The waterfall structure in fund distribution outlines the sequential allocation of returns, prioritizing capital repayment, preferred returns, and then carried interest, ensuring clear compensation tiers. The European waterfall model differs by requiring the return of all invested capital to limited partners before any carried interest is paid to the general partner, promoting risk alignment. Understanding these distinctions is crucial for investors evaluating fund performance and distribution fairness.

Table of Comparison

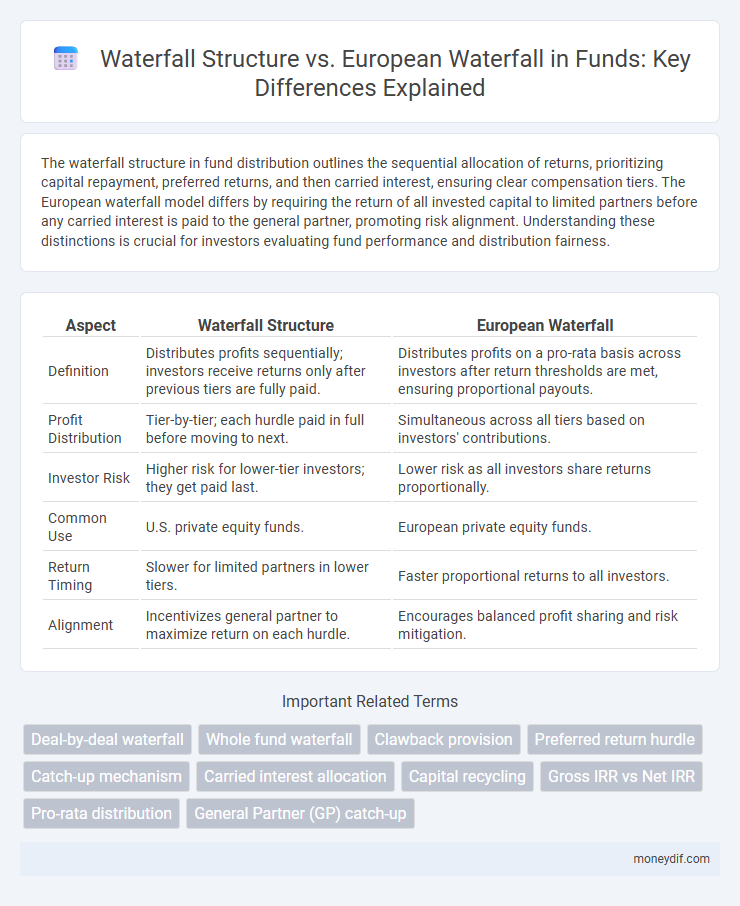

| Aspect | Waterfall Structure | European Waterfall |

|---|---|---|

| Definition | Distributes profits sequentially; investors receive returns only after previous tiers are fully paid. | Distributes profits on a pro-rata basis across investors after return thresholds are met, ensuring proportional payouts. |

| Profit Distribution | Tier-by-tier; each hurdle paid in full before moving to next. | Simultaneous across all tiers based on investors' contributions. |

| Investor Risk | Higher risk for lower-tier investors; they get paid last. | Lower risk as all investors share returns proportionally. |

| Common Use | U.S. private equity funds. | European private equity funds. |

| Return Timing | Slower for limited partners in lower tiers. | Faster proportional returns to all investors. |

| Alignment | Incentivizes general partner to maximize return on each hurdle. | Encourages balanced profit sharing and risk mitigation. |

Understanding Fund Distribution Mechanisms

The waterfall structure in fund distribution determines the sequential order in which profits are allocated to investors and the general partner, typically starting with return of capital followed by preferred returns and carried interest. The European waterfall model requires the limited partners to receive their entire capital back plus a preferred return before the general partner earns carried interest, ensuring more alignment of interests. Understanding these mechanisms is crucial for investors to evaluate risk, timing of returns, and the prioritization of payouts within private equity and venture capital funds.

Overview of the Waterfall Structure in Funds

The waterfall structure in funds dictates the sequence of cash flow distribution among investors, prioritizing return of capital, preferred returns, and profit sharing stages. In a European waterfall, distributions prioritize returning all capital to limited partners before any carried interest is paid, enhancing downside protection for investors. This contrasts with American waterfall structures, where carried interest can be distributed earlier based on individual investment performance.

What is the European Waterfall Structure?

The European Waterfall Structure is a distribution method used in private equity funds where limited partners (LPs) receive their full capital contributions and preferred returns before any profit sharing with general partners (GPs). This structure prioritizes returning invested capital to LPs, reducing risk by ensuring they are compensated before GPs participate in carried interest. It contrasts with the American Waterfall, where GPs can receive carried interest on a deal-by-deal basis, emphasizing aligned interests after each individual investment exit.

Key Differences Between Waterfall and European Waterfall

Waterfall structure typically prioritizes returning capital to investors before any profits are shared, often allowing the general partner to receive carried interest earlier in the distribution sequence. European waterfall requires the entire committed capital to be returned to limited partners before the general partner receives any carried interest, promoting greater downside protection for investors. This distinction fundamentally affects cash flow timing, risk allocation, and alignment of interests between limited partners and general partners in private equity funds.

Investor Implications: Waterfall vs. European Waterfall

The waterfall structure allocates profits sequentially, prioritizing return of capital and preferred returns before general partners participate, often resulting in delayed investor gains. The European waterfall model requires full return of all invested capital to limited partners before any carried interest is distributed, enhancing downside protection for investors. This structure typically aligns investor interests with fund managers by minimizing early profit distribution and ensuring comprehensive capital repayment.

