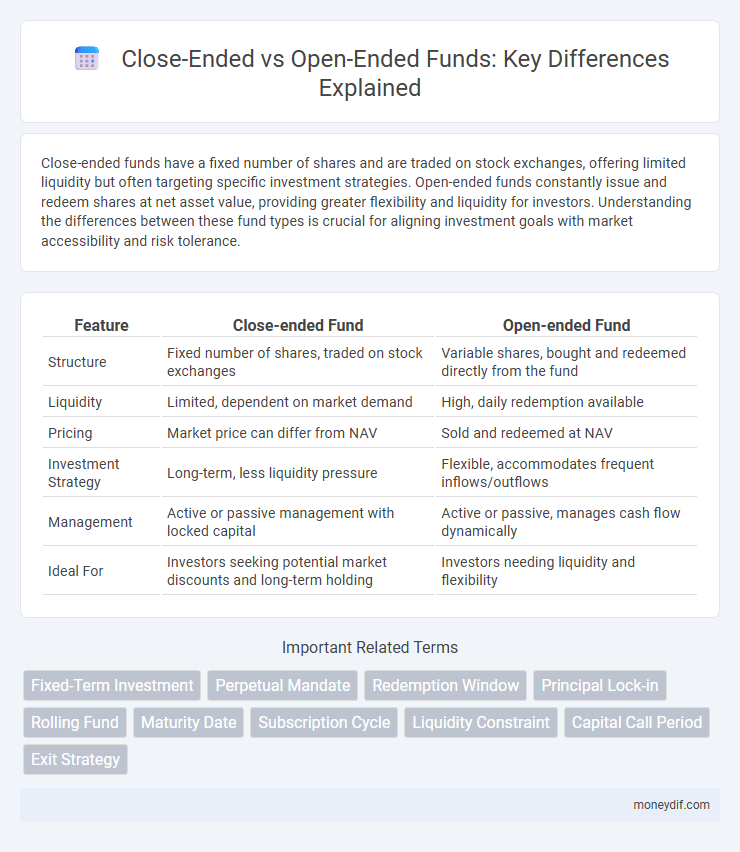

Close-ended funds have a fixed number of shares and are traded on stock exchanges, offering limited liquidity but often targeting specific investment strategies. Open-ended funds constantly issue and redeem shares at net asset value, providing greater flexibility and liquidity for investors. Understanding the differences between these fund types is crucial for aligning investment goals with market accessibility and risk tolerance.

Table of Comparison

| Feature | Close-ended Fund | Open-ended Fund |

|---|---|---|

| Structure | Fixed number of shares, traded on stock exchanges | Variable shares, bought and redeemed directly from the fund |

| Liquidity | Limited, dependent on market demand | High, daily redemption available |

| Pricing | Market price can differ from NAV | Sold and redeemed at NAV |

| Investment Strategy | Long-term, less liquidity pressure | Flexible, accommodates frequent inflows/outflows |

| Management | Active or passive management with locked capital | Active or passive, manages cash flow dynamically |

| Ideal For | Investors seeking potential market discounts and long-term holding | Investors needing liquidity and flexibility |

Introduction to Fund Structures

Close-ended funds issue a fixed number of shares traded on secondary markets, providing stable capital for long-term investments in sectors like real estate or private equity. Open-ended funds continuously issue and redeem shares at net asset value (NAV), allowing investors flexible entry and exit while managing liquidity dynamically. Fund structures influence investment strategies, liquidity profiles, and investor access based on their operational frameworks.

What Are Open-Ended Funds?

Open-ended funds continuously issue and redeem shares at the net asset value (NAV), allowing investors to buy or sell units at any time, providing high liquidity. These funds actively manage portfolios of stocks, bonds, or other securities to meet investment objectives. Unlike close-ended funds, open-ended funds do not have a fixed number of shares, enabling flexible capital flow from investor subscriptions and redemptions.

Understanding Close-Ended Funds

Close-ended funds issue a fixed number of shares during an initial public offering, trading on stock exchanges like individual stocks, which creates price fluctuations independent of their net asset value (NAV). This structure provides investors with liquidity and the potential for market-driven discounts or premiums but limits capital inflows after the initial offering. Understanding close-ended funds involves recognizing their fixed capital base, managed portfolio, and market price dynamics that differentiate them from open-ended funds, which continuously issue and redeem shares at NAV.

Key Differences: Open-Ended vs Close-Ended Funds

Open-ended funds continuously issue and redeem shares based on investor demand, offering high liquidity and price linked to net asset value (NAV). Close-ended funds issue a fixed number of shares traded on stock exchanges, with prices determined by market supply and demand, potentially deviating from NAV. Open-ended funds typically suit investors seeking flexibility, while close-ended funds may attract those looking for long-term investment opportunities.

Liquidity and Redemption Features

Close-ended funds have a fixed number of shares and are traded on stock exchanges, offering limited liquidity as investors can only buy or sell shares at market prices during trading hours. Open-ended funds continuously issue and redeem shares at net asset value (NAV), providing higher liquidity and the ability for investors to redeem shares directly from the fund at any time. Redemption features in open-ended funds allow investors to access their invested capital on demand, whereas close-ended funds often require investors to sell shares to other market participants, which can impact liquidity and pricing.

