A clawback provision in a fund requires returning previously distributed profits if certain performance targets are not met, protecting investors from overpayment. The catch-up provision allows the fund manager to receive a larger share of profits after investors achieve a specified return, aligning manager and investor interests. Both terms are essential in private equity and hedge fund agreements for balancing risk and reward between parties.

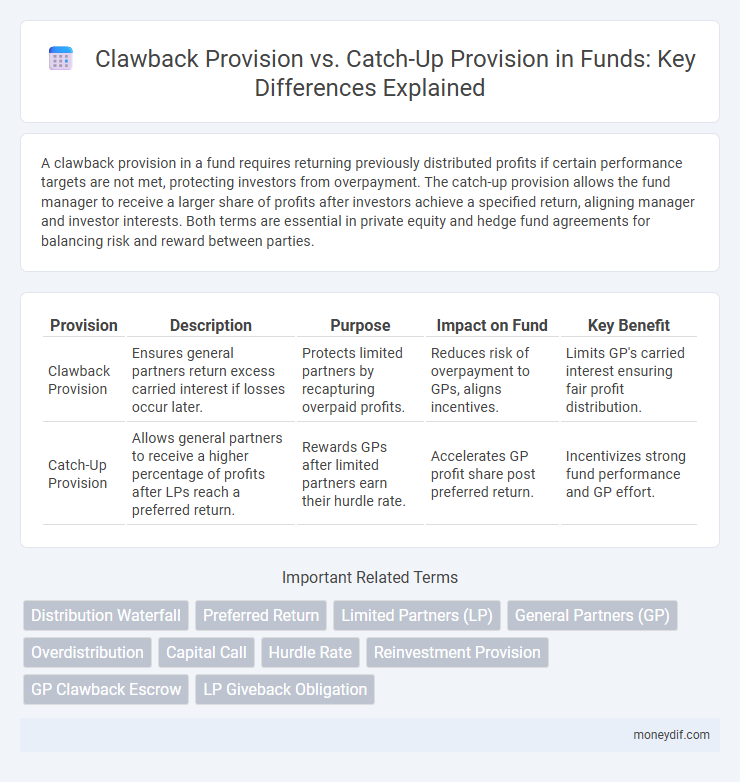

Table of Comparison

| Provision | Description | Purpose | Impact on Fund | Key Benefit |

|---|---|---|---|---|

| Clawback Provision | Ensures general partners return excess carried interest if losses occur later. | Protects limited partners by recapturing overpaid profits. | Reduces risk of overpayment to GPs, aligns incentives. | Limits GP's carried interest ensuring fair profit distribution. |

| Catch-Up Provision | Allows general partners to receive a higher percentage of profits after LPs reach a preferred return. | Rewards GPs after limited partners earn their hurdle rate. | Accelerates GP profit share post preferred return. | Incentivizes strong fund performance and GP effort. |

Introduction to Clawback and Catch-Up Provisions in Funds

Clawback provisions in funds ensure that general partners return excess carried interest to limited partners if the fund underperforms over its lifecycle, maintaining fair profit distribution. Catch-up provisions allow general partners to receive a higher percentage of profits once limited partners have received their preferred return, accelerating the manager's compensation to a predetermined threshold. Understanding these mechanisms is crucial for assessing risk allocation and incentive alignment in private equity and hedge fund agreements.

Defining Clawback Provision: Key Concepts

A clawback provision in fund agreements ensures that limited partners receive their agreed-upon returns by requiring fund managers to return excess profits if performance targets are not met over the fund's life. This mechanism protects investors by aligning manager incentives with long-term fund performance and preventing premature profit distribution before the agreed hurdle rate is achieved. Clawback provisions are critical in private equity and venture capital funds to maintain equitable profit allocation and financial accountability.

Understanding Catch-Up Provision: An Overview

Catch-up provision in fund agreements allows limited partners (LPs) to receive a larger share of profits after the general partner (GP) attains a preferred return, ensuring the GP "catches up" to an agreed-upon carried interest level. This mechanism balances incentive allocation by accelerating GP compensation once LPs have secured their minimum returns, optimizing fund performance alignment. Catch-up provisions differ significantly from clawback clauses, which serve as a corrective measure to recover excess distributions to GPs.

Purpose and Importance in Fund Management

Clawback provisions serve to protect investors by ensuring fund managers return excess carried interest if overall returns fall short of agreed benchmarks, maintaining alignment of interests. Catch-up provisions enable fund managers to quickly recoup their share of profits after limited partners receive their preferred return, incentivizing performance excellence. Both clauses are critical in fund management for balancing risk and reward, fostering trust, and enhancing long-term investment outcomes.

Mechanisms of Clawback Provisions

Clawback provisions in fund agreements enforce the return of previously distributed profits to ensure limited partners receive their agreed-upon preferred returns before general partners share in carried interest. These mechanisms typically require general partners to repay excess carried interest if subsequent losses or underperformance reduce the overall returns below the hurdle rate. By aligning incentives, clawback provisions protect investors from premature profit allocations and maintain equitable distribution throughout the fund's lifecycle.

