Committed capital refers to the total amount investors pledge to invest in a fund, representing their contractual obligation over the fund's lifespan. Called capital is the portion of the committed capital that the fund manager has actually requested and received from investors to finance investments or cover expenses. Understanding the distinction between committed and called capital is crucial for evaluating fund liquidity, investment pacing, and capital deployment strategies.

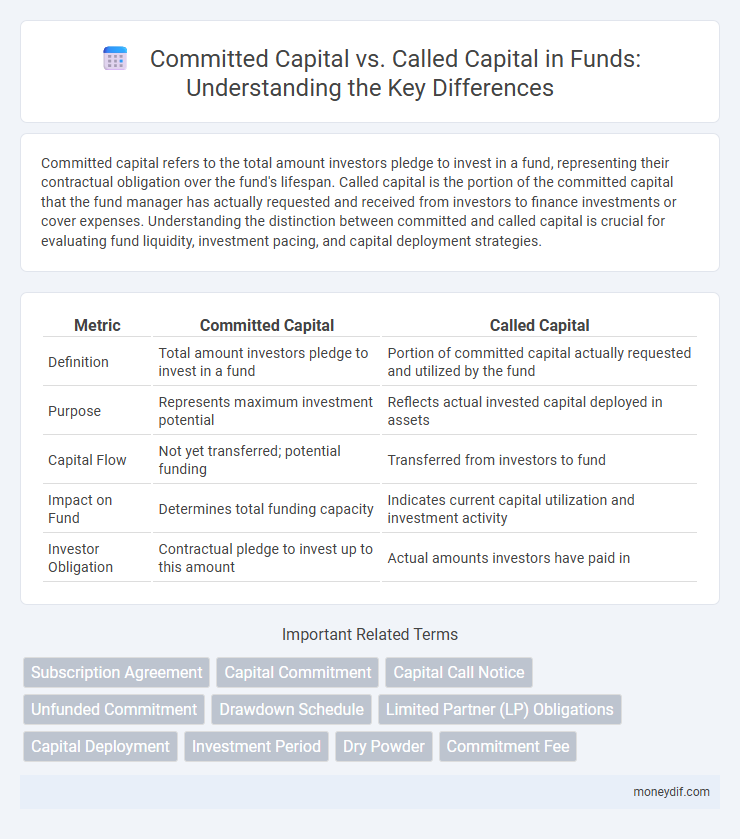

Table of Comparison

| Metric | Committed Capital | Called Capital |

|---|---|---|

| Definition | Total amount investors pledge to invest in a fund | Portion of committed capital actually requested and utilized by the fund |

| Purpose | Represents maximum investment potential | Reflects actual invested capital deployed in assets |

| Capital Flow | Not yet transferred; potential funding | Transferred from investors to fund |

| Impact on Fund | Determines total funding capacity | Indicates current capital utilization and investment activity |

| Investor Obligation | Contractual pledge to invest up to this amount | Actual amounts investors have paid in |

Understanding Committed Capital in Fund Management

Committed capital represents the total amount investors pledge to a fund, forming the financial foundation for fund managers to deploy capital over the investment period. It differs from called capital, which is the portion of committed funds actually requested and utilized by the fund at any given time. Accurate understanding of committed capital allows fund managers to plan investment strategies, manage liquidity, and meet capital calls efficiently.

What is Called Capital? Key Concepts Explained

Called capital refers to the portion of committed capital that a private equity fund or investment vehicle requests from its investors for actual deployment in investments or covering fund expenses. It represents the actual amount of capital paid by investors, triggered by capital calls based on the fund's investment needs or operational requirements. Understanding called capital is essential for investors to track their payment obligations and the fund's utilization of committed resources effectively.

Committed Capital vs Called Capital: Core Differences

Committed Capital represents the total amount investors pledge to a fund, while Called Capital refers to the portion of that commitment the fund manager has actually requested for investment. Committed Capital sets the maximum investment limit, whereas Called Capital reflects the actual funds deployed for portfolio acquisitions or expenses. Understanding the distinction is crucial for evaluating a fund's liquidity, investment pacing, and future capital calls.

The Role of Committed Capital in Private Equity Funds

Committed capital represents the total amount of investor capital pledged to a private equity fund, serving as the financial foundation for the fund's investment strategy and enabling portfolio expansion. This commitment guarantees fund managers access to necessary resources over the investment period, facilitating strategic acquisitions and operational improvements. Unlike called capital, which is the portion of committed capital actually drawn down for investments and expenses, committed capital reflects the long-term financial backing critical for fund stability and growth.

