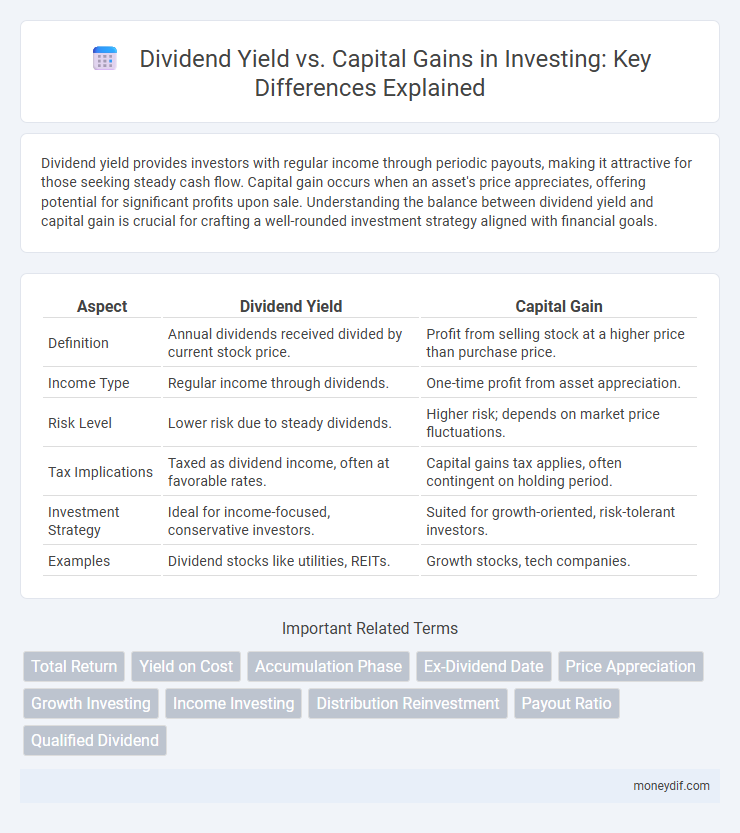

Dividend yield provides investors with regular income through periodic payouts, making it attractive for those seeking steady cash flow. Capital gain occurs when an asset's price appreciates, offering potential for significant profits upon sale. Understanding the balance between dividend yield and capital gain is crucial for crafting a well-rounded investment strategy aligned with financial goals.

Table of Comparison

| Aspect | Dividend Yield | Capital Gain |

|---|---|---|

| Definition | Annual dividends received divided by current stock price. | Profit from selling stock at a higher price than purchase price. |

| Income Type | Regular income through dividends. | One-time profit from asset appreciation. |

| Risk Level | Lower risk due to steady dividends. | Higher risk; depends on market price fluctuations. |

| Tax Implications | Taxed as dividend income, often at favorable rates. | Capital gains tax applies, often contingent on holding period. |

| Investment Strategy | Ideal for income-focused, conservative investors. | Suited for growth-oriented, risk-tolerant investors. |

| Examples | Dividend stocks like utilities, REITs. | Growth stocks, tech companies. |

Understanding Dividend Yield and Capital Gain

Dividend yield represents the annual dividend payment expressed as a percentage of the stock price, providing investors with a measurable income stream from their investments. Capital gain refers to the profit realized when selling a stock at a higher price than its purchase price, reflecting the appreciation of the asset. Understanding dividend yield and capital gain helps investors balance income generation with potential growth in portfolio value.

Key Differences Between Dividend Yield and Capital Gain

Dividend yield represents the annual dividend income as a percentage of the stock price, providing steady cash flow to investors, while capital gain reflects the profit realized from selling a stock at a higher price than its purchase cost. Dividend yield is crucial for income-focused investors seeking regular payouts, whereas capital gain appeals to growth-oriented investors prioritizing asset appreciation. The key difference lies in dividend yield delivering immediate returns through dividends, whereas capital gain offers potential long-term wealth accumulation through price increases.

How Dividend Yield Impacts Investment Returns

Dividend yield directly influences investment returns by providing a steady income stream, which can be reinvested to compound growth over time. High dividend yields often indicate financially stable companies that generate consistent profits, attracting income-focused investors. In comparison to capital gains, dividends offer more predictable returns, reducing portfolio volatility and enhancing long-term total return potential.

Capital Gain: Definition and Importance in Investing

Capital gain refers to the profit realized from the sale of an asset, such as stocks, when the selling price exceeds the purchase price. It plays a crucial role in investing as it directly impacts the overall return and wealth accumulation by capturing the asset's appreciation over time. Investors often prioritize capital gains for long-term growth strategies, leveraging market trends and company performance to maximize portfolio value.

Dividend Yield vs Capital Gain: Which Is More Tax-Efficient?

Dividend yield typically offers more tax efficiency than capital gains due to favorable tax treatment on qualified dividends, which are often taxed at lower rates compared to short-term capital gains. Capital gains tax rates vary based on the holding period, with long-term gains taxed more favorably than short-term gains, but reinvested dividends can compound tax advantages over time. Investors should consider individual tax brackets and holding periods when choosing between dividend yield and capital gain strategies to optimize after-tax returns.

