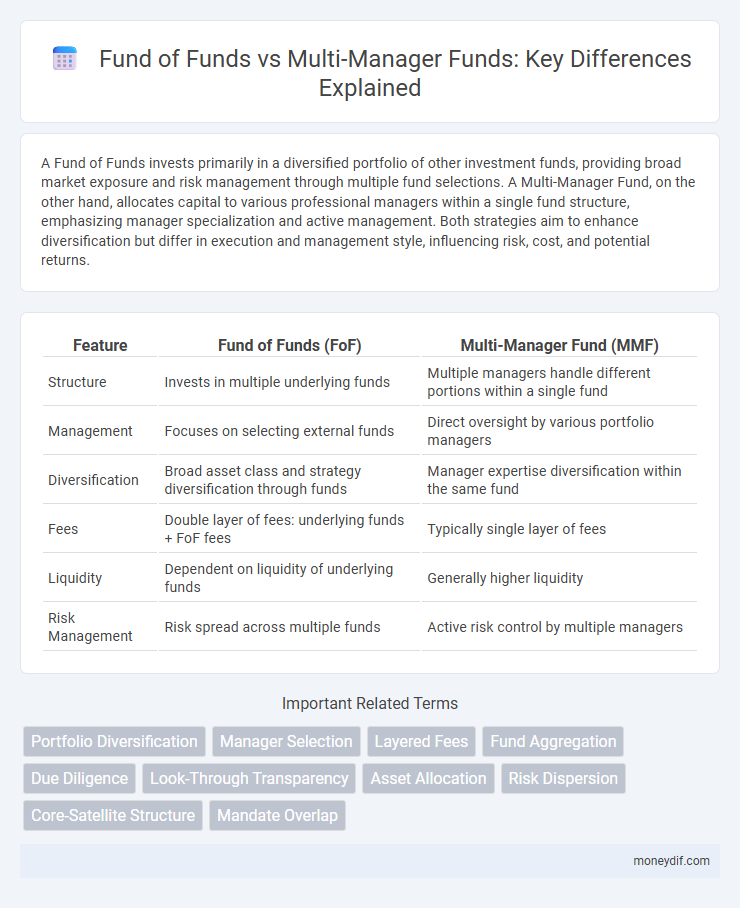

A Fund of Funds invests primarily in a diversified portfolio of other investment funds, providing broad market exposure and risk management through multiple fund selections. A Multi-Manager Fund, on the other hand, allocates capital to various professional managers within a single fund structure, emphasizing manager specialization and active management. Both strategies aim to enhance diversification but differ in execution and management style, influencing risk, cost, and potential returns.

Table of Comparison

| Feature | Fund of Funds (FoF) | Multi-Manager Fund (MMF) |

|---|---|---|

| Structure | Invests in multiple underlying funds | Multiple managers handle different portions within a single fund |

| Management | Focuses on selecting external funds | Direct oversight by various portfolio managers |

| Diversification | Broad asset class and strategy diversification through funds | Manager expertise diversification within the same fund |

| Fees | Double layer of fees: underlying funds + FoF fees | Typically single layer of fees |

| Liquidity | Dependent on liquidity of underlying funds | Generally higher liquidity |

| Risk Management | Risk spread across multiple funds | Active risk control by multiple managers |

Understanding Fund of Funds and Multi-Manager Funds

Fund of Funds (FoF) invests in a diversified portfolio of other investment funds to achieve broad market exposure and risk management, offering access to multiple asset classes and strategies through a single vehicle. Multi-Manager Funds deploy capital by selecting various fund managers within one investment fund, aiming to leverage specialized expertise and active management across different sectors or styles. Understanding their structural differences helps investors align choices with goals for diversification, cost efficiency, and performance optimization.

Structural Differences between Fund of Funds and Multi-Manager Funds

Fund of Funds structures invest in multiple underlying funds to achieve diversified exposure, prioritizing external fund managers and typically incurring layered fees. Multi-Manager Funds, however, centralize portfolio management within a single fund that employs multiple internal or external managers, allowing direct control over asset allocation and cost efficiencies. Structural differences hinge on ownership of underlying assets, fee layering, and the degree of centralized investment decision-making.

Investment Strategies: Fund of Funds vs Multi-Manager Funds

Fund of Funds primarily invests in a diversified portfolio of other funds to achieve broad market exposure and risk mitigation across asset classes. Multi-Manager Funds select multiple portfolio managers within a single fund structure, leveraging specialized investment strategies to optimize returns in targeted sectors or investment styles. Both approaches emphasize diversification but differ in manager selection focus and flexibility in portfolio construction.

Diversification Approaches in Fund of Funds and Multi-Manager Funds

Fund of Funds achieve diversification by investing in a portfolio of various underlying funds, spreading risk across multiple asset managers and strategies to optimize returns. Multi-Manager Funds employ a selection of individual managers managing separate mandates within a single fund, allowing targeted exposure to different investment styles or asset classes. Both approaches enhance risk management but differ in structure, with Fund of Funds focusing on broader fund selection and Multi-Manager Funds emphasizing active manager allocation.

