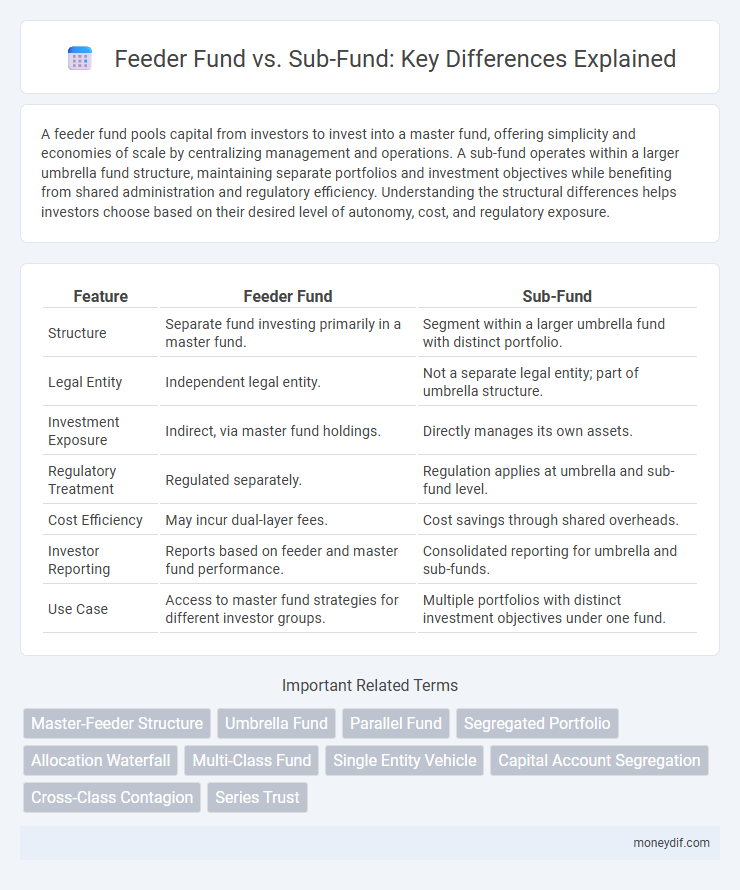

A feeder fund pools capital from investors to invest into a master fund, offering simplicity and economies of scale by centralizing management and operations. A sub-fund operates within a larger umbrella fund structure, maintaining separate portfolios and investment objectives while benefiting from shared administration and regulatory efficiency. Understanding the structural differences helps investors choose based on their desired level of autonomy, cost, and regulatory exposure.

Table of Comparison

| Feature | Feeder Fund | Sub-Fund |

|---|---|---|

| Structure | Separate fund investing primarily in a master fund. | Segment within a larger umbrella fund with distinct portfolio. |

| Legal Entity | Independent legal entity. | Not a separate legal entity; part of umbrella structure. |

| Investment Exposure | Indirect, via master fund holdings. | Directly manages its own assets. |

| Regulatory Treatment | Regulated separately. | Regulation applies at umbrella and sub-fund level. |

| Cost Efficiency | May incur dual-layer fees. | Cost savings through shared overheads. |

| Investor Reporting | Reports based on feeder and master fund performance. | Consolidated reporting for umbrella and sub-funds. |

| Use Case | Access to master fund strategies for different investor groups. | Multiple portfolios with distinct investment objectives under one fund. |

Understanding Feeder Funds: Definition and Structure

Feeder funds pool investor capital and invest primarily into a single master fund, providing access to diversified assets while maintaining separate investor accounts. In contrast, a sub-fund operates as a distinct portfolio within an umbrella fund, allowing investors to choose specialized investment strategies under one legal entity. Understanding feeder funds involves recognizing their role in channeling funds into master portfolios, optimizing operational efficiency and centralized management.

What is a Sub-Fund? Key Characteristics Explained

A Sub-Fund is a distinct investment portfolio within a larger umbrella fund, allowing investors to access diversified assets under a single fund structure. Each Sub-Fund operates independently with its own investment strategy, asset allocation, and financial statements, providing tailored exposure while benefiting from the administrative efficiencies of the master fund. This structure enhances risk segregation and regulatory compliance, making Sub-Funds ideal for varying investor preferences within one fund vehicle.

Feeder Fund vs Sub-Fund: Core Differences

Feeder funds pool capital from investors and invest exclusively into a single master fund, creating a simplified structure that allows smaller investors to access larger investment opportunities. Sub-funds are distinct entities within an umbrella fund, each with separate portfolios and liabilities, providing investors with diversified options under one legal structure. The core difference lies in feeder funds channeling resources into one master fund, while sub-funds operate as independent compartments within a collective fund framework.

Investment Flows: How Feeder and Sub-Funds Operate

Feeder funds pool capital from multiple investors, directing those investment flows into a master fund, centralizing portfolio management and optimizing economies of scale. Sub-funds operate as distinct compartments within a single umbrella fund, where investment flows are segregated but managed under a unified legal structure, allowing for tailored strategies without separate fund entities. Understanding these mechanisms helps investors assess liquidity, cost efficiency, and diversification benefits within multi-tiered fund structures.

Regulatory Considerations for Feeder and Sub-Funds

Regulatory considerations for feeder funds primarily involve compliance with jurisdictions governing investor eligibility and restrictions on direct investments, ensuring adherence to offering and disclosure requirements specific to feeder structures. Sub-funds operate under a master fund framework, requiring regulatory approvals for segregated asset pools, yet benefit from a consolidated reporting regime and streamlined compliance under umbrella fund regulations. Both feeder and sub-funds must navigate anti-money laundering (AML) rules, tax implications, and cross-border regulatory obligations to maintain transparent and lawful investment operations.

