The capital account reflects the total invested capital and accumulated income or losses allocated to each investor in a fund, while the Net Asset Value (NAV) represents the per-share value of the fund's assets minus liabilities. NAV is calculated by dividing the fund's total net assets by the outstanding shares, providing an up-to-date measure of the fund's market value. Understanding the distinction between capital account and NAV is critical for assessing investor equity versus market valuation within a fund.

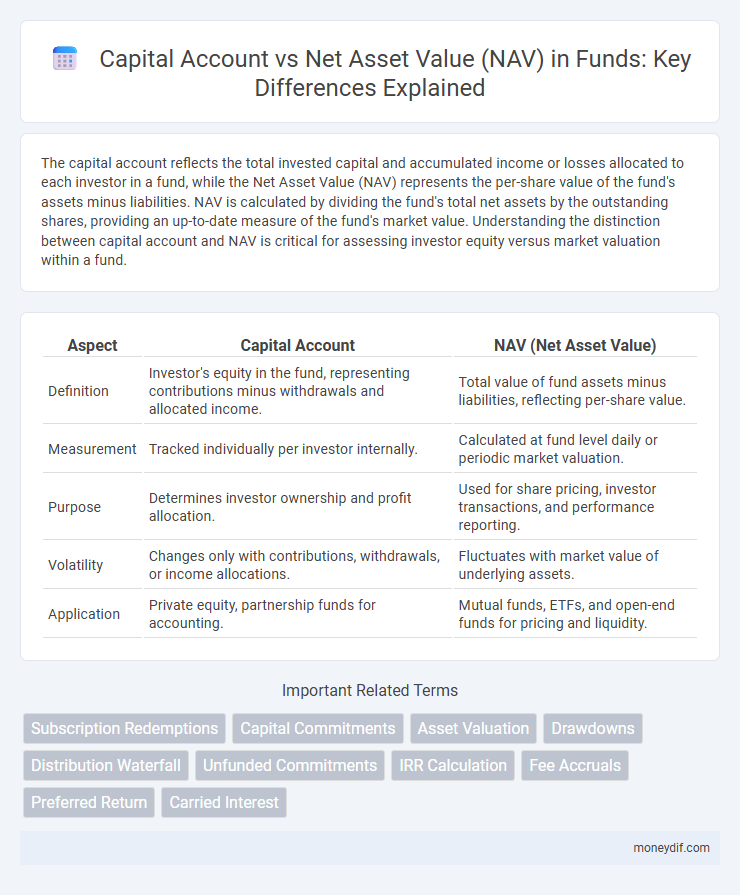

Table of Comparison

| Aspect | Capital Account | NAV (Net Asset Value) |

|---|---|---|

| Definition | Investor's equity in the fund, representing contributions minus withdrawals and allocated income. | Total value of fund assets minus liabilities, reflecting per-share value. |

| Measurement | Tracked individually per investor internally. | Calculated at fund level daily or periodic market valuation. |

| Purpose | Determines investor ownership and profit allocation. | Used for share pricing, investor transactions, and performance reporting. |

| Volatility | Changes only with contributions, withdrawals, or income allocations. | Fluctuates with market value of underlying assets. |

| Application | Private equity, partnership funds for accounting. | Mutual funds, ETFs, and open-end funds for pricing and liquidity. |

Understanding Capital Account in Fund Management

The capital account represents the total invested equity by limited partners in a fund, reflecting their initial and subsequent capital contributions. Unlike the net asset value (NAV), which calculates the current market value of the fund's assets minus liabilities, the capital account tracks investors' ownership stakes and distributions over time. Accurate management of the capital account is essential for determining profit shares, capital calls, and redemptions within private equity and hedge fund structures.

NAV (Net Asset Value): Definition and Importance

Net Asset Value (NAV) represents the per-share value of a fund's assets minus its liabilities, serving as a crucial metric for assessing the fund's performance and investor returns. NAV is calculated daily by dividing the total market value of the fund's portfolio, including cash and receivables, by the number of outstanding shares. Investors rely on NAV to determine the buying or selling price of mutual fund shares, making it essential for pricing transparency and investment decision-making.

Key Differences Between Capital Account and NAV

The capital account represents the total amount of money invested by the fund's owners, including initial contributions and subsequent capital calls, while NAV (Net Asset Value) reflects the current market value of the fund's assets minus its liabilities. Unlike the static capital account, NAV fluctuates daily based on asset performance, market conditions, and expenses, providing a real-time snapshot of the fund's financial health. Investors monitor NAV to assess their share value, whereas the capital account tracks the cumulative invested capital without reflecting unrealized gains or losses.

Role of Capital Account in Investor Reporting

The capital account plays a crucial role in investor reporting by providing a detailed record of each investor's contributions, withdrawals, and share of the fund's earnings, which ensures transparency and accuracy in tracking individual ownership. Unlike the net asset value (NAV), which reflects the overall value of the fund's assets minus liabilities at a specific point in time, the capital account offers a dynamic, transaction-based perspective essential for understanding changes in investor equity. This detailed accounting supports precise allocation of profits, losses, and distributions, enabling investors to monitor their investment performance and equity position comprehensively.

