Drawdown refers to the reduction of invested capital in a fund, often during periods of market downturns or when assets are sold at a loss. Distribution involves the payment of income or capital gains earned by the fund to its investors, reflecting realized profits rather than losses. Understanding the distinction between drawdown and distribution is crucial for assessing a fund's performance and investor returns.

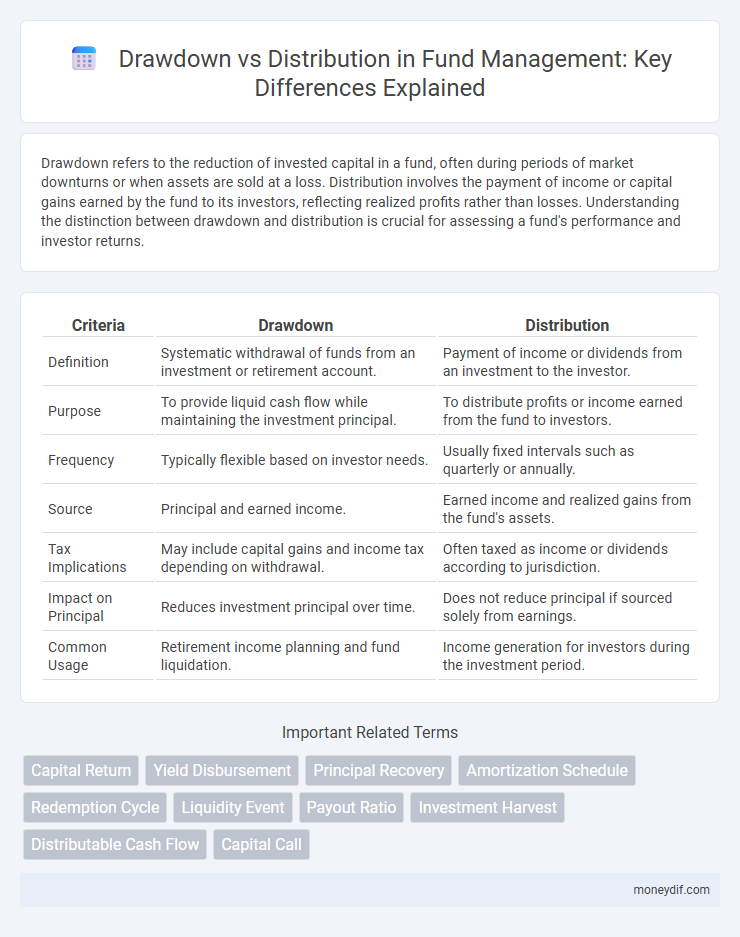

Table of Comparison

| Criteria | Drawdown | Distribution |

|---|---|---|

| Definition | Systematic withdrawal of funds from an investment or retirement account. | Payment of income or dividends from an investment to the investor. |

| Purpose | To provide liquid cash flow while maintaining the investment principal. | To distribute profits or income earned from the fund to investors. |

| Frequency | Typically flexible based on investor needs. | Usually fixed intervals such as quarterly or annually. |

| Source | Principal and earned income. | Earned income and realized gains from the fund's assets. |

| Tax Implications | May include capital gains and income tax depending on withdrawal. | Often taxed as income or dividends according to jurisdiction. |

| Impact on Principal | Reduces investment principal over time. | Does not reduce principal if sourced solely from earnings. |

| Common Usage | Retirement income planning and fund liquidation. | Income generation for investors during the investment period. |

Overview of Drawdown and Distribution in Fund Management

Drawdown in fund management refers to the process of capital calls made by fund managers to investors for investing in portfolio assets, representing committed but yet-to-be-deployed capital. Distribution involves returning profits, dividends, or capital back to investors from realized exits or income generated by the fund's investments. Understanding the timing and magnitude of drawdowns and distributions is essential for evaluating fund liquidity, performance, and investor cash flow expectations.

Key Definitions: What is Drawdown vs What is Distribution?

Drawdown in a fund refers to the process of calling committed capital from investors to finance investments or cover expenses, often occurring during the early stages of the fund's life cycle. Distribution is the return of profits or capital back to investors, typically realized through dividends, interest, or proceeds from asset sales, marking the fund's performance and return generation phase. Understanding the distinction between drawdown and distribution is crucial for assessing a fund's capital deployment and return realization timeline.

The Role of Drawdown in Fund Operations

Drawdown in fund operations refers to the process of calling committed capital from investors to finance investments, enabling the fund to deploy capital strategically over time. This mechanism contrasts with distributions, which return realized profits or capital back to investors after the fund has exited investments or generated returns. Effective drawdown management is critical for maintaining liquidity, optimizing investment timing, and aligning cash flows between the general partner and limited partners.

