Parallel fund structures allow investors to participate in the same investment opportunities simultaneously while maintaining separate legal entities, optimizing regulatory compliance and tax benefits. Master funds centralize investor capital into a single pooled entity, simplifying administration and enhancing economies of scale but potentially limiting investor customization. Choosing between parallel and master fund structures depends on investor preferences regarding control, reporting requirements, and jurisdictional considerations.

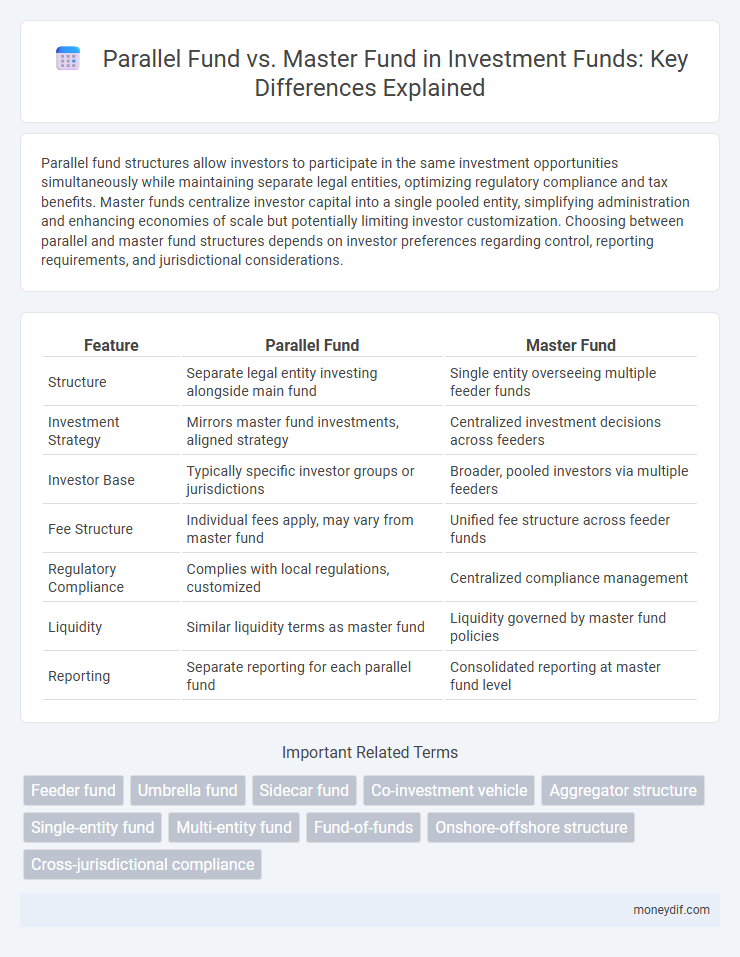

Table of Comparison

| Feature | Parallel Fund | Master Fund |

|---|---|---|

| Structure | Separate legal entity investing alongside main fund | Single entity overseeing multiple feeder funds |

| Investment Strategy | Mirrors master fund investments, aligned strategy | Centralized investment decisions across feeders |

| Investor Base | Typically specific investor groups or jurisdictions | Broader, pooled investors via multiple feeders |

| Fee Structure | Individual fees apply, may vary from master fund | Unified fee structure across feeder funds |

| Regulatory Compliance | Complies with local regulations, customized | Centralized compliance management |

| Liquidity | Similar liquidity terms as master fund | Liquidity governed by master fund policies |

| Reporting | Separate reporting for each parallel fund | Consolidated reporting at master fund level |

Introduction to Parallel Funds and Master Funds

Parallel funds replicate the investment strategy of a master fund but operate as separate legal entities, allowing different groups of investors to participate under tailored terms or jurisdictions. Master funds consolidate capital from various parallel funds to make centralized investments, achieving economies of scale and streamlined portfolio management. This structure optimizes capital deployment and regulatory compliance while maintaining alignment of investment returns across all funds.

