Currency carry trade exploits differences in interest rates by borrowing in low-yield currencies and investing in high-yield currencies to earn the interest rate differential. Covered interest arbitrage involves capitalizing on discrepancies between spot and forward exchange rates to secure risk-free profits through simultaneous currency exchange and forward contracts. While the carry trade carries exchange rate risk, covered interest arbitrage mitigates this risk by locking in forward rates.

Table of Comparison

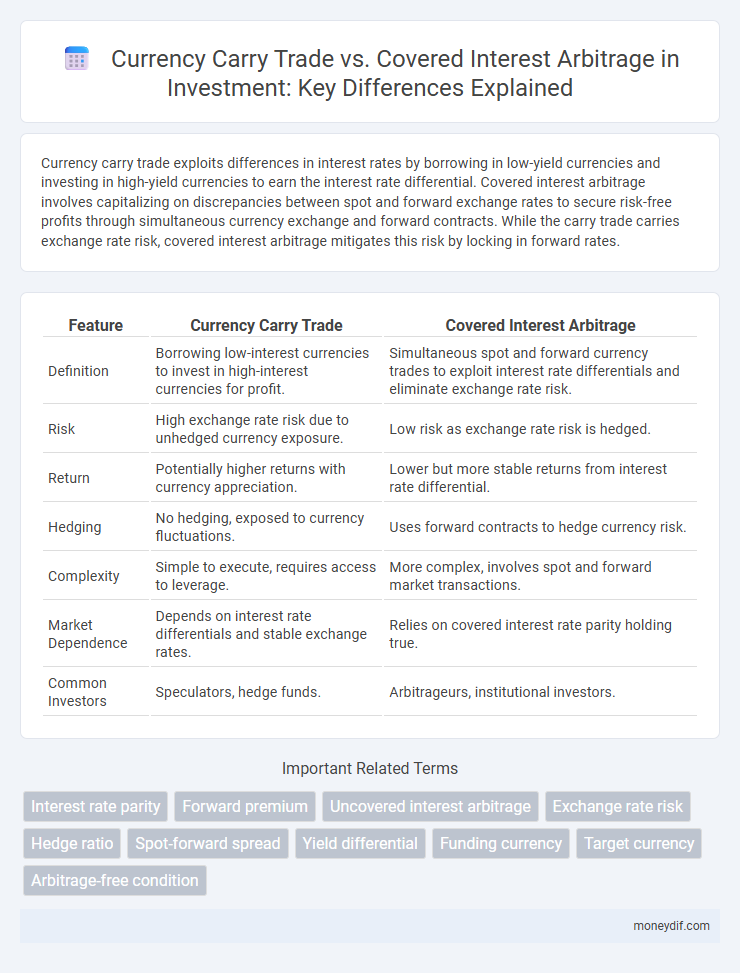

| Feature | Currency Carry Trade | Covered Interest Arbitrage |

|---|---|---|

| Definition | Borrowing low-interest currencies to invest in high-interest currencies for profit. | Simultaneous spot and forward currency trades to exploit interest rate differentials and eliminate exchange rate risk. |

| Risk | High exchange rate risk due to unhedged currency exposure. | Low risk as exchange rate risk is hedged. |

| Return | Potentially higher returns with currency appreciation. | Lower but more stable returns from interest rate differential. |

| Hedging | No hedging, exposed to currency fluctuations. | Uses forward contracts to hedge currency risk. |

| Complexity | Simple to execute, requires access to leverage. | More complex, involves spot and forward market transactions. |

| Market Dependence | Depends on interest rate differentials and stable exchange rates. | Relies on covered interest rate parity holding true. |

| Common Investors | Speculators, hedge funds. | Arbitrageurs, institutional investors. |

Introduction to Currency Carry Trade and Covered Interest Arbitrage

Currency carry trade involves borrowing funds in a low-interest-rate currency and investing in a high-interest-rate currency to profit from the interest rate differential. Covered interest arbitrage exploits discrepancies between spot and forward exchange rates to lock in risk-free returns by simultaneously engaging in the spot and forward currency markets. Both strategies hinge on interest rate differentials but differ in risk exposure, with carry trade bearing exchange rate risk and covered interest arbitrage offering a hedged approach.