Assessing Risk: Dividend Yield Compared to Capital Gain

Dividend yield offers a steady income stream, often preferred by risk-averse investors seeking predictable cash flow, whereas capital gain involves potential appreciation in stock price but with higher volatility and uncertainty. Assessing risk involves evaluating dividend stability, payout ratio, and company fundamentals against market conditions influencing capital gains. Balancing dividend yield and capital gain strategies helps diversify risk exposure and tailor investment portfolios to individual risk tolerance.

Suitability for Investors: Dividend Yield or Capital Gain

Dividend yield suits income-focused investors seeking regular cash flow from their investments, typically preferred by retirees or those needing steady income. Capital gain aligns with growth-oriented investors willing to accept market volatility for the potential of higher long-term returns. Understanding risk tolerance and financial goals is essential when choosing between dividend yield and capital gain strategies.

Long-Term Growth: Dividend Yield Versus Capital Gains

Dividend yield provides steady income through periodic payouts, appealing to investors seeking consistent cash flow, while capital gains focus on asset appreciation over time, often resulting in larger wealth accumulation. Long-term growth typically favors capital gains as reinvested earnings compound, driving significant portfolio value increases. Balancing dividend yield and capital gains aligns with diversified investment strategies optimizing both income and capital appreciation.

Market Conditions: When to Prioritize Dividend Yield or Capital Gain

Dividend yield becomes a priority in stable or declining market conditions where steady income and lower risk are valued by investors seeking consistent cash flow. Capital gain typically takes precedence in bullish or expanding markets, as rising stock prices offer higher potential returns through asset appreciation. Understanding market cycles and economic indicators enables investors to balance dividend yield and capital gain strategies effectively.

Building a Balanced Portfolio: Integrating Dividend Yield and Capital Gain

A balanced investment portfolio integrates dividend yield and capital gain to optimize total returns while managing risk. High dividend yield stocks provide steady income and stability, whereas capital gain-focused assets offer growth potential through price appreciation. Combining these strategies allows investors to achieve income generation and wealth accumulation, enhancing portfolio diversification and resilience.

Important Terms

Total Return

Total Return combines Dividend Yield and Capital Gain to measure the full investment performance, reflecting income from dividends plus appreciation in stock price. While Dividend Yield provides immediate cash flow, Capital Gain represents the increase in asset value, and their balance influences overall portfolio growth.

Yield on Cost

Yield on Cost (YOC) measures the dividend return based on the original investment price, highlighting income growth over time, while Dividend Yield compares current dividend income to the current market price, emphasizing the stock's income-generating efficiency. Capital Gain reflects the price appreciation of the stock itself, impacting total return but not directly influencing the Yield on Cost calculation.

Accumulation Phase

The Accumulation Phase in investing focuses on maximizing capital gains by reinvesting earnings rather than prioritizing dividend yield, which provides steady income but slower portfolio growth. Investors in this phase emphasize growth stocks with lower dividend payouts to build wealth over time through price appreciation.

Ex-Dividend Date

The ex-dividend date determines eligibility for receiving a dividend, impacting the dividend yield by signaling when a stock begins trading without the upcoming dividend price adjustment. Investors focusing on dividend yield prioritize stocks on or before the ex-dividend date for income, whereas those targeting capital gains may buy after this date, anticipating price appreciation rather than immediate dividend income.

Price Appreciation

Price appreciation refers to the increase in the value of an asset over time, which contributes to capital gains realized when the asset is sold. Investors often compare dividend yield, indicating income return from dividends, against capital gain potential driven by price appreciation to balance income and growth objectives in their portfolios.

Growth Investing

Growth investing focuses on capital gains by targeting companies with high potential for earnings expansion, often resulting in lower or no dividend yields. Investors prioritize stock price appreciation over immediate income, contrasting with dividend yield strategies that emphasize steady income through regular dividend payments.

Income Investing

Income investing focuses on generating steady cash flow primarily through dividend yield, which provides regular income from shares of established companies with consistent payouts. Capital gain complements this strategy by offering potential asset appreciation, but income investors prioritize high dividend yield for reliable returns over time.

Distribution Reinvestment

Distribution reinvestment amplifies total returns by converting dividend yields into additional shares, enhancing compounding effects compared to relying solely on capital gains. Investors focusing on dividend yield benefit from reinvested distributions, which can outperform pure capital appreciation strategies over time.

Payout Ratio

Payout ratio measures the proportion of earnings distributed as dividends relative to the dividend yield, highlighting the income portion of total shareholder returns compared to capital gain potential. A high payout ratio often signals steady dividend income but may limit reinvestment for growth, potentially reducing capital gains, whereas a lower payout ratio can indicate greater retained earnings for capital appreciation.

Qualified Dividend

Qualified dividends, taxed at favorable long-term capital gains rates, often enhance total shareholder returns when combined with dividend yield, providing a more tax-efficient income stream compared to ordinary dividends. Investors balance dividend yield against potential capital gains to optimize after-tax returns, influencing portfolio allocation between growth and income-focused stocks.

Dividend Yield vs Capital Gain Infographic

moneydif.com

moneydif.com