Open architecture in fund management allows investors to access a diverse range of investment products across multiple providers, enhancing portfolio customization and flexibility. Closed architecture limits investment options to proprietary or affiliated funds, often reducing choice but potentially simplifying decision-making and offering streamlined services. Investors seeking tailored strategies often prefer open architecture for its broader opportunities and transparency.

Table of Comparison

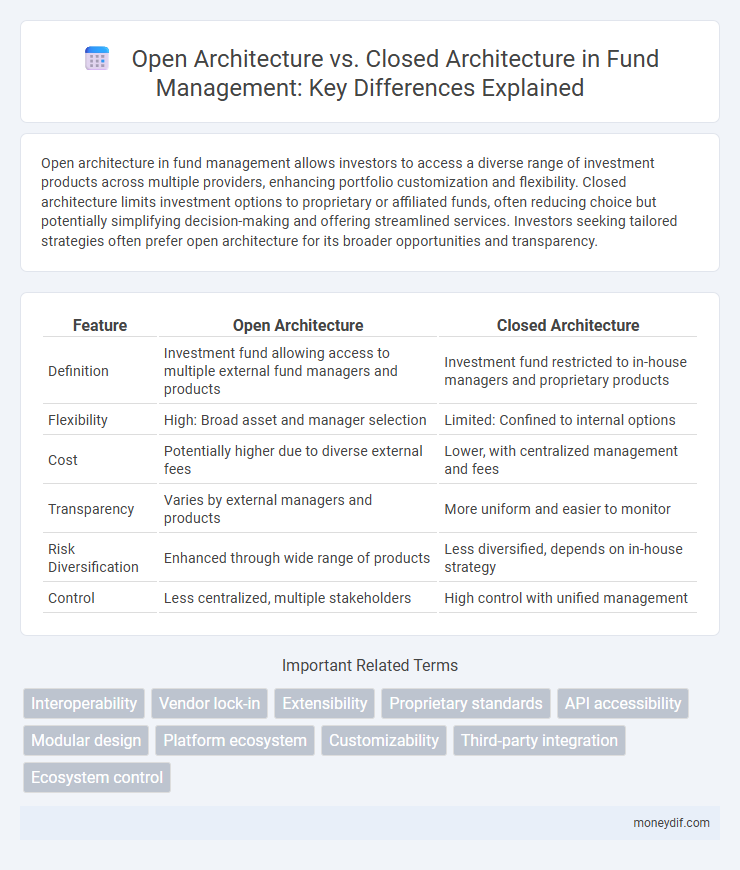

| Feature | Open Architecture | Closed Architecture |

|---|---|---|

| Definition | Investment fund allowing access to multiple external fund managers and products | Investment fund restricted to in-house managers and proprietary products |

| Flexibility | High: Broad asset and manager selection | Limited: Confined to internal options |

| Cost | Potentially higher due to diverse external fees | Lower, with centralized management and fees |

| Transparency | Varies by external managers and products | More uniform and easier to monitor |

| Risk Diversification | Enhanced through wide range of products | Less diversified, depends on in-house strategy |

| Control | Less centralized, multiple stakeholders | High control with unified management |

Understanding Fund Architectures: Open vs Closed

Open fund architecture enables investors to access a broad range of investment products from multiple external managers within one platform, enhancing diversification and flexibility. Closed fund architecture restricts investment options to internal or affiliated managers, promoting tighter control and streamlined management but potentially limiting investor choice. Selecting between open and closed architectures impacts fund transparency, cost efficiency, and portfolio customization.

Key Features of Open Architecture Funds

Open architecture funds feature access to a diverse range of investment products and managers, allowing portfolio customization and flexibility tailored to individual investor needs. These funds emphasize transparency, offering clear insights into holdings, fees, and performance metrics, fostering informed decision-making. Enhanced diversification potential reduces risk exposure by combining multiple asset classes and strategies within a single investment framework.

Defining Closed Architecture Fund Structures

Closed architecture fund structures restrict investment options to a predefined set of funds or managers within the platform, limiting investor choice and enhancing control over portfolio composition. These structures often feature curated selections aligned with specific investment strategies, regulatory requirements, or proprietary products. By contrast, open architecture offers broader access but closed architecture prioritizes consistency, risk management, and streamlined oversight in fund selection.

Benefits of Open Architecture in Fund Management

Open architecture in fund management enhances portfolio diversification by allowing access to a wide range of external funds and investment products beyond proprietary offerings. This structure promotes cost efficiency and transparency, enabling investors to select competitively priced funds tailored to specific risk and return profiles. It also fosters innovation and flexibility, empowering fund managers to adapt strategies quickly in response to market changes and client needs.

