white-label funds that are created by third parties but marketed under a distributor's brand, while shelf funds provide pre-registered, ready-to-launch investment products enabling quicker market entry. These structures impact fund management flexibility, regulatory compliance, and speed to market, catering to varying strategic needs within asset management firms.

Open architecture platform

Open architecture platforms enable financial firms to choose between white label funds, which are customized investment products branded under the firm's name, and shelf funds, which are pre-existing investment funds available for immediate offering.

Collective Investment Trust (CIT)

A Collective Investment Trust (CIT) differs from a White Label Fund and a Shelf Fund by offering pooled investment vehicles managed by trust companies, enabling customized investment solutions and lower fees compared to traditional mutual funds.

Series trust structure

Series trust structure offers distinct segregated portfolios within a single legal entity, allowing White label funds to customize their investment strategy efficiently and reduce setup costs compared to traditional Shelf funds, which typically require separate legal entities for each fund. This structure enhances operational flexibility and risk isolation, making it an ideal solution for asset managers seeking scalable fund administration under a unified trust framework.

Shelf registration

Shelf registration allows issuers to offer securities multiple times over a set period, enabling white label funds to quickly launch sub-funds under a single registration, whereas shelf funds utilize this mechanism to raise capital opportunistically without multiple filings.

1940 Act fund

The 1940 Act fund complies with the Investment Company Act of 1940, providing regulatory oversight and investor protections for mutual funds and other investment vehicles. White label funds are custom-branded investment products managed under third-party fund platforms, offering tailored investment strategies, whereas shelf funds are pre-registered funds that allow issuers to quickly launch new investment vehicles without the need for additional SEC filings.

Multi-series trust

A multi-series trust enables the creation of multiple sub-funds under a single legal entity, offering greater flexibility and cost efficiency compared to traditional white label funds or shelf funds.

White label fund vs Shelf fund Infographic

moneydif.com

moneydif.com