Accredited Investors meet specific income or net worth criteria set by the SEC, allowing them access to certain private investment opportunities. Qualified Purchasers represent a higher tier of investors with significantly larger assets, granting them eligibility to invest in more complex and less regulated investment vehicles. Understanding the distinction is crucial for tailoring investment strategies and complying with regulatory requirements.

Table of Comparison

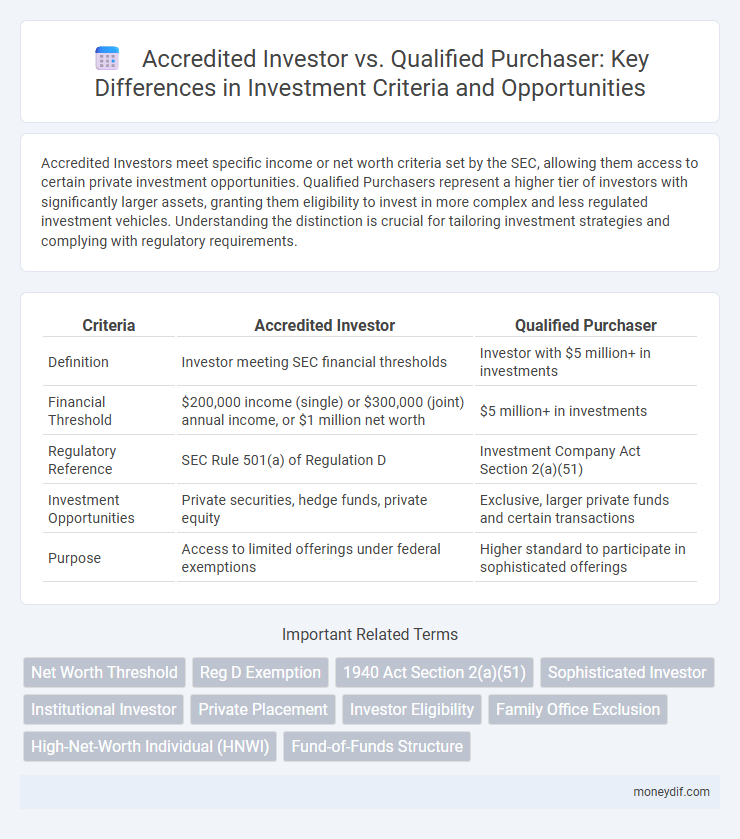

| Criteria | Accredited Investor | Qualified Purchaser |

|---|---|---|

| Definition | Investor meeting SEC financial thresholds | Investor with $5 million+ in investments |

| Financial Threshold | $200,000 income (single) or $300,000 (joint) annual income, or $1 million net worth | $5 million+ in investments |

| Regulatory Reference | SEC Rule 501(a) of Regulation D | Investment Company Act Section 2(a)(51) |

| Investment Opportunities | Private securities, hedge funds, private equity | Exclusive, larger private funds and certain transactions |

| Purpose | Access to limited offerings under federal exemptions | Higher standard to participate in sophisticated offerings |

Accredited Investor vs Qualified Purchaser: Key Differences

An accredited investor meets specific income or net worth thresholds set by the SEC, typically $200,000 annual income or $1 million net worth excluding primary residence, enabling access to private securities offerings. A qualified purchaser is a more exclusive classification requiring at least $5 million in investments, allowing participation in exclusive investment funds under the Investment Company Act of 1940. The key differences lie in the financial criteria and the types of investments each can access, with qualified purchasers qualifying for more sophisticated, less regulated investment opportunities.

Understanding Accredited Investor Criteria

Accredited investors must meet specific financial thresholds set by the SEC, including having a net worth exceeding $1 million excluding primary residence or an annual income over $200,000 for individuals ($300,000 for joint income) in the past two years. These criteria ensure access to certain investment opportunities, such as private placements and hedge funds, which are not registered with the SEC. Understanding these qualifications helps investors determine eligibility for specialized investment options and regulatory exemptions.

Qualified Purchaser Requirements Explained

Qualified purchasers must meet stringent financial criteria, including owning at least $5 million in investments individually or $25 million jointly with a family, as defined by the Investment Company Act of 1940. This high threshold allows access to exclusive private investment funds and opportunities not available to accredited investors, who have lower asset or income requirements. Understanding these requirements is essential for investors aiming to participate in sophisticated investment vehicles with potentially higher risks and returns.

Regulatory Background: Legal Foundations

Accredited Investor status is defined under Regulation D of the Securities Act of 1933, enabling individuals and entities meeting specific income or net worth thresholds to invest in certain private securities offerings without full SEC registration. Qualified Purchaser standards, established by the Investment Company Act of 1940, impose higher financial thresholds, typically $5 million or more in investments, granting access to an even broader range of exempt investment vehicles. These legal foundations ensure differentiated investor protections and access levels based on financial sophistication and resources.

Investment Opportunities: Who Qualifies for What?

Accredited investors qualify for a broad range of private investment opportunities including hedge funds, private equity, and venture capital due to meeting income or net worth thresholds set by the SEC. Qualified purchasers face higher asset requirements, typically $5 million or more in investments, granting access to exclusive funds and specialized private placements with potentially greater returns and reduced regulatory restrictions. Understanding these distinctions is critical for investors seeking diversified portfolios and enhanced alternative investment options.

