Vintage year refers to the specific year when a fund begins its investment period, marking the start of its lifecycle and influencing its market conditions and investment opportunities. Fund term denotes the total duration over which the fund operates, typically spanning 7 to 10 years, encompassing the investing, managing, and exiting phases. Understanding the distinction between vintage year and fund term is crucial for evaluating performance timelines and comparing funds within the same market cycle.

Table of Comparison

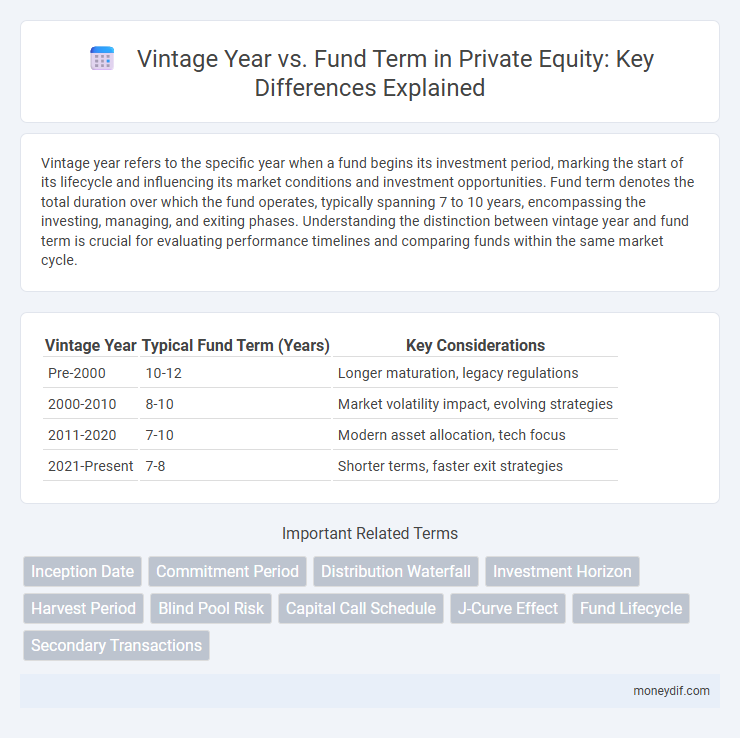

| Vintage Year | Typical Fund Term (Years) | Key Considerations |

|---|---|---|

| Pre-2000 | 10-12 | Longer maturation, legacy regulations |

| 2000-2010 | 8-10 | Market volatility impact, evolving strategies |

| 2011-2020 | 7-10 | Modern asset allocation, tech focus |

| 2021-Present | 7-8 | Shorter terms, faster exit strategies |

Understanding Vintage Year in Fund Investments

The vintage year in fund investments signifies the year a fund first calls capital and begins actively deploying assets, serving as a key metric for benchmarking performance against peers. It enables investors to compare funds initiated in the same market cycle, reflecting similar economic conditions and investment opportunities. Understanding the vintage year helps assess the fund term's impact on investment strategy, risk profile, and potential returns over time.

Defining Fund Term: Key Concepts

Fund term refers to the duration during which a private equity or venture capital fund operates, typically ranging from 7 to 12 years. Vintage year marks the year when the fund makes its first investment, serving as a benchmark for performance comparison among similar funds launched in the same period. Understanding the fund term is crucial for investors to gauge the liquidity timeline and exit strategies relative to the vintage year.

The Significance of Vintage Year for Investors

The vintage year of a fund marks the initial investment period and is crucial for investors to assess market conditions and economic cycles affecting fund performance. It enables comparison across funds initiated in the same timeframe, providing a benchmark for expected returns and risk profiles. Understanding the vintage year alongside the fund term helps investors gauge the investment horizon and potential liquidity timing.

How Fund Term Impacts Investment Returns

A fund's vintage year marks the initial capital call and start of its investment period, directly influencing its fund term, which typically spans 7 to 10 years. The fund term dictates the timeline for deploying capital, managing assets, and ultimately realizing returns through exits, aligning investor expectations on liquidity and performance milestones. Lengthier fund terms often allow for more strategic asset growth and market cycles adaptation, potentially enhancing long-term investment returns compared to shorter terms.

Comparing Vintage Year and Fund Term: What Matters Most?

Vintage year indicates when a fund begins investing, directly impacting market exposure and economic cycles, while fund term defines its active lifespan and exit timeline. Both factors shape investment strategy effectiveness and expected returns, with vintage year affecting timing risk and fund term influencing liquidity horizons. Investors prioritize vintage year for macroeconomic alignment and fund term for cash flow planning, making both crucial for comprehensive fund evaluation.

