A haircut refers to the percentage reduction applied to the value of an asset used as collateral to protect lenders against market volatility, ensuring the loan remains adequately secured. A margin call occurs when the value of the collateral falls below a specified maintenance margin, requiring the investor to deposit additional funds or securities to restore the account to the minimum required balance. Both concepts are critical in risk management, as haircuts mitigate potential losses upfront, while margin calls enforce ongoing compliance with leverage limits.

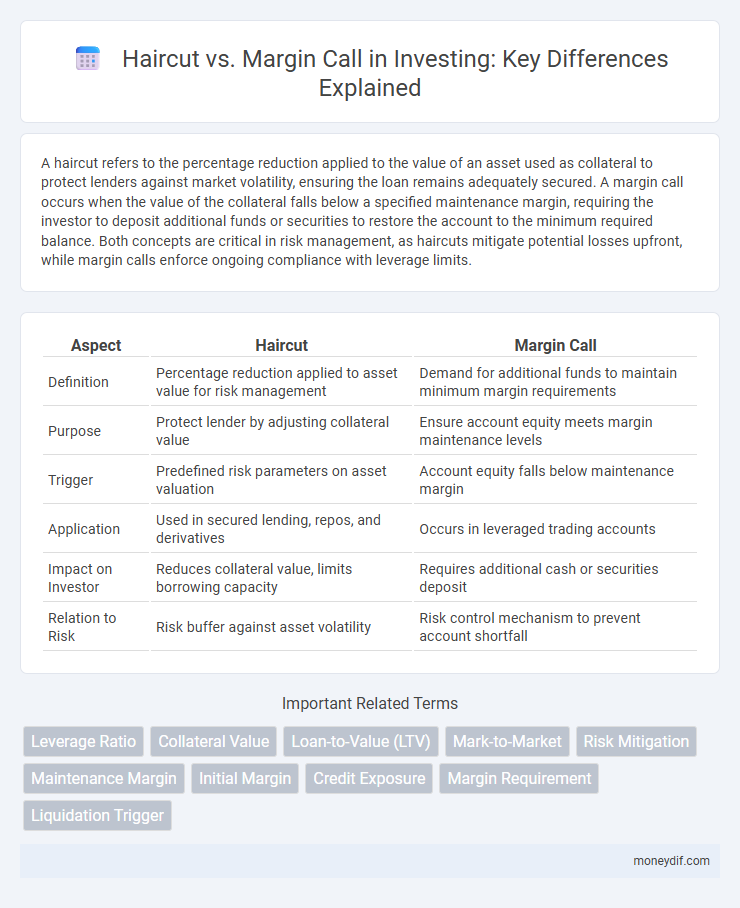

Table of Comparison

| Aspect | Haircut | Margin Call |

|---|---|---|

| Definition | Percentage reduction applied to asset value for risk management | Demand for additional funds to maintain minimum margin requirements |

| Purpose | Protect lender by adjusting collateral value | Ensure account equity meets margin maintenance levels |

| Trigger | Predefined risk parameters on asset valuation | Account equity falls below maintenance margin |

| Application | Used in secured lending, repos, and derivatives | Occurs in leveraged trading accounts |

| Impact on Investor | Reduces collateral value, limits borrowing capacity | Requires additional cash or securities deposit |

| Relation to Risk | Risk buffer against asset volatility | Risk control mechanism to prevent account shortfall |

Understanding Haircut in Investment

A haircut in investment refers to the percentage reduction applied to the market value of an asset when used as collateral for a loan, reflecting the risk of price volatility. This adjustment ensures lenders have a buffer against potential declines in asset value, mitigating credit risk. Unlike a margin call, which demands additional funds when collateral value drops below a maintenance threshold, a haircut proactively sets collateral limits before lending.

Defining Margin Call in Trading

A margin call in trading occurs when an investor's account equity falls below the broker's required maintenance margin, prompting a demand for additional funds or securities to cover potential losses. This mechanism protects brokers from significant defaults by ensuring investors maintain a minimum collateral level against borrowed funds. Understanding margin calls is crucial for managing leveraged positions and avoiding forced liquidation of assets.

Haircut vs Margin Call: Key Differences

Haircut and margin call are critical concepts in investment risk management, where a haircut refers to the percentage reduction applied to the market value of an asset used as collateral to account for potential price volatility. A margin call occurs when the value of collateral falls below a required maintenance margin, prompting investors to deposit additional funds or securities to cover the shortfall. Understanding the key differences between haircut and margin call helps investors manage leverage effectively and avoid forced liquidation during market fluctuations.

