Anchor investors typically commit large capital early in a fundraising round, providing stability and attracting other investors, while cornerstone investors are strategic partners who subscribe to a significant portion of an offering, often before it opens to the public. Both types of investors play crucial roles in enhancing market confidence and ensuring the success of the fund raise. Their commitments often come with negotiated terms that can influence fund governance and investor relations.

Table of Comparison

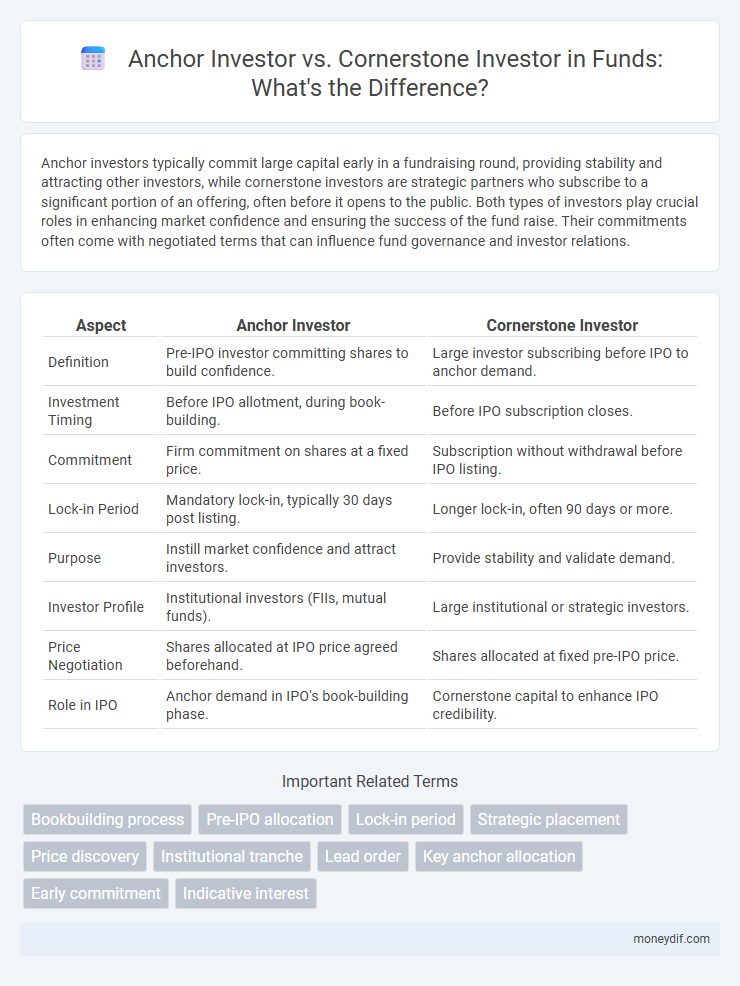

| Aspect | Anchor Investor | Cornerstone Investor |

|---|---|---|

| Definition | Pre-IPO investor committing shares to build confidence. | Large investor subscribing before IPO to anchor demand. |

| Investment Timing | Before IPO allotment, during book-building. | Before IPO subscription closes. |

| Commitment | Firm commitment on shares at a fixed price. | Subscription without withdrawal before IPO listing. |

| Lock-in Period | Mandatory lock-in, typically 30 days post listing. | Longer lock-in, often 90 days or more. |

| Purpose | Instill market confidence and attract investors. | Provide stability and validate demand. |

| Investor Profile | Institutional investors (FIIs, mutual funds). | Large institutional or strategic investors. |

| Price Negotiation | Shares allocated at IPO price agreed beforehand. | Shares allocated at fixed pre-IPO price. |

| Role in IPO | Anchor demand in IPO's book-building phase. | Cornerstone capital to enhance IPO credibility. |

Introduction to Anchor and Cornerstone Investors

Anchor investors provide significant capital commitments early in a fund's lifecycle, offering stability and confidence to attract additional investors. Cornerstone investors typically secure a substantial allocation before a fund's initial close, ensuring a critical base of committed capital and signaling strong market interest. Both play essential roles in enhancing fund credibility, liquidity, and successful fundraising outcomes.

Defining Anchor Investors in Fundraising

Anchor investors in fundraising are large, reputed entities that commit substantial capital early in a fundraise, thereby providing credibility and attracting other investors. They play a pivotal role by stabilizing the investment round, often negotiating favorable terms due to their early commitment and influence. Distinct from cornerstone investors, anchor investors are typically identified before the formal launch and are integral in setting the fund's valuation and momentum.

Understanding Cornerstone Investors

Cornerstone investors are key participants in fundraising rounds, typically securing a significant allocation of shares before the official launch, thereby boosting market confidence and attracting additional investors. Unlike anchor investors who stabilize the market after launch, cornerstone investors commit early to provide a foundation for the fund's success, often negotiated to hold shares for a lock-in period. Their commitment signals strong endorsement and helps in price discovery, crucial for achieving optimal fund valuation and investor trust.

Key Differences Between Anchor and Cornerstone Investors

Anchor investors commit significant capital early in a fundraise, providing initial stability and confidence to attract other investors, often securing preferential terms like board representation. Cornerstone investors also invest substantial amounts but typically join slightly later, focusing on strategic cooperation and long-term partnership without necessarily influencing governance directly. The key difference lies in timing, influence on fund management, and the level of involvement in fund operations.