Understanding Distribution: Purpose and Process

Distribution in funds refers to the process where profits, income, or capital gains are paid out to investors, reflecting the realization of returns from the underlying assets. Unlike drawdown, which involves capital withdrawal for investment purposes, distribution aims to provide investors with periodic cash flow or returns from the fund's performance. Understanding distribution focuses on how funds allocate earnings, comply with regulatory requirements, and manage investor expectations regarding timing and amount of payouts.

Financial Implications: Drawdown vs Distribution

Drawdown involves withdrawing capital from an investment fund, reducing the principal and potentially impacting future returns, whereas distribution refers to the payment of income or profits to investors without affecting the fund's capital base. Drawdowns can trigger tax liabilities related to capital gains, while distributions are often taxed as income, influencing investors' after-tax returns. Understanding these differences is crucial for optimizing portfolio strategy and managing cash flow in investment funds.

Drawdown and Distribution: Impact on Fund Performance

Drawdown represents the reduction in a fund's capital from its peak, directly influencing risk assessment and investor confidence, while distribution refers to the payout of income or capital gains to investors, affecting the fund's net asset value and reinvestment potential. A higher drawdown can indicate increased volatility and potential underperformance, whereas distributions can signal steady income but may reduce the fund's growth capacity. Understanding the balance between drawdowns and distributions is crucial for evaluating a fund's performance sustainability and long-term return prospects.

Timing and Frequency: Comparing Drawdowns to Distributions

Drawdowns refer to the timing when invested capital is called from investors, typically occurring during the early stages of a fund's lifecycle to finance acquisitions or developments. Distributions happen later, as returns generated from investments are paid back to investors, often on a semi-annual or annual basis. The frequency of drawdowns is generally more irregular and concentrated, while distributions tend to follow a more predictable and consistent schedule aligned with realized gains.

Investor Perspective: Drawdown vs Distribution

From an investor perspective, drawdown refers to the initial capital deployment phase where committed funds are actively invested, generating the potential for growth but with limited or no immediate returns. Distribution occurs later when the fund returns capital and profits to investors, providing realized gains and cash flow as investments are liquidated or matured. Understanding the timing and structure of drawdowns versus distributions is crucial for managing liquidity expectations and assessing overall investment performance.

Risks and Considerations in Managing Drawdowns and Distributions

Managing drawdowns and distributions involves balancing liquidity needs with long-term capital preservation to mitigate risks such as forced asset sales and market timing losses. Understanding the fund's asset liquidity profile and stress-testing scenarios helps prevent adverse impacts on portfolio valuation and investor confidence. Effective communication with investors regarding drawdown schedules and distribution policies reduces uncertainty and aligns expectations with fund performance constraints.

Best Practices for Balancing Drawdown and Distribution Strategies

Effective fund management requires balancing drawdown and distribution strategies to maintain liquidity while maximizing investor returns. Establishing clear thresholds for drawdown limits and aligning distributions with cash flow projections helps prevent overextension of capital. Utilizing predictive analytics and stress-testing scenarios can optimize timing and size of distributions without compromising the fund's long-term growth objectives.

Important Terms

Capital Return

Capital Return refers to the repayment of invested principal to investors, directly impacting the drawdown and distribution phases of a fund's lifecycle; drawdown involves capital calls to finance investments, while distributions represent the return of capital plus profits to investors. Effective management of capital return balances minimizing drawdown amounts and maximizing timely distributions to optimize investor cash flow and fund performance.

Yield Disbursement

Yield disbursement refers to the process of allocating earnings generated from investments, where drawdown represents the withdrawal of capital from a fund, and distribution signifies the payment of income, such as dividends or interest, to investors. Effective management of drawdown versus distribution strategies ensures optimal liquidity while maximizing investor returns within yield-focused portfolios.

Principal Recovery

Principal recovery refers to the process of returning the original invested capital to the investor, which directly influences the net drawdown by reducing the outstanding principal balance. Distribution, in contrast, includes both principal repayments and earnings; focusing on principal recovery helps distinguish between capital returns and profit distributions, essential for accurate performance measurement and risk assessment.

Amortization Schedule

An amortization schedule outlines the periodic loan repayments, while drawdown refers to the initial loan disbursement and distribution involves subsequent fund transfers to borrowers.

Redemption Cycle

The redemption cycle directly impacts drawdown frequency and distribution timing, influencing fund liquidity and investor returns.

Liquidity Event

A liquidity event triggers distributions to investors based on the net proceeds after drawdowns are recouped from invested capital.

Payout Ratio

A lower payout ratio during periods of significant drawdown preserves capital and supports more sustainable distribution levels over time.

Investment Harvest

Investment Harvest analyzes drawdown strategies versus distribution methods to optimize portfolio sustainability and maximize investor returns.

Distributable Cash Flow

Distributable Cash Flow (DCF) measures the funds available for drawdown versus distribution to investors, balancing capital deployment and income returns.

Capital Call

A capital call initiates the drawdown process where committed funds are requested from investors, while distributions represent the return of capital or profits back to those investors.

Drawdown vs Distribution Infographic

moneydif.com

moneydif.com