Fundamental Concepts: Understanding Carry Trade and Covered Interest Arbitrage

Currency carry trade involves borrowing in a low-interest-rate currency and investing in a high-interest-rate currency to profit from the interest rate differential, while exposed to exchange rate risk. Covered interest arbitrage eliminates exchange rate risk by simultaneously entering the spot and forward foreign exchange markets to lock in a risk-free return based on interest rate differentials. Both strategies rely on differences in interest rates across countries but differ primarily in their treatment of currency risk and the use of forward contracts.

Mechanics of Currency Carry Trade: How It Works

Currency carry trade involves borrowing low-interest-rate currencies to invest in higher-yielding assets in another currency, profiting from the interest rate differential. Investors capitalize on stable or predictable exchange rates to avoid losses from currency fluctuations, making funding currency choice and hedge strategies crucial. Success depends on monitoring interest rate trends, currency volatility, and central bank policies to optimize returns without incurring significant exchange rate risks.

How Covered Interest Arbitrage Operates

Covered interest arbitrage operates by exploiting the interest rate differentials between two countries while using forward contracts to hedge exchange rate risk. Investors borrow in a currency with a lower interest rate and convert the funds into a currency with a higher interest rate, simultaneously entering a forward contract to lock in the exchange rate for converting returns back. This strategy ensures risk-free profits through protected interest arbitrage, contrasting with currency carry trade which exposes investors to currency risk.

Key Differences Between Carry Trade and Covered Interest Arbitrage

Currency carry trade involves borrowing in low-interest-rate currencies and investing in high-interest-rate currencies to profit from interest rate differentials and potential currency appreciation. Covered interest arbitrage eliminates exchange rate risk by using forward contracts to lock in the exchange rate, ensuring a risk-free return based on interest rate differentials between two countries. The key difference lies in currency risk exposure: carry trade assumes currency risk, while covered interest arbitrage hedges it to achieve arbitrage profits.

Risk Factors in Currency Carry Trade vs. Arbitrage

Currency carry trade involves borrowing in low-interest-rate currencies and investing in high-interest-rate currencies, exposing investors to significant exchange rate risk and potential sudden currency devaluation. Covered interest arbitrage uses forward contracts to hedge exchange rate risk, minimizing exposure to currency fluctuations but facing risks related to interest rate differentials and transaction costs. The primary risk in carry trade is currency volatility, while arbitrage risks stem from incomplete market efficiency and potential counterparty defaults.

Profit Potential: Evaluating Returns in Both Strategies

Currency carry trade offers profit potential through interest rate differentials by borrowing in low-yield currencies and investing in high-yield ones, but it carries significant exchange rate risk. Covered interest arbitrage locks in returns by exploiting interest rate differentials while using forward contracts to hedge currency exposure, resulting in lower risk but typically smaller, more stable profits. Investors seeking higher but riskier returns may prefer carry trades, whereas those prioritizing risk mitigation often choose covered interest arbitrage for consistent gains.

Impact of Interest Rate Differentials

Interest rate differentials play a crucial role in both currency carry trade and covered interest arbitrage by influencing potential returns and risks associated with these strategies. In currency carry trade, investors borrow in low-interest-rate currencies and invest in high-interest-rate currencies to capitalize on the differential, exposing themselves to exchange rate volatility. Covered interest arbitrage involves exploiting interest rate differentials while using forward contracts to hedge against currency risk, thus providing a risk-adjusted arbitrage opportunity based on interest rate parity.

Regulatory and Market Influences on Strategy Choice

Currency carry trade often faces heightened regulatory scrutiny due to its exposure to sudden capital flow reversals and central bank interventions, making risk management crucial. Covered interest arbitrage benefits from more predictable regulatory environments, as its reliance on forward contracts reduces exposure to exchange rate volatility and regulatory shifts. Market volatility and monetary policy divergence significantly influence the strategic preference between these approaches, with tighter regulations favoring the relative safety of covered interest arbitrage.

