Black Swan events are rare, unpredictable occurrences with severe consequences that defy standard risk models, while Gray Swan events are more foreseeable and can be anticipated through careful analysis. Investors must differentiate between these risks to implement strategies that protect portfolios from sudden market shocks and capitalize on potential warning signs. Incorporating scenario planning and stress testing can enhance resilience against both Black Swan and Gray Swan scenarios.

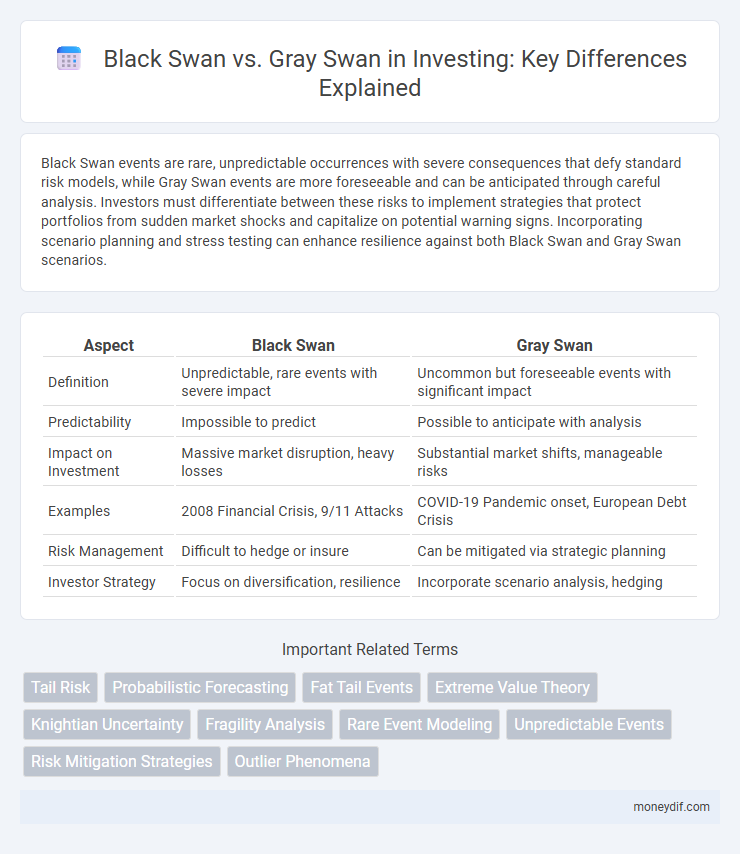

Table of Comparison

| Aspect | Black Swan | Gray Swan |

|---|---|---|

| Definition | Unpredictable, rare events with severe impact | Uncommon but foreseeable events with significant impact |

| Predictability | Impossible to predict | Possible to anticipate with analysis |

| Impact on Investment | Massive market disruption, heavy losses | Substantial market shifts, manageable risks |

| Examples | 2008 Financial Crisis, 9/11 Attacks | COVID-19 Pandemic onset, European Debt Crisis |

| Risk Management | Difficult to hedge or insure | Can be mitigated via strategic planning |

| Investor Strategy | Focus on diversification, resilience | Incorporate scenario analysis, hedging |

Understanding Black Swan and Gray Swan Events in Investment

Black Swan events in investment describe rare, unpredictable occurrences with massive impact, such as the 2008 financial crisis, which defy conventional risk models. Gray Swan events are more foreseeable but still extreme, like housing market corrections, allowing investors to prepare using scenario analysis and stress testing. Recognizing the differences helps investors develop robust risk management strategies that balance resilience and opportunity in volatile markets.

Key Differences Between Black Swan and Gray Swan Scenarios

Black Swan scenarios are characterized by their extreme rarity, unpredictability, and severe impact on financial markets, often causing catastrophic losses. Gray Swan events, while still significant and impactful, are more foreseeable and have identifiable risk factors, allowing investors to prepare and mitigate potential damage. Understanding these distinctions helps portfolio managers implement risk management strategies and adjust asset allocations accordingly.

Historical Examples of Black Swan Events in Financial Markets

The 2008 Global Financial Crisis and the 1987 Black Monday stock market crash serve as prime historical examples of Black Swan events in financial markets, characterized by their unpredictability and severe impact on global economies. The Dot-com Bubble burst in 2000 also exemplifies a Black Swan, surprising investors with rapid market collapse and long-lasting consequences for technology stocks. These events highlight the challenges in risk management and the importance of preparing for extreme market volatility beyond traditional forecasting models.

Notable Gray Swan Incidents and Their Impact on Investments

Notable Gray Swan incidents such as the 2008 financial crisis and the COVID-19 pandemic significantly disrupted global markets, causing unprecedented volatility and substantial portfolio losses. These events were foreseeable yet underestimated risks, leading investors to reassess asset allocation strategies and emphasize risk management tools like diversification and hedging. The lasting impact of Gray Swan events includes heightened scrutiny of economic indicators and increased demand for resilient investment instruments.

