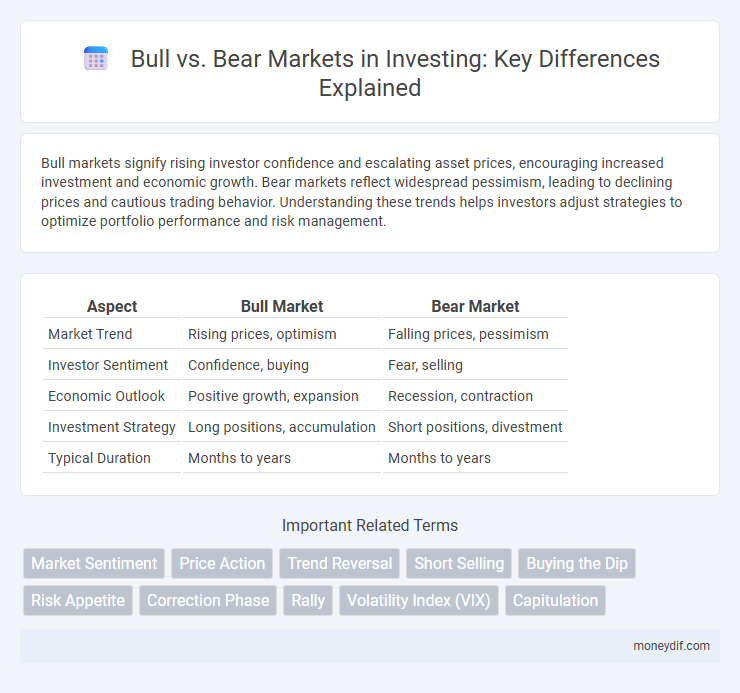

Bull markets signify rising investor confidence and escalating asset prices, encouraging increased investment and economic growth. Bear markets reflect widespread pessimism, leading to declining prices and cautious trading behavior. Understanding these trends helps investors adjust strategies to optimize portfolio performance and risk management.

Table of Comparison

| Aspect | Bull Market | Bear Market |

|---|---|---|

| Market Trend | Rising prices, optimism | Falling prices, pessimism |

| Investor Sentiment | Confidence, buying | Fear, selling |

| Economic Outlook | Positive growth, expansion | Recession, contraction |

| Investment Strategy | Long positions, accumulation | Short positions, divestment |

| Typical Duration | Months to years | Months to years |

Understanding Bull and Bear Markets

Bull markets are characterized by rising stock prices, investor confidence, and economic growth, often leading to sustained gains over months or years. Bear markets feature declining prices, widespread pessimism, and reduced investment activity, typically signaling economic downturns or recessions. Understanding these market cycles helps investors make informed decisions about portfolio management and risk assessment.

Key Characteristics of Bull Markets

Bull markets are defined by sustained increases in stock prices, typically driven by strong investor confidence and robust economic growth. Key characteristics include rising corporate earnings, increased trading volume, and low unemployment rates, which collectively encourage buying activity. Market sentiment during bull phases is generally optimistic, leading to higher valuations and expanded market capitalization.

Defining Traits of Bear Markets

Bear markets are characterized by a prolonged decline in asset prices, typically falling 20% or more from recent highs, signaling widespread investor pessimism. These periods often coincide with economic downturns, rising unemployment, and reduced consumer spending, leading to lower corporate earnings. Market volatility increases significantly, as investors react to negative news and uncertainty surrounding future economic growth.

Economic Indicators in Bull vs Bear Phases

Economic indicators such as GDP growth, unemployment rates, and consumer confidence sharply differ between bull and bear markets, with bull phases marked by rising GDP, low unemployment, and strong consumer spending. In contrast, bear markets often feature contracting GDP, increasing unemployment, and declining consumer confidence, signaling economic slowdown. Monitoring leading indicators like manufacturing activity and stock market trends provides critical insights into transitioning between bullish and bearish phases in investment cycles.

