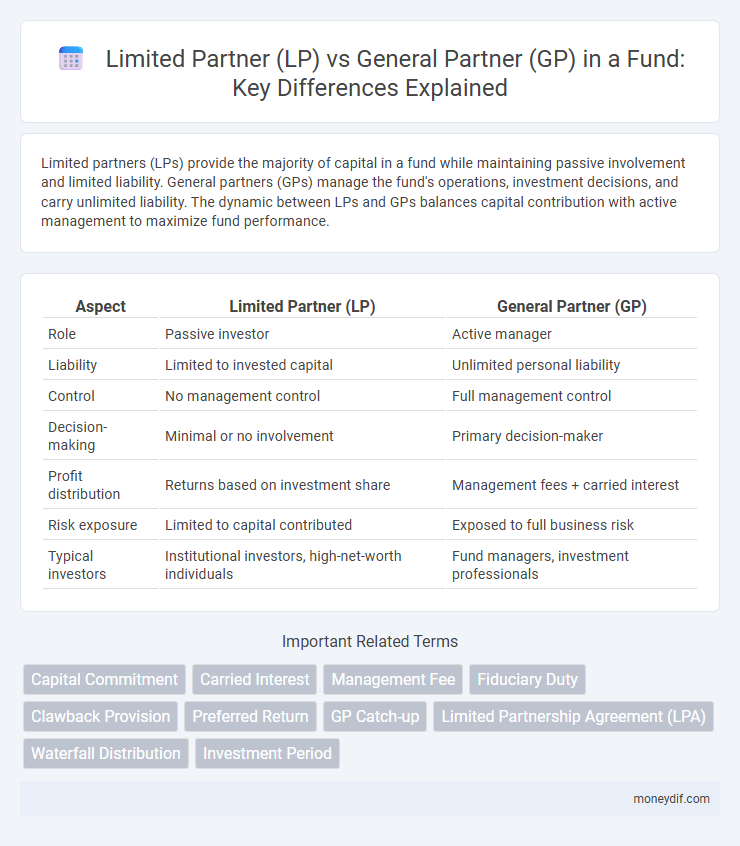

Limited partners (LPs) provide the majority of capital in a fund while maintaining passive involvement and limited liability. General partners (GPs) manage the fund's operations, investment decisions, and carry unlimited liability. The dynamic between LPs and GPs balances capital contribution with active management to maximize fund performance.

Table of Comparison

| Aspect | Limited Partner (LP) | General Partner (GP) |

|---|---|---|

| Role | Passive investor | Active manager |

| Liability | Limited to invested capital | Unlimited personal liability |

| Control | No management control | Full management control |

| Decision-making | Minimal or no involvement | Primary decision-maker |

| Profit distribution | Returns based on investment share | Management fees + carried interest |

| Risk exposure | Limited to capital contributed | Exposed to full business risk |

| Typical investors | Institutional investors, high-net-worth individuals | Fund managers, investment professionals |

Introduction to Fund Structures: LP vs GP

Limited partners (LPs) primarily act as investors contributing capital to a fund while having limited liability and no involvement in day-to-day management. General partners (GPs) manage fund operations, make investment decisions, and bear unlimited liability. This LP-GP structure balances risk and control, with LPs receiving profits and GPs earning management fees and carried interest.

Defining Limited Partners (LP)

Limited Partners (LPs) in a fund contribute capital but do not manage daily operations, providing limited liability protection up to their invested amount. Their role is primarily passive, benefiting from potential returns without bearing responsibility for the fund's debts or legal obligations. This structure allows LPs to diversify investments across multiple funds while minimizing personal risk.

Understanding General Partners (GP)

General Partners (GPs) manage the fund's day-to-day operations, make investment decisions, and assume unlimited liability for the fund's obligations. They are responsible for sourcing deals, conducting due diligence, and guiding portfolio companies to maximize returns. Unlike Limited Partners (LPs), GPs actively control the fund and earn a management fee plus carried interest based on the fund's performance.

Key Roles and Responsibilities: LP vs GP

Limited Partners (LPs) primarily provide capital to the fund and have limited liability, with no involvement in daily operations or management decisions. General Partners (GPs) actively manage the fund, making investment decisions, handling portfolio companies, and assuming full liability for the fund's obligations. GPs also bear responsibility for reporting to LPs and ensuring compliance with regulatory requirements.

Investment Decision-Making: Who Holds the Power?

Limited partners (LPs) typically provide the capital but have limited influence on day-to-day investment decisions, leaving control primarily to general partners (GPs). General partners hold the authority to make investment choices, manage portfolio companies, and execute the fund's strategy. This structural division ensures GPs drive operational decisions while LPs maintain a passive role, mainly overseeing performance through reporting and governance rights.

Risk and Liability Differences between LP and GP

Limited partners (LPs) possess limited liability, meaning their financial risk is confined to their capital contributions without personal responsibility for the fund's debts or obligations. General partners (GPs) face unlimited liability, bearing full personal responsibility for all fund liabilities and operational risks. This distinction significantly influences investor risk exposure and management control within private equity or venture capital funds.