Key Definitions: What Are Parallel Funds and Master Funds?

Parallel funds are investment vehicles that run alongside a master fund, typically sharing the same investment strategy, portfolio, and management but operating as separate legal entities to accommodate different investors or regulatory requirements. Master funds serve as the primary investment portfolio holding assets, with various feeder or parallel funds pooling capital that flows into the master fund for unified management and consolidated reporting. The structure optimizes capital deployment, regulatory compliance, and investor diversification while maintaining strategic coherence across the fund family.

Structure and Formation Differences

A parallel fund operates alongside a master fund, allowing investors to access similar portfolio assets but under separate legal entities to accommodate differing regulatory or tax requirements. The master fund acts as a centralized pool capitalizing on economies of scale, while parallel funds maintain distinct structures tailored to specific investor groups or jurisdictions. This structural distinction enables flexible formation, with parallel funds often formed as separate limited partnerships or corporations, whereas the master fund is typically a single entity aggregating multiple capital pools.

Investment Strategies: Parallel Fund vs. Master Fund

Parallel funds operate alongside master funds, allowing investors to gain exposure to the same portfolio companies but often through different jurisdictions or regulatory frameworks, which can optimize tax efficiency and compliance. Master funds consolidate multiple investors' capital into a single pooled entity, enabling streamlined management and potentially lower operational costs while executing unified investment strategies. This structural difference influences capital deployment, risk allocation, and reporting, making the choice between parallel and master funds critical for aligning with specific investment goals and legal requirements.

Regulatory and Legal Considerations

Parallel funds operate as separate legal entities, allowing investors to comply with local regulatory requirements while accessing the same investment strategy as the master fund. Master funds pool investor capital into a single vehicle, streamlining administration but requiring compliance with a unified regulatory framework across jurisdictions. Legal considerations for parallel funds include investor segregation and jurisdiction-specific disclosures, whereas master funds must address consolidated reporting and cross-border regulatory adherence.

Fund Management and Operational Complexity

Parallel funds operate as separate legal entities with distinct investor bases, allowing tailored investment terms but increasing operational complexity due to duplicated administrative and compliance tasks. Master funds consolidate multiple investor commitments under a single vehicle, streamlining fund management and reducing administrative overhead while enabling centralized investment decision-making. Managing parallel funds demands robust coordination between entities, whereas master funds benefit from simplified reporting and operational efficiencies.

Tax Implications in Parallel and Master Fund Structures

Parallel funds maintain separate tax filings for each entity, allowing investors to benefit from direct transparency and specific local tax treatments aligned with their jurisdictions. In master fund structures, the master fund typically acts as a consolidated vehicle with its own tax obligations, potentially leading to different tax liability timings and less direct investor-level reporting. Understanding the tax implications of each structure is crucial for optimizing investor tax efficiency and compliance across multiple jurisdictions.

Investor Participation and Allocation

Investor participation in a master fund allows for pooled capital from multiple parallel funds, streamlining allocation and management under one main investment vehicle. Parallel funds operate alongside the master fund, enabling investors to participate selectively in specific portfolios or regions while maintaining individual allocation terms. This structure enhances flexibility in investor commitments and ensures tailored exposure across diverse asset classes within the overarching fund strategy.

Advantages and Disadvantages of Each Structure

Parallel funds offer increased regulatory flexibility by allowing separate investor classes to invest alongside each other while maintaining distinct legal and tax treatments. Master funds streamline management by pooling assets from various parallel funds, providing operational efficiency and unified investment decision-making but may introduce complexity in investor reporting and tax compliance. Choosing between parallel and master fund structures depends on balancing administrative simplicity against tailored investor requirements and jurisdiction-specific regulations.

Choosing the Right Structure: Parallel Fund or Master Fund?