Risk Assessment: Black Swan vs. Gray Swan in Portfolio Management

Risk assessment in portfolio management differentiates Black Swan events--unpredictable, extreme occurrences with severe impact--from Gray Swan events, which are rare but identifiable with moderate probability. Effective portfolio strategies incorporate scenario analysis and stress testing to prepare for Gray Swans, while maintaining robust diversification and liquidity buffers to mitigate Black Swan shocks. Quantitative models often underestimate Black Swan risks, requiring qualitative judgment and adaptive risk management frameworks to safeguard asset allocations.

Strategies to Mitigate Black and Gray Swan Risks

Strategies to mitigate Black Swan and Gray Swan risks in investment revolve around diversification, stress testing, and maintaining liquidity buffers. Incorporating scenario analysis and adaptive risk management frameworks helps investors anticipate rare but impactful events, minimizing portfolio vulnerabilities. Allocating assets across uncorrelated sectors and employing dynamic hedging techniques further enhance resilience against unpredictable market shocks.

Investor Psychology: Coping with Rare and Predictable Market Shocks

Investor psychology plays a crucial role in navigating Black Swan and Gray Swan events, as Black Swans represent rare, unpredictable shocks that trigger extreme market fear and irrational behavior, while Gray Swans are foreseeable but often underestimated risks causing moderate anxiety. Understanding cognitive biases like overconfidence and loss aversion helps investors prepare emotionally for these market anomalies by fostering disciplined risk management and strategic diversification. Emphasizing resilience and adaptability in investor mindset improves decision-making during crises, reducing panic selling and enabling capital preservation amid unpredictable financial turmoil.

Black Swan Event Detection: Is it Possible?

Detecting Black Swan events remains inherently challenging due to their rare, unpredictable nature and severe market impact. Advanced algorithms and machine learning models analyze anomalies and low-probability indicators but often fail to predict true Black Swans before they occur. Investors rely on robust risk management and diversification to mitigate the financial fallout from these unforeseen market disruptions.

Building Resilient Investment Portfolios Against Swans

Building resilient investment portfolios requires understanding the distinct risks posed by Black Swan and Gray Swan events. Black Swan events are unpredictable, rare occurrences with severe impact, while Gray Swans are more foreseeable risks with potentially significant consequences. Diversification across asset classes, stress testing under extreme scenarios, and integrating adaptive risk management strategies enhance portfolio robustness against both unpredictable and anticipated systemic shocks.

The Future of Investing: Preparing for Unforeseeable and Foreseeable Risks

Effective investment strategies distinguish between Black Swan events, characterized by their extreme unpredictability and severe impact, and Gray Swan events, which are rare but foreseeable risks with significant consequences. Investors focusing on The Future of Investing implement robust risk management frameworks and scenario analysis to mitigate losses from Black Swans while developing contingency plans for Gray Swans. Leveraging advanced data analytics and diversification enhances resilience against both unforeseeable shocks and foreseeable market disruptions.

Important Terms

Tail Risk

Tail risk represents extreme, improbable financial losses often associated with Black Swan events, which are unpredictable and rare, in contrast to Gray Swan events that are unlikely but foreseeable and quantifiable.

Probabilistic Forecasting

Probabilistic forecasting quantifies the likelihood of extreme events, distinguishing rare Black Swan occurrences, which are unpredictable and carry massive impact, from Gray Swan events that are rare but somewhat foreseeable through advanced data analysis.

Fat Tail Events

Fat Tail events represent extreme, unpredictable occurrences with higher probability than normal, contrasting Black Swan events as entirely unforeseen and Gray Swan events as rare but somewhat predictable.

Extreme Value Theory

Extreme Value Theory quantifies the probability and impact of rare, high-magnitude events, distinguishing unpredictable Black Swan events from more foreseeable Gray Swan risks.

Knightian Uncertainty

Knightian uncertainty describes unpredictable risks that lack quantifiable probabilities, distinguishing Black Swan events as highly rare and unforeseeable, while Gray Swan events are rare but somewhat predictable within risk management frameworks.

Fragility Analysis

Fragility analysis assesses systems' vulnerability to Black Swan events--highly unpredictable and severe disruptions--while contrasting with Gray Swan events, which are rare but potentially foreseeable risks.

Rare Event Modeling

Rare event modeling distinguishes Black Swan events, which are unpredictable and have extreme impact, from Gray Swan events that are rare but foreseeable and can be mitigated through probabilistic risk assessment.

Unpredictable Events

Unpredictable events characterized as Black Swans are rare, high-impact occurrences outside normal expectations, while Gray Swans are more foreseeable, possessing known risks but still capable of significant disruption; risk management must differentiate between these to enhance preparedness and resilience. Understanding the frequency, impact, and predictability of these events drives strategic decision-making in finance, disaster planning, and systemic risk assessment.

Risk Mitigation Strategies

Risk mitigation strategies for Black Swan events focus on building robust, adaptive systems to withstand unpredictable, high-impact shocks, while Gray Swan strategies emphasize scenario planning and risk reduction based on known, plausible but unlikely threats.

Outlier Phenomena

Outlier phenomena such as Black Swan events represent highly unpredictable, high-impact occurrences beyond regular expectations, whereas Gray Swan events are rare but foreseeable risks with measurable probabilities.

Black Swan vs Gray Swan Infographic

moneydif.com

moneydif.com