How Catch-Up Provisions Operate in Practice

Catch-up provisions in fund agreements enable general partners to receive a larger share of profits once limited partners have achieved a predetermined return threshold, typically the preferred return or hurdle rate. These provisions operate by allowing general partners to "catch up" on their carried interest until they reach an agreed percentage of total profits, aligning incentives and promoting fund performance. In practice, catch-up mechanisms ensure general partners are rewarded proportionally after meeting limited partners' minimum return expectations.

Key Differences Between Clawback and Catch-Up Provisions

Clawback provisions require fund managers to return excess profits if returns fall below a predefined threshold, ensuring alignment with investor interests. Catch-up provisions allow managers to receive a higher share of profits after investors achieve a preferred return, accelerating their compensation. The key difference lies in clawback's risk mitigation by reclaiming overpaid fees, while catch-up focuses on incentivizing performance by fast-tracking profit sharing.

Practical Examples in Private Equity and Venture Capital

Clawback provisions in private equity ensure that general partners return excess carried interest to limited partners if initial distributions exceed agreed profit splits, often triggered after final fund liquidation. Catch-up provisions enable general partners to receive a larger share of profits once limited partners achieve their preferred return, exemplified when venture capital funds allocate 100% profits to LPs until hurdle rates are met before GPs capture their full carried interest. Practical use of clawback and catch-up clauses balances risk and reward, ensuring fair profit allocation during exit events like IPOs or acquisitions in venture capital and private equity funds.

Legal and Regulatory Considerations

Clawback provisions require fund managers to return excess carried interest to investors if performance targets are not sustained, ensuring compliance with fiduciary duties and mitigating risks of overpayment under securities regulations. Catch-up provisions allow fund managers to receive a larger share of profits after limited partners reach a preferred return, necessitating clear contractual language to avoid disputes under contract law and regulatory scrutiny. Both provisions must align with relevant jurisdictional laws, including ERISA for pension-related funds, and comply with disclosure requirements mandated by securities regulators.

Implications for Fund Managers and Investors

Clawback provisions ensure fund managers return excess carried interest if performance benchmarks are later unmet, aligning their incentives with long-term investor returns and protecting investors from overpaid fees. Catch-up provisions allow managers to quickly receive their share of profits after limited partners achieve a predefined return, accelerating incentive compensation but potentially increasing short-term risk exposure for investors. Balancing these provisions influences fund manager behavior, risk appetite, and investor protection, impacting overall fund performance and alignment of interests.

Important Terms

Distribution Waterfall

Distribution Waterfall structures prioritize the sequence of cash flows between investors and sponsors, with Clawback Provisions ensuring sponsors return excess profits if initial overpayments occur, while Catch-Up Provisions enable sponsors to rapidly recover their preferred returns after return hurdles are met, optimizing alignment of interests and risk-sharing in private equity deals. Distinguishing between Clawback and Catch-Up mechanisms is critical for understanding the timing and conditions under which profits are distributed in limited partnership agreements.

Preferred Return

Preferred Return ensures investors receive a minimum profit before profits are shared, Clawback Provision requires fund managers to return excess distributions if later profits are insufficient, and Catch-Up Provision allows fund managers to quickly recover their share after preferred returns are met.

Limited Partners (LP)

Limited Partners (LPs) benefit from clawback provisions that ensure repayment of excess carried interest to maintain fair profit distribution, while catch-up provisions accelerate General Partners' share of profits after LPs receive their preferred return.

General Partners (GP)

General Partners (GP) are subject to clawback provisions that ensure they return excess carried interest if limited partners' (LP) preferred returns are not met, maintaining fair profit distribution in private equity funds. Catch-up provisions enable GPs to receive a larger share of profits after LPs have achieved their preferred return, accelerating GP compensation before profit splits normalize.

Overdistribution

Overdistribution occurs when distributions to beneficiaries exceed the available income or principal, triggering the importance of clawback provisions to recover excess amounts and ensure equitable allocation. Catch-up provisions enable subsequent distributions to compensate for prior underdistributions, maintaining balance without necessitating repayment.

Capital Call

A capital call triggers investor contributions, while clawback provisions ensure excess returns are returned to limited partners, and catch-up provisions allow general partners to receive a higher share of profits after limited partners achieve preferred returns.

Hurdle Rate

The hurdle rate determines the minimum return a fund must achieve before activating the clawback provision or enabling the catch-up provision in private equity agreements.

Reinvestment Provision

Reinvestment Provision allows the reinvestment of returned funds to maximize returns, differing from Clawback Provision, which requires returning excess profits to investors if performance targets aren't met. Catch-Up Provision ensures that once the investor receives their preferred return, the fund manager can quickly catch up on their share of profits, balancing incentives between investor protection and manager compensation.

GP Clawback Escrow

GP Clawback Escrow is a fund withheld from the General Partner's carried interest to secure repayment under the Clawback Provision, ensuring that limited partners receive their preferred returns before the GP retains profits. The Catch-Up Provision allows the GP to rapidly recoup accumulated carried interest after return hurdles are met, but GP Clawback Escrow mitigates risk by holding back excess gains subject to future clawbacks.

LP Giveback Obligation

LP Giveback Obligation requires limited partners to return excess distributions, typically triggered by clawback provisions that reclaim overpaid amounts, whereas catch-up provisions allow general partners to receive accelerated compensation after limited partners meet preferred returns.

Clawback Provision vs Catch-Up Provision Infographic

moneydif.com

moneydif.com