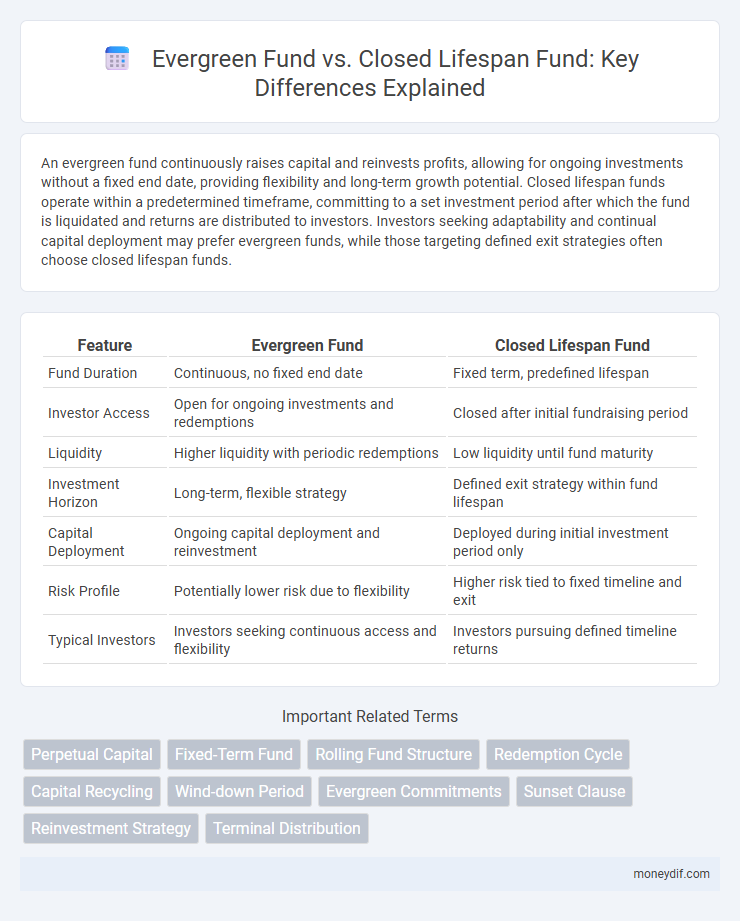

An evergreen fund continuously raises capital and reinvests profits, allowing for ongoing investments without a fixed end date, providing flexibility and long-term growth potential. Closed lifespan funds operate within a predetermined timeframe, committing to a set investment period after which the fund is liquidated and returns are distributed to investors. Investors seeking adaptability and continual capital deployment may prefer evergreen funds, while those targeting defined exit strategies often choose closed lifespan funds.

Table of Comparison

| Feature | Evergreen Fund | Closed Lifespan Fund |

|---|---|---|

| Fund Duration | Continuous, no fixed end date | Fixed term, predefined lifespan |

| Investor Access | Open for ongoing investments and redemptions | Closed after initial fundraising period |

| Liquidity | Higher liquidity with periodic redemptions | Low liquidity until fund maturity |

| Investment Horizon | Long-term, flexible strategy | Defined exit strategy within fund lifespan |

| Capital Deployment | Ongoing capital deployment and reinvestment | Deployed during initial investment period only |

| Risk Profile | Potentially lower risk due to flexibility | Higher risk tied to fixed timeline and exit |

| Typical Investors | Investors seeking continuous access and flexibility | Investors pursuing defined timeline returns |

Introduction to Fund Structures: Evergreen vs Closed Lifespan

Evergreen funds offer continuous capital raising and indefinite investment periods, allowing flexible entry and exit for investors, whereas closed lifespan funds have a predetermined lifespan with fixed capital commitments and scheduled liquidation. Evergreen structures support long-term asset growth and ongoing portfolio management, while closed lifespan funds provide defined timelines and clear exit strategies, often appealing to investors seeking structured returns. Understanding these distinctions is critical for aligning investment horizons and liquidity preferences with fund objectives.

Defining Evergreen Funds

Evergreen funds are investment vehicles with no predetermined end date, allowing continuous capital inflows and redemptions, which supports long-term asset growth and flexible portfolio management. Unlike closed lifespan funds, which have fixed terms and require liquidation of assets at maturity, evergreen funds prioritize ongoing investments and reinvestment strategies to optimize returns over time. This structure benefits investors seeking liquidity and sustained exposure to evolving market opportunities.

Understanding Closed Lifespan Funds

Closed lifespan funds operate with a fixed term, typically ranging from 7 to 15 years, during which all investments are made, managed, and liquidated before the fund's closure. These funds provide defined exit strategies and predictable timelines for returns, appealing to investors seeking structured investment horizons. Unlike evergreen funds that continuously raise capital and reinvest, closed lifespan funds emphasize disciplined asset allocation and planned distributions to investors.

Key Differences Between Evergreen and Closed Lifespan Funds

Evergreen funds continuously raise capital and reinvest returns without a fixed end date, offering ongoing investment opportunities and liquidity to investors. Closed lifespan funds have a defined term, typically 7-15 years, during which capital is committed, invested, and eventually liquidated for distribution to investors. The primary distinction lies in their structure: evergreen funds allow perpetual capital deployment, while closed lifespan funds operate within a finite timeframe, impacting liquidity, capital raising, and exit strategies.

