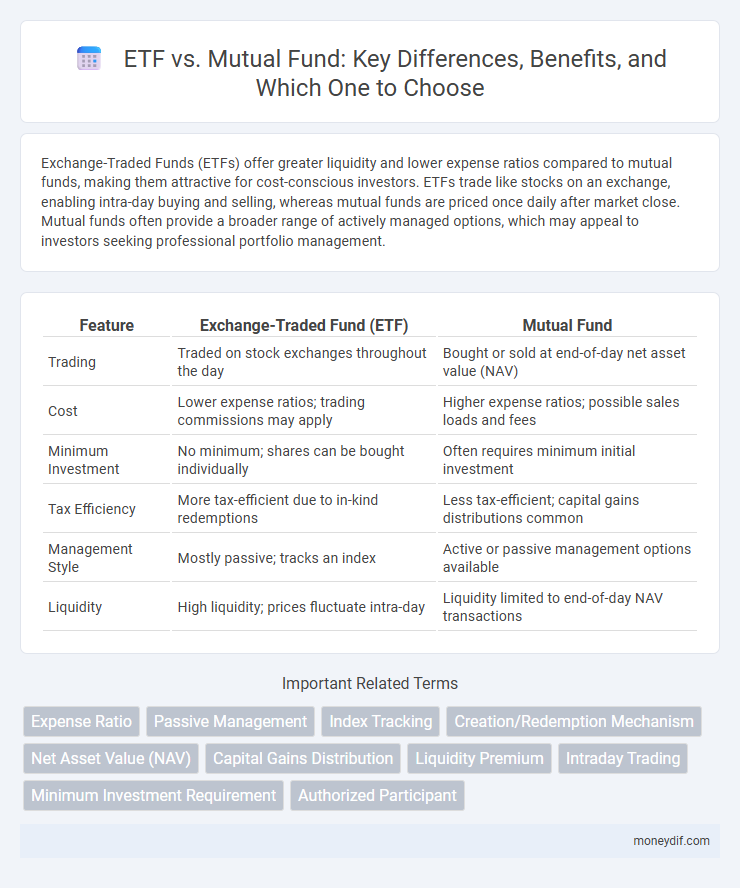

Exchange-Traded Funds (ETFs) offer greater liquidity and lower expense ratios compared to mutual funds, making them attractive for cost-conscious investors. ETFs trade like stocks on an exchange, enabling intra-day buying and selling, whereas mutual funds are priced once daily after market close. Mutual funds often provide a broader range of actively managed options, which may appeal to investors seeking professional portfolio management.

Table of Comparison

| Feature | Exchange-Traded Fund (ETF) | Mutual Fund |

|---|---|---|

| Trading | Traded on stock exchanges throughout the day | Bought or sold at end-of-day net asset value (NAV) |

| Cost | Lower expense ratios; trading commissions may apply | Higher expense ratios; possible sales loads and fees |

| Minimum Investment | No minimum; shares can be bought individually | Often requires minimum initial investment |

| Tax Efficiency | More tax-efficient due to in-kind redemptions | Less tax-efficient; capital gains distributions common |

| Management Style | Mostly passive; tracks an index | Active or passive management options available |

| Liquidity | High liquidity; prices fluctuate intra-day | Liquidity limited to end-of-day NAV transactions |

Overview of Exchange-Traded Funds (ETFs) and Mutual Funds

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering real-time pricing and intraday liquidity, while Mutual Funds are pooled investment vehicles priced once daily after market close. ETFs typically have lower expense ratios and greater tax efficiency compared to Mutual Funds, making them attractive for cost-conscious investors. Mutual Funds provide professional management and automatic reinvestment options, making them suitable for long-term, hands-off investing.

Key Structural Differences Between ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) trade on stock exchanges throughout the day with real-time pricing, while mutual funds are priced once daily after market close. ETFs offer intraday liquidity and typically have lower expense ratios compared to mutual funds, which may have higher fees due to active management and load charges. Structural differences also include ETFs being passively managed with portfolio transparency, whereas mutual funds often involve active management and less frequent disclosure of holdings.

Investment Strategies: ETFs vs Mutual Funds

Exchange-Traded Funds (ETFs) typically employ passive investment strategies by tracking specific indexes, offering lower expense ratios and intraday trading flexibility. Mutual Funds often use active management strategies aiming to outperform benchmarks through selective stock picking, resulting in higher fees and less trading liquidity. Investors choose ETFs for cost-efficiency and transparency, while Mutual Funds attract those seeking professional active management and potential for market outperformance.

Costs and Fees Comparison

Exchange-Traded Funds (ETFs) typically have lower expense ratios averaging around 0.10% to 0.50%, compared to mutual funds which often charge between 0.50% and 1.50% annually. ETFs incur trading commissions and bid-ask spreads, while mutual funds usually apply front-end or back-end loads along with higher management fees. Investors should consider both expense ratios and additional transaction costs when comparing overall fund expenses.

Liquidity and Trading Flexibility

Exchange-Traded Funds (ETFs) offer higher liquidity as they trade on stock exchanges throughout the day, allowing investors to buy and sell shares at market prices instantly. Mutual funds, by contrast, are priced once daily after market close, limiting the ability to trade on intraday price movements. This intraday trading flexibility makes ETFs more suitable for active investors seeking to capitalize on real-time market fluctuations.