Drawbacks of Closed Architecture Funds

Closed architecture funds limit investment options to a predefined set of proprietary products, restricting portfolio diversification. This lack of flexibility often leads to higher fees and suboptimal asset allocation, impairing overall fund performance. Investors face reduced transparency and fewer opportunities to adapt to changing market conditions, increasing financial risk.

Investor Access: Open Architecture vs Closed Architecture

Open architecture in fund management provides investors with broad access to a diverse range of investment products and external fund managers, enhancing portfolio customization and flexibility. Closed architecture restricts investor access to proprietary or in-house funds, limiting choices but potentially simplifying decision-making and aligning with the provider's strategic objectives. Investor access under open architecture supports diversification and personalized investment strategies, while closed architecture offers a more controlled and integrated investment approach.

Impact on Fund Performance and Diversification

Open architecture in fund management enhances performance by allowing access to a broader range of investment products, enabling greater diversification and customization aligned with investor goals. Closed architecture limits fund managers to proprietary products, potentially restricting asset allocation and increasing vulnerability to market-specific risks. As a result, funds utilizing open architecture often achieve superior risk-adjusted returns through diversified exposure and increased flexibility.

Cost Implications and Fee Structures

Open architecture in fund management often results in lower overall costs due to competitive fee structures and access to a diverse range of third-party investment products, enabling tailored portfolio solutions. Closed architecture typically involves higher fees because investment options are limited to in-house products, reducing flexibility and potentially leading to less optimized cost-efficiency. Investors seeking cost-effective fund management tend to prefer open architecture for its transparent fee models and broader investment choices.

Regulatory Considerations for Fund Architectures

Regulatory considerations for fund architectures significantly differ between open and closed models, influencing investor protection and compliance obligations. Open architecture funds often face stricter regulatory scrutiny due to their broader distribution channels and diverse product offerings, necessitating enhanced transparency and risk management protocols. Closed architecture funds benefit from a more controlled environment but must adhere to stringent disclosure requirements to ensure transparency for a limited investor base.

Choosing the Right Fund Architecture for Your Portfolio

Selecting the right fund architecture involves evaluating open architecture's flexibility to access diverse investment products against closed architecture's streamlined control and proprietary funds. Open architecture enables portfolio diversification through third-party fund offerings, enhancing customization aligned with investor goals. Closed architecture may limit choices but offers integrated management and potentially lower fees, ideal for investors seeking simplicity and consistency.

Important Terms

Interoperability

Interoperability in open architecture systems enables seamless integration of diverse components and third-party applications, promoting flexibility and scalability. Closed architecture restricts interoperability, limiting system expansion and customization by confining compatibility to proprietary hardware and software.

Vendor lock-in

Vendor lock-in occurs when a customer is dependent on a single supplier's proprietary technology, limiting flexibility and increasing switching costs, commonly associated with closed architecture systems. In contrast, open architecture promotes interoperability and standardization, reducing vendor lock-in by enabling easier integration and migration across diverse platforms.

Extensibility

Extensibility in open architecture systems allows seamless integration of third-party modules and custom features, enhancing scalability and adaptability in diverse environments. Closed architecture restricts modifications and expansions, limiting flexibility and potentially increasing reliance on proprietary solutions.

Proprietary standards

Proprietary standards restrict interoperability by confining system design to vendor-specific components, contrasting with open architecture that promotes compatibility and integration through publicly accessible standards. Closed architecture systems prioritize control and security via proprietary standards, limiting customization, while open architecture fosters innovation and flexibility by enabling third-party development.

API accessibility

API accessibility in open architecture systems enables seamless integration and interoperability across diverse platforms through standardized protocols, fostering innovation and flexibility. In contrast, closed architecture limits API accessibility to proprietary systems, restricting third-party access and reducing cross-platform compatibility.

Modular design

Modular design enhances flexibility and scalability by allowing components to be independently developed and easily replaced, aligning closely with open architecture principles that promote interoperability and customization through standardized interfaces. In contrast, closed architecture typically integrates proprietary modules, limiting adaptability and third-party integration, which can constrain innovation and system evolution.

Platform ecosystem

Platform ecosystems thrive on open architecture by fostering innovation and interoperability, while closed architecture limits flexibility and user-driven expansion within the ecosystem.

Customizability

Open architecture systems maximize customizability by allowing users to modify, upgrade, and integrate third-party components, fostering flexibility and innovation. In contrast, closed architecture restricts customization options, limiting hardware and software changes to proprietary solutions and controlled environments.

Third-party integration

Third-party integration is more seamless and scalable in open architecture systems due to standardized interfaces, whereas closed architecture systems restrict integration by limiting external access and compatibility.

Ecosystem control

Open architecture ecosystems enable greater integration flexibility and scalability compared to closed architecture systems, which limit customization and interoperability.

Open architecture vs Closed architecture Infographic

moneydif.com

moneydif.com