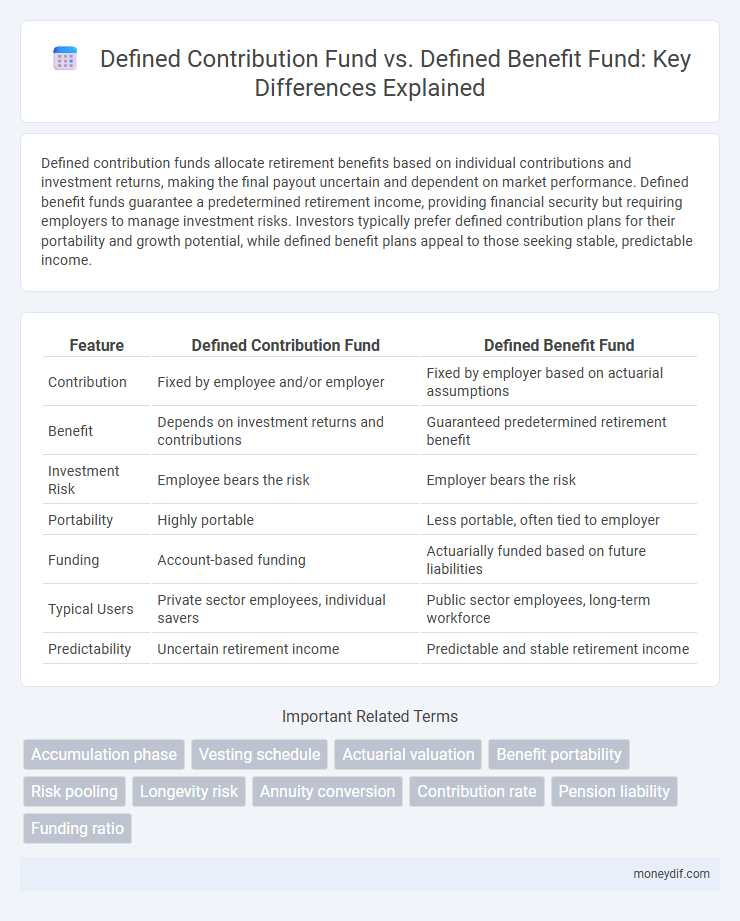

Defined contribution funds allocate retirement benefits based on individual contributions and investment returns, making the final payout uncertain and dependent on market performance. Defined benefit funds guarantee a predetermined retirement income, providing financial security but requiring employers to manage investment risks. Investors typically prefer defined contribution plans for their portability and growth potential, while defined benefit plans appeal to those seeking stable, predictable income.

Table of Comparison

| Feature | Defined Contribution Fund | Defined Benefit Fund |

|---|---|---|

| Contribution | Fixed by employee and/or employer | Fixed by employer based on actuarial assumptions |

| Benefit | Depends on investment returns and contributions | Guaranteed predetermined retirement benefit |

| Investment Risk | Employee bears the risk | Employer bears the risk |

| Portability | Highly portable | Less portable, often tied to employer |

| Funding | Account-based funding | Actuarially funded based on future liabilities |

| Typical Users | Private sector employees, individual savers | Public sector employees, long-term workforce |

| Predictability | Uncertain retirement income | Predictable and stable retirement income |

Overview of Defined Contribution and Defined Benefit Funds

Defined Contribution (DC) funds allocate fixed contributions from employees and employers into individual accounts, with retirement benefits dependent on investment performance and accumulated balances, offering portability and investment choice. Defined Benefit (DB) funds promise a predetermined retirement benefit calculated using a formula based on salary history and tenure, placing investment risk on the employer and providing predictable income for retirees. The primary distinction lies in risk allocation, where DC funds shift investment risk to participants, while DB funds retain risk within the sponsoring organization.

Key Structural Differences

Defined contribution funds allocate retirement benefits based on individual contributions and investment performance, with payout amounts fluctuating according to account value at retirement. Defined benefit funds guarantee a fixed, predetermined pension benefit, calculated through formulas involving salary history and years of service, transferring investment risk to the employer. The fundamental structural difference lies in risk allocation: defined contribution plans place investment risk on employees, whereas defined benefit plans hold employers accountable for ensuring promised payouts.

Funding and Contribution Mechanisms

Defined contribution funds rely on individual account contributions from employees and employers, with benefits depending on account performance and investment returns. In contrast, defined benefit funds guarantee a specific retirement benefit amount, with funding typically sourced from employer contributions and actuarial assumptions to ensure long-term solvency. The funding mechanism in defined benefit funds demands regular actuarial valuations to adjust contributions, while defined contribution funds emphasize steady contributions without predefined benefit obligations.

Investment Risk Allocation

Defined contribution funds place investment risk primarily on employees, as retirement benefits depend on individual contributions and market performance. In contrast, defined benefit funds allocate investment risk to employers, guaranteeing fixed pension payments regardless of investment outcomes. This fundamental difference in risk allocation significantly influences retirement planning and financial security strategies.

Benefit Calculation Methods

Defined contribution funds calculate retirement benefits based on the individual account balance accumulated from contributions and investment returns, making final payouts dependent on market performance. Defined benefit funds guarantee a fixed pension amount determined by a formula incorporating factors such as salary history, years of service, and a predetermined accrual rate. Benefit calculation methods in defined benefit plans offer predictable income, whereas defined contribution plans provide variable returns linked to investment outcomes.