Impact of Haircuts on Collateral Value

Haircuts reduce the effective value of collateral by applying a percentage deduction to its market price, thereby lowering the amount lenders recognize for securing loans or margin positions. This adjustment protects against market volatility and potential asset devaluation, ensuring the collateral covers the credit exposure under stressed conditions. Reducing collateral value through haircuts increases the likelihood of margin calls as borrowers must maintain sufficient equity to meet margin requirements despite asset price fluctuations.

Margin Call Triggers and Processes

Margin call triggers occur when an investor's equity in a margin account falls below the broker's required maintenance margin, often due to declining asset prices or increased loan value. Brokers initiate the margin call process by notifying the investor to deposit additional funds or sell assets to restore the account to the minimum margin level. Failure to meet the margin call can result in forced liquidation of securities to cover the shortfall, protecting the broker from credit risk.

Risk Management: Haircuts and Margin Calls

Haircuts in investment risk management represent a percentage deduction applied to the value of collateral to account for market volatility and potential declines, thereby reducing exposure to credit risk. Margin calls occur when the value of an investor's margin account falls below the required maintenance margin, prompting the need to deposit additional funds or liquidate assets to restore the account balance. Effective risk management relies on monitoring haircuts and margin calls to maintain sufficient collateral and minimize the likelihood of forced asset sales during market downturns.

How Haircuts Affect Leverage

Haircuts reduce the value of collateral to account for potential market fluctuations, effectively limiting the amount investors can borrow and decreasing leverage. A higher haircut means lower borrowing capacity, forcing investors to commit more equity and reducing overall leverage risk. This mechanism helps maintain financial stability by preventing over-leveraging during volatile market conditions.

Preventing Margin Calls: Best Practices

Maintaining a sufficient margin buffer and regularly monitoring account equity can effectively prevent margin calls. Implementing stop-loss orders and diversifying investments reduce the risk of sudden portfolio declines triggering haircuts that lead to margin calls. Staying informed on market volatility and adjusting leverage appropriately enhances risk management and protects capital.

Real-World Examples: Haircuts and Margin Calls

In the 2008 financial crisis, Lehman Brothers faced significant margin calls as asset values plummeted, forcing urgent collateral replenishment to maintain trading positions. Haircuts, commonly applied by central banks like the Federal Reserve, increased sharply during this period to mitigate risk, reflecting reduced confidence in asset liquidity and creditworthiness. These real-world examples demonstrate how haircuts and margin calls act as critical risk management tools in volatile markets, directly impacting investment strategies and liquidity requirements.

Choosing Safe Strategies: Haircut vs Margin Call

Choosing safe investment strategies involves understanding the difference between haircut and margin call mechanisms. A haircut represents the percentage reduction applied to the market value of an asset to account for risk, thereby enhancing collateral safety and minimizing loss exposure. Margin calls occur when the equity in a margin account falls below the required maintenance level, prompting investors to add funds or liquidate positions to avoid forced selling.

Important Terms

Leverage Ratio

The leverage ratio influences the likelihood of a margin call by determining the haircut size applied to collateral, where higher leverage requires larger haircuts to mitigate risk and prevent forced liquidations.

Collateral Value

Collateral value determines the required haircut percentage, which directly influences the likelihood of a margin call during market fluctuations.

Loan-to-Value (LTV)

Loan-to-Value (LTV) ratio determines the allowable haircut percentage before triggering a margin call to maintain collateral adequacy.

Mark-to-Market

Mark-to-Market adjusts asset values daily to reflect current market prices, triggering margin calls when the haircut--the difference between an asset's market value and its loan value--exceeds preset thresholds.

Risk Mitigation

Risk mitigation in financial markets involves strategies like applying haircuts to collateral, reducing exposure by valuing assets below their market price to cushion against market volatility. Margin calls act as a reactive mechanism requiring additional funds when collateral values fall below maintenance levels, ensuring continuous protection against credit risk.

Maintenance Margin

Maintenance margin is the minimum equity level an investor must maintain in a margin account to avoid a margin call, where a haircut represents the percentage reduction in asset value used to calculate this margin requirement.

Initial Margin

Initial margin requirements reduce counterparty risk by setting a collateral buffer, while haircuts adjust asset values to mitigate market volatility before triggering a margin call.

Credit Exposure

Credit exposure increases when the haircut on collateral is low, necessitating more frequent margin calls to mitigate counterparty risk.

Margin Requirement

A margin requirement sets the minimum equity needed in a trading account to cover potential losses, while a haircut adjusts the collateral value downward to determine this requirement and a margin call occurs when the account equity falls below the margin requirement, prompting a demand for additional funds.

Liquidation Trigger

A liquidation trigger occurs when a margin call is unmet and the haircut on collateral value falls below the required threshold, forcing forced asset sales to cover losses.

Haircut vs Margin Call Infographic

moneydif.com

moneydif.com