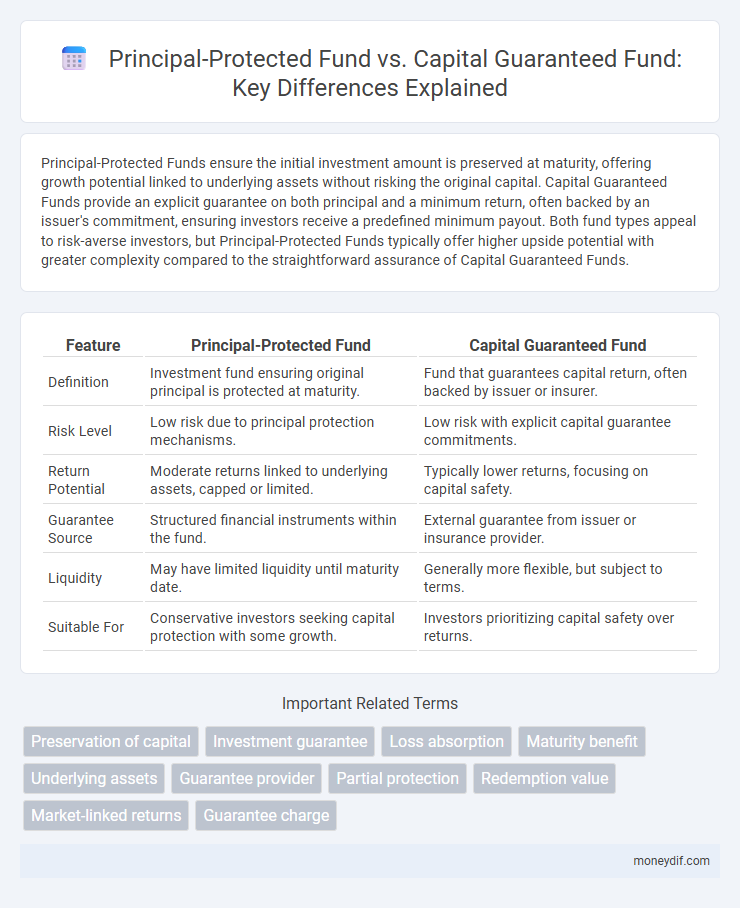

Principal-Protected Funds ensure the initial investment amount is preserved at maturity, offering growth potential linked to underlying assets without risking the original capital. Capital Guaranteed Funds provide an explicit guarantee on both principal and a minimum return, often backed by an issuer's commitment, ensuring investors receive a predefined minimum payout. Both fund types appeal to risk-averse investors, but Principal-Protected Funds typically offer higher upside potential with greater complexity compared to the straightforward assurance of Capital Guaranteed Funds.

Table of Comparison

| Feature | Principal-Protected Fund | Capital Guaranteed Fund |

|---|---|---|

| Definition | Investment fund ensuring original principal is protected at maturity. | Fund that guarantees capital return, often backed by issuer or insurer. |

| Risk Level | Low risk due to principal protection mechanisms. | Low risk with explicit capital guarantee commitments. |

| Return Potential | Moderate returns linked to underlying assets, capped or limited. | Typically lower returns, focusing on capital safety. |

| Guarantee Source | Structured financial instruments within the fund. | External guarantee from issuer or insurance provider. |

| Liquidity | May have limited liquidity until maturity date. | Generally more flexible, but subject to terms. |

| Suitable For | Conservative investors seeking capital protection with some growth. | Investors prioritizing capital safety over returns. |

Understanding Principal-Protected Funds

Principal-Protected Funds secure the original investment amount by design, limiting downside risk while allowing potential upside gains through exposure to market-linked instruments. Unlike Capital Guaranteed Funds, which often offer a formal guarantee backed by a third party or insurer, Principal-Protected Funds rely on structured financial products or investment strategies to preserve principal. Investors seeking capital preservation with some growth potential typically prefer Principal-Protected Funds due to their risk-managed approach and transparency in principal protection mechanisms.

What Are Capital Guaranteed Funds?

Capital Guaranteed Funds are investment products designed to protect the initial capital invested while offering potential returns linked to market performance. These funds guarantee the principal amount at maturity, ensuring investors do not incur losses on their original investment, even if market values decline. They differ from Principal-Protected Funds by the specific mechanisms and guarantee structures that vary based on contractual terms and underlying asset management strategies.

Key Structural Differences

Principal-Protected Funds typically use derivatives and fixed-income securities to ensure the initial investment amount remains intact at maturity, emphasizing protection through market-linked strategies. Capital Guaranteed Funds rely on guarantees from financial institutions, offering predefined returns with minimal risk exposure by securing capital through bonds or insurance contracts. The key structural difference lies in the level of risk transfer and the underlying mechanisms securing the principal, with principal protection often involving dynamic asset allocation, whereas capital guarantees depend on contractual guarantees.

Investment Strategies Compared

Principal-Protected Funds employ investment strategies that allocate a portion of the portfolio to zero-coupon bonds or fixed-income securities to ensure the initial investment is preserved, while the remaining assets are invested in equities or derivatives for growth potential. Capital Guaranteed Funds typically use dynamic hedging techniques or structured products to maintain the capital guarantee, actively managing risk exposures throughout the investment period. Both strategies emphasize capital preservation but differ in approach, with Principal-Protected Funds relying on bond maturity values and Capital Guaranteed Funds utilizing sophisticated risk management tools for downside protection.