Practical Considerations: Selecting the Right Strategy for Investors

Investors must evaluate interest rate differentials, transaction costs, and currency risk exposure when choosing between currency carry trade and covered interest arbitrage. Currency carry trade offers higher potential returns by exploiting unsecured interest rate gaps but entails significant exchange rate risk and exposure to market volatility. Covered interest arbitrage minimizes currency risk through forward contracts, making it suitable for risk-averse investors seeking more stable, arbitrage-based returns despite lower profit margins.

Important Terms

Interest rate parity

Interest rate parity (IRP) ensures that the difference in interest rates between two countries is offset by the forward exchange rate, eliminating arbitrage opportunities in the foreign exchange markets. Currency carry trade exploits deviations from IRP by borrowing in low-interest-rate currencies and investing in high-interest-rate currencies, while covered interest arbitrage uses forward contracts to lock in risk-free profits when IRP conditions are temporarily violated.

Forward premium

Forward premium reflects the expected future appreciation or depreciation of a currency and plays a crucial role in currency carry trade, where investors borrow in low-interest-rate currencies to invest in higher-yielding ones, profiting from interest rate differentials if the forward premium aligns favorably. In covered interest arbitrage, traders exploit discrepancies between forward rates and interest rate differentials by simultaneously engaging in spot and forward contracts to lock in riskless profits, effectively neutralizing exchange rate risk influenced by the forward premium.

Uncovered interest arbitrage

Uncovered interest arbitrage involves capitalizing on interest rate differentials without currency hedging, exposing investors to exchange rate risk, unlike covered interest arbitrage which eliminates this risk through forward contracts. Currency carry trade exploits similar interest rate gaps but relies on market speculation of stable or favorable exchange rates rather than guaranteed hedging mechanisms found in covered interest arbitrage.

Exchange rate risk

Exchange rate risk arises in currency carry trade due to exposure to fluctuations in spot exchange rates when borrowing in a low-interest currency and investing in a high-interest currency without hedging. Covered interest arbitrage eliminates exchange rate risk by locking in forward exchange rates, ensuring returns through simultaneous spot and forward market transactions that exploit interest rate differentials.

Hedge ratio

The hedge ratio in currency carry trade quantifies the proportion of foreign exchange risk hedged to balance potential returns against currency volatility, optimizing exposure to interest rate differentials. In covered interest arbitrage, the hedge ratio equals one, as investors fully hedge exchange rate risk through forward contracts to lock in arbitrage profits without exposure to currency fluctuations.

Spot-forward spread

Spot-forward spread reflects the interest rate differential between two currencies and plays a crucial role in currency carry trade by indicating potential returns from holding higher-yielding currencies. In covered interest arbitrage, the spot-forward spread is used to lock in risk-free profits by exploiting discrepancies between spot rates, forward rates, and interest rate parity.

Yield differential

Yield differential plays a crucial role in currency carry trade by exploiting higher interest rates of one currency against lower rates of another to generate profit from interest rate gaps. In contrast, covered interest arbitrage neutralizes exchange rate risk through forward contracts, ensuring arbitrageurs earn the interest rate differential guaranteed by the forward premium or discount.

Funding currency

Funding currency in currency carry trade typically involves borrowing in low-interest-rate currencies like the Japanese yen or Swiss franc to invest in higher-yielding currencies, capitalizing on interest rate differentials. In contrast, covered interest arbitrage neutralizes exchange rate risk by simultaneously engaging in spot and forward contracts, ensuring profits solely from interest rate discrepancies between the funding currency and the target currency.

Target currency

Target currency plays a crucial role in currency carry trade, where investors borrow in low-yield currencies to invest in higher-yield target currencies, seeking profit from the interest rate differential. In contrast, covered interest arbitrage involves simultaneous spot and forward contracts to exploit discrepancies in interest rate parity between the base and target currency, ensuring risk-free profits.

Arbitrage-free condition

The arbitrage-free condition ensures no riskless profit opportunity exists between currency carry trade and covered interest arbitrage by aligning forward exchange rates with interest rate differentials. When covered interest parity holds, deviations permit profitable carry trades, but arbitrageurs quickly restore equilibrium by exploiting discrepancies in spot and forward rates relative to interest rates.

Currency carry trade vs Covered interest arbitrage Infographic

moneydif.com

moneydif.com