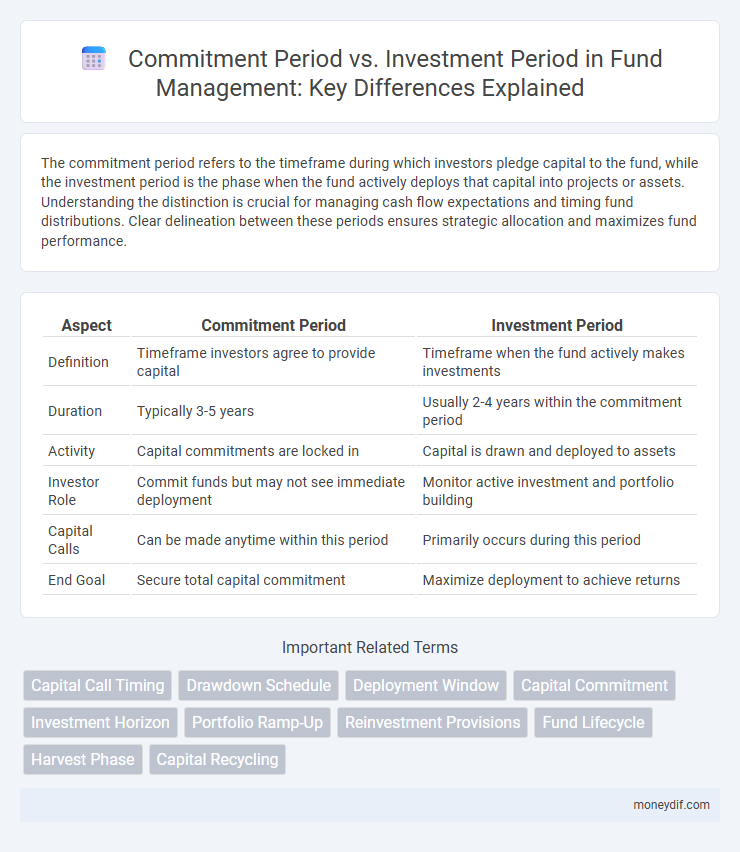

The commitment period refers to the timeframe during which investors pledge capital to the fund, while the investment period is the phase when the fund actively deploys that capital into projects or assets. Understanding the distinction is crucial for managing cash flow expectations and timing fund distributions. Clear delineation between these periods ensures strategic allocation and maximizes fund performance.

Table of Comparison

| Aspect | Commitment Period | Investment Period |

|---|---|---|

| Definition | Timeframe investors agree to provide capital | Timeframe when the fund actively makes investments |

| Duration | Typically 3-5 years | Usually 2-4 years within the commitment period |

| Activity | Capital commitments are locked in | Capital is drawn and deployed to assets |

| Investor Role | Commit funds but may not see immediate deployment | Monitor active investment and portfolio building |

| Capital Calls | Can be made anytime within this period | Primarily occurs during this period |

| End Goal | Secure total capital commitment | Maximize deployment to achieve returns |

Definition of Commitment Period in Fund Management

The commitment period in fund management refers to the timeframe during which investors are obligated to allocate capital to the fund, usually starting from the fund's inception and lasting several years. This period allows fund managers to draw down committed capital from investors to make investments and support portfolio companies. Unlike the investment period, which is focused specifically on actively deploying funds, the commitment period encompasses the overall timeframe for capital call obligations and initial investment activities.

Understanding the Investment Period in Private Equity Funds

The investment period in private equity funds typically spans three to five years, during which the fund actively deploys capital into portfolio companies. This phase follows the commitment period, where investors pledge capital but actual investments have not yet commenced. Understanding the investment period is crucial for aligning expectations on capital calls, deal sourcing, and value creation timelines within the fund's lifecycle.

Key Differences Between Commitment Period and Investment Period

The commitment period refers to the timeframe in which investors pledge capital to a fund, typically spanning several years, whereas the investment period is the phase during which the fund actively deploys that capital into assets or projects. Commitment period emphasizes capital allocation and legal obligations, while the investment period centers on asset acquisition and portfolio building. Key differences include the commitment period focusing on investor capital calls and capital commitments, while the investment period involves investment sourcing, due diligence, and execution.

Timeline and Phases: Commitment vs Investment Period

The Commitment Period typically spans the initial years of a fund's lifecycle, during which limited partners agree to provide capital commitments. The Investment Period follows, representing the phase when the fund actively deploys these committed funds into portfolio companies or assets. Understanding the timeline distinction between the Commitment Period and Investment Period is critical for aligning cash flow expectations and managing investment strategies effectively.