Psychological Drivers: Investor Sentiment

Investor sentiment plays a crucial role in shaping Bull and Bear markets, as optimism and confidence drive Bull markets, while fear and pessimism dominate Bear markets. Emotional biases such as herd behavior and overconfidence intensify market trends, influencing buying and selling decisions. Understanding these psychological drivers helps investors anticipate market shifts and manage risk effectively.

Common Investment Strategies for Bulls

Bull investors typically employ strategies such as buying and holding growth stocks, leveraging margin accounts to amplify gains, and investing in call options to capitalize on anticipated market upswings. Emphasizing sectors with strong earnings momentum, such as technology or consumer discretionary, enhances portfolio performance during bullish trends. Tactical asset allocation and periodic profit-taking help manage risk while maximizing returns in rising markets.

Navigating Bear Markets: Protective Measures

Navigating bear markets requires implementing protective investment strategies such as diversifying portfolios, increasing cash holdings, and focusing on high-quality dividend-paying stocks to mitigate losses. Utilizing stop-loss orders and defensive sectors like utilities and consumer staples can preserve capital during market downturns. Investors should also consider hedging techniques like options or inverse ETFs to shield portfolios from prolonged bearish trends.

Impact on Stock Market Performance

Bull markets drive sustained optimism, leading to increased investor confidence, higher stock prices, and expanded capital inflows. Bear markets trigger pessimism, resulting in widespread sell-offs, declining stock valuations, and reduced market liquidity. The cyclical interplay between bull and bear phases significantly influences portfolio strategies and overall market volatility.

Historical Case Studies: Bulls and Bears

Historical case studies of Bull markets, such as the 1920s Roaring Twenties and the post-2008 financial recovery, illustrate sustained periods of rising asset prices driven by economic growth and investor confidence. Bear markets, exemplified by the 1929 Great Depression and the 2008 Global Financial Crisis, show sharp declines in market indices due to economic recessions and financial instability. These contrasting market phases highlight the cyclical nature of investments and the importance of timing and risk management in portfolio strategies.

Preparing Your Portfolio for Market Cycles

Understanding the characteristics of bull and bear markets is essential for preparing your portfolio to withstand market cycles. Diversifying investments across asset classes like stocks, bonds, and commodities helps mitigate risk and capitalize on growth opportunities during upward trends while protecting capital in downturns. Implementing strategies such as regular portfolio rebalancing and maintaining a cash reserve ensures agility and resilience amid market volatility.

Important Terms

Market Sentiment

Market sentiment reflects investor attitudes, with bullish sentiment indicating optimism and rising prices, while bearish sentiment signals pessimism and declining market trends.

Price Action

Price action reveals market sentiment by showing bullish momentum through higher highs and higher lows, while bearish trends are characterized by lower highs and lower lows.

Trend Reversal

Trend reversal signals the shift from a bullish market, characterized by rising prices and optimism, to a bearish market marked by declining prices and pessimism.

Short Selling

Short selling profits from declining asset prices and is a common strategy used by bear market investors to capitalize on market downturns.

Buying the Dip

Buying the dip during a bull market capitalizes on temporary price drops, whereas in a bear market it risks deeper losses as downward trends persist.

Risk Appetite

Risk appetite significantly influences investor behavior in bull and bear markets, with bullish environments encouraging higher risk tolerance due to optimistic growth expectations, while bearish markets drive risk aversion amid uncertainty and potential losses. Understanding this dynamic helps investors calibrate portfolio strategies to align with prevailing market sentiments and volatility patterns.

Correction Phase

The Correction Phase in a bull market typically signals a temporary price pullback of 10-20%, often followed by renewed upward momentum, while in a bear market it can represent brief recoveries before further declines.

Rally

Rally periods in the stock market often indicate bullish momentum as investors drive prices higher, contrasting with bearish phases characterized by declining prices and negative sentiment.

Volatility Index (VIX)

The Volatility Index (VIX) measures market expectations of near-term volatility, often rising during bear markets and falling in bull markets as investor sentiment shifts.

Capitulation

Capitulation occurs when bearish investors overwhelmingly sell off assets, signaling a potential market bottom and a shift toward bullish sentiment.

Bull vs Bear Infographic

moneydif.com

moneydif.com