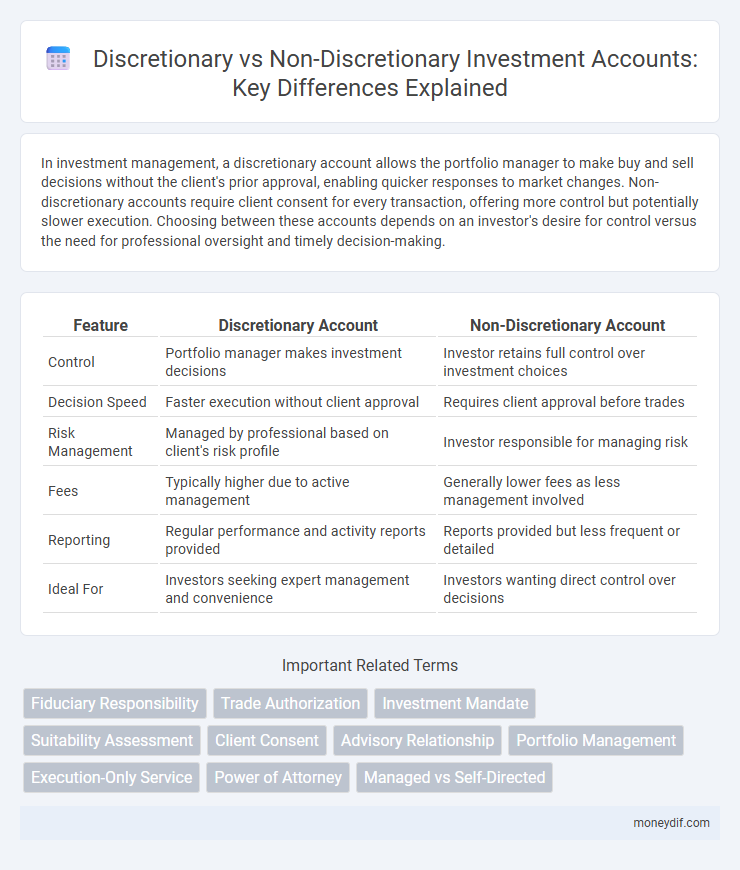

In investment management, a discretionary account allows the portfolio manager to make buy and sell decisions without the client's prior approval, enabling quicker responses to market changes. Non-discretionary accounts require client consent for every transaction, offering more control but potentially slower execution. Choosing between these accounts depends on an investor's desire for control versus the need for professional oversight and timely decision-making.

Table of Comparison

| Feature | Discretionary Account | Non-Discretionary Account |

|---|---|---|

| Control | Portfolio manager makes investment decisions | Investor retains full control over investment choices |

| Decision Speed | Faster execution without client approval | Requires client approval before trades |

| Risk Management | Managed by professional based on client's risk profile | Investor responsible for managing risk |

| Fees | Typically higher due to active management | Generally lower fees as less management involved |

| Reporting | Regular performance and activity reports provided | Reports provided but less frequent or detailed |

| Ideal For | Investors seeking expert management and convenience | Investors wanting direct control over decisions |

Discretionary vs Non-Discretionary Accounts: Key Differences

Discretionary accounts allow financial advisors to make investment decisions without client approval, enabling faster responses to market changes, while non-discretionary accounts require client consent for each transaction, giving investors full control but potentially slower execution. The level of control and decision-making authority distinguishes discretionary accounts, which suit clients seeking professional management, from non-discretionary accounts, ideal for hands-on investors. Risk management also differs; discretionary accounts rely on advisor expertise, whereas non-discretionary accounts depend on the investor's direct involvement in choices.

Understanding Discretionary Accounts in Investment

Discretionary accounts allow investment managers to make trading decisions and execute transactions on behalf of clients without needing prior approval for each trade, providing convenience and swift action in fluctuating markets. These accounts typically involve a formal agreement outlining the scope of the manager's authority, aligning investment strategies with the client's risk tolerance and financial goals. Investors benefit from professional portfolio management, which can optimize asset allocation and capitalize on timely market opportunities.

What Is a Non-Discretionary Account?

A non-discretionary account is an investment account where the investor retains full control over all trading decisions, requiring the advisor's approval before executing any transactions. Investors in non-discretionary accounts actively participate in the selection of securities, investment strategies, and timing of trades, ensuring personalized decision-making aligned with their specific financial goals. This contrasts with discretionary accounts, where advisors have the authority to manage the portfolio without prior consent for each trade.

Pros and Cons of Discretionary Investment Accounts

Discretionary investment accounts allow portfolio managers to make trading decisions on behalf of clients, offering the advantage of professional expertise and timely market responses that can optimize returns. However, these accounts often come with higher management fees and reduced client control over individual investment choices, which may not suit investors who prefer direct involvement or customized strategies. The efficiency of discretionary accounts suits those seeking convenience and expertise, but it carries the risk of misalignment with personal investment goals if communication between client and manager is insufficient.

Advantages and Disadvantages of Non-Discretionary Accounts

Non-discretionary investment accounts provide clients with full control over trading decisions, ensuring personalized management aligned with their preferences and risk tolerance. However, this autonomy requires investors to be actively involved, potentially leading to missed opportunities or delayed responses in fast-moving markets. The lack of professional discretion can result in less efficient portfolio adjustments compared to discretionary accounts managed by experienced advisors.

Who Should Choose a Discretionary Account?