Pricing and Valuation Mechanisms

Close-ended funds trade on stock exchanges with prices driven by market demand and supply, often deviating from their net asset value (NAV), leading to potential discounts or premiums. Open-ended funds redeem shares directly from investors at NAV, calculated at the end of each trading day based on the underlying assets' market value. This pricing mechanism ensures that open-ended funds consistently reflect the true value of their portfolio, while close-ended funds' prices may fluctuate independently of NAV.

Investment Flexibility and Strategies

Close-ended funds have a fixed number of shares and trade on stock exchanges, allowing limited investment flexibility but enabling managers to pursue less liquid, long-term strategies. Open-ended funds continuously issue and redeem shares at net asset value, providing higher liquidity and allowing investors to enter or exit based on market demand. Investment strategies in close-ended funds often include leveraged positions and niche markets, while open-ended funds typically focus on diversified, highly liquid assets to accommodate investor redemptions.

Risks Associated with Each Fund Type

Close-ended funds carry risks such as market price volatility and illiquidity, as shares trade on exchanges and may not reflect the net asset value. Open-ended funds face redemption risk, where large investor withdrawals can force asset sales at unfavorable prices, impacting overall fund performance. Both fund types involve management risk, but the liquidity mechanisms distinctly shape their respective risk profiles.

Suitability: Which Fund Is Right for You?

Close-ended funds typically suit investors seeking stable investments with fixed capital, as they trade on stock exchanges and offer limited liquidity compared to open-ended funds. Open-ended funds provide higher liquidity by allowing continuous buying and redeeming of shares, making them ideal for investors prioritizing flexibility and ease of access. Assess your investment horizon, liquidity needs, and risk tolerance to determine whether a close-ended or open-ended fund aligns best with your financial goals.

Final Thoughts: Making Informed Fund Choices

Choosing between close-ended and open-ended funds hinges on understanding liquidity preferences and investment goals; close-ended funds offer fixed capital and trade on exchanges, providing price stability, while open-ended funds allow continuous buying and selling, enhancing flexibility. Investor risk tolerance and time horizon significantly impact fund selection, with close-ended funds often suited for long-term commitments and open-ended funds accommodating ongoing portfolio adjustments. Evaluating fund performance, fees, and management style ensures informed decisions aligned with financial objectives and market conditions.

Important Terms

Fixed-Term Investment

Fixed-term investments often come with fixed maturity dates, making them compatible with close-ended funds that have a predetermined lifespan and limited redemption options. Open-ended funds offer more liquidity by allowing investors to enter or exit at any time, but they typically invest in assets without fixed maturity, differing from the structured timeline of fixed-term investments.

Perpetual Mandate

Perpetual mandates typically align with open-ended funds, offering indefinite investment periods, while close-ended funds operate under fixed terms limiting the mandate duration.

Redemption Window

Redemption Window refers to the specific time frame during which investors in a close-ended fund can redeem their shares, contrasting with open-ended funds that allow continuous redemption at net asset value. Close-ended funds typically have limited redemption windows, often quarterly or annually, whereas open-ended funds provide daily liquidity, impacting investor flexibility and fund management strategies.

Principal Lock-in

Principal lock-in refers to the restriction on withdrawing the original investment amount, commonly found in close-ended funds, whereas open-ended funds typically allow flexible redemption without principal lock-in.

Rolling Fund

Rolling Funds offer an open-ended investment structure, allowing continuous capital commitments and periodic capital calls from investors, unlike close-ended funds, which have a fixed capital pool and set investment period. This flexibility enables Rolling Funds to adapt dynamically to new opportunities, providing venture capital managers with ongoing funding without the limitations of a predetermined fund size or duration.

Maturity Date

The maturity date marks the fixed endpoint in close-ended investment products, defining when principal and interest are repaid, while open-ended investments lack a maturity date, allowing continuous buying and selling without a fixed timeline. Close-ended funds offer structured exit strategies at maturity, whereas open-ended funds provide liquidity through ongoing shares transactions.

Subscription Cycle

Subscription cycles define the billing frequency and renewal terms in subscription models, with close-ended subscriptions having a fixed duration and automatically terminating at the end, while open-ended subscriptions continue indefinitely until canceled by the subscriber. Businesses leveraging open-ended models benefit from recurring revenue streams and customer retention, whereas close-ended cycles provide predictable timelines for service delivery and budget management.

Liquidity Constraint

Liquidity constraint significantly affects investment flexibility, where close-ended funds impose limits on redemptions, restricting investors' ability to quickly access capital, while open-ended funds provide continuous liquidity through daily share redemption at net asset value. This fundamental difference influences portfolio management strategies and risk tolerance, as open-ended funds accommodate fluctuating cash needs whereas close-ended funds require investors to accept greater liquidity risk.

Capital Call Period

The capital call period in a close-ended fund typically spans a fixed timeframe, during which investors are required to commit capital upon the fund manager's request, ensuring structured investment capital deployment. Open-ended funds, in contrast, do not have a defined capital call period, allowing continuous investor subscriptions and redemptions, which impacts liquidity and capital availability dynamics.

Exit Strategy

Exit strategies for investments vary significantly between close-ended and open-ended funds; close-ended funds typically have a fixed maturity date allowing investors to exit upon fund liquidation, whereas open-ended funds offer liquidity through continuous share redemptions at net asset value. Understanding the exit options is crucial as close-ended funds may require secondary market sales often subject to liquidity constraints, while open-ended funds provide more flexibility but may impose redemption gates or fees during market stress.

Close-ended vs Open-ended Infographic

moneydif.com

moneydif.com