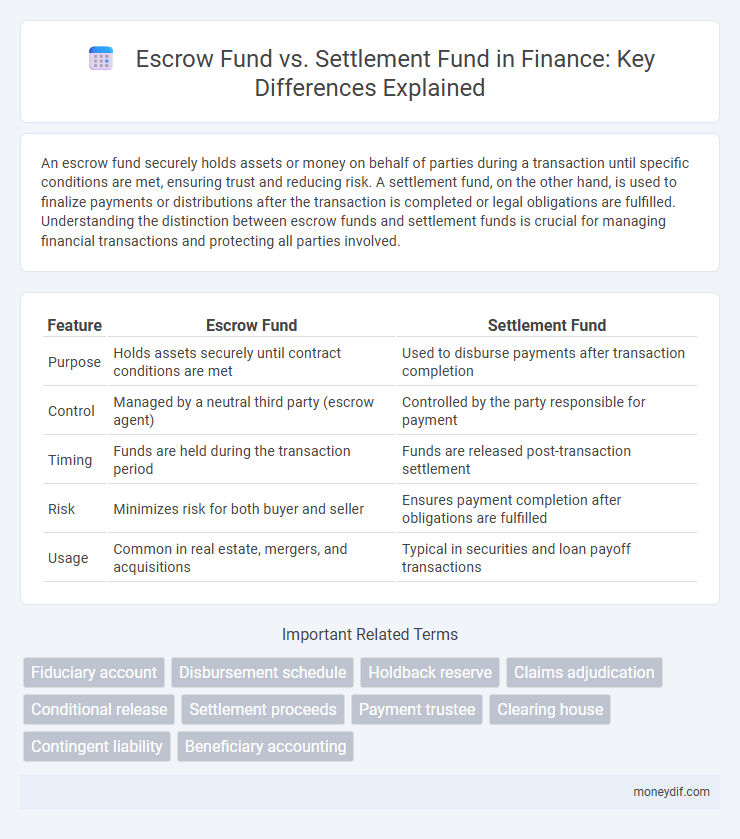

An escrow fund securely holds assets or money on behalf of parties during a transaction until specific conditions are met, ensuring trust and reducing risk. A settlement fund, on the other hand, is used to finalize payments or distributions after the transaction is completed or legal obligations are fulfilled. Understanding the distinction between escrow funds and settlement funds is crucial for managing financial transactions and protecting all parties involved.

Table of Comparison

| Feature | Escrow Fund | Settlement Fund |

|---|---|---|

| Purpose | Holds assets securely until contract conditions are met | Used to disburse payments after transaction completion |

| Control | Managed by a neutral third party (escrow agent) | Controlled by the party responsible for payment |

| Timing | Funds are held during the transaction period | Funds are released post-transaction settlement |

| Risk | Minimizes risk for both buyer and seller | Ensures payment completion after obligations are fulfilled |

| Usage | Common in real estate, mergers, and acquisitions | Typical in securities and loan payoff transactions |

Introduction to Escrow Funds and Settlement Funds

Escrow funds are financial accounts held by a neutral third party to securely manage and disburse money during transactions, ensuring that terms between buyers and sellers are met before funds are released. Settlement funds refer to the money exchanged between parties to finalize a transaction, often used in stock trading or real estate closings to complete the transfer of assets. Understanding the distinction between escrow funds and settlement funds is crucial for ensuring secure and compliant financial transactions.

Key Definitions: Escrow Fund vs Settlement Fund

An escrow fund is a secure account where funds are held temporarily by a third party during a transaction until specific contractual conditions are met. A settlement fund, on the other hand, refers to the payment made to finalize a transaction, such as the transfer of assets or securities after all obligations are fulfilled. Understanding the distinction between escrow funds, which safeguard interests during negotiations, and settlement funds, which complete the exchange, is crucial in financial and legal transactions.

How Escrow Funds Work

Escrow funds operate by holding money securely in a third-party account until contractual obligations between buyer and seller are fulfilled, ensuring trust and reducing risk during transactions. These funds are commonly used in real estate, mergers, and acquisitions to protect both parties by releasing the money only when all specified conditions are met. Escrow accounts provide transparency and safeguard against fraud, making them essential in complex financial dealings compared to settlement funds, which are typically disbursed after transaction completion.

How Settlement Funds Operate

Settlement funds operate by holding money during a transaction to ensure payment upon meeting specific contractual obligations, providing security for both buyer and seller. These funds are released only after verification that all terms of the agreement are fulfilled, often involving banks or third-party escrow agents. This process mitigates risk by preventing premature disbursement and ensuring that funds are transferred in accordance with agreed conditions.

