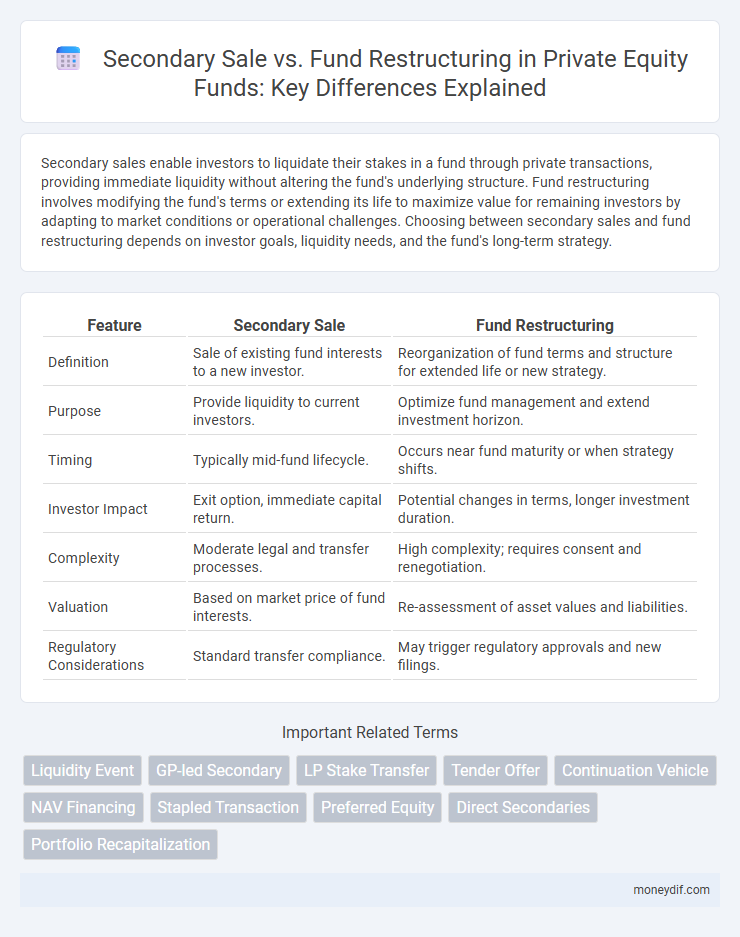

Secondary sales enable investors to liquidate their stakes in a fund through private transactions, providing immediate liquidity without altering the fund's underlying structure. Fund restructuring involves modifying the fund's terms or extending its life to maximize value for remaining investors by adapting to market conditions or operational challenges. Choosing between secondary sales and fund restructuring depends on investor goals, liquidity needs, and the fund's long-term strategy.

Table of Comparison

| Feature | Secondary Sale | Fund Restructuring |

|---|---|---|

| Definition | Sale of existing fund interests to a new investor. | Reorganization of fund terms and structure for extended life or new strategy. |

| Purpose | Provide liquidity to current investors. | Optimize fund management and extend investment horizon. |

| Timing | Typically mid-fund lifecycle. | Occurs near fund maturity or when strategy shifts. |

| Investor Impact | Exit option, immediate capital return. | Potential changes in terms, longer investment duration. |

| Complexity | Moderate legal and transfer processes. | High complexity; requires consent and renegotiation. |

| Valuation | Based on market price of fund interests. | Re-assessment of asset values and liabilities. |

| Regulatory Considerations | Standard transfer compliance. | May trigger regulatory approvals and new filings. |

Introduction to Secondary Sale and Fund Restructuring

Secondary sale involves the transfer of existing fund interests or assets between investors, allowing liquidity without altering the fund's structure. Fund restructuring entails modifying the terms, duration, or governance of a fund to address challenges like underperformance or investor demands. Both strategies provide pathways for managing investment portfolios, balancing liquidity needs and operational flexibility.

Defining Secondary Sales in Private Funds

Secondary sales in private funds involve the transfer of existing limited partnership interests from one investor to another, allowing liquidity without altering the fund's original terms or asset allocation. These transactions provide investors an exit opportunity before fund maturity, typically facilitated through negotiated agreements or secondary market platforms. Unlike fund restructuring, secondary sales do not modify the fund's structure or management but enable portfolio rebalancing and capital redeployment within the private equity ecosystem.

Understanding Fund Restructuring: Key Concepts

Fund restructuring involves altering the terms, duration, or structure of an existing investment fund to address issues such as underperformance, liquidity constraints, or investor demands. This process often includes negotiating new agreements, adjusting asset allocations, and potentially extending the fund's life to maximize remaining value for stakeholders. Understanding these key concepts is essential for investors considering fund restructuring as an alternative to secondary sales, which involve transferring existing fund interests to new buyers without altering the fund's structure.