Tax Efficiency and Implications

Exchange-Traded Funds (ETFs) typically offer greater tax efficiency compared to Mutual Funds due to their unique creation and redemption mechanism, which limits capital gains distributions. Mutual Funds often incur higher capital gains taxes as they must sell securities to meet redemptions, triggering taxable events for investors. Investors seeking tax-advantaged portfolios frequently prefer ETFs to minimize annual tax liabilities and enhance after-tax returns.

Performance Tracking and Benchmarking

Exchange-Traded Funds (ETFs) typically offer more precise performance tracking of their underlying indices due to their passive management and real-time market pricing, which allows investors to closely match benchmark returns. Mutual funds often experience tracking errors and delayed pricing since they are actively managed and priced at the end of the trading day, leading to potential deviations from benchmark performance. The tighter correlation between ETFs and their benchmarks enhances transparency and cost-efficiency in portfolio management compared to most mutual funds.

Transparency and Reporting Standards

Exchange-Traded Funds (ETFs) offer greater transparency by disclosing their daily holdings, enabling investors to track assets and market value in real-time. Mutual Funds typically report holdings quarterly, which can delay visibility into portfolio composition and affect timely decision-making. Regulatory frameworks like the SEC's requirement for ETF disclosure enhance transparency and investor confidence compared to traditional mutual fund reporting standards.

Suitability for Different Types of Investors

Exchange-Traded Funds (ETFs) offer greater flexibility with intraday trading and lower expense ratios, making them suitable for active investors seeking cost efficiency and market timing opportunities. Mutual Funds provide professional management and are ideal for investors preferring a hands-off approach with automatic reinvestment and systematic investment plans. Investors focused on diversification and long-term growth may prefer mutual funds, while those valuing liquidity and lower fees often opt for ETFs.

Pros and Cons Summary: ETF vs Mutual Fund

Exchange-Traded Funds (ETFs) offer intraday trading flexibility, lower expense ratios, and tax efficiency compared to Mutual Funds, which are priced only once at the end of the day and often carry higher fees. Mutual Funds provide professional management and potential access to a broader range of asset classes but tend to have minimum investment requirements and less tax efficiency. Investors seeking liquidity and cost-effectiveness may prefer ETFs, while those prioritizing active management and diverse options might favor Mutual Funds.

Important Terms

Expense Ratio

Expense ratios for Exchange-Traded Funds (ETFs) typically range from 0.05% to 0.75%, often lower than Mutual Funds, which average between 0.50% and 1.50%, impacting long-term investment returns significantly.

Passive Management

Passive management in Exchange-Traded Funds (ETFs) involves tracking a specific index with minimal portfolio changes, resulting in lower expense ratios compared to active Mutual Funds. ETFs provide intraday trading flexibility and tax efficiency through in-kind redemptions, whereas Mutual Funds typically trade once daily and may incur higher capital gains distributions.

Index Tracking

Index tracking through Exchange-Traded Funds (ETFs) offers lower expense ratios and intraday trading flexibility compared to traditional Mutual Funds, which typically have higher fees and are priced only at market close.

Creation/Redemption Mechanism

The creation/redemption mechanism in Exchange-Traded Funds (ETFs) allows authorized participants to exchange large blocks of shares, known as creation units, directly with the ETF issuer in return for underlying securities, enhancing liquidity and enabling intraday trading. Mutual funds do not utilize this process; instead, investors buy and redeem shares directly from the fund at the end of the trading day at the net asset value (NAV), limiting trading flexibility and potentially increasing transaction costs.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of an Exchange-Traded Fund (ETF) or Mutual Fund, calculated by dividing the total value of the fund's assets minus liabilities by the number of outstanding shares. ETFs typically trade at prices close to their NAV due to arbitrage mechanisms, whereas Mutual Funds are bought and sold based solely on their end-of-day NAV pricing.

Capital Gains Distribution

Capital gains distribution in Exchange-Traded Funds (ETFs) is typically lower compared to Mutual Funds due to the ETF's in-kind redemption process, which minimizes taxable events. Mutual Funds often generate higher capital gains distributions through the sale of securities to meet shareholder redemptions, leading to potential tax liabilities for investors.

Liquidity Premium

Liquidity premium in Exchange-Traded Funds (ETFs) tends to be lower due to their continuous trading on secondary markets, allowing investors to buy and sell shares throughout the trading day with narrower bid-ask spreads. Mutual funds often exhibit higher liquidity premiums because transactions occur only at end-of-day net asset values (NAV), limiting trading flexibility and potentially increasing transaction costs.

Intraday Trading

Intraday trading of Exchange-Traded Funds (ETFs) offers greater liquidity and real-time price fluctuations, enabling traders to capitalize on short-term market movements compared to mutual funds, which are priced only once at the end of the trading day and lack intraday trading flexibility. The ability to execute instant buy and sell orders in ETFs makes them more suitable for active traders seeking intraday opportunities, whereas mutual funds are typically more aligned with long-term investment strategies.

Minimum Investment Requirement

Exchange-Traded Funds (ETFs) typically have no minimum investment requirement beyond the price of one share, making them accessible for individual investors with limited capital. In contrast, mutual funds often impose minimum investments ranging from $500 to $3,000 or more, which can be a barrier for some investors seeking diversification.

Authorized Participant

Authorized Participants (APs) play a crucial role in the creation and redemption process of Exchange-Traded Funds (ETFs), enabling liquidity and price alignment with the underlying assets, a mechanism absent in mutual funds where transactions occur directly with the fund at the end-of-day net asset value (NAV). This difference allows ETFs to trade intraday on exchanges like stocks, while mutual funds are priced and traded once daily after market close.

Exchange-Traded Fund (ETF) vs Mutual Fund Infographic

moneydif.com

moneydif.com