Primary Purposes of Escrow and Settlement Funds

Escrow funds primarily serve as secure deposits held by a neutral third party to ensure contractual obligations are met before the transfer of assets or funds occurs. Settlement funds are designated for finalizing transactions, specifically to disburse payments and close financial agreements after terms are satisfied. The key distinction lies in escrow funds safeguarding interests during the transaction process, while settlement funds facilitate the concluding monetary exchange.

Legal Framework and Regulatory Requirements

Escrow funds are held by a neutral third party under strict legal frameworks to ensure secure transactions, often governed by specific escrow agreements and financial regulations. Settlement funds, on the other hand, facilitate the completion of transactions and are subject to regulatory requirements related to payment processing and anti-money laundering (AML) laws. Both funds operate under regulatory oversight, but escrow funds typically involve more stringent fiduciary duties and compliance obligations to protect parties involved in legal contracts.

Advantages and Disadvantages of Each Fund Type

Escrow funds provide secure holding of assets during transactions, minimizing risks for buyers and sellers, but they often involve higher fees and longer processing times. Settlement funds enable immediate availability for transaction completion, facilitating faster deal closure, although they may lack the protective oversight of escrow arrangements. Choosing between escrow and settlement funds depends on the trade-off between security and speed, with escrow funds favoring risk mitigation and settlement funds prioritizing transaction efficiency.

Use Cases: When to Choose Escrow or Settlement Funds

Escrow funds are ideal for real estate transactions or mergers where conditional release of money ensures contractual obligations are met, providing security for both parties. Settlement funds are used primarily in legal cases to distribute awarded compensation quickly and efficiently once the judgment is finalized. Choosing escrow funds suits scenarios requiring staged payments or third-party oversight, while settlement funds fit finalizing payouts after dispute resolutions.

Risk Management and Security Considerations

Escrow funds provide enhanced risk management by holding assets securely with a neutral third party until contract conditions are fulfilled, minimizing fraud and ensuring transactional compliance. Settlement funds, while facilitating the final transfer of payments, carry higher risks if improperly managed due to direct account transfers without intermediary safeguards. Effective security considerations in escrow funds include robust legal frameworks and transparent auditing, whereas settlement funds require stringent payment system controls to prevent misappropriation and settlement failures.

Summary: Choosing Between Escrow and Settlement Funds

Escrow funds securely hold assets during a transaction, ensuring conditions are met before release, while settlement funds are the actual payments exchanged to finalize deals. Selecting between escrow and settlement funds depends on the transaction's complexity, risk level, and timing requirements. Investors prioritize escrow funds for protection in conditional transactions and settlement funds for immediate payment upon completion.

Important Terms

Fiduciary account

A fiduciary account holds funds on behalf of clients, with escrow funds representing money held temporarily during transactions and settlement funds denoting the final transfer of money after transaction completion.

Disbursement schedule

The disbursement schedule specifies the timing and conditions for releasing funds from an escrow account versus a settlement fund to ensure secure and timely payments.

Holdback reserve

A holdback reserve is a portion of funds retained in an escrow account to ensure contractual obligations are met before releasing the remaining settlement fund.

Claims adjudication

Claims adjudication involves evaluating and validating insurance claims, where escrow funds serve as temporary holds ensuring transaction security, while settlement funds are disbursed to finalize claims payments. Differentiating escrow and settlement funds is critical for accurate financial tracking and compliance during the adjudication process.

Conditional release

Conditional release ensures payment is made from the escrow fund only after contractual obligations are met, unlike a settlement fund which distributes agreed-upon amounts without contingencies.

Settlement proceeds

Settlement proceeds held in an escrow fund are temporarily secured assets managed by a neutral third party until contract conditions are met, whereas settlement funds represent the final disbursed amounts transferred to the entitled parties upon completion of the settlement agreement.

Payment trustee

A payment trustee manages and safeguards funds during transactions, ensuring proper allocation between escrow and settlement funds. Escrow funds are held temporarily to secure obligations until contract conditions are met, while settlement funds are distributed to finalize the transaction after fulfillment and approval.

Clearing house

A clearing house facilitates the transfer and settlement of funds by managing escrow accounts that temporarily hold funds until final settlement is confirmed, ensuring secure and efficient transaction completion.

Contingent liability

Contingent liability arises when an escrow fund is held to secure potential claims, whereas a settlement fund is established to finalize payment obligations after dispute resolution.

Beneficiary accounting

Beneficiary accounting distinguishes escrow funds held in trust for pending transactions from settlement funds released upon transaction completion for final distribution.

Escrow fund vs Settlement fund Infographic

moneydif.com

moneydif.com