Vintage Year Trends and Market Cycles

Vintage year trends provide critical insights into fund performance by capturing the economic and market conditions at the time of fund inception, directly influencing investment opportunities and risk levels. Market cycles play a pivotal role in shaping vintage year returns, as funds launched during economic expansions often experience higher valuations and exit multiples, whereas those initiated in downturns may face longer holding periods and distressed asset acquisitions. Understanding the interplay between vintage year and fund term enables investors to better assess timing risks and optimize portfolio diversification across different economic cycles.

Fund Term Length: Factors to Consider

Fund term length is a critical factor influenced by the vintage year, investment strategy, and market conditions. Typical private equity funds have terms ranging from 7 to 12 years, allowing sufficient time for asset acquisition, value creation, and exit planning. Investors must assess liquidity preferences, expected holding periods, and potential extension provisions when evaluating fund term length against vintage year dynamics.

Risks Associated with Vintage Year Selection

Selecting a fund based on its vintage year involves significant risk factors, including market timing and economic cycles that can deeply impact returns. Vintage year performance varies due to differing capital deployment periods, investment pace, and exit environment, which influences the fund term and liquidity timeline. Understanding these dynamics helps investors mitigate risks related to valuation fluctuations and illiquidity associated with vintage year selection.

Aligning Investment Goals with Vintage Year and Fund Term

Aligning investment goals with the vintage year of a fund ensures that the timing of capital deployment matches anticipated market cycles and economic conditions. The fund term, typically ranging from 7 to 12 years, dictates the investment horizon and exit strategy, influencing risk tolerance and return expectations. Understanding the interplay between vintage year and fund term enables investors to optimize portfolio diversification and achieve targeted performance outcomes.

Best Practices for Evaluating Vintage Year vs Fund Term

Evaluating the vintage year versus fund term requires a detailed analysis of market conditions and investment cycles at the time of fund inception to assess potential returns and risks accurately. Best practices include comparing vintage year performance with peer funds from the same period and factoring in macroeconomic trends that influence exit opportunities within the fund term. Concentrating on historical exit multiples and cash flow timing enables investors to gauge alignment between fund duration and expected investment maturity effectively.

Important Terms

Inception Date

Inception date marks the official start of a fund, which aligns with its vintage year and determines the timeline for its fund term.

Commitment Period

The commitment period typically spans the first 3 to 5 years of a private equity fund's life, aligning closely with the vintage year to maximize capital deployment and investment opportunities. Unlike the overall fund term, which often lasts 10 to 12 years, the commitment period focuses on active capital calls, whereas the remaining years emphasize portfolio management and exit strategies.

Distribution Waterfall

The distribution waterfall in private equity typically prioritizes returns based on the vintage year, with cash flows allocated differently across fund terms to optimize investor payouts and align with investment horizons.

Investment Horizon

Investment horizon analysis compares vintage year performance against fund term duration to optimize timing and returns in private equity investments.

Harvest Period

The harvest period typically occurs at the end of a fund term, aligning with the vintage year to maximize returns through the exit of investments.

Blind Pool Risk

Blind pool risk increases when the vintage year misaligns with the fund term, as this timing discrepancy can impact investment performance and capital deployment efficiency.

Capital Call Schedule

A Capital Call Schedule outlines the timing and amount of capital commitments requested from investors, often influenced by the fund's Vintage Year and overall Fund Term. Funds with earlier Vintage Years typically have shorter Fund Terms, leading to more front-loaded capital calls, while newer vintages extend capital deployment and distribution phases over a longer period.

J-Curve Effect

The J-Curve effect in private equity illustrates how fund returns initially dip during early years of a Vintage Year due to management fees and investment costs, before rising significantly as investments mature and generate profits over the Fund Term. This phenomenon highlights that Vintage Year timing directly impacts return trajectories, with longer Fund Terms allowing the J-Curve's upward phase to materialize through value realization.

Fund Lifecycle

Fund lifecycle analysis compares vintage year to fund term to optimize investment timing and maximize returns within specified periods.

Secondary Transactions

Secondary transactions in private equity are influenced by the vintage year and fund term, as older vintage year funds nearing the end of their term often see increased liquidity events and portfolio asset sales. Understanding the interplay between vintage year and fund term is crucial for timing secondary market deals, optimizing pricing, and managing investment exit strategies effectively.

Vintage Year vs Fund Term Infographic

moneydif.com

moneydif.com