Profit Distribution and Fee Structures

Limited partners (LPs) primarily receive profit distributions based on their capital contributions, typically through preferred returns or carried interest, while general partners (GPs) earn management fees--usually around 2% of committed capital--and a larger share of carried interest, often 20% of profits. Profit distribution structures favor LPs with priority returns before GPs participate in excess gains, aligning incentives but emphasizing GPs' compensation through fees for fund management and performance. This fee and profit-sharing model balances risk and reward between LPs, who provide capital, and GPs, who manage investments and drive fund performance.

Legal and Regulatory Considerations

Limited partners (LPs) typically have limited liability and passive roles in fund management, whereas general partners (GPs) assume full legal responsibility and operational control, making them subject to more stringent regulatory obligations. LPs are often protected under securities laws and benefit from exemption provisions, while GPs must comply with fiduciary duties, registration requirements, and ongoing disclosure mandates under relevant securities regulations such as the Investment Advisers Act. The allocation of legal risks and regulatory compliance protocols between LPs and GPs is a critical factor in fund structuring and governance.

Typical Investor Profiles: LP and GP

Limited Partners (LPs) typically consist of institutional investors, such as pension funds, endowments, and family offices, seeking passive investment opportunities with limited liability. General Partners (GPs) are usually experienced fund managers or firms responsible for active management, decision-making, and operational oversight of the fund. LPs provide the majority of capital, while GPs contribute expertise and manage daily activities in pursuit of targeted returns.

Conclusion: Choosing the Right Role in Fund Investments

Limited partners (LPs) provide capital and enjoy limited liability without active management responsibilities, while general partners (GPs) manage the fund, make investment decisions, and assume unlimited liability. Selecting the appropriate role depends on one's risk tolerance, desired involvement level, and expertise in fund management. Investors seeking passive income with lower risk typically choose LP status, whereas experienced professionals aiming for control and higher returns often prefer the GP role.

Important Terms

Capital Commitment

Capital commitment represents the total amount a limited partner (LP) agrees to invest in a private equity or venture capital fund, which the general partner (GP) calls upon over time for investments and fund expenses. The LP's capital commitment is legally binding, while the GP's role involves managing those committed funds, deploying capital strategically, and making investment decisions on behalf of the fund.

Carried Interest

Carried interest represents the share of profits that general partners (GPs) earn as an incentive beyond their capital contribution, typically around 20%, in private equity and venture capital funds. Limited partners (LPs) primarily receive returns based on their capital investment without participating in carried interest, reinforcing the GP's role in fund management and performance-driven rewards.

Management Fee

Management fees are typically charged by the general partner (GP) to cover operational expenses and are a percentage of the committed capital, usually around 2%, while limited partners (LPs) are the investors who pay these fees but do not participate in daily management. The GP uses management fees to fund deal sourcing, portfolio management, and administrative costs, aligning their interests with LPs through profit-sharing mechanisms like carried interest.

Fiduciary Duty

Limited partners (LPs) in a partnership primarily hold a fiduciary duty to act in good faith and avoid gross negligence, while general partners (GPs) bear broader fiduciary responsibilities including the duty of loyalty, care, and full disclosure in managing the partnership's affairs. GPs must prioritize the partnership's interests above personal gain, actively managing liabilities and assets, whereas LPs typically have limited control but are protected from personal liability beyond their investment.

Clawback Provision

The Clawback Provision in private equity ensures that the General Partner (GP) returns excess carried interest to Limited Partners (LPs) if the overall fund performance falls below a certain threshold, aligning GP incentives with LP returns. This mechanism protects LPs by requiring GPs to repay disproportionate profits, maintaining fairness in profit distribution over the fund lifecycle.

Preferred Return

Preferred return is the minimum annual return that limited partners (LPs) receive before general partners (GPs) participate in profit-sharing, ensuring LPs recover initial investments with priority. This hurdle rate aligns interests by compensating LPs for risk and incentivizing GPs to achieve superior fund performance beyond the preferred return threshold.

GP Catch-up

GP Catch-up clauses enable general partners (GPs) to receive a larger share of profits after limited partners (LPs) achieve their preferred return, aligning incentives and ensuring GPs capture performance fees. This mechanism balances risk and reward distribution by prioritizing LP returns before GPs increase their compensation beyond the initial agreement.

Limited Partnership Agreement (LPA)

A Limited Partnership Agreement (LPA) defines the roles, rights, and obligations of Limited Partners (LPs) and General Partners (GPs) in a partnership, where LPs typically contribute capital and have limited liability, while GPs manage the business operations and bear unlimited liability. The LPA outlines profit distribution, decision-making authority, and exit conditions to protect LP interests and grant GPs operational control.

Waterfall Distribution

Waterfall distribution in private equity defines the order in which returns are allocated between limited partners (LPs) and general partners (GPs), prioritizing LPs' return of capital and preferred returns before GPs receive carried interest. This structured payout mechanism ensures LPs recover their investments and hurdle rates prior to GPs sharing in the remaining profits, aligning incentives between both parties.

Investment Period

The investment period, typically ranging from three to five years, defines when general partners (GPs) actively deploy capital from limited partners (LPs) into portfolio companies to generate returns. Limited partners commit capital upfront but have restricted control during this phase, while general partners manage investments and operational decisions to optimize fund performance within the defined timeline.

limited partner (LP) vs general partner (GP) Infographic

moneydif.com

moneydif.com