Risk Profiles: An In-Depth Comparison

Principal-Protected Funds typically offer a safeguard of the initial investment amount by investing in low-risk fixed income instruments combined with options, resulting in a moderate to low-risk profile suitable for conservative investors. Capital Guaranteed Funds provide a full guarantee of the invested capital, often through insurance mechanisms or government backing, which generally involves even lower risk but may limit potential returns. The key difference lies in risk exposure: Principal-Protected Funds carry slight market risk due to partial equity exposure, whereas Capital Guaranteed Funds aim for near-zero risk by prioritizing secure asset allocation.

Performance Potential and Return Expectations

Principal-Protected Funds typically offer lower performance potential due to their strict preservation of the initial investment, often investing in fixed-income instruments combined with options to capture market upside. Capital Guaranteed Funds also ensure the initial capital but may employ more aggressive asset allocations or derivatives to enhance returns, resulting in potentially higher return expectations compared to strictly principal-protected options. Investors should assess the trade-off between downside protection and growth opportunities when comparing these fund types.

Liquidity and Access to Funds

Principal-Protected Funds typically offer higher liquidity, allowing investors to access their funds more easily before maturity without significant penalties. Capital Guaranteed Funds, while ensuring the invested capital is secured, often impose stricter access conditions and may limit withdrawals until the guarantee period ends. Understanding the liquidity terms is crucial for investors requiring flexible access to their investments while maintaining capital security.

Costs and Fee Structures

Principal-Protected Funds often feature higher management fees due to active portfolio management aimed at preserving the initial investment, whereas Capital Guaranteed Funds generally incur lower fees as they rely on safer, fixed-income instruments to secure the capital. Costs in Principal-Protected Funds may include upfront fees, performance fees, and higher expense ratios reflecting the cost of hedging strategies, while Capital Guaranteed Funds typically have minimal charges focused on administrative and custodial expenses. Investors should carefully analyze the fee structures as higher costs in Principal-Protected Funds can erode net returns despite the safety net, contrasting with the cost-efficient nature of Capital Guaranteed Funds that prioritize capital security.

Suitable Investors for Each Fund

Principal-Protected Funds suit conservative investors seeking preservation of initial capital with potential market-linked returns over a defined period. Capital Guaranteed Funds attract risk-averse individuals prioritizing absolute capital security combined with minimal but steady income. Both fund types cater to investors valuing safety, yet Principal-Protected Funds offer limited growth prospects, whereas Capital Guaranteed Funds emphasize guaranteed principal with conservative growth.

Choosing Between Principal-Protected and Capital Guaranteed Funds

Choosing between Principal-Protected Funds and Capital Guaranteed Funds depends on risk tolerance and investment horizon. Principal-Protected Funds secure the initial investment amount by using options or derivatives, offering limited upside with minimized downside risk. Capital Guaranteed Funds often embed guarantees through insurance contracts, providing a safety net while potentially limiting liquidity and flexibility.

Important Terms

Preservation of capital

Principal-Protected Funds secure initial investment by investing in low-risk assets and derivatives, while Capital Guaranteed Funds ensure capital return through contractual guarantees often backed by insurers or financial institutions.

Investment guarantee

Principal-Protected Funds secure the initial investment amount by investing in low-risk assets, while Capital Guaranteed Funds provide a formal guarantee from the issuer ensuring the return of the principal at maturity regardless of market performance.

Loss absorption

Loss absorption in Principal-Protected Funds occurs through investment returns exceeding initial capital, whereas Capital Guaranteed Funds absorb losses by insurer-backed guarantees ensuring original capital return.

Maturity benefit

Maturity benefits in Principal-Protected Funds ensure the initial investment is returned without gains, while Capital Guaranteed Funds promise both the principal and a minimum return at maturity.

Underlying assets

Underlying assets in Principal-Protected Funds typically include a combination of zero-coupon bonds or fixed income securities and equity-linked instruments, designed to secure the principal while allowing potential market gains. Capital Guaranteed Funds primarily invest in high-quality fixed income products or government bonds to ensure capital preservation, with limited exposure to riskier assets to maintain the capital guarantee.

Guarantee provider

Guarantee providers play a crucial role in Principal-Protected Funds by ensuring investors receive their initial investment back regardless of market fluctuations, whereas Capital Guaranteed Funds often rely on insurance companies or financial institutions to secure the minimum capital value. The effectiveness of the guarantee provider impacts the fund's risk profile, cost structure, and investor confidence in both Principal-Protected and Capital Guaranteed investments.

Partial protection

Partial protection in Principal-Protected Funds allows investors to recover a portion of their initial investment while participating in market gains, offering a balance between risk and return. Capital Guaranteed Funds, however, ensure the full return of the principal amount at maturity, providing maximum security but often with limited upside potential.

Redemption value

Redemption value in Principal-Protected Funds ensures return of the initial investment at maturity without market risk, while Capital Guaranteed Funds provide a minimum guaranteed amount but may allow partial exposure to market fluctuations affecting the final redemption value.

Market-linked returns

Market-linked returns in Principal-Protected Funds offer potential growth with the safety of the original investment, whereas Capital Guaranteed Funds ensure the principal amount with limited exposure to market fluctuations.

Guarantee charge

Guarantee charge in Principal-Protected Funds typically covers cost of securing the initial investment through contingent claims or zero-coupon bonds, ensuring the principal at maturity without market risk. In contrast, Capital Guaranteed Funds impose a guarantee charge for actively managed portfolios, balancing investment growth potential with a fixed minimum return, often resulting in higher fees due to portfolio insurance or dynamic hedging strategies.

Principal-Protected Fund vs Capital Guaranteed Fund Infographic

moneydif.com

moneydif.com