Benefits and Risks: A Comparative Analysis

Accredited Investors gain access to a broad range of private investment opportunities, such as hedge funds and venture capital, with less stringent financial thresholds compared to Qualified Purchasers, who must meet higher asset requirements but benefit from access to exclusive, often lower-risk investment vehicles. The main risk for Accredited Investors involves less regulatory protection and potential exposure to higher volatility, whereas Qualified Purchasers enjoy enhanced regulatory safeguards but face the challenge of meeting significant wealth criteria. Understanding these distinctions enables investors to strategically diversify portfolios while aligning risk tolerance with regulatory frameworks and investment exclusivity.

Access to Private Investments: Comparing Investor Status

Accredited Investors gain access to private investments such as hedge funds, private equity, and venture capital based on financial criteria including income exceeding $200,000 or a net worth over $1 million excluding primary residence. Qualified Purchasers meet a higher threshold, typically owning at least $5 million in investments, allowing entry to exclusive investment opportunities like certain private funds with fewer regulatory restrictions. The distinction significantly impacts portfolio diversification, risk exposure, and compliance requirements in private market transactions.

Compliance and Verification: How to Qualify

Compliance and verification for Accredited Investors require meeting income thresholds of $200,000 annually for individuals or $300,000 jointly for couples, or possessing a net worth exceeding $1 million excluding the primary residence. Qualified Purchasers must hold at least $5 million in investments, verified through thorough documentation such as financial statements and brokerage records. Firms and individuals are subjected to rigorous background checks and due diligence processes to ensure adherence to regulatory standards under the SEC guidelines.

Financial Thresholds and Documentation Needed

Accredited investors must meet a financial threshold of $1 million in net worth excluding primary residence or $200,000 annual income for individuals, verified through tax returns or bank statements. Qualified purchasers require significantly higher assets, typically $5 million or more in investments, with documentation including detailed financial statements and third-party verification. Meeting these standards ensures access to exclusive investment opportunities under SEC regulations.

Choosing the Right Status for Your Investment Goals

Accredited investors meet the SEC's financial criteria, such as a net worth exceeding $1 million or an income above $200,000 annually, granting access to private securities and hedge funds. Qualified purchasers, with a higher asset threshold of $5 million or more, qualify for a broader range of exclusive investment opportunities, including certain private equity funds and funds of funds. Selecting the right status depends on your investment capital and long-term goals, as qualified purchasers unlock more sophisticated and potentially higher-return instruments than accredited investors.

Important Terms

Net Worth Threshold

The Net Worth Threshold for an Accredited Investor is $1 million excluding primary residence, whereas a Qualified Purchaser must own at least $5 million in investments, reflecting higher financial criteria for sophisticated investment access.

Reg D Exemption

Reg D exemption primarily applies to Accredited Investors, allowing companies to raise capital without SEC registration, while Qualified Purchasers meet higher asset thresholds for access to more exclusive investment opportunities under different regulatory frameworks.

1940 Act Section 2(a)(51)

Section 2(a)(51) of the 1940 Act defines qualified purchasers as individuals or entities owning at least $5 million in investments, distinguishing them from accredited investors who meet lower financial thresholds under Regulation D.

Sophisticated Investor

A sophisticated investor possesses sufficient knowledge and experience to evaluate investment risks, differing from an accredited investor who meets specific income or net worth thresholds, while a qualified purchaser must have at least $5 million in investments to access exclusive private investment opportunities.

Institutional Investor

Institutional investors, often qualifying as accredited investors under SEC Rule 501 and frequently meeting the higher financial thresholds of qualified purchasers defined by the Investment Company Act of 1940, benefit from access to a broader range of private investment opportunities and reduced regulatory restrictions.

Private Placement

Private Placement offerings often limit participation to Accredited Investors meeting specific income or net worth criteria, while Qualified Purchasers face higher investment thresholds, enabling access to a broader range of exclusive investment opportunities under U.S. securities regulations.

Investor Eligibility

Investor eligibility criteria distinguish Accredited Investors as individuals meeting specific income or net worth thresholds, while Qualified Purchasers must satisfy higher asset requirements, allowing them access to broader and more complex investment opportunities.

Family Office Exclusion

The Family Office Exclusion allows family offices managing at least $5 million in assets to qualify as accredited investors, while qualified purchasers require $5 million in investments individually or $25 million collectively, enabling access to different private investment opportunities.

High-Net-Worth Individual (HNWI)

High-Net-Worth Individuals (HNWI) often qualify as Accredited Investors by meeting SEC financial criteria of $1 million net worth or $200,000 annual income, while only those with over $5 million in investments typically meet the stricter Qualified Purchaser status required for certain private investment opportunities.

Fund-of-Funds Structure

Fund-of-funds structures typically limit investments to accredited investors investing over $1 million or qualified purchasers holding at least $5 million in investments, ensuring compliance with SEC regulatory standards.

Accredited Investor vs Qualified Purchaser Infographic

moneydif.com

moneydif.com