Choosing between a parallel fund and a master fund hinges on investor composition and regulatory considerations; parallel funds enable co-investors to participate in separate entities that mirror the master fund's strategy, maintaining tailored legal and tax treatment, whereas master funds consolidate capital into a single pooled entity, streamlining management and reporting. Parallel funds offer flexibility for accommodating diverse investor requirements and compliance regimes, while master funds enhance operational efficiency and simplify governance with centralized decision-making. The optimal structure depends on factors such as investor diversity, regulatory jurisdiction, tax optimization, and administrative burden.

Important Terms

Feeder fund

A feeder fund pools capital from investors and channels it into a master fund, which manages the underlying investments, whereas a parallel fund runs alongside the master fund but maintains separate legal entities and investor bases. Feeder funds enhance accessibility to the master fund's portfolio, while parallel funds allow different investor groups to invest under similar strategies with tailored terms and regulatory compliance.

Umbrella fund

Umbrella funds structure investment vehicles under a single legal entity, allowing parallel funds to operate alongside a master fund with shared investment objectives but separate capital commitments and investor bases. Parallel funds replicate the master fund's portfolio to accommodate investors with differing regulatory or tax requirements, enhancing flexibility while maintaining aligned investment strategies.

Sidecar fund

A Sidecar fund typically co-invests alongside a Master fund, allowing limited partners to gain increased exposure to specific deal opportunities without diluting the Master fund's overall portfolio. Parallel funds operate simultaneously with Master funds, mirroring their investment strategy but maintaining separate legal and financial structures to optimize tax and regulatory benefits.

Co-investment vehicle

A co-investment vehicle allows limited partners to invest alongside a private equity fund, offering direct exposure to specific deals with potentially lower fees and increased control. In contrast, a parallel fund pools capital from multiple investors to invest concurrently with a master fund, maintaining separate legal structures and often mirroring the master fund's strategy with enhanced transparency and risk allocation.

Aggregator structure

An aggregator structure consolidates multiple parallel funds under a single umbrella, allowing investors to pool resources while maintaining separate investment mandates and legal entities. Unlike a master fund where assets are commingled into one fund vehicle, parallel funds retain distinct ownership and regulatory compliance, optimizing flexibility and risk management for diverse investor groups.

Single-entity fund

A single-entity fund pools capital from investors into one legal entity, contrasting with parallel funds that operate multiple entities simultaneously to accommodate different investor groups while maintaining the same investment strategy. Master funds consolidate assets from various feeder funds or parallel vehicles, streamlining management and investment operations under one main fund structure.

Multi-entity fund

A multi-entity fund structure includes parallel funds that operate simultaneously under a master fund, allowing investors to participate in distinct legal entities while sharing common investment strategies and management.

Fund-of-funds

A Fund-of-funds invests in multiple underlying funds, often distinguishing between Parallel funds, which co-invest alongside the main Fund-of-funds while maintaining separate legal entities and investment terms, and Master funds, which consolidate assets under a single management vehicle with unified terms and reporting. The choice impacts diversification, fee structures, and risk exposure, with Parallel funds offering tailored strategies per investor and Master funds streamlining administration and potentially lowering costs.

Onshore-offshore structure

An onshore-offshore structure often involves establishing an offshore master fund that investors access through onshore parallel funds to optimize tax efficiency and regulatory compliance. Parallel funds replicate the economic interests of the master fund while enabling domestic investors to adhere to local jurisdiction requirements and minimize withholding taxes.

Cross-jurisdictional compliance

Cross-jurisdictional compliance requires parallel funds to navigate multiple regulatory frameworks separately, as each parallel fund is treated as an independent entity under local laws, unlike master funds that consolidate compliance and reporting responsibilities within a single jurisdiction. This distinction impacts due diligence, transparency obligations, and tax reporting, necessitating tailored compliance strategies for parallel funds to manage divergent regulatory requirements effectively.

Parallel fund vs Master fund Infographic

moneydif.com

moneydif.com