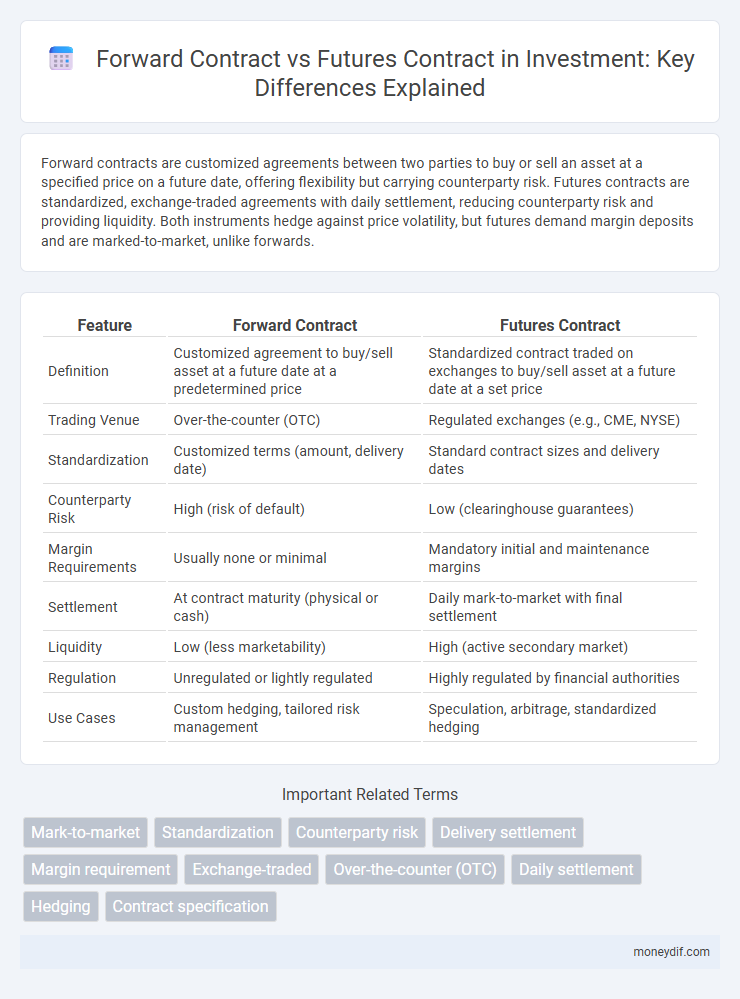

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified price on a future date, offering flexibility but carrying counterparty risk. Futures contracts are standardized, exchange-traded agreements with daily settlement, reducing counterparty risk and providing liquidity. Both instruments hedge against price volatility, but futures demand margin deposits and are marked-to-market, unlike forwards.

Table of Comparison

| Feature | Forward Contract | Futures Contract |

|---|---|---|

| Definition | Customized agreement to buy/sell asset at a future date at a predetermined price | Standardized contract traded on exchanges to buy/sell asset at a future date at a set price |

| Trading Venue | Over-the-counter (OTC) | Regulated exchanges (e.g., CME, NYSE) |

| Standardization | Customized terms (amount, delivery date) | Standard contract sizes and delivery dates |

| Counterparty Risk | High (risk of default) | Low (clearinghouse guarantees) |

| Margin Requirements | Usually none or minimal | Mandatory initial and maintenance margins |

| Settlement | At contract maturity (physical or cash) | Daily mark-to-market with final settlement |

| Liquidity | Low (less marketability) | High (active secondary market) |

| Regulation | Unregulated or lightly regulated | Highly regulated by financial authorities |

| Use Cases | Custom hedging, tailored risk management | Speculation, arbitrage, standardized hedging |

Overview: Forward Contracts vs Futures Contracts

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified price on a future date, typically traded over-the-counter with limited liquidity and counterparty risk. Futures contracts are standardized, exchange-traded agreements with daily settlement, margin requirements, and high liquidity, reducing counterparty risk through clearinghouses. Both instruments are used for hedging and speculation, but futures offer greater transparency and regulatory oversight compared to forwards.

