The carry pool is a portion of profit allocated to fund managers as an incentive, typically after surpassing a return hurdle, while the profit distribution reserve serves as a buffer to ensure consistent payouts to investors. Carry pools align managers' interests with investors by rewarding outperformance, whereas profit distribution reserves protect against volatility by smoothing distributions over time. Balancing these two mechanisms optimizes fund performance and investor confidence.

Table of Comparison

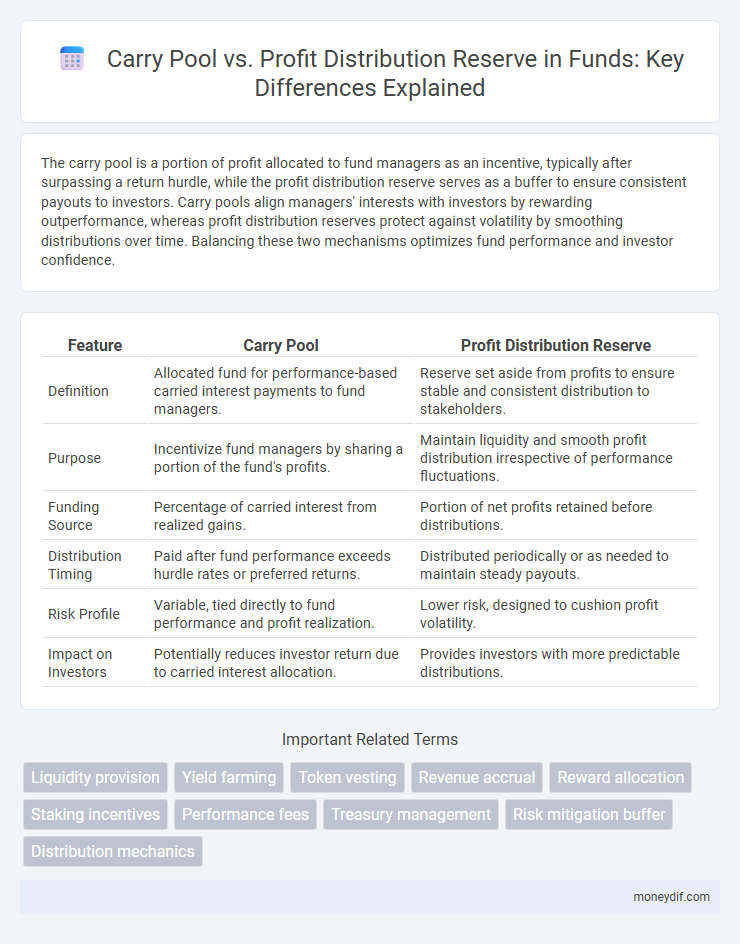

| Feature | Carry Pool | Profit Distribution Reserve |

|---|---|---|

| Definition | Allocated fund for performance-based carried interest payments to fund managers. | Reserve set aside from profits to ensure stable and consistent distribution to stakeholders. |

| Purpose | Incentivize fund managers by sharing a portion of the fund's profits. | Maintain liquidity and smooth profit distribution irrespective of performance fluctuations. |

| Funding Source | Percentage of carried interest from realized gains. | Portion of net profits retained before distributions. |

| Distribution Timing | Paid after fund performance exceeds hurdle rates or preferred returns. | Distributed periodically or as needed to maintain steady payouts. |

| Risk Profile | Variable, tied directly to fund performance and profit realization. | Lower risk, designed to cushion profit volatility. |

| Impact on Investors | Potentially reduces investor return due to carried interest allocation. | Provides investors with more predictable distributions. |

Understanding Carry Pool in Fund Management

The carry pool represents the portion of profits allocated to fund managers as performance incentives, typically structured as a percentage of returns above a predefined hurdle rate. Profit distribution reserves are funds set aside to ensure stable payouts to investors, often covering future liabilities or smoothing distributions. Understanding the carry pool's role is crucial for aligning manager incentives with investor interests, promoting fund performance and long-term growth.

What Is Profit Distribution Reserve?

Profit Distribution Reserve is a designated fund set aside from a company's earnings to ensure the availability of resources for future dividend payments to shareholders. This reserve enhances financial stability by retaining profits rather than distributing them immediately, allowing for consistent returns even during periods of fluctuating income. Unlike the Carry pool, which allocates performance fees to fund managers, the Profit Distribution Reserve focuses on safeguarding shareholder dividends.

Key Differences: Carry Pool vs Profit Distribution Reserve

The carry pool allocates a predetermined percentage of fund profits to the general partners as incentive compensation, typically tied to fund performance benchmarks. In contrast, the profit distribution reserve is set aside to manage timing differences in profit payouts and ensure smooth cash flow to limited partners. Key differences lie in carry pools being directly linked to performance-based rewards, while profit distribution reserves act as financial buffers for equitable profit allocation.

How Carry Pool Works in Investment Funds

The carry pool in investment funds represents the portion of profits allocated to fund managers as performance-based compensation, typically ranging from 10% to 30% of the fund's gains beyond a predefined hurdle rate. This incentive aligns managers' interests with investors by rewarding superior returns and encouraging active portfolio management. Unlike the profit distribution reserve, which holds retained earnings for future distributions, the carry pool is specifically earmarked to motivate and compensate fund managers for exceeding performance benchmarks.