Investors seeking professional portfolio management with minimal daily involvement should choose a discretionary account, allowing advisors to make trading decisions on their behalf. High-net-worth individuals or those with complex financial situations benefit from the expertise and swift decision-making that discretionary accounts provide. Those preferring control over each trade or who want to stay actively involved in their investment choices may find a non-discretionary account more suitable.

Is a Non-Discretionary Account Right for You?

A non-discretionary account allows investors to retain full control over trading decisions, making it suitable for those who prefer active involvement and personalized strategies. This type of account requires constant communication with the advisor, ensuring all transactions are pre-approved, which appeals to individuals seeking transparency and control. Investors comfortable with making timely decisions and monitoring market conditions may find a non-discretionary account aligns better with their investment goals and risk tolerance.

Costs and Fees: Discretionary vs Non-Discretionary Accounts

Discretionary accounts typically involve higher management fees due to the active decision-making performed by financial advisors, which can range from 0.5% to 2% of assets under management annually. Non-discretionary accounts often incur lower costs since the advisor provides guidance without executing trades, thus reducing administrative and transaction fees. Investors should consider the trade-off between higher fees in discretionary accounts and the autonomy and potentially lower costs in non-discretionary accounts when managing investments.

Impact on Portfolio Management and Control

Discretionary accounts grant portfolio managers full authority to make investment decisions on behalf of clients, enabling swift responses to market changes and potentially optimizing portfolio performance. Non-discretionary accounts require client approval for each transaction, restricting manager autonomy and possibly delaying timely investment actions. This fundamental difference affects the level of control investors maintain versus the agility of portfolio management strategies.

How to Decide Between Discretionary and Non-Discretionary Accounts

Choosing between discretionary and non-discretionary investment accounts depends on the investor's level of involvement and control preferences. Discretionary accounts allow portfolio managers to make decisions and execute trades on behalf of clients, ideal for those seeking professional management without day-to-day oversight. Non-discretionary accounts require investor approval for each transaction, suited for individuals who want full control over investment decisions and direct involvement in their portfolio management.

Important Terms

Fiduciary Responsibility

Fiduciary responsibility in discretionary accounts requires financial advisors to actively manage investments and make decisions in the client's best interest without prior approval, while non-discretionary accounts demand advisor recommendations but leave final investment decisions to the client, emphasizing a different level of fiduciary duty. Understanding these distinctions is crucial for investors seeking tailored portfolio management that aligns with their risk tolerance and financial goals.

Trade Authorization

Trade Authorization in discretionary accounts grants the portfolio manager full authority to make investment decisions and execute trades without client approval, whereas in non-discretionary accounts, clients retain control and must approve each trade before execution. Regulatory compliance mandates clear documentation of trade authorization agreements to ensure transparency and protect client interests in both account types.

Investment Mandate

An Investment Mandate defines the specific guidelines and objectives tailored for managing a portfolio, crucial in distinguishing between discretionary and non-discretionary accounts. In discretionary accounts, the investment manager has full authority to make decisions within the mandate, whereas in non-discretionary accounts, the manager must obtain client approval before executing any trades, ensuring alignment with the investor's preferences and risk tolerance.

Suitability Assessment

Suitability assessment ensures client investment choices align with their financial goals, risk tolerance, and time horizon, crucial in discretionary accounts where advisors make decisions on behalf of clients, and non-discretionary accounts where clients retain control over trades. Regulatory standards mandate thorough suitability evaluations to protect investors from unsuitable investments and ensure fiduciary responsibility.

Client Consent

Client consent is mandatory when executing trades in a discretionary account, as the advisor has the authority to make decisions without prior approval, whereas in a non-discretionary account, explicit client consent is required for each trade before execution. Understanding the distinct consent requirements ensures compliance with regulatory standards and protects client autonomy in portfolio management.

Advisory Relationship

Advisory relationships in discretionary accounts empower advisors to make investment decisions and execute trades without prior client approval, leveraging their expertise for dynamic portfolio management. In non-discretionary accounts, advisors provide recommendations but must obtain client consent before implementing any transactions, ensuring client control over investment actions.

Portfolio Management

Discretionary accounts in portfolio management allow investment managers to make buy or sell decisions without client approval, enabling faster response to market changes and personalized strategy execution. Non-discretionary accounts require client consent for each transaction, maintaining investor control but potentially delaying investment actions and reducing agility in dynamic markets.

Execution-Only Service

Execution-only service involves clients making investment decisions without advisory input, contrasting with discretionary accounts where portfolio managers actively make decisions on behalf of clients. Non-discretionary accounts require client approval for transactions, while discretionary accounts enable managers to execute trades independently within agreed parameters.

Power of Attorney

A Power of Attorney (POA) for a discretionary account grants the agent full authority to make investment decisions and execute trades without client approval, enhancing flexibility and rapid response to market changes. In contrast, a POA linked to a non-discretionary account requires the agent to obtain the client's consent before any transaction, ensuring client control but potentially delaying investment actions.

Managed vs Self-Directed

A managed discretionary account allows investment managers to make decisions and execute trades on behalf of clients without prior approval, providing professional oversight and timely responses to market changes. In contrast, a self-directed non-discretionary account requires the investor's explicit consent for each transaction, offering full control but demanding active involvement and decision-making from the client.

Discretionary Account vs Non-Discretionary Account Infographic

moneydif.com

moneydif.com