Key Differences Between Forwards and Futures

Forward contracts are customized agreements traded over-the-counter (OTC) between two parties, allowing tailored terms such as contract size and settlement date, whereas futures contracts are standardized agreements traded on regulated exchanges with fixed terms. Forwards carry counterparty risk due to the lack of intermediary clearinghouses, while futures contracts benefit from daily mark-to-market margining, reducing default risk and enhancing liquidity. The settlement of forwards typically occurs at the contract's maturity, whereas futures contracts can be closed or offset prior to expiration, providing greater flexibility for investors.

How Forward Contracts Work in Investments

Forward contracts in investments involve a customizable agreement between two parties to buy or sell an asset at a specified future date for a price agreed upon today, allowing investors to hedge against price volatility. These contracts are typically traded over-the-counter (OTC), which offers flexibility in terms, underlying asset, and settlement but increases counterparty risk due to lack of standardization. Investors use forward contracts to lock in prices for commodities, currencies, or securities, aligning asset acquisition or disposition with future financial goals and managing exposure to market fluctuations.

The Role of Futures Contracts in Financial Markets

Futures contracts play a crucial role in financial markets by providing standardized, exchange-traded agreements that enable investors to hedge risk or speculate on price movements of assets such as commodities, currencies, and indexes. Unlike forward contracts, futures facilitate price transparency, liquidity, and credit risk mitigation through daily settlement and margin requirements. This standardization and regulation enhance market efficiency, allowing participants to better manage exposure and price discovery.

Risk Management: Forwards vs Futures

Forward contracts offer customized terms tailored to specific risk exposures, enabling precise hedging against price fluctuations in underlying assets. Futures contracts provide standardized terms and are traded on organized exchanges, enhancing liquidity but requiring daily settlement of gains and losses, which introduces margin risk. The choice between forwards and futures hinges on the balance between customization in risk management and the operational advantages of standardized, regulated trading environments.

Pricing Mechanisms: Forward vs Futures Contracts

Forward contracts are priced through customized agreements between parties, reflecting the spot price adjusted for the cost of carry, including interest rates, dividends, and storage costs, without daily settlement. Futures contracts have standardized pricing determined by the exchange, incorporating daily mark-to-market adjustments and margin requirements, which affect the forward price and reduce credit risk. The presence of daily settlement in futures contracts causes their prices to converge to spot prices more closely over time compared to forwards.

Flexibility and Customization: Which Is Better?

Forward contracts offer superior flexibility and customization, allowing parties to tailor contract terms such as size, maturity date, and underlying asset to their specific investment needs. Futures contracts, being standardized and traded on exchanges, lack this level of customization but provide greater liquidity and reduced counterparty risk. Investors seeking precise risk management prefer forwards, while those valuing ease of trading and price transparency lean towards futures.

Settlement Processes for Forwards and Futures

Forward contracts settle at the end of the contract term through physical delivery or cash settlement based on the agreed-upon price, allowing customization between counterparties. Futures contracts undergo daily mark-to-market settlement via a clearinghouse, ensuring margin requirements are met and minimizing default risk. This standardized, regulated clearing process in futures increases liquidity and reduces counterparty risk compared to forwards.

Use Cases: When to Choose Forward or Futures Contracts

Forward contracts suit businesses seeking customized agreements with specific delivery dates and quantities, ideal for hedging risks in commodities or currencies with tailored terms. Futures contracts are preferred by traders and investors requiring standardized, exchange-traded instruments for liquidity and daily settlement, commonly used in markets like oil, gold, and equity indexes. Selecting forward contracts aligns with needs for flexibility and private negotiation, whereas futures contracts excel in transparent pricing and regulated market environments.

Pros and Cons: Forward Contracts vs Futures Contracts

Forward contracts offer customization and privacy, enabling tailored terms between parties, but carry higher counterparty risk and lower liquidity. Futures contracts provide standardized terms, high liquidity, and reduced credit risk through clearinghouses, but lack flexibility and may require margin deposits. Choosing between the two depends on the investor's need for customization versus the benefits of standardization and risk mitigation.