How Called Capital Works in Investment Funds

Called capital represents the portion of committed capital that a fund manager requests from investors to fund specific investments or operational expenses. This mechanism allows the fund to efficiently manage cash flow by only calling capital when needed, rather than holding the entire committed amount upfront. Investors typically provide called capital based on agreed schedules or investment opportunities, ensuring capital deployment aligns with the fund's investment pace and strategy.

Investor Obligations: Committed vs Called Capital

Committed capital represents the total amount an investor pledges to invest in a fund, establishing a legal obligation to provide the full amount when requested. Called capital refers to the portion of committed capital that fund managers have formally requested and received from investors to finance actual investments or expenses. Investors are obligated to fulfill called capital demands according to the terms of the fund agreement, ensuring liquidity for ongoing fund operations.

Impact on Fund Performance: Committed and Called Capital

Committed capital represents the total amount investors pledge to provide, while called capital is the actual portion drawn down by the fund for investments. The timing and efficiency of converting committed capital into called capital critically influence a fund's liquidity and deployment strategy, directly impacting performance metrics such as internal rate of return (IRR) and cash-on-cash multiples. Effective management of capital calls ensures optimal capital utilization, reducing idle capital and enhancing overall fund returns.

Managing Liquidity: The Timing of Called Capital

Committed capital represents the total amount investors pledge to a fund, while called capital refers to the portion actually required from investors at a given time. Managing liquidity effectively depends on the timing of called capital, ensuring that funds are drawn down only when necessary for investments or expenses. This strategic timing reduces idle cash and optimizes capital deployment for maximum fund efficiency.

Legal Agreements and Capital Commitments

Committed capital refers to the total amount an investor legally agrees to invest in a fund under binding legal agreements such as Limited Partnership Agreements (LPAs). Called capital is the portion of committed capital that the fund manager has formally requested and received to fund investments or cover expenses. Legal agreements outline the schedule and conditions under which capital calls occur, ensuring investors fulfill their capital commitments over the fund's lifecycle.

Best Practices for Tracking Committed and Called Capital

Effective tracking of committed and called capital requires implementing robust capital call schedules and real-time monitoring systems to ensure timely capital calls align with investor agreements. Utilizing specialized fund management software enhances transparency, enabling accurate reconciliation between committed amounts and actual draws. Regular audits and detailed reporting foster investor confidence by clearly distinguishing between committed capital commitments and the capital already called for investment activities.

Important Terms

Subscription Agreement

A Subscription Agreement explicitly outlines the terms under which investors commit capital to a fund, specifying the total Committed Capital they agree to invest over the fund's life. While Committed Capital represents the total investment promise, Called Capital refers to the portion of that commitment actually requested and paid by investors during capital calls made by the fund manager for active deployment.

Capital Commitment

Capital commitment represents the total invested amount pledged by investors, with committed capital indicating the full agreed investment and called capital referring to the portion of committed capital that has been requested and contributed to date.

Capital Call Notice

A Capital Call Notice formally requests investors to contribute a portion of their Committed Capital, increasing the Called Capital used for investment purposes.

Unfunded Commitment

Unfunded Commitment represents the difference between Committed Capital pledged by investors and Called Capital actually drawn by the fund.

Drawdown Schedule

A drawdown schedule outlines the timing and amounts of capital calls from investors, distinguishing committed capital--the total capital investors pledge--from called capital, which represents the actual funds requested and deployed by the fund. Effective management of the drawdown schedule ensures alignment between committed capital commitments and the fund's capital needs, optimizing liquidity and investment pacing.

Limited Partner (LP) Obligations

Limited Partners (LPs) are obligated to fulfill their commitment by providing Called Capital up to the amount of their Committed Capital as requested by the General Partner during the fund's investment period.

Capital Deployment

Capital deployment efficiency is measured by comparing committed capital, the total capital investors pledge, versus called capital, the actual funds drawn by the fund for investment purposes. Maximizing called capital utilization accelerates portfolio growth and reduces uninvested capital drag, optimizing overall fund performance.

Investment Period

The investment period refers to the timeframe during which a fund can draw down committed capital from investors to make investments, distinguishing it from called capital, which is the portion of committed capital actually deployed or transferred. Efficient management of the investment period is crucial to maximize portfolio growth while minimizing the gap between committed and called capital to optimize liquidity and investor returns.

Dry Powder

Dry powder represents the uncalled portion of committed capital that private equity firms retain for future investments and operational needs.

Commitment Fee

Commitment fee is charged on committed capital but not on called capital, incentivizing investors to fully utilize their committed funds.

Committed Capital vs Called Capital Infographic

moneydif.com

moneydif.com