Impact on General Partners and Limited Partners

The waterfall structure dictates the priority of distributions between General Partners (GPs) and Limited Partners (LPs), significantly impacting their returns and risk exposure. In a European waterfall, LPs receive their full invested capital and preferred returns before GPs receive any carried interest, offering greater downside protection to LPs but potentially delaying GP compensation. Traditional waterfall models often allow GPs to collect carried interest earlier, increasing GP incentives but also imposing higher risk on LPs by reducing capital return priority.

Cash Flow Prioritization in Fund Structures

Cash flow prioritization in fund structures significantly differs between waterfall structures and European waterfalls. The European waterfall ensures limited partners receive full return of capital and preferred returns before any carried interest is allocated to the general partner, promoting conservative distribution of proceeds. In contrast, traditional waterfall structures might distribute carried interest earlier based on deal-by-deal basis, potentially exposing limited partners to higher risk.

Advantages of Traditional Waterfall Structure

The traditional waterfall structure offers a clear, predefined distribution hierarchy that prioritizes return of capital to investors before profit sharing, minimizing ambiguity in payout timing. It provides strong alignment between general partners and limited partners by ensuring investors recover principal early, thereby reducing risk exposure. This straightforward model simplifies fund management and enhances predictability of returns, which appeals to conservative investors seeking stable cash flow.

Benefits and Limitations of the European Waterfall

The European Waterfall structure in fund distribution ensures limited partners receive their entire capital back plus preferred returns before any carried interest is allocated to general partners, promoting investor protection and risk mitigation. This structure benefits limited partners by prioritizing return of capital and aligning interests, but it can delay incentive payouts to general partners, potentially reducing their motivation and impacting fund manager performance. The primary limitation is reduced flexibility for general partners compared to the American (waterfall) structure, as it enforces a stricter, sequential capital return process.

Choosing the Right Waterfall Structure for Your Fund

Choosing the right waterfall structure for your fund depends on aligning investor returns and fund manager incentives with the specific investment strategy and risk profile. The European waterfall structure prioritizes returning all capital contributions to limited partners before performance fees are shared, offering greater investor protection. In contrast, the American waterfall allows for earlier distribution of carried interest, potentially accelerating fund manager rewards but increasing risk for investors.

Important Terms

Deal-by-deal waterfall

Deal-by-deal waterfall allocates profits immediately after each individual investment's exit, prioritizing earlier returns to investors compared to the European waterfall model, which aggregates all investments before distributing proceeds. This structure enhances cash flow timing and risk distribution, making it more attractive for investors seeking quicker paybacks.

Whole fund waterfall

The whole fund waterfall method distributes returns based on the total fund performance, ensuring limited partners receive their preferred return before general partners participate, in contrast to the European waterfall which requires full return of capital to limited partners across all deals before any carry is paid. This approach aligns investor interests by managing risk at the fund level rather than deal-by-deal, offering a more conservative and equitable profit distribution structure.

Clawback provision

A clawback provision in private equity ensures that limited partners receive their preferred returns before general partners share profits, often integrated within the European waterfall structure, where profits are distributed sequentially only after LPs achieve full capital return and preferred returns. Unlike the American waterfall, which allows GP carry distributions per deal or tranche, the European waterfall with clawback mandates GP refunds if cumulative carried interest exceeds agreed thresholds upon fund liquidation.

Preferred return hurdle

Preferred return hurdle in European waterfall structure ensures limited partners receive a minimum return before any carried interest is distributed, contrasting with waterfall structures where returns may be allocated differently among tiers.

Catch-up mechanism

The catch-up mechanism accelerates profit distribution to the general partner after limited partners receive their preferred return, commonly used in the American-style waterfall structure. In contrast, the European waterfall requires limited partners to be fully repaid their capital and preferred return before any catch-up occurs, ensuring more sequential and conservative capital return.

Carried interest allocation

Carried interest allocation in a waterfall structure prioritizes returning capital and preferred returns to limited partners before general partners receive their share, while the European waterfall requires full return of all contributed capital and preferred returns to all limited partners across all investments before any carried interest is allocated. This approach ensures a more conservative, cumulative return hurdle is met, aligning incentives over the entire fund rather than individual deals.

Capital recycling

Capital recycling in private equity involves reinvesting proceeds from asset sales back into new investments, enhancing portfolio returns within predefined distribution frameworks. The waterfall structure dictates the order of cash flow distribution between limited and general partners, with European waterfalls requiring full return of capital to LPs before GPs receive carry, whereas waterfall structures in general may allow earlier GP participation based on deal or deal-by-deal performance.

Gross IRR vs Net IRR

Gross IRR measures the total return on an investment before fees and carried interest, while Net IRR reflects the actual return to investors after these deductions, making it crucial for performance evaluation. The waterfall structure dictates the distribution of returns, with European waterfall ensuring limited partners receive their full capital back before general partners share profits, influencing the timing and magnitude of Net IRR compared to a typical waterfall model.

Pro-rata distribution

Pro-rata distribution allocates returns proportionally among investors based on their respective capital contributions, contrasting with the European waterfall structure that prioritizes full return of capital to limited partners before general partners receive profits. Unlike the American waterfall, which allows promote distributions at deal-by-deal level, the European waterfall ensures a global catch-up and return of capital, emphasizing risk mitigation for limited partners.

General Partner (GP) catch-up

The General Partner (GP) catch-up clause in a waterfall structure allows the GP to receive a larger share of profits after Limited Partners (LPs) achieve their preferred return, often accelerating GP compensation compared to the European waterfall, which requires LPs to be fully repaid their entire capital plus preferred returns before the GP receives carried interest. The American waterfall with catch-up aligns GP incentives with performance in individual deals, while the European waterfall aggregates returns across the entire fund, prioritizing LP capital return before GP profit participation.

waterfall structure vs European waterfall Infographic

moneydif.com

moneydif.com