Important Terms

Mark-to-market

Mark-to-market valuation is applied daily in futures contracts, ensuring that gains and losses are settled each trading day, while forward contracts are typically valued and settled only at maturity, leading to credit risk exposure. Futures contracts trade on regulated exchanges with standardized terms, enhancing liquidity and reducing counterparty risk compared to customized forward contracts.

Standardization

Standardization in forward contracts is minimal, allowing customization of contract terms such as quantity, price, and settlement date, whereas futures contracts are highly standardized with fixed contract sizes, expiration dates, and daily settlement rules governed by regulated exchanges. This standardization in futures contracts enhances liquidity, transparency, and reduces counterparty risk through the clearinghouse mechanism.

Counterparty risk

Counterparty risk is significantly higher in forward contracts due to their over-the-counter nature, lacking a centralized clearinghouse, which increases the likelihood of default by one party. Futures contracts mitigate counterparty risk through daily mark-to-market settlement and clearinghouse guarantees, ensuring greater financial security and transparency for traders.

Delivery settlement

Delivery settlement in forward contracts involves the actual transfer of the underlying asset at the contract's maturity, allowing customized terms between parties. In contrast, futures contracts typically settle through daily margin adjustments and can involve physical delivery or cash settlement based on standardized contract specifications.

Margin requirement

Margin requirements for forward contracts are typically negotiated privately and involve little to no upfront margin, exposing parties to higher counterparty risk, whereas futures contracts mandate standardized initial and maintenance margins regulated by clearinghouses to mitigate credit risk and ensure market stability. Futures margins are marked to market daily, requiring variation margin adjustments that dynamically reflect price changes, unlike forwards which settle only at contract maturity.

Exchange-traded

Exchange-traded forward contracts provide standardized terms and regulated counterparties, reducing counterparty risk compared to over-the-counter forwards, while futures contracts are highly standardized, cleared through central counterparties, and traded on regulated exchanges like CME and ICE, ensuring liquidity and price transparency. Both forward and futures contracts obligate parties to transact assets at a predetermined price on a specified future date, but futures require daily margin adjustments and mark-to-market settlements, contrasting with the typically customizable and settled-at-maturity nature of forwards.

Over-the-counter (OTC)

Over-the-counter (OTC) forward contracts are customized agreements traded directly between parties, offering flexibility in contract terms but bearing counterparty risk, whereas futures contracts are standardized, exchange-traded instruments with daily settlement and reduced credit exposure. While OTC forwards allow tailored hedging strategies for specific needs in currency, commodity, or interest rate markets, futures contracts provide greater liquidity and transparent pricing through centralized clearinghouses.

Daily settlement

Daily settlement in futures contracts involves marking positions to market each trading day, ensuring profits and losses are realized and margin requirements adjusted, whereas forward contracts settle only at maturity, exposing parties to greater credit risk due to the absence of interim cash flow adjustments. This difference in settlement frequency significantly impacts risk management strategies and liquidity considerations between the two derivative instruments.

Hedging

Hedging with forward contracts involves customized agreements between parties to buy or sell assets at a specific future date and price, offering flexibility but higher counterparty risk. Futures contracts, standardized and traded on exchanges, provide greater liquidity and reduced counterparty risk, making them preferred for hedging commodity prices and financial instruments.

Contract specification

Forward contracts are customized agreements traded over-the-counter, allowing parties to negotiate specific terms such as contract size, maturity date, and underlying asset details, while futures contracts are standardized, exchange-traded agreements with fixed contract specifications including uniform contract size, standardized delivery months, and regulated settlement procedures. The flexibility of forward contracts suits personalized risk management, whereas futures contracts offer enhanced liquidity, transparency, and reduced counterparty risk due to centralized clearinghouses.

Forward contract vs Futures contract Infographic

moneydif.com

moneydif.com