Tax Implications: Feeder Fund vs Sub-Fund

Feeder funds typically channel investments into a master fund, often benefiting from consolidated tax reporting but may face limited direct tax deductions at the feeder level. Sub-funds, as compartments within an umbrella fund structure, usually enjoy tax transparency, allowing investors to be taxed individually on income and gains according to their jurisdiction. Understanding these distinct tax treatments is crucial for investors seeking optimal tax efficiency in multi-tiered fund structures.

Advantages and Disadvantages of Feeder Funds

Feeder funds provide investors access to a master fund by pooling resources, enabling smaller investors to benefit from economies of scale and professional management often reserved for larger funds. However, feeder funds may incur additional layers of fees and reduced transparency due to the intermediary structure, potentially impacting overall returns. While they simplify investment through a single entity, the complexity of multiple regulatory and tax jurisdictions can pose challenges for investors.

Pros and Cons of Sub-Funds

Sub-funds within a collective investment scheme offer portfolio segmentation, allowing investors to access diverse asset classes under a single umbrella, which enhances risk management and operational efficiency. However, sub-funds may face limitations in liquidity and regulatory complexity compared to feeder funds, potentially resulting in higher administrative costs and less flexibility for investors seeking direct exposure to master funds. The choice of sub-funds is ideal for investors prioritizing customization and cost-sharing but requires careful consideration of underlying fund structures and governance.

Choosing Between a Feeder Fund and Sub-Fund: Factors to Consider

Choosing between a feeder fund and a sub-fund involves evaluating factors such as investment structure, regulatory requirements, and cost efficiency. Feeder funds pool capital from investors into a master fund, offering diversification but potentially higher fees due to layered management. Sub-funds operate as separate compartments within a single umbrella fund, providing simpler administration and tax benefits while maintaining distinct investment strategies and risk profiles.

Real-World Examples of Feeder and Sub-Fund Structures

Feeder funds channel capital from multiple investors into a single master fund, exemplified by the Masters Fund structure used by BlackRock's iShares ETFs, where feeder funds aggregate assets to maximize investment scale. Sub-funds operate under a single umbrella fund, maintaining separate portfolios and investor rights, as seen in Luxembourg's SICAV structures like the JPMorgan Investment Funds, offering diversified strategies within one entity. The feeder fund model benefits from centralized management and consolidated operations, while sub-funds provide legal segregation and tailored investment approaches across multiple risk profiles.

Important Terms

Master-Feeder Structure

A Master-Feeder Structure involves a Master Fund pooling assets from multiple Feeder Funds, whereas a Sub-Fund operates as a separate portfolio within an umbrella fund sharing the same legal entity but distinct investments.

Umbrella Fund

An Umbrella Fund is a collective investment structure that contains multiple Sub-Funds, each with distinct investment objectives and assets, allowing investors to diversify within one consolidated vehicle. A Feeder Fund, by contrast, pools investor capital to invest exclusively in a single master fund, often an Umbrella Fund's Sub-Fund, optimizing operational efficiency and centralized management.

Parallel Fund

Parallel funds operate alongside feeder funds and sub-funds by allowing investors to access the same underlying assets through separate legal structures, often tailored to different investor types or jurisdictions. While feeder funds pool capital into a master fund and sub-funds represent individual compartments within the master fund, parallel funds run independently but mirror the investment strategy to provide regulatory or tax efficiencies.

Segregated Portfolio

A Segregated Portfolio is a legally distinct pool of assets within a single investment fund structure, often used to isolate risks between different portfolios such as in feeder funds and sub-funds. Feeder funds invest primarily in one master fund while sub-funds operate as separate compartments within an umbrella fund, both benefiting from the protective asset segregation that prevents liabilities from one portfolio affecting others.

Allocation Waterfall

Allocation Waterfall in investment structures dictates the sequential distribution of returns first to Feeder Funds before reaching Sub-Funds, ensuring proper prioritization of investor interests. Feeder Funds aggregate capital from multiple investors and channel it into the main fund, while Sub-Funds represent segmented investment pools within the overall fund architecture, each with distinct return streams governed by the waterfall hierarchy.

Multi-Class Fund

A Multi-Class Fund structure allows investors to access different share classes with varying fee structures within a single fund, while Feeder Funds pool capital into a master fund and Sub-Funds operate as distinct segments within an umbrella fund offering diversified investment strategies.

Single Entity Vehicle

A Single Entity Vehicle consolidates multiple investment strategies within one legal structure, differing from feeder fund and sub-fund models where feeder funds channel capital into a master fund and sub-funds operate as distinct pools under an umbrella fund respectively. This structure reduces administrative complexity and regulatory requirements compared to feeder and sub-fund arrangements, offering streamlined governance and cost efficiencies.

Capital Account Segregation

Capital account segregation enables clear separation of investor assets within feeder funds and sub-funds, ensuring precise tracking of each investor's contributions and returns. In feeder funds, capital accounts aggregate investor interests funneling into a master fund, whereas sub-funds maintain distinct capital accounts under a single umbrella fund, allowing for tailored investment strategies and customized risk profiles.

Cross-Class Contagion

Cross-class contagion occurs when risks or losses in a feeder fund negatively impact the associated sub-fund, undermining the overall stability and performance of the investment structure.

Series Trust

Series Trust structures allow investors to hold multiple portfolios under a single legal entity, facilitating efficient management and cost savings compared to traditional mutual funds. In this context, a feeder fund aggregates capital from investors to invest in a master fund, whereas a sub-fund operates as a separate portfolio within the Series Trust, offering tailored investment strategies while maintaining shared administrative infrastructure.

Feeder Fund vs Sub-Fund Infographic

moneydif.com

moneydif.com