Roles of Anchor Investors in Fund Launches

Anchor investors provide substantial initial capital commitments that instill market confidence during fund launches, attracting other investors through their endorsement. Their involvement often shapes the fund's strategic direction and governance, leveraging their industry expertise to influence portfolio selection and risk management. By stabilizing early fundraising phases, anchor investors enhance the fund's credibility and facilitate smoother regulatory approvals.

Importance of Cornerstone Investors in IPOs

Cornerstone investors play a crucial role in IPOs by committing a substantial portion of shares before the offering, ensuring market confidence and stabilizing demand. Their involvement signals strong institutional endorsement, which can attract additional investors and enhance the overall valuation of the fund. Unlike anchor investors, cornerstone investors typically agree to a lock-up period, reinforcing long-term commitment and reducing price volatility post-listing.

Benefits Anchor Investors Bring to Funds

Anchor investors provide substantial credibility and confidence to funds by committing significant capital early, which attracts additional investors and stabilizes fundraising efforts. Their involvement often leads to favorable terms and reduced risk perception due to their established market reputation and thorough due diligence. Funds benefit from anchor investors' strategic support and long-term commitment, enhancing overall fund stability and growth potential.

Strategic Advantages of Cornerstone Investment

Cornerstone investors provide strategic advantages by enhancing fund credibility and attracting additional high-quality investors through their commitment prior to fund closure. Their early participation signals strong market endorsement, which supports the fund's valuation and stability during the initial offering phase. Unlike anchor investors, cornerstone investors often secure preferential allocation and governance rights, fostering deeper alignment with long-term fund objectives.

Risks Associated with Anchor and Cornerstone Investors

Anchor investors commit significant capital early in a fund's lifecycle, potentially exposing the fund to concentration risk if their capital is withdrawn or reduced. Cornerstone investors, often institutional entities, may impose strategic or governance demands that limit fund flexibility, creating operational risks. Both investor types introduce reputational risk if their financial stability or public image deteriorates, impacting the fund's ability to attract further investment.

Choosing Between Anchor and Cornerstone Investors for Your Fund

Selecting between anchor and cornerstone investors hinges on your fund's strategic goals and capital requirements. Anchor investors typically provide large initial commitments that enhance credibility and attract additional capital, while cornerstone investors often bring long-term stability and sector-specific expertise that can drive governance and value creation. Evaluating their investment horizons, influence on fund structure, and alignment with your vision ensures optimal fundraising outcomes and sustainable growth.

Important Terms

Bookbuilding process

The bookbuilding process involves soliciting bids from institutional investors to determine the price at which shares will be offered, with anchor investors typically committing early and influencing demand momentum. Cornerstone investors differ by agreeing to purchase a significant share allocation prior to the IPO pricing, providing stability and confidence to other potential investors.

Pre-IPO allocation

Pre-IPO allocation involves distributing shares to key investors before a company goes public, with Anchor investors typically receiving a significant portion to build market confidence, while Cornerstone investors commit substantial funds to stabilize the offering and enhance credibility. Anchor investors are often institutional players invited before the IPO launch, whereas Cornerstone investors secure a fixed allotment as part of the listing agreement, both playing crucial roles in ensuring successful capital raising and price stability.

Lock-in period

The lock-in period for anchor investors typically ranges from 30 to 90 days post-IPO, ensuring price stability and investor confidence by restricting the sale of allotted shares. Cornerstone investors, however, often agree to longer lock-in periods, sometimes extending beyond 180 days, reflecting their strategic commitment and support for the company's market presence.

Strategic placement

Strategic placement involves attracting anchor investors who provide long-term support and credibility, whereas cornerstone investors commit substantial capital before listing to boost market confidence.

Price discovery

Anchor investors and cornerstone investors both play pivotal roles in price discovery by stabilizing initial demand and reducing volatility during an IPO, with anchor investors committing capital before pricing and cornerstone investors securing large allocations to enhance market confidence.

Institutional tranche

Institutional tranche refers to the portion of shares reserved for institutional investors during a public offering, often associated with anchor investors who commit to investing sizeable amounts early to build market confidence. Cornerstone investors differ by providing long-term commitment and stability without tradable shares for a lock-in period, influencing the institutional tranche's demand and pricing.

Lead order

Lead orders typically come from anchor investors who commit to substantial shares during a public offering to provide market stability, while cornerstone investors agree to purchase large portions ahead of the IPO to signal confidence and attract other investors. Both anchor and cornerstone investors are crucial for successful fundraising, but anchor investors usually participate in the book-building process, whereas cornerstone investors secure allocation without active bidding.

Key anchor allocation

Key anchor allocation defines the specific portion of shares reserved for anchor investors, who provide early commitment and credibility by investing significant capital before the public offering. Cornerstone investors, distinct yet similar, secure a predetermined stake in the IPO, often as institutional entities contributing stability and confidence without participating in the bidding process.

Early commitment

Early commitment by cornerstone investors often signals strong market confidence, while anchor investors provide foundational support through substantial pre-IPO share allocations.

Indicative interest

Indicative interest reflects the preliminary level of commitment from Anchor investors, who provide early funding signals in a public offering without a binding agreement, contrasting with Cornerstone investors who typically have legally binding commitments and secure significant share allocations to instill market confidence. Anchor investors' indicative interest helps gauge market response ahead of finalizing issue pricing, whereas Cornerstone investors often close their allocation before the listing date, playing a strategic role in stabilizing the issue price.

Anchor investor vs Cornerstone investor Infographic

moneydif.com

moneydif.com