Primary Differences Between Secondary Sale and Fund Restructuring

Secondary sale involves the direct transfer of existing ownership interests in a fund from one investor to another, typically enabling liquidity for the seller without altering the fund's underlying structure or strategy. Fund restructuring, on the other hand, entails comprehensive changes such as extending the fund's life, modifying its terms, or recapitalizing assets to optimize performance and align with investors' evolving objectives. The primary differences lie in liquidity provision versus strategic realignment, with secondary sales focused on ownership transfer and fund restructuring centered on operational and structural modifications.

Motivations for Pursuing Secondary Sales

Secondary sales provide liquidity to limited partners seeking to exit before fund maturity, enabling portfolio rebalancing and risk management. Investors pursue secondary sales to optimize capital allocation, respond to shifting market conditions, or meet regulatory and compliance requirements. Unlike fund restructuring, secondary sales offer immediate cash realization without altering the fund's fundamental structure or governance.

Common Triggers for Fund Restructuring

Common triggers for fund restructuring include significant changes in market conditions, underperformance of portfolio assets, and shifts in regulatory environments. Secondary sales often occur when limited partners seek liquidity, while restructuring typically addresses prolonged fund life extensions, alignment of interests, or strategic shifts in investment objectives. These events aim to optimize fund value, manage risk, and enhance returns for all stakeholders.

Process Overview: Secondary Sale vs Fund Restructuring

Secondary sale involves the transfer of existing investor commitments or fund interests to new buyers, facilitating liquidity without altering the fund's original terms. Fund restructuring modifies the fund's legal or economic framework, such as extending duration or changing fee structures, requiring consent from investors and often regulatory approvals. Understanding the procedural nuances, including documentation, approvals, and valuation, is crucial for effective secondary sales and fund restructurings.

Benefits and Drawbacks of Each Strategy

Secondary sale offers immediate liquidity for investors by enabling the sale of fund interests to new buyers, reducing exposure to illiquid assets but may involve discounts impacting returns. Fund restructuring allows continuity of investment by modifying terms or extending duration, preserving value and avoiding forced sales but can face complexities in stakeholder agreement and regulatory approval. Weighing these strategies involves balancing short-term cash needs against long-term investment goals and operational flexibility.

Regulatory and Legal Considerations

Secondary sales involve the transfer of existing fund interests to new investors, requiring compliance with securities regulations such as the Securities Act of 1933 and adherence to transfer restrictions outlined in fund agreements. Fund restructuring entails amendments to the fund's terms, often triggering regulatory scrutiny under the Investment Company Act of 1940 and necessitating shareholder approvals to avoid breaches of fiduciary duties. Both processes must carefully navigate disclosure requirements and anti-fraud provisions enforced by the SEC to ensure legal compliance and mitigate potential litigation risks.

Choosing the Right Strategy for Investors and Fund Managers

Secondary sales offer investors liquidity by enabling the transfer of fund interests to third parties, often at a discount reflecting market demand and asset performance. Fund restructuring involves modifying the fund's terms or extending its life to maximize returns, which benefits long-term investors and aligns interests with fund managers. Selecting the right strategy depends on factors such as investor liquidity needs, fund performance, and the potential impact on net asset value.

Important Terms

Liquidity Event

A liquidity event enables stakeholders to convert equity into cash through secondary sales or fund restructuring that adjusts investment terms and asset allocations.

GP-led Secondary

GP-led secondary transactions often encompass secondary sales and fund restructurings, where secondary sales involve direct asset sales to new investors, while fund restructurings realign LP interests and extend fund life cycles.

LP Stake Transfer

LP stake transfer in secondary sales facilitates liquidity for investors, while fund restructuring involves reallocating LP interests to optimize fund management and align stakeholder objectives.

Tender Offer

Tender offers in secondary sales enable shareholders to sell their stakes directly to an acquiring entity, facilitating liquidity without altering the fund structure. In contrast, fund restructuring involves reorganizing the fund's assets or terms, often blending secondary sales with broader changes to optimize investment returns and governance.

Continuation Vehicle

Continuation vehicles facilitate secondary sales by enabling fund restructuring that extends asset management beyond the original fund's term.

NAV Financing

NAV financing provides liquidity solutions for secondary sales by enabling investors to monetize fund interests, while fund restructuring optimizes capital allocation and extends investment horizons within private equity portfolios.

Stapled Transaction

Stapled transactions combine secondary sales of portfolio assets with concurrent primary fundraising, allowing investors to acquire existing stakes alongside commitments to new fund structures. This approach facilitates liquidity for current investors while enabling fund managers to restructure or raise additional capital through new fund vehicles.

Preferred Equity

Preferred equity in secondary sales typically offers liquidity to investors by enabling the transfer of ownership stakes, while fund restructuring adjusts the terms and capital structure to realign interests and optimize returns.

Direct Secondaries

Direct secondaries involve the secondary sale of individual private equity assets or stakes, contrasting with fund restructuring which reorganizes entire fund portfolios to optimize performance and liquidity.

Portfolio Recapitalization

Portfolio recapitalization involves secondary sales where limited partners sell stakes to new investors, whereas fund restructuring modifies fund terms to extend duration or adjust investment strategy.

Secondary Sale vs Fund Restructuring Infographic

moneydif.com

moneydif.com