Roles of Investors During the Commitment Period

During the Commitment Period, investors pledge capital to the fund but are not required to transfer full amounts immediately, allowing the fund manager to call capital when investment opportunities arise. Investors play a crucial role in monitoring the fund's deployment strategy, ensuring their commitments align with expected timeframes and risk profiles. Effective communication between investors and fund managers during this phase helps optimize capital allocation and supports strategic investment decisions.

Fund Manager Activities in the Investment Period

The investment period is the active phase where fund managers deploy committed capital into targeted assets, conduct due diligence, and negotiate deal terms. Fund managers focus on sourcing opportunities, executing investments, and optimizing portfolio performance during this time. Monitoring ongoing investments and adjusting strategies to enhance returns are critical responsibilities throughout the investment period.

Impact on Capital Calls: Commitment vs Investment Phases

The Commitment Period defines the timeframe during which investors legally commit capital to the fund, triggering initial and often scheduled capital calls. The Investment Period follows, focusing on deploying the committed capital into portfolio companies, leading to more targeted and potentially variable capital calls based on deal flow. Understanding the distinction between these periods is crucial for predicting liquidity needs and managing cash flow expectations for both fund managers and investors.

Exit Strategies and Their Timing Relative to Both Periods

The commitment period defines the timeframe during which investors pledge capital, while the investment period marks when the fund deploys this capital into assets. Exit strategies typically begin after the investment period, allowing the fund to realize returns by selling or liquidating investments strategically. Timing these exits post-investment ensures maximized returns and efficient capital recycling aligned with the fund's lifecycle.

Legal and Contractual Considerations for Both Periods

The commitment period in a fund legally defines the timeframe during which investors are obligated to contribute capital as per the limited partnership agreement or subscription documents. The investment period, often overlapping but distinct, specifies the window for deploying committed capital into eligible investments, governed by contractual terms that regulate extensions and recycling of capital. Both periods require precise legal provisions to protect investor rights, ensure compliance with fund mandates, and manage liabilities arising from capital calls and investment activities.

Common Misconceptions: Commitment Period vs Investment Period

The commitment period in a fund refers to the timeframe during which investors are obligated to provide capital upon the fund manager's request, while the investment period denotes when the fund actively deploys this capital into portfolio companies. A common misconception is that these periods are interchangeable or identical, but the commitment period often exceeds the investment period to allow for capital calls and reserve allocations. Understanding the distinction is crucial for managing liquidity expectations and aligning investor commitments with the fund's deployment strategy.

Important Terms

Capital Call Timing

Capital call timing is crucial in managing the Commitment Period versus the Investment Period, as investors are required to provide committed capital during the Commitment Period, typically lasting 3 to 5 years, while the Investment Period represents the timeframe in which the fund actively deploys that capital into portfolio companies or assets. Precise coordination ensures capital is called efficiently to match investment opportunities without leaving excess uninvested capital throughout the fund lifecycle.

Drawdown Schedule

The Drawdown Schedule outlines the timeline for capital calls during the Commitment Period, while the Investment Period specifies the timeframe in which committed funds are actively deployed into investments.

Deployment Window

The deployment window defines the timeframe in which capital commitments are actively invested, distinguishing it from the broader commitment period that spans the entire duration of the fund agreement. Understanding the deployment window in relation to the investment period is crucial for efficient capital allocation and performance tracking in private equity and venture capital portfolios.

Capital Commitment

Capital Commitment defines the total invested capital within the Commitment Period, while the Investment Period specifies the timeframe for deploying committed capital into assets or projects.

Investment Horizon

The investment horizon determines the balance between the commitment period, during which capital is locked, and the overall investment period, affecting liquidity and potential returns.

Portfolio Ramp-Up

Portfolio ramp-up refers to the gradual increase in capital deployment during the Commitment Period, contrasting with the Investment Period, which is the designated timeframe for actively sourcing and closing investments. The Commitment Period sets investor obligations for capital contributions, while the Investment Period defines the window for utilizing those committed funds to build a diversified portfolio.

Reinvestment Provisions

Reinvestment provisions typically allow the use of returns generated during the Commitment Period to be reinvested, extending the effective Investment Period and enhancing capital deployment flexibility.

Fund Lifecycle

The Commitment Period defines the timeframe when investors pledge capital, while the Investment Period refers to the phase during which the fund actively deploys those committed funds into portfolio companies.

Harvest Phase

The Harvest Phase follows the Investment Period and Commitment Period, focusing on maximizing returns from matured investments rather than deploying new capital.

Capital Recycling

Capital recycling maximizes portfolio liquidity by balancing the commitment period, during which capital is obligated, against the investment period, when funds are actively deployed to generate returns.

Commitment Period vs Investment Period Infographic

moneydif.com

moneydif.com