Portability and Flexibility

Defined contribution funds offer higher portability and flexibility, allowing employees to transfer their accumulated balances between employers or investment options with relative ease. Defined benefit funds, by contrast, are less portable, often tying benefits to specific employers and offering fixed payouts that lack investment flexibility. Portability in defined contribution plans supports greater employee mobility, while flexibility in investment choices can potentially enhance retirement outcomes.

Employer and Employee Roles

Defined contribution funds assign employers the role of making fixed contributions to individual employee accounts, with employees bearing investment risk and retirement outcomes dependent on account performance. In contrast, defined benefit funds require employers to guarantee a predetermined retirement benefit, assuming responsibility for investment risk and funding any shortfalls, while employees typically have limited control over contributions or investment choices. The distinction significantly affects financial planning, risk allocation, and the predictability of retirement income for both parties.

Regulatory and Compliance Aspects

Defined contribution funds operate under regulations that emphasize transparency and participant disclosures, requiring regular reporting on individual account balances and investment options. Defined benefit funds face stringent compliance mandates related to funding status, actuarial assumptions, and periodic risk assessments to ensure long-term solvency and pension promise fulfillment. Regulatory bodies such as the Pension Benefit Guaranty Corporation (PBGC) in the U.S. impose strict fiduciary and funding requirements specifically tailored to defined benefit plans.

Long-term Financial Security

Defined contribution funds allocate retirement savings based on employee and employer contributions, where investment risk is borne by the individual, impacting long-term financial security through market performance. Defined benefit funds promise a fixed retirement benefit determined by salary and years of service, offering predictable long-term income but with higher funding risk for the employer. For sustained financial security, defined benefit funds provide greater income stability, while defined contribution funds require proactive investment management to achieve comparable retirement outcomes.

Choosing Between Defined Contribution and Defined Benefit Funds

Choosing between defined contribution and defined benefit funds depends on factors such as risk tolerance, retirement goals, and employer offerings. Defined contribution funds provide individual account growth based on contributions and investment performance, while defined benefit funds guarantee a fixed payout at retirement, backed by the employer. Evaluating the trade-offs between investment control, predictability of income, and potential returns is essential for optimal retirement planning.

Important Terms

Accumulation phase

The accumulation phase in defined contribution funds depends on individual contributions and investment performance, while in defined benefit funds it is determined by a predetermined formula based on salary and years of service.

Vesting schedule

A vesting schedule in a defined contribution fund typically grants employees ownership of their contributions and employer matches over time, whereas in a defined benefit fund, vesting determines employees' rights to receive a guaranteed pension benefit based on years of service.

Actuarial valuation

Actuarial valuation for Defined Benefit (DB) funds focuses on estimating future liabilities based on current and projected member demographics, salary growth, and retirement patterns, ensuring sufficient assets to meet promised benefits. In contrast, Defined Contribution (DC) funds require minimal actuarial assumptions since benefits depend on accumulated contributions and investment returns, shifting longevity and investment risks to members.

Benefit portability

Benefit portability in defined contribution funds allows employees to transfer their accumulated retirement savings to new employers or accounts, enhancing flexibility and continuous investment growth. In contrast, defined benefit funds typically have limited portability since pension benefits are tied to an employer's plan and calculated based on salary and years of service, restricting transferability.

Risk pooling

Risk pooling in defined benefit funds allows employers to share investment and longevity risks across all members, providing more predictable retirement incomes, whereas defined contribution funds do not pool risk, making individual members solely responsible for investment performance and retirement outcomes. This fundamental difference impacts funding stability, with defined benefit plans offering greater financial security against market volatility compared to the potentially higher but uncertain returns in defined contribution schemes.

Longevity risk

Longevity risk poses a significant challenge in defined benefit funds, as these plans guarantee fixed pensions regardless of lifespan, potentially leading to financial shortfalls if beneficiaries live longer than expected. Defined contribution funds transfer this risk to participants, as payouts depend on accumulated savings and investment performance, making retirees responsible for managing their lifespan against available resources.

Annuity conversion

Annuity conversion in defined contribution funds provides individuals with a guaranteed income stream by converting accumulated savings into periodic payments, contrasting defined benefit funds where retirement income is predetermined based on salary and service years.

Contribution rate

Defined contribution funds feature variable contribution rates based on individual choices and market performance, while defined benefit funds maintain fixed contribution rates determined by actuarial calculations to guarantee specific retirement benefits.

Pension liability

Defined benefit funds create pension liabilities based on promised payouts, while defined contribution funds limit employer liability to contributions made without guarantees on final benefits.

Funding ratio

The funding ratio measures the financial health of a pension plan by comparing its assets to its liabilities, often revealing higher volatility in Defined Contribution funds due to individual account balance fluctuations versus the more stable Defined Benefit funds that promise fixed payouts. Defined Benefit funds typically target a funding ratio close to or above 100% to ensure promised benefits, while Defined Contribution funds lack a guaranteed payout, making their funding ratios less indicative of future retirement income security.

Defined contribution fund vs Defined benefit fund Infographic

moneydif.com

moneydif.com