Mechanisms of Profit Distribution Reserve

Profit Distribution Reserve functions as a strategic allocation of earned profits set aside to stabilize dividend payments and fund future obligations, enhancing financial resilience. Unlike Carry Pools, which specifically reward fund managers through carried interest mechanisms tied to fund performance, Profit Distribution Reserves provide a broader mechanism to ensure consistent returns for investors. This reserve is calculated based on net profits after all operational costs and carried interest allocations, supporting sustainable capital distribution without impacting the fund's operational liquidity.

Advantages of Using a Carry Pool

Using a carry pool streamlines the alignment of interests between fund managers and limited partners by enabling a transparent and performance-based incentive structure. It enhances motivation for fund managers to maximize returns, as carried interest is directly linked to investment success, fostering long-term value creation. This approach also simplifies profit-sharing calculations compared to profit distribution reserves, reducing administrative complexity and potential disputes over allocation timing.

Benefits of Profit Distribution Reserve for Investors

Profit Distribution Reserve enhances investor confidence by ensuring a dedicated pool of funds for future profit allocations, reducing payout uncertainty. This reserve supports consistent and timely returns, fostering long-term investment stability. Investors benefit from improved transparency and risk mitigation compared to the variable nature of Carry Pool allocations.

Carry Pool and Fund Performance Metrics

The Carry Pool represents the allocation of a fund's carried interest, directly tied to the fund's performance metrics such as Internal Rate of Return (IRR) and Total Value to Paid-In (TVPI) multiples, incentivizing general partners based on realized and unrealized gains. This performance-based component contrasts with the Profit Distribution Reserve, which typically holds undistributed profits earmarked for future payouts or contingencies. Monitoring Carry Pool metrics provides insight into the alignment of interests between fund managers and investors, emphasizing realized fund performance and projected value growth.

Impacts on Stakeholder Incentives: Carry Pool vs Profit Distribution Reserve

Carry pools align fund managers' incentives with long-term performance by granting them a share of profits only after a predefined hurdle rate is achieved, fostering value creation and commitment. Profit distribution reserves, often used to smooth payouts, can dilute immediate reward signals, potentially reducing managers' motivation to maximize returns promptly. Stakeholders benefit from carry pools through enhanced alignment with fund success, while profit distribution reserves offer risk mitigation but may weaken direct performance incentives.

Best Practices for Structuring Fund Profit Allocation

Carry pool structures typically allocate carried interest to fund managers based on performance benchmarks, ensuring alignment with investor returns. Profit distribution reserve acts as a safeguard, retaining a portion of profits to manage future obligations and potential clawbacks, enhancing risk management. Combining a clearly defined carry pool with an appropriately sized profit distribution reserve supports transparency and equitable profit allocation in fund management.

Important Terms

Liquidity provision

Liquidity provision in Carry pools enhances capital efficiency while Profit distribution reserves focus on allocating earned returns to stakeholders.

Yield farming

Yield farming strategies involving Carry pools optimize returns by allocating a portion of generated rewards to incentivize liquidity providers, while Profit Distribution Reserves accumulate earnings to ensure sustainable payouts and platform stability. Balancing the Carry pool and Profit distribution reserve enhances yield efficiency by managing immediate incentives alongside long-term profitability reserves.

Token vesting

Token vesting ensures gradual release of tokens from the carry pool to founders and team members, while the profit distribution reserve allocates realized earnings for stakeholder dividends and operational funding.

Revenue accrual

Revenue accrual impacts the carry pool by increasing the funds allocated for performance incentives before profit distribution reserves are adjusted. Profit distribution reserves reflect the retained earnings available after revenue accruals, ensuring accurate allocation between carried interest and shareholder distributions.

Reward allocation

Reward allocation optimizes fund management by balancing the Carry pool, designated for performance incentives, with the Profit distribution reserve, which ensures systematic profit sharing among stakeholders.

Staking incentives

Staking incentives in Carry Pools often focus on long-term value appreciation through equity participation, aligning rewards with overall fund performance, whereas Profit Distribution Reserves provide immediate, periodic payouts derived from net profits to incentivize active participation and liquidity. The Carry Pool structure typically rewards stakeholders with a share of carried interest, while Profit Distribution Reserves ensure consistent, measurable returns that enhance staking appeal and sustainability.

Performance fees

Performance fees are calculated based on the Carry pool, which represents the share of profits allocated to fund managers, whereas the Profit distribution reserve holds retained earnings reserved for future payouts to investors.

Treasury management

Treasury management strategically balances the carry pool, which allocates performance fees to fund managers, against the profit distribution reserve, a retained earnings fund ensuring liquidity and stability for future operations. Optimizing the carry pool allocation enhances incentive alignment in investment funds, while maintaining a robust profit distribution reserve supports sustainable cash flow and risk mitigation.

Risk mitigation buffer

A risk mitigation buffer in a carry pool serves to protect investors by absorbing potential losses before distributions are made, preserving capital stability during volatile periods. In contrast, a profit distribution reserve allocates surplus earnings to ensure consistent payouts and support long-term fund performance without compromising risk management.

Distribution mechanics

Distribution mechanics distinguish Carry pool as the portion allocated to incentivize fund managers, while Profit distribution reserve refers to retained earnings set aside for future payouts or contingencies.

Carry pool vs Profit distribution reserve Infographic

moneydif.com

moneydif.com