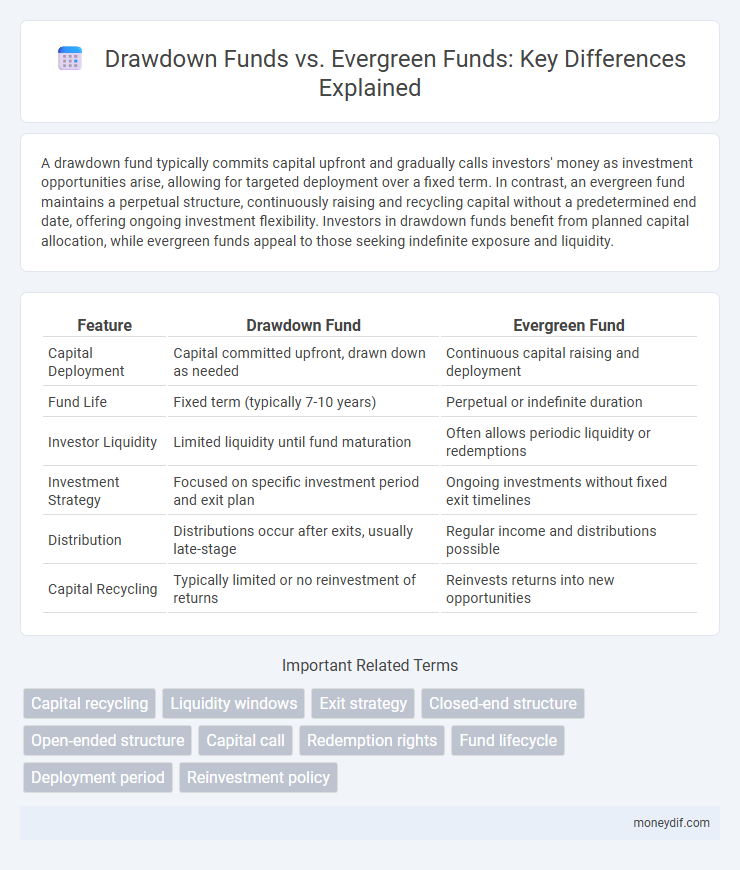

A drawdown fund typically commits capital upfront and gradually calls investors' money as investment opportunities arise, allowing for targeted deployment over a fixed term. In contrast, an evergreen fund maintains a perpetual structure, continuously raising and recycling capital without a predetermined end date, offering ongoing investment flexibility. Investors in drawdown funds benefit from planned capital allocation, while evergreen funds appeal to those seeking indefinite exposure and liquidity.

Table of Comparison

| Feature | Drawdown Fund | Evergreen Fund |

|---|---|---|

| Capital Deployment | Capital committed upfront, drawn down as needed | Continuous capital raising and deployment |

| Fund Life | Fixed term (typically 7-10 years) | Perpetual or indefinite duration |

| Investor Liquidity | Limited liquidity until fund maturation | Often allows periodic liquidity or redemptions |

| Investment Strategy | Focused on specific investment period and exit plan | Ongoing investments without fixed exit timelines |

| Distribution | Distributions occur after exits, usually late-stage | Regular income and distributions possible |

| Capital Recycling | Typically limited or no reinvestment of returns | Reinvests returns into new opportunities |

Introduction to Drawdown and Evergreen Funds

Drawdown funds allocate committed capital in stages, requiring investors to contribute funds only when the manager identifies specific investment opportunities, optimizing cash flow and reducing idle capital. Evergreen funds continuously recycle capital by reinvesting returns, allowing ongoing investment without a fixed end date, providing flexibility for long-term asset management. Both fund structures cater to different investment horizons and liquidity preferences, with drawdown funds typically used for private equity and evergreen funds favored in renewable energy and sustainable investments.

Key Structural Differences

Drawdown funds operate with a fixed capital commitment, releasing capital to investments in phases and aiming for full deployment before the fund's termination. Evergreen funds maintain indefinite capital, continuously recycling returns into new investments without a formal end date. The primary structural difference lies in capital lifecycle management: drawdown funds have a finite investment period, while evergreen funds support ongoing, flexible investment activities.

Capital Commitment and Deployment

Drawdown funds require investors to commit capital upfront but call it over time as investment opportunities arise, optimizing cash flow and minimizing idle capital. Evergreen funds maintain a continuous capital pool without fixed commitments, enabling immediate deployment and ongoing reinvestment of returns. Capital commitment in drawdown funds is structured with defined drawdown schedules, while evergreen funds emphasize flexible, uncommitted capital deployment.

Liquidity and Redemption Features

Drawdown funds typically have limited liquidity with capital committed upfront and drawn down over time, restricting redemptions until the fund reaches maturity or specific milestones. Evergreen funds offer enhanced liquidity through open-ended structures allowing investors to redeem shares periodically, often quarterly or annually, subject to notice periods and redemption gates. Redemption features in drawdown funds are generally inflexible, while evergreen funds prioritize investor exit flexibility by incorporating continuous capital recycling and redemption mechanisms.

Investment Timeline and Horizon

Drawdown funds follow a fixed investment timeline, typically ranging from 7 to 12 years, where capital is called, invested, and returned to investors within a predetermined period. Evergreen funds feature an open-ended structure with no fixed termination date, allowing continuous capital deployment and recycling of returns, supporting a long-term investment horizon. This flexible timeline in evergreen funds enables ongoing portfolio management and adaptive capital allocation according to market opportunities.