Liquidity and Redemption Terms

Evergreen Funds offer continuous capital raising with flexible liquidity options, allowing investors to redeem shares periodically, often quarterly or annually, depending on fund terms. Closed Lifespan Funds have a fixed duration, typically 7-12 years, with limited liquidity and redemption opportunities only at the fund's termination or specific liquidity events. Investors seeking regular access to their capital prefer Evergreen Funds, while those favoring long-term investments accept the redemption restrictions of Closed Lifespan Funds.

Investment Horizon and Return Profiles

Evergreen funds offer an open-ended investment horizon, allowing continuous capital inflow and reinvestment, which supports long-term growth and flexibility in portfolio adjustments. Closed lifespan funds have a fixed term, typically ranging from 7 to 12 years, creating a defined exit strategy that often targets accelerated returns within a specific timeframe. Investment returns in evergreen funds tend to be more stable and compounded over time, while closed lifespan funds aim for higher, time-constrained gains aligned with their predetermined lifecycle.

Fund Management Flexibility

Evergreen Funds offer fund management flexibility by allowing continuous capital inflows and outflows without a fixed end date, enabling ongoing investment opportunities and portfolio adjustments. Closed Lifespan Funds operate with a predetermined duration, limiting flexibility in managing capital as funds are typically locked until maturity, restricting the ability to adapt to market changes. This fundamental difference impacts liquidity management, strategic reallocation, and responsiveness to market conditions within each fund type.

Investor Suitability and Target Profiles

Evergreen funds are ideal for investors seeking continuous capital deployment with flexible redemption schedules, typically appealing to those prioritizing long-term growth and liquidity. Closed lifespan funds suit investors with defined investment horizons aiming for targeted returns within a fixed period, often aligning with institutional or high-net-worth profiles seeking structured exit strategies. Both fund types cater to different risk tolerances and liquidity needs, making investor suitability contingent on individual financial goals and timeframes.

Regulatory Considerations and Compliance

Evergreen funds operate with ongoing capital raising and redemption, requiring continuous regulatory oversight to ensure compliance with investor disclosure and liquidity management rules under frameworks like the SEC's Investment Company Act. Closed lifespan funds have a fixed term, prompting strict adherence to regulatory timelines for capital deployment, distributions, and winding up, with compliance focused on meeting predefined milestones and investor notification obligations. Both fund types must navigate distinct regulatory environments, aligning governance structures and reporting protocols to their respective operational lifecycles.

Choosing the Right Fund Structure for Your Investment Goals

Evergreen funds offer continuous fundraising and flexible exit options, making them ideal for investors seeking long-term, adaptable capital deployment. Closed lifespan funds operate on a fixed term with predetermined exit strategies, suitable for investors aiming for defined time horizons and structured returns. Selecting the right fund structure depends on your investment timeline, liquidity preferences, and risk tolerance.

Important Terms

Perpetual Capital

Perpetual Capital typically operates through Evergreen Funds, which allow continuous capital inflow and flexible investment horizons, contrasting with Closed Lifespan Funds that have fixed terms and predetermined exit strategies.

Fixed-Term Fund

Fixed-Term Funds have a predetermined lifespan, allowing investors to anticipate the fund's exit strategy and return timeline, unlike Evergreen Funds which operate with no fixed end date and continuously accept new capital. Closed Lifespan Funds share similarities with Fixed-Term Funds in their defined duration but often focus on specific investment horizons, while Evergreen Funds prioritize flexibility and ongoing capital deployment.

Rolling Fund Structure

A rolling fund structure continuously raises capital through periodic subscriptions enabling evergreen fund characteristics with ongoing investment capacity, unlike closed lifespan funds which have a fixed fundraising period and finite lifecycle.

Redemption Cycle

Redemption cycles in evergreen funds offer ongoing liquidity allowing investors to redeem shares periodically, whereas closed lifespan funds have fixed redemption windows aligned with the fund's predetermined term, limiting investor exit options until maturity.

Capital Recycling

Capital recycling enhances investment agility by allowing Evergreen Funds to reinvest proceeds continuously, unlike Closed Lifespan Funds that distribute returns upon exit and cease operations. This dynamic recycling mechanism in Evergreen Funds supports sustained asset growth and portfolio diversification, optimizing long-term capital efficiency.

Wind-down Period

A wind-down period in an evergreen fund involves gradual asset liquidation while allowing ongoing capital commitments, contrasting with closed lifespan funds that have fixed terms and a predetermined exit strategy. Evergreen funds offer continuous investment opportunities, whereas closed lifespan funds enforce structured distributions and final liquidation schedules.

Evergreen Commitments

Evergreen Commitments in Evergreen Funds allow continuous capital recycling and indefinite investment periods, contrasting with Closed Lifespan Funds that have fixed terms and limited capital deployment windows.

Sunset Clause

The Sunset Clause in investment funds mandates a predefined termination date, ensuring that Closed Lifespan Funds liquidate assets and return capital to investors, contrasting with Evergreen Funds which allow continuous fundraising and indefinite operation. This clause provides a clear exit strategy, enhancing investor certainty by limiting the fund's lifespan and aligning with specific investment horizons.

Reinvestment Strategy

Evergreen funds enable perpetual reinvestment of returns to support ongoing growth, whereas closed lifespan funds distribute returns at maturity, limiting reinvestment opportunities.

Terminal Distribution

Terminal distribution in Evergreen Funds occurs continuously without a fixed end date, whereas Closed Lifespan Funds execute terminal distributions at the fund's predetermined expiration, marking the final return of capital to investors.

Evergreen Fund vs Closed Lifespan Fund Infographic

moneydif.com

moneydif.com