How NAV Reflects Fund Performance

Net Asset Value (NAV) represents the per-share market value of a fund's assets minus its liabilities, providing an accurate measure of the fund's current worth. Unlike the capital account, which tracks investor contributions and withdrawals, NAV adjusts daily to reflect portfolio gains, losses, and income, thereby offering real-time insight into fund performance. Investors rely on NAV fluctuations to evaluate the fund's profitability and make informed decisions about buying or selling shares.

Calculation Methods: Capital Account vs NAV

Capital Account calculation tracks individual investor contributions, distributions, and share of profits or losses, reflecting each partner's equity in the fund. NAV (Net Asset Value) calculation determines the total value of the fund's assets minus liabilities, divided by the number of outstanding shares, representing the per-share value for investors. Capital Account emphasizes transactional equity movements, while NAV focuses on current market valuation for pricing shares.

Implications for Fund Investors

Capital account reflects the cumulative contributions and withdrawals of investors, while NAV (net asset value) represents the per-share value of the fund's assets minus liabilities. Investors rely on NAV for accurate, real-time valuation of their holdings, which impacts their decision-making on buying or redeeming shares. Understanding the distinction helps investors assess liquidity, tax consequences, and performance measurement within the fund structure.

Impact on Profit Distribution and Redemption

Capital account adjustments directly influence profit distribution by reflecting investors' actual contributions and withdrawals, ensuring accurate allocation of earnings. NAV (Net Asset Value) serves as the basis for redemption calculations, determining the value per share at the time of investor exits. Discrepancies between capital account and NAV can affect the timing and fairness of profit distribution and redemption pricing.

Regulatory Considerations: Capital Account vs NAV

Regulatory considerations distinguish capital account reporting from NAV calculations, requiring strict compliance with valuation standards and transparency rules set by financial authorities. Capital accounts reflect investors' equity and contributions, whereas NAV represents the fund's total market value minus liabilities, impacting reporting frequency and audit requirements. Regulators emphasize accurate NAV determination to ensure fair investor redemption pricing and prevent market manipulation.

Best Practices for Tracking Capital Account and NAV

Accurate tracking of the capital account and NAV (Net Asset Value) requires a rigorous reconciliation process, integrating detailed investment valuations, contributions, distributions, and fees in real time. Utilizing automated accounting systems and standardized reporting frameworks enhances transparency and consistency, reducing discrepancies between capital account balances and NAV calculations. Regular audits and clear communication of valuation methodologies foster investor confidence and ensure compliance with regulatory standards.

Important Terms

Subscription Redemptions

Subscription redemptions impact a fund's capital account by adjusting the contributed capital based on investor inflows and outflows, directly influencing the net asset value (NAV) per share. Accurate reconciliation between capital account changes and NAV ensures transparent valuation reflecting the proportional ownership after subscriptions or redemptions.

Capital Commitments

Capital commitments represent the obligated amount investors pledge to contribute to a fund, directly impacting the capital account balances recorded for each partner. These commitments influence the NAV (net asset value) calculation by determining the fund's available equity for investment, as NAV reflects the total assets minus liabilities attributable to committed capital.

Asset Valuation

Asset valuation directly impacts both the capital account and the Net Asset Value (NAV), where the capital account reflects owners' equity adjustments based on asset revaluation, while NAV represents the total value of assets minus liabilities, crucial for investor decision-making. Accurate asset valuation ensures the capital account aligns with fair market value, and a precise NAV facilitates transparent financial reporting and portfolio performance assessment.

Drawdowns

Drawdowns represent the reduction of an investment's capital account relative to its peak value, often measured against the Net Asset Value (NAV) to assess actual portfolio losses. Analyzing drawdowns through the lens of capital account versus NAV provides insight into liquidity constraints and valuation discrepancies affecting overall fund performance.

Distribution Waterfall

The distribution waterfall outlines the order and priority in which investment returns are distributed to investors based on their capital accounts compared to the net asset value (NAV) of the fund. It ensures that investors receive payments proportional to their capital contributions before profits are allocated according to NAV-based performance metrics.

Unfunded Commitments

Unfunded commitments represent the capital investors are obligated to contribute to a fund but have not yet paid, directly impacting the capital account by increasing the total committed capital without immediate cash inflow. This difference causes disparities between the capital account and the net asset value (NAV), as NAV reflects the current market value of assets minus liabilities, excluding pending capital contributions.

IRR Calculation

IRR calculation evaluates investment performance by comparing cash flows in the capital account against changes in NAV to accurately measure returns over time.

Fee Accruals

Fee accruals in relation to the capital account impact the investor's equity by increasing liabilities that reduce the net asset value (NAV) of a fund. Accurate tracking of fee accruals ensures proper alignment between the capital account balances and the fund's NAV, reflecting true economic performance and investor returns.

Preferred Return

Preferred Return represents a priority profit distribution to investors before general partners share profits, closely linked to capital account balances to track each investor's equity contribution. NAV (Net Asset Value) measures an investment's market value after liabilities, providing a dynamic metric for evaluating performance beyond static capital account figures.

Carried Interest

Carried interest represents a share of the profits allocated to fund managers, typically reflected in the capital account but not directly counted in the net asset value (NAV) until realized gains are recognized; it aligns managers' incentives with investment performance while maintaining NAV's focus on current asset valuations. The capital account tracks carried interest accruals as contingent capital, impacting the fund's equity structure, whereas NAV measures the market value of assets minus liabilities, excluding unrealized carried interest until distribution.

capital account vs NAV (net asset value) Infographic

moneydif.com

moneydif.com