Risk Management Approaches

Drawdown funds implement risk management by deploying capital in staged tranches, limiting exposure until milestones are met, which mitigates capital loss during early investment phases. Evergreen funds maintain continuous capital recycling without fixed end dates, employing dynamic risk assessment to balance ongoing investments and redemptions. Both structures integrate diversification and active portfolio monitoring to optimize risk-return profiles tailored to investor time horizons.

Typical Investor Profiles

Drawdown funds typically attract institutional investors and high-net-worth individuals seeking structured, phased investments with clear exit timelines. Evergreen funds appeal more to venture capitalists and long-term growth investors prioritizing continuous capital deployment without fixed redemption dates. Investor profiles for drawdown funds emphasize capital preservation and planned returns, while evergreen fund investors focus on flexibility and sustained portfolio scaling.

Use Cases and Sector Preferences

Drawdown funds excel in infrastructure and real estate projects requiring substantial upfront capital and defined exit strategies, making them ideal for sectors with predictable cash flows and finite timelines. Evergreen funds suit technology and healthcare sectors where continuous innovation and extended growth periods demand flexible capital deployment without a fixed termination date. Use cases for drawdown funds include large-scale energy projects and commercial property developments, whereas evergreen funds favor early-stage venture investments and biotechnology research with ongoing capital needs.

Performance Measurement and Reporting

Drawdown funds track performance by measuring capital committed, invested, and returned over a fixed lifecycle, emphasizing IRR and TVPI metrics for precise evaluation. Evergreen funds focus on ongoing capital deployment and returns, reporting through NAV growth and DPI ratios to reflect continuous reinvestment effects. Transparent, periodic reporting tailored to fund structure enhances accurate performance assessment and investor decision-making.

Choosing the Right Fund Structure

Choosing the right fund structure depends on the investment horizon and liquidity needs, with drawdown funds offering fixed capital deployment over a set period and evergreen funds providing ongoing capital recycling without a predetermined end date. Drawdown funds suit investors seeking defined timelines and clear exit strategies, while evergreen funds attract those valuing continuous investment opportunities and flexibility. Assessing fund lifecycle, investor return expectations, and operational complexity is critical to aligning the fund structure with strategic investment goals.

Important Terms

Capital recycling

Capital recycling maximizes investment efficiency by redeploying returns from Drawdown funds with fixed lifespans, whereas Evergreen funds continuously reinvest capital without liquidation deadlines.

Liquidity windows

Liquidity windows define specific timeframes when investors can redeem their shares, a feature commonly associated with drawdown funds that limit withdrawals to manage capital deployment during the investment period. Evergreen funds, in contrast, offer continuous liquidity without fixed redemption cycles, enabling ongoing investor access while balancing fund stability through periodic liquidity assessments.

Exit strategy

Exit strategies for drawdown funds typically involve liquidating investments within a fixed timeframe to return capital to investors, whereas evergreen funds adopt continuous deployment and recycling of capital without a predefined exit horizon.

Closed-end structure

Closed-end structures typically involve fixed capital drawdowns for a set investment period, contrasting with evergreen funds that allow continuous capital inflows and redemptions.

Open-ended structure

Open-ended structures in Drawdown funds typically feature fixed investment periods with capital called over time and returned upon asset liquidation, whereas Evergreen funds continuously accept new capital and allow ongoing investor redemptions without a fixed termination date.

Capital call

A capital call triggers investor contributions in Drawdown funds, which operate on a fixed commitment to invest a predetermined amount over a set period, whereas Evergreen funds continuously raise and deploy capital without a fixed fundraising timeline, enabling ongoing capital calls as new opportunities arise. Drawdown funds focus on fully capitalizing investment projects, while Evergreen funds provide flexible liquidity and reinvestment options through recurring capital calls.

Redemption rights

Redemption rights in drawdown funds are typically limited and exercised only after the fund has completed its investment period, whereas evergreen funds offer more flexible redemption options allowing investors to withdraw capital periodically. This difference impacts liquidity, as drawdown funds lock committed capital until exit events, while evergreen funds enable ongoing investor redemptions aligned with the fund's perpetual structure.

Fund lifecycle

Fund lifecycle phases differ notably between drawdown funds and evergreen funds, where drawdown funds have a finite investment period followed by an exit phase, typically spanning 7-12 years, while evergreen funds operate with no fixed end date, allowing continuous capital deployment and recycling. Drawdown funds focus on capital calls from limited partners during the investment phase, whereas evergreen funds continuously attract new investors and reinvest returns, sustaining an ongoing funding cycle.

Deployment period

Deployment periods for drawdown funds typically span 3 to 5 years, during which committed capital is actively invested before transitioning to the harvesting phase, whereas evergreen funds operate with no fixed deployment period, continuously recycling capital through ongoing investments and divestitures. Drawdown funds require structured capital calls from investors within the deployment window, while evergreen funds maintain flexibility by allowing ongoing subscriptions and redemptions aligned with fund inflows and outflows.

Reinvestment policy

Reinvestment policy for drawdown funds restricts capital returns until full deployment, while evergreen funds allow continuous reinvestment and indefinite capital recycling.

Drawdown fund vs Evergreen fund Infographic

moneydif.com

moneydif.com