Fee Structures: Comparing Costs and Expenses

Fund of Funds typically incur higher fees due to the layered expense ratios from multiple underlying funds, which include both management and performance fees at each level. Multi-Manager Funds often have a single management fee covering the collective portfolio managers, potentially reducing overall costs for investors. Evaluating the total expense ratios and transparency of fee structures is crucial when comparing these investment vehicles for cost efficiency.

Risk Management Techniques in Both Fund Types

Fund of Funds employs diversification by investing in multiple underlying funds, effectively spreading risk across various asset classes and strategies to minimize exposure to any single investment. Multi-Manager Funds utilize active manager selection and ongoing performance monitoring to balance risk through dynamic allocation and manager expertise, allowing for tailored responses to market changes. Both structures integrate rigorous due diligence, risk assessment tools, and portfolio rebalancing to enhance risk-adjusted returns and mitigate systemic and idiosyncratic risks.

Performance Evaluation: Analyzing Historical Returns

Fund of Funds typically aggregate returns from multiple underlying funds, making performance evaluation reliant on the combined historical returns and fee structures of each component fund. Multi-Manager Funds allocate assets to various portfolio managers who directly manage segments of the portfolio, allowing performance analysis to focus on individual manager skill and contribution to overall returns. Comparing historical returns requires adjusting for differences in diversification, management fees, and risk profiles inherent to each fund structure.

Liquidity Considerations in Fund of Funds vs Multi-Manager Funds

Fund of Funds typically face lower liquidity due to multiple layers of investment, creating longer redemption cycles compared to Multi-Manager Funds that invest directly in diverse managers with potentially quicker access to underlying assets. The added complexity in Fund of Funds often results in delayed transparency and redemption timing, increasing liquidity risk for investors. Multi-Manager Funds generally provide enhanced liquidity profiles by enabling more control over portfolio allocations and direct manager relationships.

Regulatory and Tax Implications

Fund of Funds typically face stricter regulatory requirements due to their structure of investing primarily in other funds, triggering additional layers of compliance and disclosure obligations. Multi-Manager Funds often benefit from streamlined regulatory oversight since they invest directly in multiple managers' portfolios, reducing complexity in reporting and compliance. Tax implications vary as Fund of Funds may be subject to double taxation on distributions, whereas Multi-Manager Funds often allow more tax-efficient treatment by consolidating underlying investments under a single tax wrapper.

Choosing the Right Option: Key Factors for Investors

Investors should consider diversification strategies when choosing between Fund of Funds and Multi-Manager Funds, as both offer pooled investment but differ in structure and fee layers. Fund of Funds provides access to multiple underlying funds managed by external managers, typically incurring higher fees due to dual management costs, while Multi-Manager Funds are directly managed portfolios designed to combine expert managers within a single fund at lower overall expenses. Assessing risk tolerance, cost sensitivity, and investment objectives is crucial to selecting the optimal fund type that aligns with long-term financial goals.

Important Terms

Portfolio Diversification

Fund of Funds enhance portfolio diversification by investing in various underlying funds, while Multi-Manager Funds achieve diversification through allocating assets to multiple specialized managers within a single fund structure.

Manager Selection

Fund of Funds typically allocates capital to external fund managers with diversified strategies, while Multi-Manager Funds directly manage separate portfolios within a single consolidated investment structure.

Layered Fees

Layered fees in Fund of Funds typically result from multiple management and performance fees charged by both the underlying funds and the overarching fund manager, often leading to higher overall expenses compared to Multi-Manager Funds. Multi-Manager Funds usually negotiate fees at the portfolio level, reducing duplication and providing a more cost-efficient structure while maintaining diversified investment exposure.

Fund Aggregation

Fund aggregation in Fund of Funds involves consolidating various underlying investment funds into a single portfolio, whereas Multi-Manager Fund aggregation combines multiple professional managers' strategies within one fund to diversify risk and enhance returns.

Due Diligence

Due diligence in Fund of Funds focuses on evaluating underlying fund managers' strategies and performance, while in Multi-Manager Funds it emphasizes assessing individual portfolio manager expertise and asset allocation efficiency.

Look-Through Transparency

Look-Through Transparency enables detailed visibility into underlying assets and fees of Fund of Funds structures while Multi-Manager Funds typically consolidate performance without granular exposure.

Asset Allocation

Fund of Funds diversifies by investing in multiple distinct funds, while Multi-Manager Funds allocate assets among various professional managers within a single fund structure to optimize risk-adjusted returns.

Risk Dispersion

Fund of Funds diversify risk by investing in multiple underlying funds, whereas Multi-Manager Funds distribute risk by allocating assets across various professional managers within a single fund structure.

Core-Satellite Structure

Core-Satellite Structure integrates a stable core portfolio with active satellite investments, distinguishing Fund of Funds by primarily investing in multiple funds while Multi-Manager Funds focus on directly allocating assets to various professional managers.

Mandate Overlap

Mandate overlap occurs when both Fund of Funds and Multi-Manager Funds invest in similar asset classes or underlying funds, leading to potential redundancy in portfolio exposure and increased risk concentration. This overlap can dilute diversification benefits and create challenges in performance attribution and risk management for investors holding both structures.

Fund of Funds vs Multi-Manager Fund Infographic

moneydif.com

moneydif.com